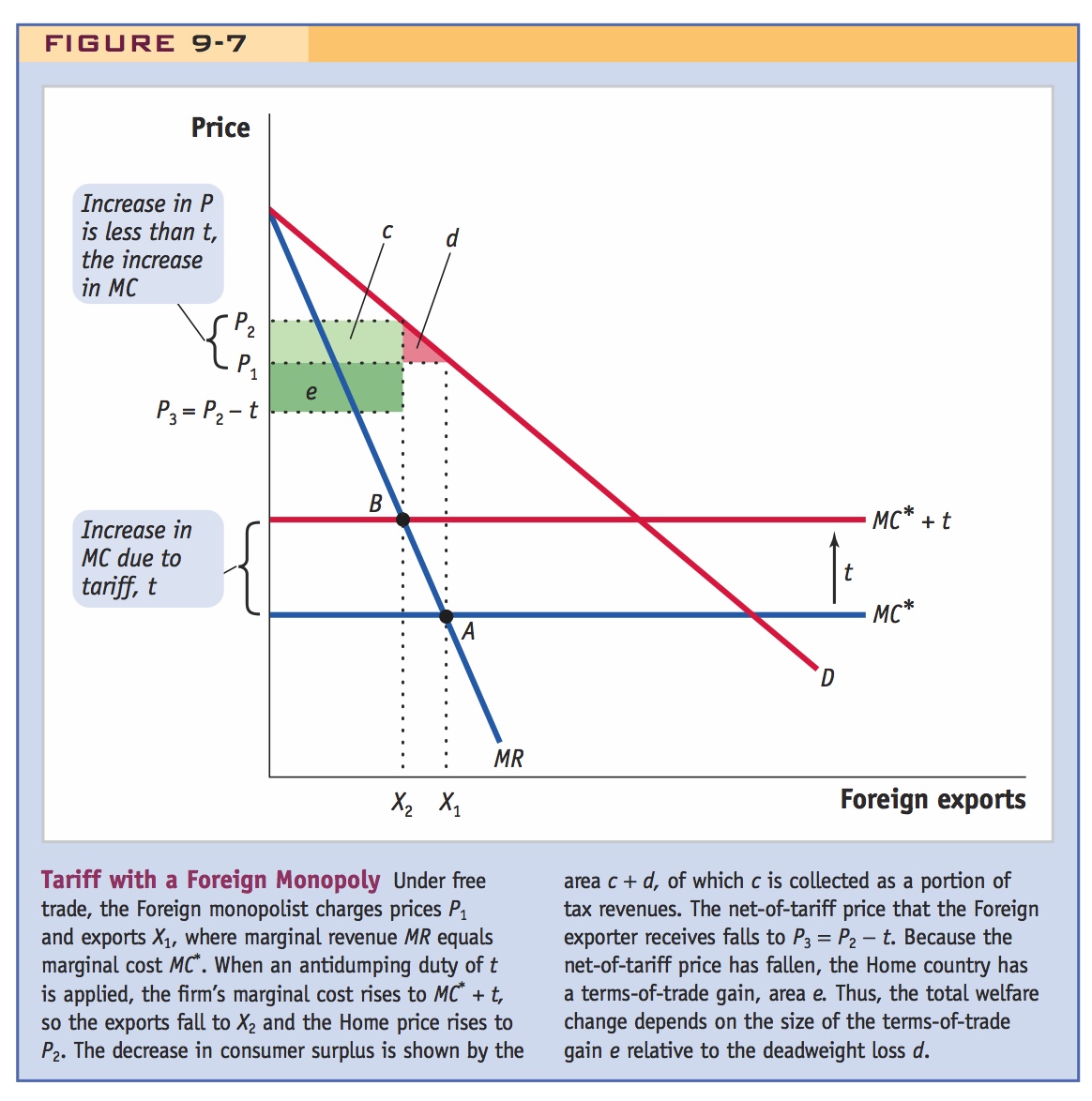

Tariff with a Foreign Monopoly Under free trade, the Foreign monopolist charges prices P1 and exports X1, where marginal revenue MR equals marginal cost MC*. When an antidumping duty of t is applied, the firm’s marginal cost rises to MC* + t, so the exports fall to X2 and the Home price rises to P2. The decrease in consumer surplus is shown by the area c + d, of which c is collected as a portion of tax revenues. The net-of-tariff price that the Foreign exporter receives falls to P3 = P2 − t. Because the net-of-tariff price has fallen, the Home country has a terms-of-trade gain, area e. Thus, the total welfare change depends on the size of the terms-of-trade gain e relative to the deadweight loss d.