New Ideas and Cutting-Edge Growth

Several predictions of the simple Solow model are consistent with the evidence—countries with higher investment rates have higher GDP per capita, and countries grow faster the farther their capital stock is from its steady-state level. One prediction of the simplest form of the Solow model, however, is inconsistent with the evidence. The simplest form of the Solow model predicts zero economic growth in the long run. Remember, in the long run, the capital stock stops growing because Investment = Depreciation, and if the capital stock isn’t growing, then neither is output. The United States, however, has been growing for more than 200 years, so we will need to look at a better developed version of the Solow model. In particular, is there any way to escape the iron logic? Yes, better ideas can keep the economy growing even in the long run.

155

Better Ideas Drive Long-Run Economic Growth

Better ideas let us produce more output from the same inputs of physical and human capital. A personal computer today has about the same amount of silicon and labor input as a computer produced 20 years ago, but today’s computer is much better—the difference is ideas. Recall our simple production function:

Remembering that we let A stand for ideas that increase productivity, let’s now write our production function as

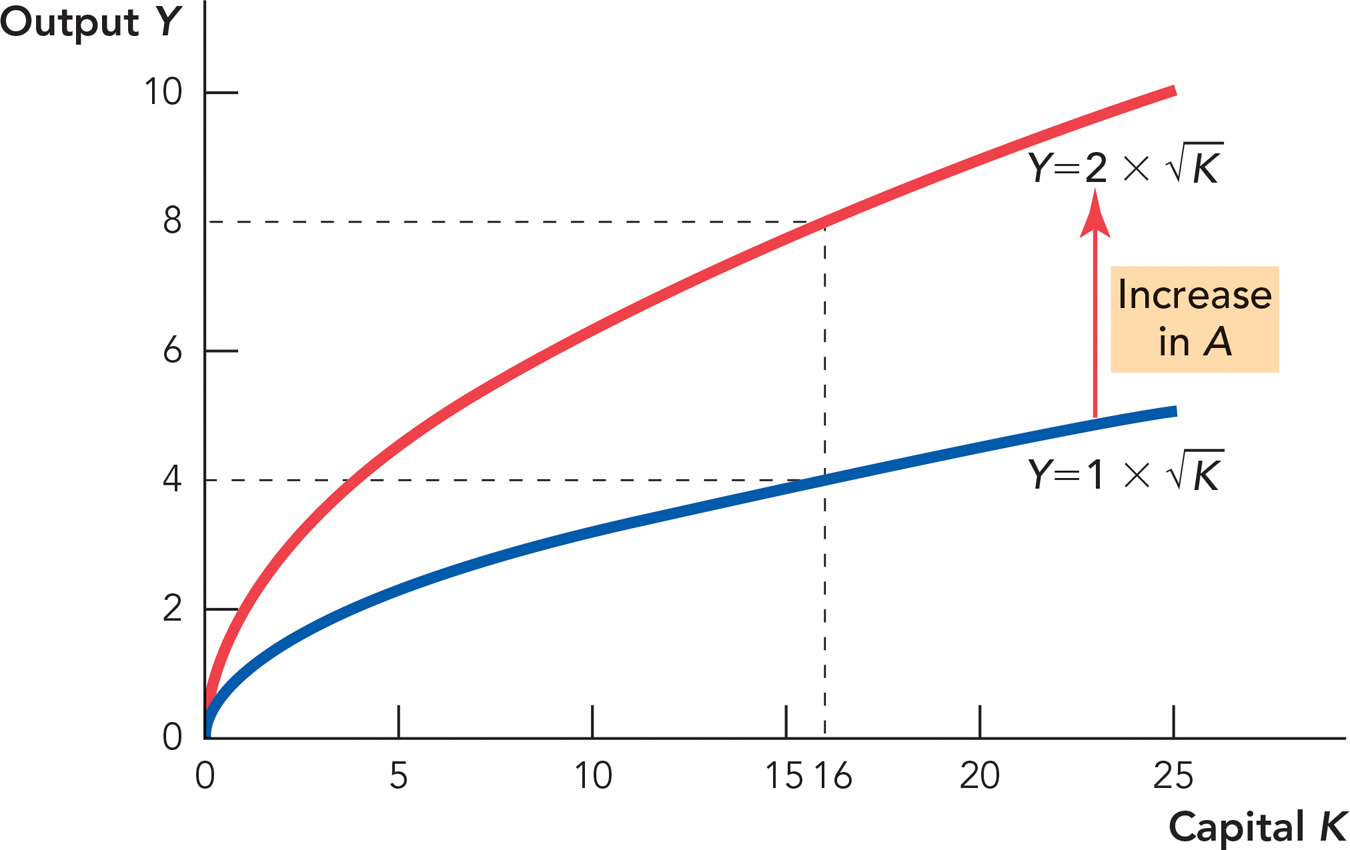

Notice that better ideas or technological knowledge—as represented by increases in A—increases output even while holding K constant, that is, an increase in A represents an increase in productivity. Figure 8.10 graphs two production functions. The first is when A =1, the production function that we have been working with all along. The second is when A = 2. Notice that when K = 16, output is 4 when A =1, but it’s 8 when A = 2.Technological knowledge means that we can get more output from the same input.

So long as we develop better ideas that shift the production function upward, economic growth will continue. In a way, it should be obvious that better ideas are the key to long-run economic growth. How much economic growth would there have been without the discovery of electricity or DNA or the development of the internal combustion engine, the computer chip, or the polymerase chain reaction? It’s just not enough to throw more effort at a problem; we have to actually know what we are doing and that boils down to ideas.

