PROBLEMS

- (PPP) Richland and Poorland each have two industries: traded TVs and nontraded house maintenance. The world price of TVs is R$100 (R$ = Richland dollar). Assume for now that the exchange rate is R$1 = 1 PP (PP = Poorland peso) and that prices are flexible. It takes 1 day for a worker in each country to visit and maintain 1 house. It takes 1 day for a Richland worker to make a TV, and 4 days for a Poorland worker.

- What is the Richland wage in R$ per day? What is the Poorland wage in PP per day? In R$ per day? What is the ratio of Poorland to Richland wages in a common currency?

- What is the price of a house maintenance visit in each country?

- Assume people in each country spend half their income on TVs and half on house maintenance. Compute the CPI (consumer price index) for each country given by the square root of (TV price) times (house maintenance price).

- Compute the standard of living in each country by dividing local currency wages by the CPI from part (c)? Is Poorland really as poor as suggested by the last answer in part (a)?

- Productivity now doubles in the Poorland TV industry, all else equal. How many days does it now take for Poorland workers to make a TV? What happens to the wage in Poorland? The price of house maintenance? The CPI?

- If the central bank of Poorland wants to avoid inflation in this situation, how would it like to adjust the exchange rate?

- (PPP) “Some fast-growing poorer countries face a conflict between wanting to maintain a fixed exchange rate with a rich country and wanting to keep inflation low.” Explain the logic behind this statement. Use the examples of Slovakia and China to illustrate your argument.

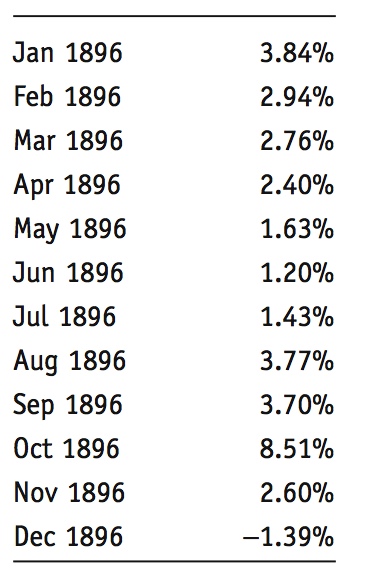

- (UIP) What is a peso problem? In the case of fixed exchange rates, explain how peso problems can account for persistent interest rate differentials. Study the U.S.–Britain short-term (end-of-month) nominal interest rate differentials shown below for the year 1896 (from NBER series 13034). Both countries were on the gold standard at a fixed exchange rate of $4.86 throughout this year. Did the United States have a peso problem? When did it become really big? When did it go away? (Extra Credit: Do some research on the Web and discover the political reasons for the timing of this peso problem.)

- (UIP) You are in discussion with a forex trader.

- She reveals that she made a 10% annual rate of return last year. Based on these data, can we say that the forex market in question violates the efficient markets hypothesis (EMH)?

- The trader reveals that she can make predictable 10% annual rates of return on forex trades for a pair of currencies, with a standard deviation of 25%, and has been doing so for a long time. Calculate the Sharpe ratio for these trades. Based on these data, does the forex market in question satisfy EMH?

- Can the trader’s predictable profits be explained by trading frictions? By risk aversion?

- (Default) “Poor countries are exploited when they borrow in global capital markets, because they are charged an extortionate rate of interest.” Explain how empirical evidence and theoretical arguments might counter this assertion.

- (Default) The Republic of Delinquia has a nondisaster output level of $100 each year. With 10% probability each year, output falls to a disaster level of $80, and the country will feel so much pain that it will default and pay neither principal nor interest on its debts. The country decides to borrow $20 at the start of the year, and keep the money under the mattress. It will default and keep the money in the event that output is low, but this will entail sacrificing $4 in punishment costs. Otherwise, it pays back principal and interest due. Lenders are competitive and understand these risks fully.

- What is the probability of default in Delinquia?

- The interest rate on safe loans is 8% per annum, so a safe loan has to pay off 1.08 times $20. What is the lending rate charged by competitive lenders on the risky loan to Delinquia?

- What does Delinquia consume in disaster years? In nondisaster years?

- Repeat part (c) for the case where Delinquia cannot borrow. Is Delinquia better off with or without borrowing?

- (Global Crisis) When emerging markets elected to accumulate vast sums of reserves in the 2000s decade, did this create a problem in developed markets? How might this problem be resolved, or resolve itself, going forward? Does the EM decision to accumulate the reserves look like a wise one, after the fact?

- (Global Crisis) In 2010 there was a risk that the state of Ireland was at risk of going broke because it had poured too much money into its insolvent banks to try to keep them alive, but already incomes had fallen massively and public services were being cut harshly too. Describe the trade-offs involved in the various options: (a) increasing austerity (raising taxes and cutting spending) even more to keep the banks alive; (b) letting the State default on its external debt to keep the banks alive and limit austerity; (c) allow the banks to fail to save the State’s creditworthiness and limit austerity. Consider the problem from a purely Irish national interest perspective first. Now think of an EU level perspective: how is your analysis of who should foot the bill affected by the fact that many of the Irish bank creditors were foreign (many in the EU), and that many of the risks of financial damage were due to contagion to other (principally EU) foreign countries.