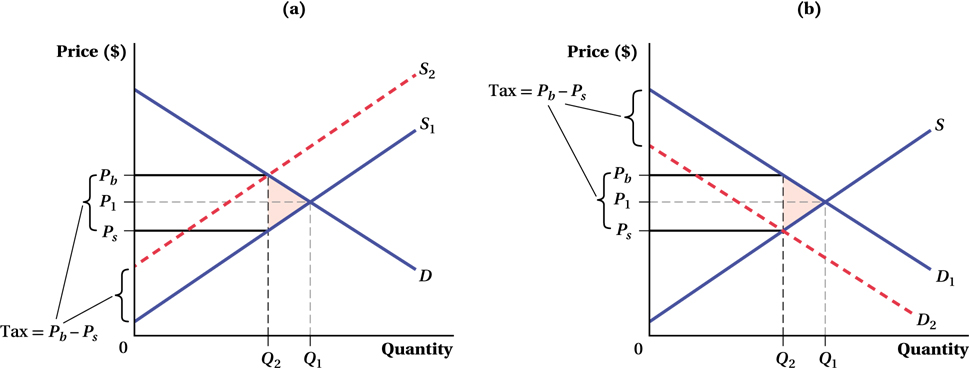

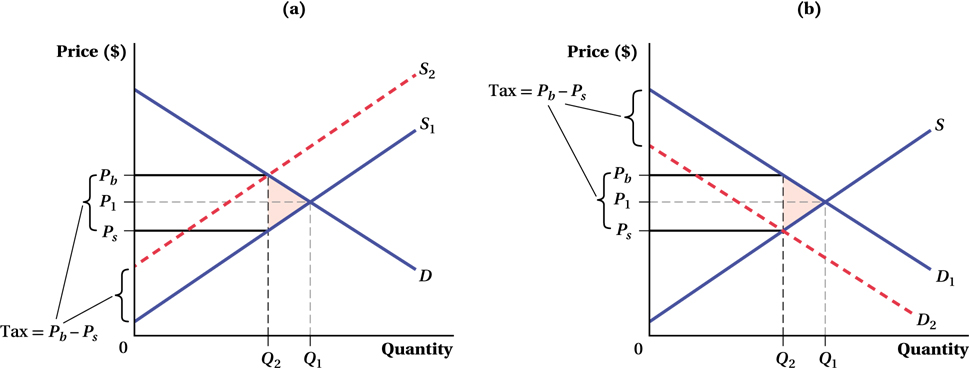

Figure 3.13 Tax Incidence

(a) The tax incidence is unaffected by whether the seller or buyer pays the tax. When the seller pays the tax, the supply curve shifts inward by the amount of the tax, Pb – Ps, from S1 to S2. The equilibrium quantity decreases from Q1 to Q2. The seller now faces price Ps at the equilibrium, while the buyer pays price Pb.

(b) When the buyer pays the tax, the demand curve shifts inward by the amount of the tax, Pb – Ps, from D1 to D2. The equilibrium quantity decreases from Q1 to Q2. As in panel a, the seller now faces price Ps at the equilibrium, while the buyer pays price Pb.