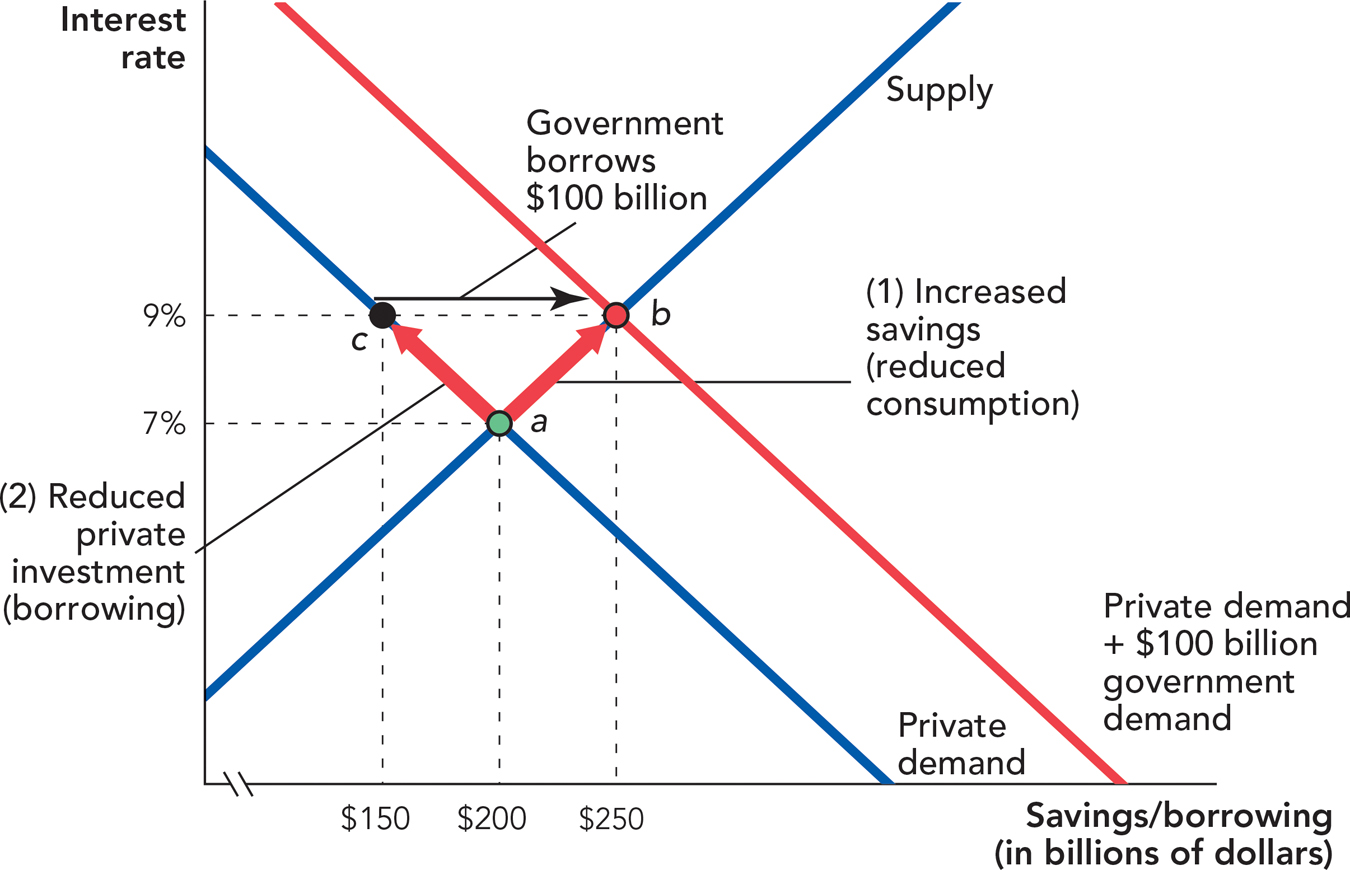

An Increase in Government Borrowing Crowds Out Private Consumption and Investment When the government borrows, it shifts the demand curve to the right moving the equilibrium from point a to point b. To reach the new equilibrium at point b, two things happen: (1) The higher interest rate draws forth more savings, which means that private consumption falls; and (2) the higher interest rate reduces the demand to borrow and invest. Thus, when the government borrows more, some of the increased borrowing is financed by reduced consumption and some by reduced investment.