Chapter 1. Government Policies

1.1

Econ Tutorial

As you progress through the tutorial, the question sequences will become available. You must complete all the question sequences to receive credit for this tutorial.

Tutorial

Questions

1

6

Question

QitdkVzZQfqkEIZXvOJyb0meoYKBoJxAQ3akQPEcDUoPpgy3ew9o8Fey5e+l2Z28vjYwTHGNAfybh2+LGwwtn7aZVxYGmNNxRarqJ9yIL2RMT0l4Cn41hOvwF6kVwUZrcnrjK/wPUisEfNUGc6pZPG4SCpqpSYfMro8jgVaFhr2NTsFw/6NZxW4pc2hLfsx57UH3FQ9CtWDJ3z70E5fEQAhQr+yemMcGQf6oapB83ry/R9yMUBaLZz/yvayIadpM+5rO7unA1GhVCkLpXTySwHB1kqr/BOdL/JTfYpwr7tE=2

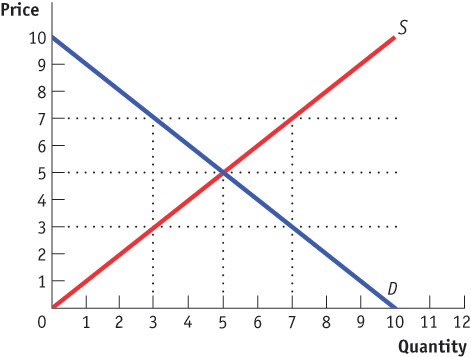

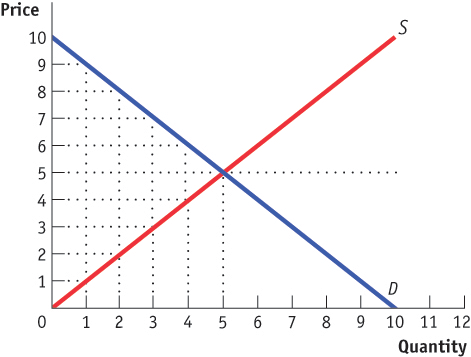

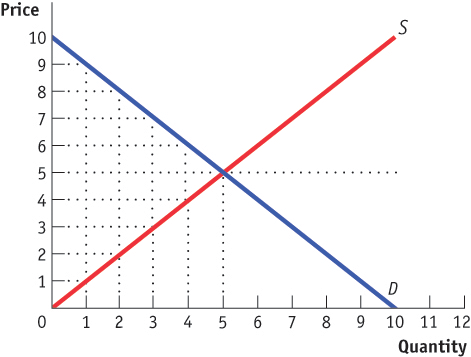

No, that's not it. Compare the quantity demanded (7) to the quantity supplied (3) at the price of 3.

Great job!

Questions

1

8

Question

2

Great job!

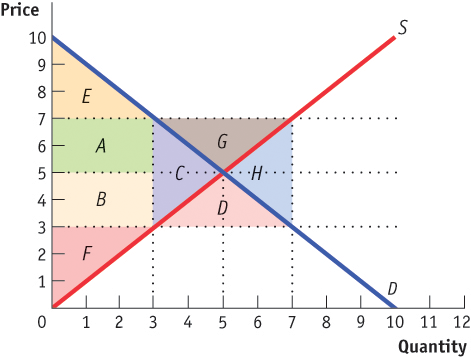

The area C represents the lost consumer and producer surplus when quantity traded falls to 3, as it will when a price ceiling of $3 is imposed.

Questions

1

18

Question

2

Great job!

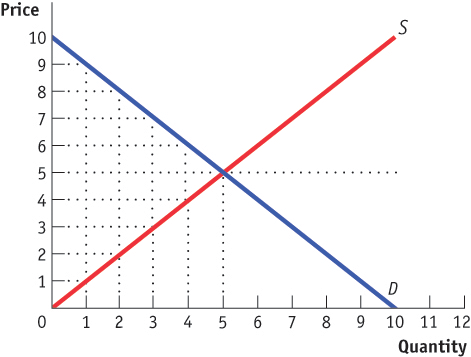

Compare the quantity supplied (7) to the quantity demanded (3) at the price of 7.

Question

2

Correct. Great job!

Incorrect. The area C represents the lost consumer and producer surplus when quantity traded falls to 3, as it will when a price ceiling of $3 is imposed.

Questions

2

7

Question

2

Great job!

The wedge is the difference ($6) between the supply price ($2) and the demand price ($8) at the quantity of 2.

Question

2

Correct. Great job!

Incorrect. The area if the triangle of deadweight loss is the 1/2(base x height) where the base is the quantity reduction of 3 (prior equilibrium quantity of 5 less the new quantity traded of 2) and the height is the wedge/quota rent of $6- (the difference between the supply price ($2) and the demand price ($8) at the quantity of 2). Hence the deadweight loss is 1/2(base x height) = 1/2(3 x 6) = 1/2(18) = 9.

