7 High-Technology Export Subsidies

Why do countries subsidize high-tech industries? Political pressure and external benefits, spillovers

1. “Strategic” Use of High-Tech Export Subsidies

Strategic export subsidies. A famous example: U.S. subsidizes Boeing, while Europe subsidizes Airbus. If the subsidy generates more profits than the cost of the subsidy then it is a good idea.

Consider a duopoly. Use game theory to model the strategic interactions of the firms: Boeing (B) and Airbus (A) compete to sell a new aircraft to the rest of the world.

a. Payoff Matrix

A 2x2 payoff matrix with strategies “produce” and “don’t produce” for each player. If one firm produces and the other does not, it gets profit of $100 and the other firm gets $0. If neither produces, neither gets any profit; if both produce, they each get negative profits of $5.

b. Nash Equilibrium

Definition of Nash equilibrium

c. Best Strategy for Boeing

Suppose B knows that A will produce. Its best response is not to produce. So the upper-left quadrant in Figure 10-8 is not a Nash Equilibrium.

d. Best Strategy for Airbus

Suppose that A knows that B will not produce. Its best response is to produce. The lower-left quadrant in Figure 10-8 is a Nash equilibrium.

e. Multiple Equilibria

The upper-right quadrant in Figure 10-8 is a Nash equilibrium, while the lower right-hand quadrant is not: There are two Nash equilibria, where one firm produces but the other does not. Which one to choose? Some external force. For example Boeing may have a first mover advantage. Then the unique Nash equilibrium is for Boeing to produce and Airbus to drop out.

2. Effect of a Subsidy to Airbus

Suppose Europe provides Airbus with a subsidy of $25 when it produces.

a. Best Strategy for Airbus.

Given that Boeing is producing, Airbus’s best response is now to produce.

b. Best Strategy for Boeing.

Given that Airbus is producing, Boeing will want to drop out.

c. Nash Equilibrium

The unique Nash equilibrium is now for Airbus to produce and Boeing to drop out.

d. European Welfare

Airbus makes profit of $125, while the subsidy cost only $25, so Europe gains.

3. Subsidy with Cost Advantage for Boeing

Suppose that Boeing has a cost advantage so that it makes $5 when Airbus produces and $125 with it doesn’t. The unique Nash equilibrium without a subsidy is for Boeing to produce and Airbus to drop out. Now let Europe give Airbus a subsidy of $25 again.

a. Best Strategy for Airbus

Given that Boeing is producing, Airbus’s best response is now to produce also.

b. Best Strategy for Boeing

Given that Airbus is producing, Boeing’s best response is to produce too. This is the unique Nash equilibrium.

c. European Welfare Once Again

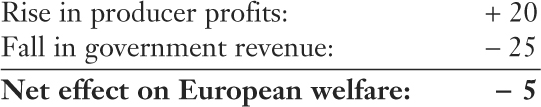

Since both firms are producing, profits are much lower for Airbus. In this case Airbus makes $20. Since the cost of the subsidy is $25, Europe is worse off.

d. Summary

Strategic subsidies don’t always raise welfare. They are more likely to be successful if they force the competing firm to exit the industry.

We turn now to consider high-technology final products. This sector of an economy also receives substantial assistance from government, with examples including subsidies to the aircraft industries in both the United States and Europe. In the United States, subsidies take the form of low-interest loans provided by the Export-Import Bank to foreign firms or governments that want to purchase aircraft from Seattle-based Boeing. (The Export-Import Bank is a U.S. government agency that finances export-related projects.) On the European side, government support for research and development and other subsidies are given to Airbus, which produces parts and assembles its finished products in a number of European countries. In Japan and South Korea, direct subsidies have been given to high-tech manufacturing firms that achieve certain targets for increasing their export sales. High-tech subsidies are given by many other countries, too.

352

China Signals Support for Rare Earths

China has changed its rare earths policy amid fears that its hard line on producers threatens its dominance of the global market for 17 key substances found in items from smartphones to missiles. In a move that Beijing describes as “promoting orderly development”, China will provide direct subsidies to revive struggling producers—a tacit acknowledgment of the strategic importance of the industry. The subsidies represent a significant shift in China’s policy of the past two years, which focused on restricting production of rare earths, closing down illegal mines, and tightening control of exports. These moves led to price fluctuations and slowing global demand.

Chen Zhanheng, of the China Rare Earths Industry Association, said the move would help the large, state-controlled rare earths companies the government is trying to promote. “In the long run, the policy can promote resource protection and effective utilisation of rare earths,” said Mr. Chen. “[The subsidy] is aimed at supporting technological upgrades, energy conservation and environmental protection.”