Solow himself tried to estimate how much of U.S. economic prosperity was due to capital and labor, and how much was due to ideas. He came up with the figure that better ideas are responsible for about three-fourths of the U.S. standard of living. Many economists have subsequently debated the exact number, but no one contests the central importance of ideas and technological progress for human well-being.

156

Solow and the Economics of Ideas in One Diagram

Let’s revisit the Solow model one last time and show how better ideas fit within that model. It’s simple: Better ideas let us produce more output from the same inputs of capital. But when we produce more output, it makes sense to increase consumption and investment. So better ideas also increase capital accumulation.

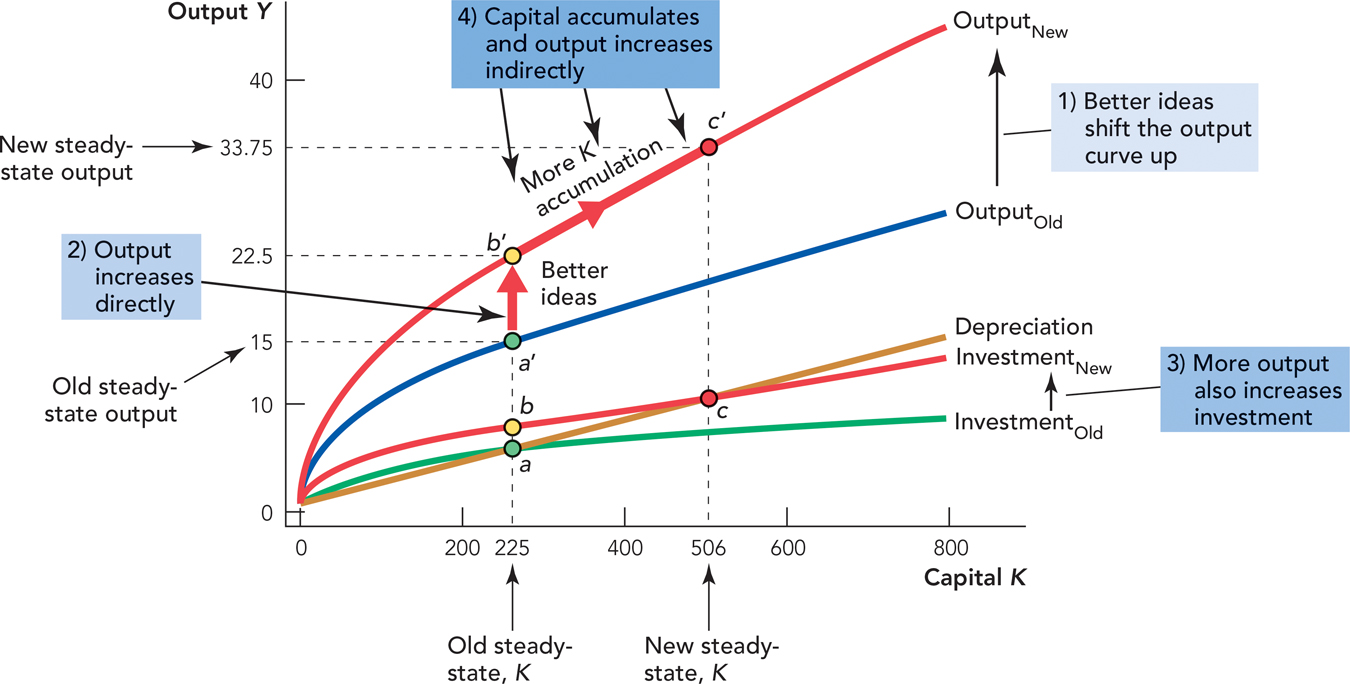

Figure 8.11 shows the process in a diagram. Okay, the diagram doesn’t look simple. Let’s take it in steps. Remember that A denotes ideas, and a bigger A means that we are working with better ideas. So imagine that we begin with A = ideas = 1. The economy is in the steady state and output = 15 (at point a′). Now suppose that A increases to A = 1.5. Better ideas produce more output from the same capital stock, so output immediately increases from 15 at point a′ to 22.5 at point b′. But with greater output, investment also increases, moving from point a to point b. Since investment is now greater than depreciation, capital begins to accumulate. Capital accumulates and the economy grows until investment is once again equal to depreciation at point c, at which point output is now 33.75 (at point c′).

Since investment is now greater than depreciation, the economy begins to accumulate more capital and thus to grow (4). The economy grows until investment is again equal to Depreciation at point c and output is at point c. Notice that better ideas increase output directly because of higher productivity and indirectly due to more capital accumulation.

CHECK YOURSELF

Question 8.7

What happens to investment and depreciation at the steady-state level of capital?

What happens to investment and depreciation at the steady-state level of capital?

Question 8.8

In Figure 8.7, how much is consumed in the old steady state? How much is consumed in the new steady state?

In Figure 8.7, how much is consumed in the old steady state? How much is consumed in the new steady state?

Question 8.9

Do countries grow faster if they are far below their steady state or if they are close?

Do countries grow faster if they are far below their steady state or if they are close?

Question 8.10

Do countries with higher investment rates have lower or higher GDP per capita?

Do countries with higher investment rates have lower or higher GDP per capita?

157

Thus, Figure 8.11 shows how the Solow model and the economics of ideas fit together. Better ideas increase output directly and, by so doing, they increase capital accumulation indirectly. Of course, before we ever reach the new level of output, ideas may have gotten even better! And, thus, the process of economic growth is a continuous two-step process of better ideas and more capital accumulation.