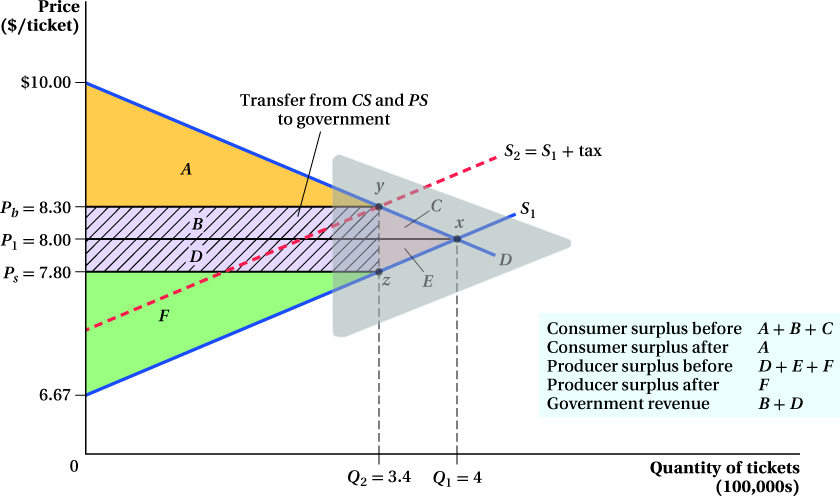

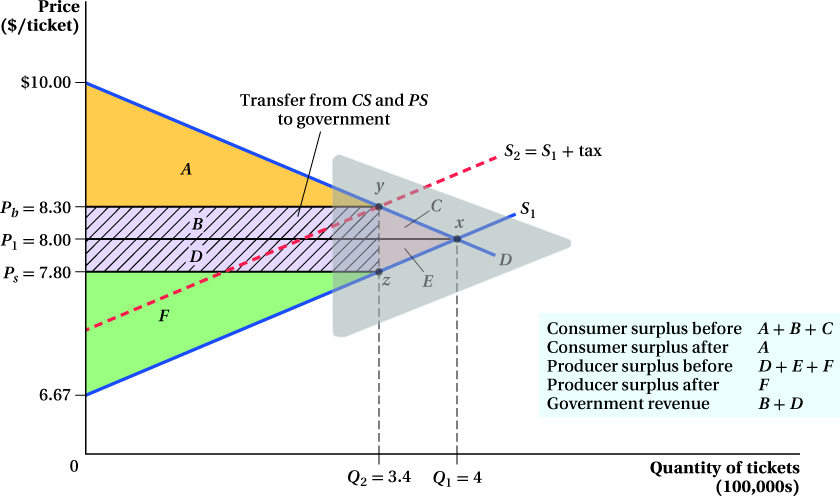

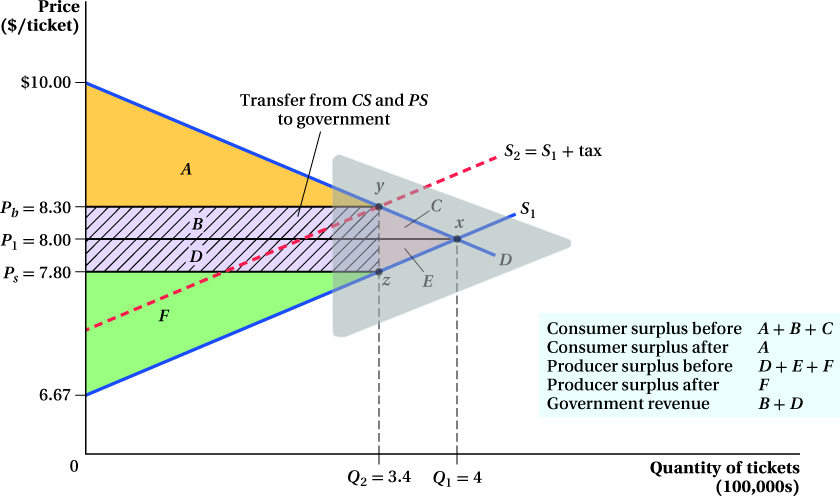

Figure 3.11 Effect of a Tax on Boston Movie Tickets

The Figure shows the effect of a $0.50 movie tax on the market for Boston movie tickets. In the pre-tax market, supply S1 and demand D intersect at the equilibrium price of $8 and the equilibrium quantity of 400,000 movie tickets. The consumer surplus is A + B + C, and the producer surplus is D + E + F. The addition of the $0.50 tax per movie ticket results in an inward shift of the supply curve from S1 to S2 by the amount of the tax and decreases the equilibrium quantity to 340,000 tickets. The resulting tax wedge creates two prices: $8.30, the price the buyer faces, and $7.80, the price the seller actually receives. The new consumer surplus is A, and the producer surplus is F. Area B + D is government tax revenue, while area C + E is the deadweight loss.