…Beijing’s near monopoly in the strategic sector has raised concerns in Washington and Tokyo, particularly when China suspended rare earths shipments to Japan during a diplomatic dispute in 2010. That incident, combined with broader concerns about the reliability of Chinese supply, triggered a surge of investment in mines outside China, several of which are set to start producing next year. Lynas Corporation, an Australia-based miner, announced yesterday that its first shipment of rare earths ore had arrived in Malaysia, where it has a processing facility expected to start producing the substances in the first half of 2013.

Source: Excerpted from “China signals support for rare earths,” Financial Times, Nov. 23, 2012, p. 14. From the Financial Times © The Financial Times Limited [2012]. All Rights Reserved.

Why do governments support their high-technology industries? In the case of agricultural products, subsidies are instituted primarily because of the political clout of those industries. Although politics plays a role in subsidies for high-tech industries, governments also subsidize these industries because they may create benefits that spill over to other firms in the economy. That is, governments believe that high-tech industry produces a positive externality. This argument for a subsidy is similar to the infant industry argument used to justify protective tariffs (see Chapter 9), except that the protection is applied to an export industry rather than an import-competing industry.

“Strategic” Use of High-Tech Export Subsidies

Introduction: Say we have the same justifications for subsidies as before, but now with the twist that they may be implemented strategically.

In addition to the spillover argument for export subsidies, governments and industries also argue that export subsidies might give a strategic advantage to export firms that are competing with a small number of rivals in international markets. By a strategic advantage, we mean that the subsidized industry can compete more effectively with its rivals on the world market. Think of the aircraft industry, which currently has just two producers of large, wide-bodied airplanes: Boeing in the United States and Airbus in Europe. Each of these firms receives some type of subsidy from its government. If high-tech subsidies allow firms to compete more effectively and earn more profits in international markets, and if the extra profits are more than the amount of the subsidy, then the exporting country will obtain an overall benefit from the export subsidy, similar to the benefit that comes from a large country applying a tariff.

353

To examine whether countries can use their subsidies strategically, we use the assumption of imperfect competition. We already used this assumption in Chapter 9, in which we considered the cases of Home monopoly and Foreign monopoly. Now we allow for two firms in the market, which is called a duopoly. In that case, each firm can set the price and quantity of its output (and hence maximize its profits) based on the price and quantity decisions of the other firm. When a government uses subsidies to affect this interaction between firms and to increase the profits of its own domestic firm, the government is said to be acting strategically. In this section, we examine the effects of strategic export subsidies to determine whether profits of the exporting firm will rise enough to offset the cost of the subsidy to the government.

Students may or may not have encountered games before, so be prepared to start with basics.

Because we now assume that certain high-tech industries operate in imperfectly competitive markets, we need to use a different set of tools to model their supply decisions than we have used thus far in this chapter. To capture the strategic decision making of two firms, we use game theory, the modeling of strategic interactions (games) between firms as they choose actions that will maximize their returns. The main goal in this section is to model the strategic interaction of high-tech firms in Home and Foreign, and then to see the impact of export subsidies on their respective decisions and payoffs.

To examine the effect of an export subsidy, we start with the free-trade situation, before any subsidies are in place. Suppose there are two firms that are competing for sales of a new type of aircraft. For example, Airbus sells the double-decker A380, and Boeing sells a smaller aircraft called the 787 Dreamliner (discussed later in the chapter). For convenience, we focus on the decision of each firm to produce a relatively new aircraft that competes with the other firm for sales to the rest of the world. By ignoring sales to firms in their own countries, we will not have to keep track of consumer surplus in the United States or Europe. Instead, the measure of welfare for these countries will depend only on the profits earned by Boeing or Airbus from their sales to the rest of the world.

For what it is worth, note that this game is known as the "Developer's Dilemma."

