Chapter 3 HEADLINES: The Big Mac Index

AP Photo/Greg Baker

Home of the undervalued burger?

For more than 25 years, The Economist newspaper has engaged in a whimsical attempt to judge PPP theory based on a well-known, globally uniform consumer good: McDonald’s Big Mac. The over- or undervaluation of a currency against the U.S. dollar is gauged by comparing the relative prices of a burger in a common currency, and expressing the difference as a percentage deviation from one:

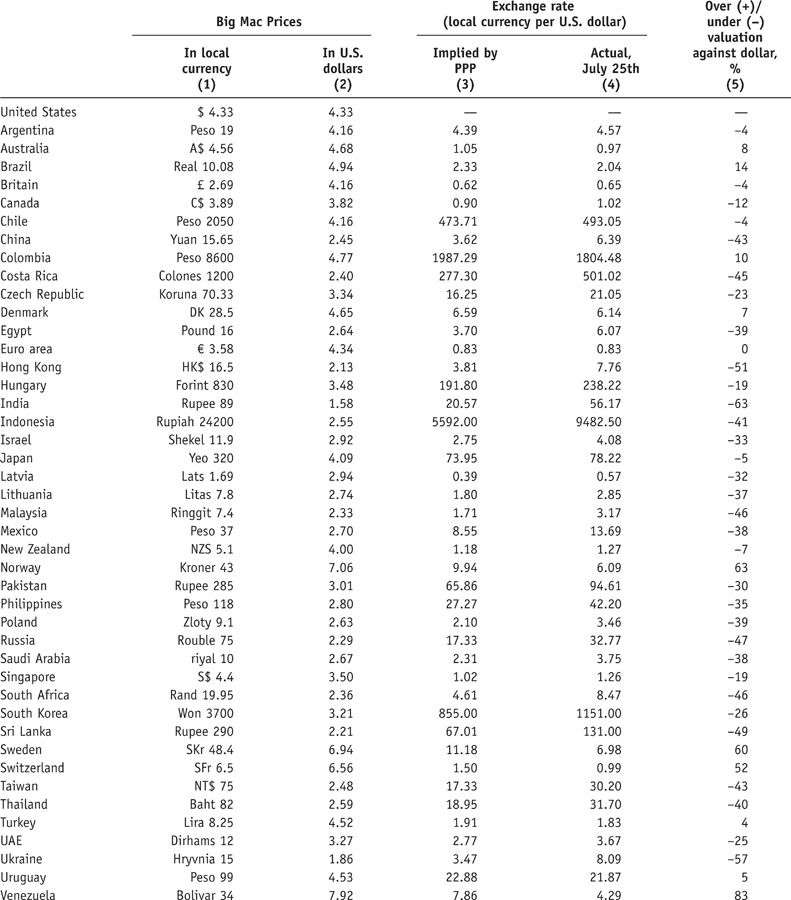

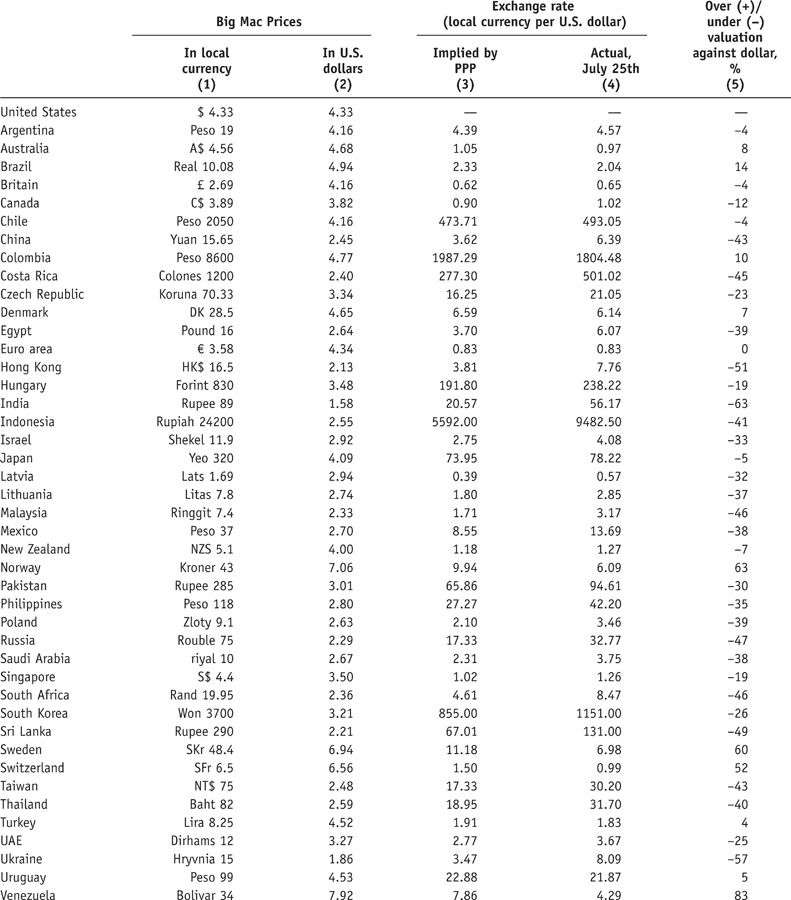

Table 14-1 shows the July 2012 survey results, and some examples will illustrate how the calculations work. Row 1 shows the average U.S. dollar price of the Big Mac of $4.33. An example of undervaluation appears in Row 2, where we see that the Buenos Aires correspondent found the same burger cost 19 pesos, which, at an actual exchange rate of 4.57 pesos per dollar, worked out to be $4.16 in U.S. currency, or 4% less than the U.S. price. So the peso was 4% undervalued against the U.S. dollar according to this measure, and Argentina’s exchange rate would have had to appreciate to 4.39 pesos per dollar to attain the level implied by a burger-based PPP theory. An example of overvaluation appears in Row 4, in the case of neighboring Brazil. There a Big Mac cost 10.08 reais, or $4.94 in U.S. currency at the prevailing exchange rate of 2.04 reais per dollar, making the Brazilian burgers 14% more expensive than their U.S. counterparts. To get to its PPP-implied level, and put the burgers at parity, Brazil’s currency would have needed to depreciate to 2.33 reais per dollar. Looking through the table, burger disparity is typical, with only 7 countries coming within ±5% of PPP.

