Chapter 22. Mrs. Watanabe's Hedge Fund

22.1 Section Title

Chapter 22 HEADLINE: Mrs. Watanabe’s Hedge Fund

The OECD estimated the total yen carry trade at $4 trillion in 2006. This trade involves not just large financial institutions but increasing numbers of Japanese individual investors, who place money in high-

TOKYO—

Ms. Itoh is one of them. Ms. Itoh, a homemaker in the central city of Nagoya, did not want her full name used because her husband still does not know. After cleaning the dinner dishes, she would spend her evenings buying and selling British pounds and Australian dollars.

When the turmoil struck the currency markets last month, Ms. Itoh spent a sleepless week as market losses wiped out her holdings. She lost nearly all her family’s $100,000 in savings.

“I wanted to add to our savings, but instead I got in over my head,” Ms. Itoh, 36, said.

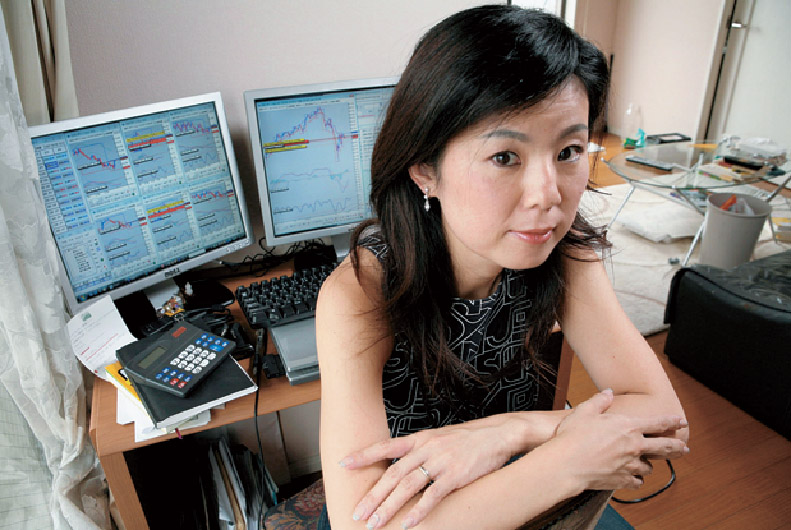

Tens of thousands of married Japanese women ventured into online currency trading in the last year and a half, playing the markets between household chores or after tucking the children into bed. While the overwhelmingly male world of traders and investors here mocked them as kimono-

Now Japan’s homemaker-

Some of the women used their own money, some used their husband’s, and some used a combination of both. But by trading, they challenged deeply held social prohibitions in Japan against money, which is often seen here as dirty, especially when earned through market speculation.

“There are strict taboos against money that isn’t earned with sweat from the brow,” said Mayumi Torii, a 41-

Ms. Torii is one of Japan’s most famous housewife-

One reason Japan’s homemakers can move markets is that they hold the purse strings of the nation’s $12.5 trillion in household savings. For more than a decade, that money languished in banks here at low interest rates. But as the rapid aging of Japan’s population has brought anxiety about the future, households are starting to move more of it overseas in search of higher returns.

A tiny fraction of this has flowed into risky investments like online currency accounts. Most of these accounts involve margin trading, in which investors place a cash deposit with a brokerage that allows them to borrow up to 20 or even 100 times their holdings for trading.

The practice has been popular not only because it vastly raises the level of potential profits, but also because it allowed wives to trade at home, said Hiroshi Takao, chief operating officer of TokyoForex, an online trading firm.

The housewife-

For a time, margin trading seemed like a surefire way to make money, as the yen moved only downward against the dollar and other currencies. But last month, in the midst of the credit turmoil, the yen soared as hedge funds and traders panicked.

Ms. Itoh recalled that she had wanted to cry as she watched the yen jump as much as 5 percent in value in a single day, Aug. 16.

“But I had to keep a poker face, because my husband was sitting behind me,” Ms. Itoh said.

She did not sell her position, thinking the yen would fall again. But by the next morning, only $1,000 remained in her account, she said… .

[M]ost of the half dozen homemaker-

“There’s no other way to make money so quickly,” she said.

Source: Excerpted from Martin Fackler, “Japanese Housewives Sweat in Secret as Markets Reel,” New York Times, September 16, 2007. © 2007 The New York Times. All rights reserved. Used by permission and protected by the Copyright Laws of the United States. The printing, copying, redistribution, or retransmission of this Content without express written permission is prohibited.

Question 1

Question

What are the risks associated with the carry trade?

65FRbtvWhl4=Question 2

Question

Could there be a dollar carry trade resulting from the low interest rate environment in the United States? If so, which currencies would you purchase?

65FRbtvWhl4=Question 3

Question

Using the principles of exchange rate fluctuations, if a large number of Japanese women continue with the carry trade, what should happen to exchange rates?

65FRbtvWhl4=