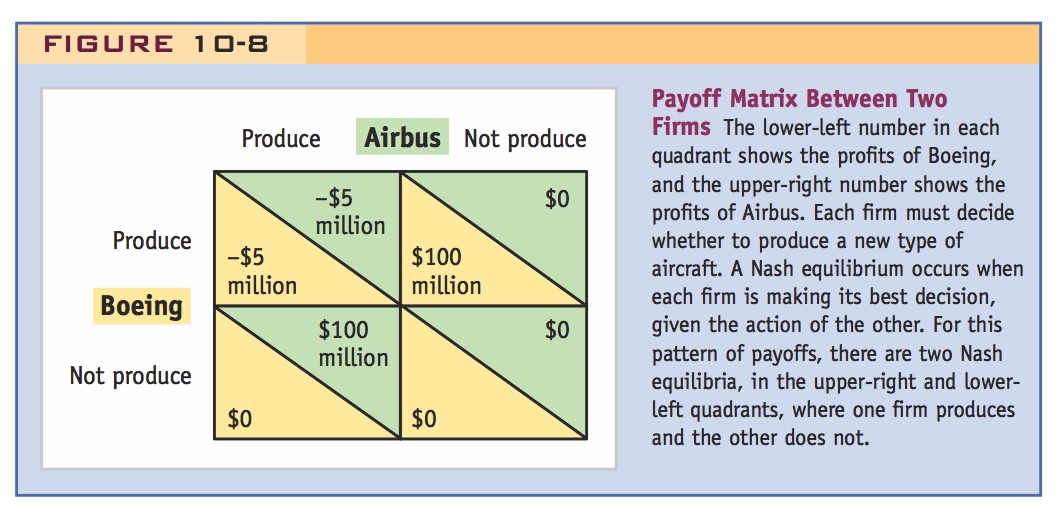

Payoff Matrix In Figure 10-8, we show a payoff matrix for Boeing and Airbus, each of which has to decide whether to produce the new aircraft. Each quadrant of the matrix shows the profit earned by Boeing in the lower-left corner and the profits of Airbus in the upper-right corner. When both firms produce (upper-left quadrant), their prices are reduced through competition, and they both end up making negative profits (i.e., losses) of $5 million.8

If Airbus produces the new aircraft and Boeing does not (lower-left quadrant), then Boeing earns nothing, whereas Airbus, the only supplier, earns high profits of $100 million. Conversely, if Boeing produces and Airbus does not (upper-right quadrant), Airbus earns nothing, and Boeing, now the only supplier, earns high profits of $100 million. Finally, if both firms choose not to produce (lower-right quadrant), then they both earn profits of 0.

354

Nash Equilibrium With the pattern of payoffs shown in Figure 10-8, we want to determine what the outcome of this game between the two firms will be. At first glance, this seems like a difficult problem. It is hard for each firm to decide what to do without knowing whether the other firm is going to produce. To solve this problem, we use the concept of the Nash equilibrium, named after John Nash, a winner of the Nobel Prize in economics.9

The idea of a Nash equilibrium is that each firm must make its own best decision, taking as given each possible action of the rival firm. When each firm is acting that way, the outcome of the game is a Nash equilibrium. That is, the action of each player is the best possible response to the action of the other player.

Best Strategy for Boeing To determine the Nash equilibrium, we proceed by checking each quadrant of the payoff matrix. Let us look at Boeing’s possible strategies, starting with the case in which its rival, Airbus, chooses to produce. If Boeing knows that Airbus will produce, then Boeing needs to decide whether to produce. If Boeing produces, then it earns −$5 million (in the upper-left quadrant); if Boeing does not produce, then it earns 0 (in the lower-left quadrant). Therefore, if Airbus produces, then Boeing is better off not producing. This finding proves that having both firms produce is not a Nash equilibrium. Boeing would never stay in production, since it prefers to drop out of the market whenever Airbus produces.

Best Strategy for Airbus Let’s continue with the case in which Boeing does not produce but Airbus does (lower-left quadrant of Figure 10-8). Is this the best strategy for Airbus? To check this, suppose that Airbus chooses instead not to produce. That would move us from the lower-left quadrant to the lower-right quadrant in Figure 10-8, meaning that Airbus’s profits fall from $100 million to 0. This outcome is worse for Airbus, so it would not change its decision: it would still choose to produce. We conclude that the decision illustrated in the lower-left quadrant, with Airbus producing and Boeing not producing, is a Nash equilibrium because each firm is making its best decision given what the other is doing. When Airbus produces, then Boeing’s best response is not to produce, and when Boeing does not produce, then Airbus’s best response is to produce. There is no reason for either firm to change its behavior from the Nash equilibrium.

355

Multiple Equilibria Is it possible to find more than one Nash equilibrium? To check for this, we need to check the other quadrants in Figure 10-8. Let us try the case in the upper-right quadrant, where Boeing produces but Airbus does not. Consider Airbus making the decision to produce or not, given that Boeing produces, or Boeing making the decision to produce or not, given that Airbus does not produce. Using the same logic we have already gone through, you can confirm that neither firm would want to change the decision it has made as seen in the upper-right quadrant: if either firm changed its choice, its profits would fall. If Boeing decides not to produce, then its profits fall to 0 (from the upper-right to the lower-right quadrant), whereas if Airbus decides to produce, its profits fall to −$5 million (from the upper-right to the upper-left quadrant). So we conclude that the upper-right quadrant, with Boeing producing and Airbus not producing, is also a Nash equilibrium. When Boeing produces, then Airbus’s best response is to not produce, and when Airbus does not produce, then Boeing’s best response is to produce. Finally, by applying the same logic to the other quadrants, we can confirm that there are no more Nash equilibria.