Source: © The Economist Newspaper Limited, London (July 26, 2012). Actual market exchange rates are for July 25, 2012. PPP-implied rate is local currency price divided by price in United

States. The U.S. price is average of four cities; China price is average of five cities; Euro area price is weighted average of prices in euro area; India price is the price of a Maharaja Mac.

After reading The Big Mac Index, consider the question(s) below. Then “submit” your response.

Question

Io0uIMye7vkXAR3oJpkl+xo5npM1dFj4cqJLidAed058tZApj6PBTd4c8gvLcXVOxK/S1S6D8F74DOxqDeZyW30AtQqz033FGv5rxtRsbPFSj/GKDfSh7HZoOsvoUm919uahZHR9lzjKXr7IBN0UBnBVZ37aqjPpnAt/5nRyLPW7NQnITUhpkKfhKwN23z6uRO9HiHU+D+Juf92fi97LzRISkQt6+wW7+vUDnPGq04UtvVQbXBE7ol+cDfYiQmgKnKZOX5fnc50=

The countries with the most overvalued exchange rates are Venezuela, Norway, Sweden, and Switzerland. The latter three countries are often considered to have a high cost of living. Furthermore, these countries were relatively unscathed by the Global Financial Crisis. The countries with the most undervalued currencies are India, Ukraine, Hong Kong, Sri Lanka, and Russia. These countries have relatively large ratios of trade to GDP ratios. As you can see, however, there is no universal characteristic of a country that has an over/undervalued exchange rate.

Question

ErIhp7JVlK3GXewY4dGx6haAM3oqy05D1n7btGCOQ4j1HZq9bGxznKz58R28nWyfus3cLFdxMddX3CxTgw7Yfxfx2MA2A46kYDgkMZIx0T+lpZxmJ9Ck2Ks29/Em99wc7EA6PiB0vxHuKvQLVD/cKAH40ME=

One would expect overvalued currencies to depreciate relative to undervalued currencies.

Question

EkTY64I4K8ifhJ777C5lKGGGILkNZKwxsta7FG9/G5FkzVgwiNJJ0zBa11vgYYBux0tW8L4iiUc1pmd6DaE3ZrHfArHdYFu2epNxjLANThAtiDA57UJXxU4TxZ3WlYFrWWYZLfCVDv5mcSVe+1h/r/YBXd9YWUSWgV0dY8PJ6vrDAcnYFpfTvbK/et8eU06z4R+zSwxGKX92allWBzh1m+sbLg6DjbVo+Z8tB/pTBX8G/UO6268stUuE8i0WRSW90FiYwtMSw+mc31A0YEB8SyNAGeKTpL9UAdAyedFySeVS9BQB81gEf7qelJ8U0oF9JIDff939YYVFDseEGO+ETpM1xhd5ce0UXD+Dsj4NXMJsmgxf6gmVMhYY9LM+x/ckjXjKr6kaj+y6QltR

The book talks about transactions costs, nontraded goods, imperfect competition and legal obstacles, and price stickiness. The Big Mac is likely to be a nontradable good (it wouldn’t taste too good after its trip across the border). However, a later Headline, The Curry Trade, shows that many people are finding ways to transport food if the price differential is large enough.

Question

DDOupG5nVQ/VHIuhs5Jy695ddjzeoKv61eGdkZL+BIEDVN4qBbLJGnLobcr99j2LlFANYpMxGScdlAI+z86MRqHeOAlgykydY56RLvJOF06W60/4f1moNoOr7zGQtbgZO/3qZi2oM5etQkLft+HU2Hbw5IhGiiUqztv6N/Pnf33mF/I4FOkbbvPHiid5+4okkyGd+mZAch758xYev8zWdSuMInm3Yz44l8xnEciPSDvRtwjRtiJ9jA+9IGYL0N87eGGuDamaKW8/Y+eeZa/fD+ksO+9uSdw+bl+o2oBhHQJ6+P6mfQ/QpSu0l25fL6T0xsZnN8wr8IKsSl7ymf4oXRuSrSg15OSYCpdyGVAnzhXM8Ra5BLwLMslqhIFZOKsW0cWUgPPt3jk=

One could select any of a number of countries, but if PPP does hold in the long run, we would expect overvalued currencies to depreciate over time and undervalued currencies to appreciate.

Question

2w4+L6sP863WKtQ+28yT99dwUZPujnk1OhrpQyGTIuovAooJPNLKKoEspP+iGnoHmx4UpIZT2ILBQx3AG8anJPyJZSD3gJdB7bzcpJdgA2Fg9yWBx9inI/lkWXYhtva1CzNC3tXhM7DmkfVOWYXDPsFOdsG3L5vRQ8W5OIVJ6hJ0dtL/fbQMpBF94rbl1blFpNDHgDmgjzHX4w4otBuwDQ==

This is an open-ended question, but one could focus on Starbucks coffee, Coke and Pepsi, or apparel items that are commonly found in several countries.