Questions

3

13

Question

2

Great job!

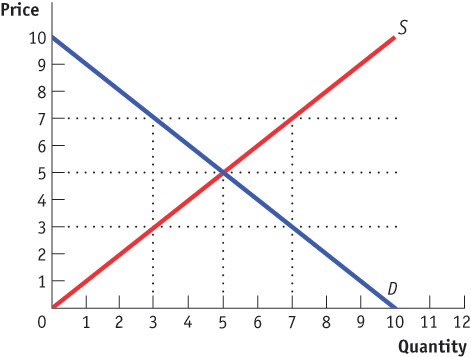

The part of the market with the greater price inelasticity will bear the greater burden of the tax. Another way to think about it is “elastic = escape”. Since buyers are more price elastic than sellers, buyers “escape” most of the burden of the tax.

Question

2

Correct. Great job!

Incorrect. The part of the market with the greater price inelasticity will bear the greater burden of the tax. Another way to think about it is “elastic = escape” Since buyers and sellers both have very similar price elasticity, as seen in the relative slopes of the supply and demand curves, they will share equally the burden of the tax.

Questions

3

9

Question

2

Great job!

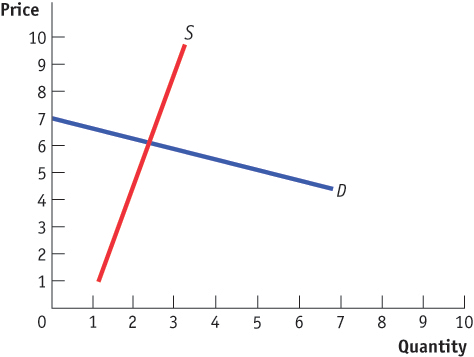

If the tax is $4, there must be a $4 difference between the price buyers and sellers each experience. No matter if the tax is levied on producers or consumers, we need to locate the points on the supply and demand curves where there is a vertical gap of the size of the tax. A quantity of 3, with (before tax) consumers paying $3 and producers receiving $7 is the only combination that satisfies the requirements.

Questions

4

9

Question

2

Great job!

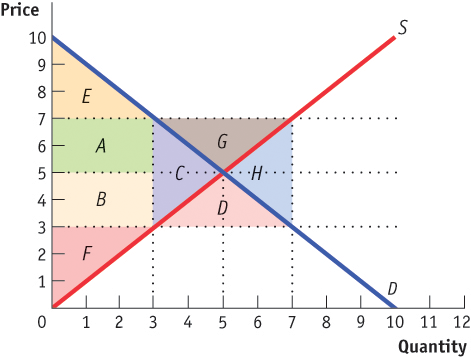

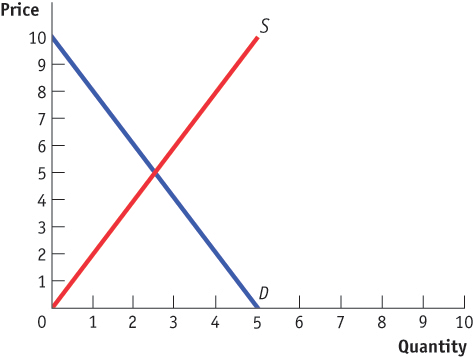

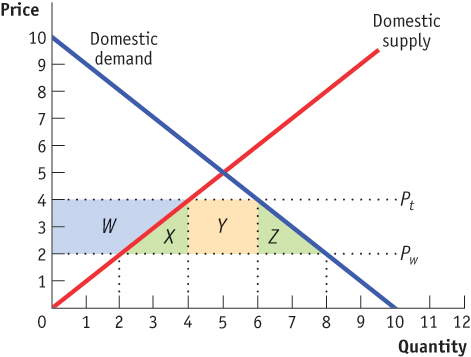

The government collects the tariff (represented by the vertical distance between Pw and Pt) times the amount imported at the new tariff price. Imports are the horizontal distance between supply and demand at the tariff price.

Question

2

Correct. Great job!

Incorrect. The government collects the tariff (represented by the vertical distance between Pw and Pt- $4-$2 = $2) times the amount imported at the new tariff price (6 – 4 = 2). Imports are the horizontal distance between supply and demand at the tariff price. Revenue = 2 x $2 = $4.

Question

2

Correct. Great job!

Incorrect. Consumer surplus falls by the entire shaded area (W + X + Y + Z), the government gains Y in tariff revenue, producers gain W in sales revenue, and X + Z are left as the areas of deadweight loss. Deadweight loss is the loss to total surplus that isn’t redistributed to sellers or the government.