Students will ask why Boeing has the first mover advantage. Just say it is a convenient way of pinning down the equilibrium so that we introduce the subsidy, and that the same argument would apply if we were to start with the other Nash equilibrium.

When there are two Nash equilibria, there must be some force from outside the model that determines in which equilibrium we are. An example of one such force is the first mover advantage, which means that one firm is able to decide whether to produce before the other firm. If Boeing had this advantage, it would choose to produce, and Airbus, as the second mover, would not produce, so we would be in the upper-right quadrant. Let us suppose that is the Nash equilibrium from which we start. Because Airbus is not producing, it is making zero profits. In this situation, the government in Europe might want to try to change the Nash equilibrium so that Airbus would instead earn positive profits. That is, by providing subsidies to Airbus, we want to determine whether the payoffs in the matrix change such that the Nash equilibrium also changes.

The type of subsidy we consider in our model is a cash payment to Airbus. In practice, however, subsidies are of many kinds: Boeing has benefited from U.S. military contracts, where the research and development (R&D) done for those contracts has been used in its civilian aircraft, too. Airbus, on the other hand, has benefited from direct R&D subsidies to defray the “launch costs” of getting a new aircraft off the ground. Both companies have benefited from low-cost loans provided by their governments to purchasers of aircraft. Later in the chapter, we examine in more detail actual export subsidies that are used in the aircraft industry.

Effect of a Subsidy to Airbus

Suppose the European governments provide a subsidy of $25 million to Airbus. With this subsidy in place, Airbus’s profits will increase by $25 million when it produces. In Figure 10-9, we add that amount to the payoffs for Airbus and check to see whether the Nash equilibria have changed. Recall that the free-trade Nash equilibria occur when one firm produces and the other does not.

Best Strategy for Airbus Let us start with the free-trade Nash equilibrium in which Boeing produces but Airbus does not (upper-right quadrant) and see whether it changes when Airbus receives a government subsidy. After the subsidy, that option is no longer a Nash equilibrium: if Boeing is producing, then Airbus is now better off by also producing because then it receives a $25 million subsidy from the government. With the subsidy, it will now earn $20 million ($5 million in negative profits plus the $25 million subsidy) even when Boeing produces. Recall that in the original situation, if Boeing produced, then Airbus would not choose to produce because otherwise it would lose $5 million. With the subsidy, Airbus now earns $20 million by producing instead of losing $5 million.

356

Best Strategy for Boeing Is this new position a Nash equilibrium? To answer that, we need to see whether Boeing would still be making the right decision given that Airbus is producing. When Airbus produces, Boeing loses $5 million when it produces (upper-left quadrant) but loses nothing when it does not produce (lower-left quadrant). Therefore, Boeing will want to drop out of the market. Once Boeing makes the decision not to produce, Airbus’s decision doesn’t change. It still chooses to produce, but its payoff increases dramatically from $20 million to $125 million, and we move to the lower-left quadrant, with Airbus producing and Boeing not.

Nash Equilibrium You can readily check that the lower-left quadrant is a unique Nash equilibrium: each firm is making its best decision, given the action of the other. Furthermore, it is the only Nash equilibrium. The effect of the European governments’ subsidy has been to shift the equilibrium from having Boeing as the only producer (where we started, in the upper-right quadrant) to having Airbus as the only producer (in the lower-left quadrant).

European Welfare The European subsidy has had a big impact on the equilibrium of the game being played between the two firms. But can we necessarily conclude that Europe is better off? To evaluate that, we need to add up the welfare of the various parties involved, much as we did earlier in the chapter.

The calculation of European welfare is simplified, however, because of our assumption that production is for export to the rest of the world. From Europe’s point of view, we do not need to worry about the effect of the subsidy on consumer surplus in its own market. The only two items left to evaluate, then, are the profits for Airbus from its sales to the rest of the world and the cost of the subsidy to the European government.

Airbus’s profits have increased from 0 (when it was not producing but Boeing was) to $125 million (now that Airbus is producing but Boeing is not). The revenue cost of the subsidy to Europe is $25 million. Therefore, the net effect of the subsidy on European welfare is

357

In this case, the subsidy led to a net gain in European welfare because the increase in profits for Airbus is more than the cost of the subsidy.10

Subsidy with Cost Advantage for Boeing

Our finding that the subsidy can raise European welfare depends on the numbers we assumed so far, however. Let us now consider another case in which Boeing has a cost advantage over Airbus. In this case, we assume that the cost advantage is the result not of U.S. subsidies but of U.S. comparative advantage in aircraft production.

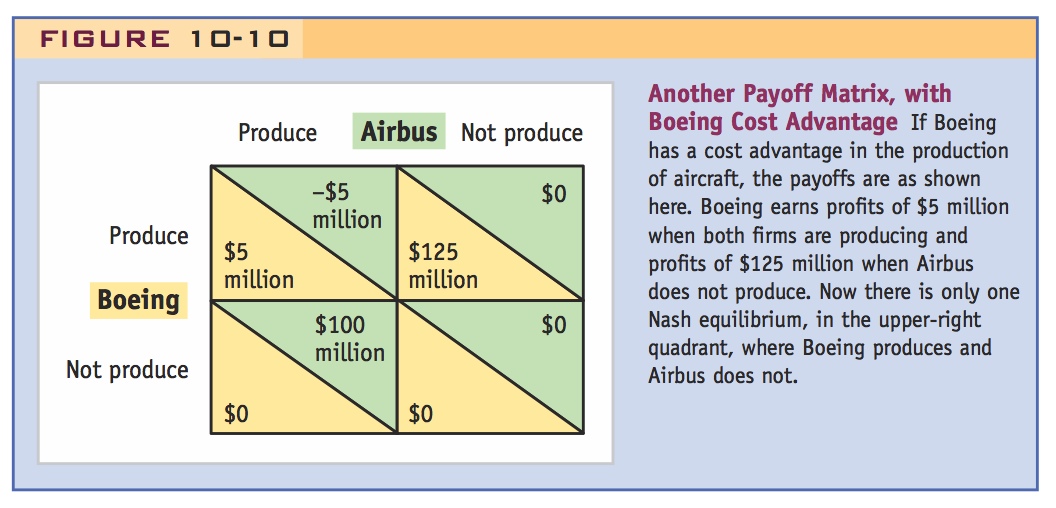

When Boeing has a cost advantage in aircraft production, the payoff matrix is as shown in Figure 10-10. Boeing earns profits of $5 million when both firms produce and profits of $125 million when Airbus does not produce. There is now only one Nash equilibrium, and it is in the upper-right quadrant in which Boeing produces and Airbus does not. The alternative free-trade Nash equilibrium in Figure 10-8 (in which Airbus produces and Boeing does not) is no longer a Nash equilibrium because—with the cost advantage we are now assuming Boeing has, even if Airbus chooses to produce—it is better for Boeing to produce and earn profits of $5 million than not produce and earn 0 profits.

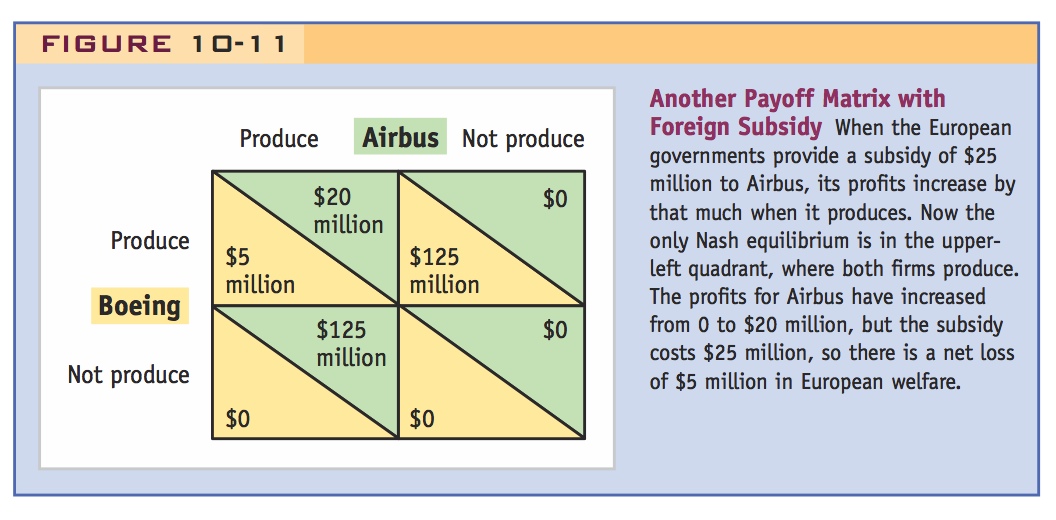

Now suppose, once again, that the European governments provide a $25 million subsidy to Airbus. We add that amount to the payoffs of Airbus when it produces (still assuming that Boeing has a cost advantage over Airbus), as shown in Figure 10-11.

Best Strategy for Airbus Let’s see how the subsidy has affected the previous Nash equilibrium in which Boeing produces and Airbus does not (upper-right quadrant). Given that Boeing produces, the decision not to produce is no longer the best one for Airbus: with the subsidy now in place and Boeing producing, Airbus’s best decision is to produce and to earn profits of $20 million (upper-left quadrant) rather than 0.

Best Strategy for Boeing Is this new position a Nash equilibrium? Once again, we need to check to see whether, given Airbus’s new post-subsidy decision to produce, Boeing is still making the right decision. Given that Airbus produces, then Boeing earns profits of $5 million when it produces and 0 when it does not. Therefore, Boeing will stay in the market, and we have proved that having both firms produce is a Nash equilibrium.

358

European Welfare Once Again When Boeing has a cost advantage, the European subsidy allows Airbus to enter the market, but it has not resulted in the exit of Boeing as it did in the earlier no-cost-advantage scenario. Let us evaluate the effect on European welfare under these circumstances.

Airbus’s profits have increased from 0 (when it was not producing, but Boeing was) to 20 (now that both firms are producing). The revenue cost of the subsidy to Europe is still 25. Therefore, the net effect of the subsidy on European welfare is

When Boeing has a cost advantage, then, the subsidy leads to a net loss in European welfare because the increase in profits for Airbus is less than the cost of the subsidy.

Point out that this makes it much less clear whether the subsidy is operationally a good idea . . . as this example suggests.

Summary The lesson that we should draw from these various examples is that under conditions of imperfect competition, a subsidy by one government to its exporting firm might increase welfare for its nation, but it might not. Although profits for the exporting firm certainly rise, there is an increase in welfare only if profits rise by more than the cost of the subsidy. This condition is more likely to be satisfied if the subsidy leads to the exit of the other firm from the market. In that case, the profits earned by the single firm could very well exceed the cost of the subsidy. When both firms remain in the market after the subsidy, however, it is unlikely that the increase in profits for the subsidized firm will exceed the subsidy cost. In the following application, we are especially interested in whether subsidies in the aircraft industry have kept one firm out of a market segment in which another produces.

A 1992 agreement limited costly subsidies between the U.S. and EU. But since then both have filed claims against the other with the WTO for illegal subsidies. Did these subsidies raise welfare? Possibly, since each subsidized a type of plane that did not directly compete with the other.

Subsidies to Commercial Aircraft

In the large passenger aircraft industry, there have been just three competitors: Boeing and McDonnell-Douglas in the United States and Airbus in Europe. The former two companies merged on August 1, 1997, so the industry effectively became a duopoly. The United States and Europe have used various types of subsidies to support their respective firms. First, there are indirect subsidies that arise because in the production of civilian and military aircraft, the research and development (R&D) for the military versions effectively subsidize R&D for the civilian aircraft. These indirect subsidies have benefited both McDonnell-Douglas and Boeing in the United States. Second, the government might directly subsidize the R&D costs of a new aircraft, as Europe subsidizes R&D at Airbus. Third, the government can subsidize the interest rates that aircraft buyers pay when they borrow money to purchase aircraft. Europe and the United States both provide such low-interest loans, for instance, through the Export-Import Bank in the United States as mentioned previously.

359

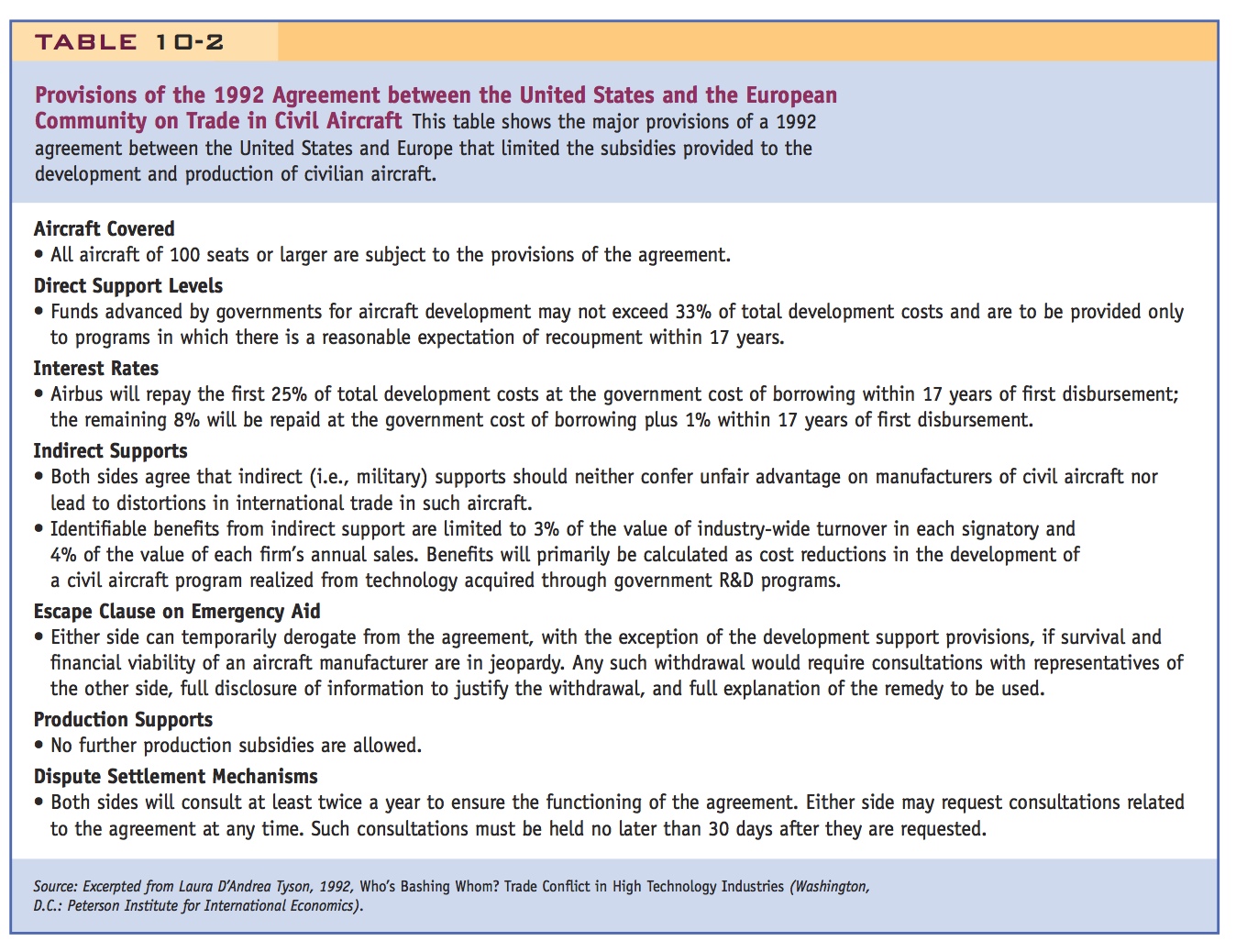

1992 Agreement Recognizing that these subsidies are ultimately costly, the United States and the European Community reached an agreement to limit them in 1992. The main features of this agreement are summarized in Table 10-2. Development subsidies are limited to 33% of the total development costs of a new aircraft, and it is expected that the aircraft manufacturers will repay these subsidies at the government interest rate. In addition, the agreement limits indirect (military) subsidies to not more than 4% of any firm’s annual sales, prohibits production subsidies, and limits the ability of government agencies to subsidize the interest rate on purchases of aircraft. According to one estimate, this agreement reduced subsidies by between 7.5% and 12.5% of the costs of production. As a result of the reduction in subsidies, prices for aircraft rose by somewhere between 3.1% and 8.8%. This agreement between the United States and Europe benefited the countries’ governments because they no longer had to spend the money on the subsidies, and most likely also benefited the aircraft companies because prices rose, but the higher prices led to welfare losses for the purchasing countries.

The Superjumbo There are recent claims that the terms of the 1992 agreement were violated by Airbus as it launched its newest aircraft: the double-decker A380, which is even larger than the Boeing 747 and will compete directly with the 747 in long flights. This “superjumbo” aircraft carries up to 555 passengers and consists of two passenger decks for its entire length. Its first test flight in Europe took place in April 2005, and its first commercial flight to the United States was in March 2007. The expenditures to develop the A380 are estimated to have been $12 billion, one-third of which the governments of France, Germany, the Netherlands, Belgium, Spain, Finland, and the United Kingdom are expected to pay. The European governments provided some $3.5 billion in low-interest loans to cover development costs. In 2005 both the United States and the European Union filed countercomplaints at the World Trade Organization (WTO) regarding illegal subsidies by the other party to their respective aircraft producers. Europe was accused of “illegally” subsidizing the A380, while the United States was accused of subsidizing the development of Boeing’s 787 commercial jet. The complaints at the WTO have been going on since 2004, as discussed in Headlines: EU Seeks $12 billion from U.S. over Boeing Aid.

AP Photo/Bob Edme

Both Airbus and Boeing have filed cases against each other at the WTO, claiming that the subsidies given for the A380 and the 787 aircraft violated the terms of the 1992 Agreement on Trade in Civil Aircraft. In bringing the initial case to the WTO in 2004, the United States declared that it would no longer abide by the 1992 Agreement, which the United States felt had outlived its usefulness. Over the years, the WTO has ruled in favor of both companies, finding that the European Union gave up to $18 billion in subsidized financing to Airbus, while the United States gave up to $4 billion in subsidized financing to Boeing. Both governments are now requesting that they be permitted to apply “countermeasures” against the other countries, which means that they can apply tariffs against products imported from those countries in retaliation for the subsidies. We do not know at this point whether these tariffs will be permitted, and it will probably be years before this complex case is ever resolved at the WTO.

360

National Welfare Will the development subsidies provided by the European governments to the Airbus A380 increase their national welfare? From the theory presented previously, that outcome is more likely to happen if Airbus is the only firm producing in that market. And such is the case, because Boeing did not try to produce a double-decker aircraft to compete with the A380. Instead, it modified its 747 jumbo jet model to compete with the A380, and it focused its R&D on its new 787 Dreamliner, a midsized (250-passenger), wide-bodied aircraft.

Because Boeing did not enter the market with its own double-decker aircraft, it is possible that the profits earned by Airbus will be large enough to cover the subsidy costs, the criterion for an increase in national welfare. But that outcome is certainly not guaranteed. The profits earned by Airbus on the A380 will depend on how many aircraft are sold and at what price. Airbus has stated that it needs to produce at least 250 planes to cover its development costs but that it expects to sell 1,500 A380s over the next 20 years. As of April 2013, it had delivered 101 of 262 aircraft ordered and was experiencing a slow-down in new orders because of small cracks discovered in the aircraft wings. These cracks have been traced to faulty brackets connecting the wings to the body, and all A380 aircraft in operation will be serviced to repair this defect. Boeing believes that market demand for the A380 superjumbo will not exceed 700 aircraft over the next 20 years. It remains to be seen whether the subsidies provided by the European Union for the A380 will ultimately pay off.

361

Boeing has its own share of difficulties with the production of the 787 Dreamliner, which was initially scheduled for delivery in 2008, but did not make its first flight until December 15, 2009. Boeing outsourced many of the components of the 787 to firms in other countries, but then had difficulty in assembling these components back in the United States, which led to the delay in its delivery. Then, in January 2013, there were battery fires in two 787 aircraft owned by Japan Air and United Airlines. Those fires led to the grounding of all 787 aircraft until the battery problem could be addressed and solved. The planes were allowed to fly again in June 2013. Finally, note that Airbus has produced a competitor for the 787 Dreamliner, the A350 wide-bodied jet, which had its maiden take-off on June 14, 2013. Boeing and Airbus will be in direct competition for customers for these new aircraft. France, Germany, and Britain pledged $4.1 billion in launch funding for the A350, and it remains to be seen whether this funding will lead to another legal case at the WTO. The fact that both firms are producing a new midsized, wide-bodied aircraft makes it less likely that either country will recoup the subsidies provided and experience a rise in national welfare from the subsidies.

Describes the dispute between Boeing and Airbus at WTO

EU Seeks $12 billion from US over Boeing Aid

The EU has asked the World Trade Organisation for permission to levy up to $12bn in punitive tariffs against US goods for Washington’s failure to dismantle illegal subsidies for Boeing, the aircraft maker. The EU request is the highest on record for so-called countermeasures in a WTO trade case and marks the latest turn in a eight year, tit-for-tat fight between the world’s largest civil aircraft….

The US in December made a similar demand for up to $10bn in countermeasures against the EU after it complained that European governments had not complied with a WTO ruling to remove illegal subsidies for Airbus. Under WTO rules, countermeasures allow a government to raise tariffs on goods from another country to recoup damages. The US and EU have previously hit politically sensitive items, such as Florida orange juice and French cheese.

The Boeing-Airbus dispute dates back to 2004, when each government filed complaints at the WTO, saying the other had lavished vast amounts of illegal subsidies on its civil aircraft maker, such as cheap financing, tax breaks, defense contracts and research and development aid. After years of litigation, both sides were ultimately found to have been guilty, although the sums for Airbus, at about $18bn, were more than four-times higher.

Nkenge Harmon, a spokeswoman for the US trade representative, said: “It is truly difficult to see how the EU characterises the finding against the US as the “worst loss” ever. “The WTO found that the EU granted $18bn in subsidised financing, which caused 342 lost sales for the United States. The WTO found $2bn to $4bn, mostly in subsidised research, against the United States, with 118 lost sales for Airbus,” she added….

Airbus said the company was “grateful to the EU Commission for taking consequential action,” and urged Boeing to come to the bargaining table. “We regret that Boeing continues a legal battle that should have long been resolved by a mutual agreement. We made offers time and again but are ready to fight it through if the other side wishes to do so.”

Source: Joshua Chaffin, Andrew Parker, and Alan Beattie, “EU seeks $12bn from US over Boeing aid,” Global Economy, September 27, 2012. From the Financial Times © The Financial Times Limited 2012. All Rights Reserved.