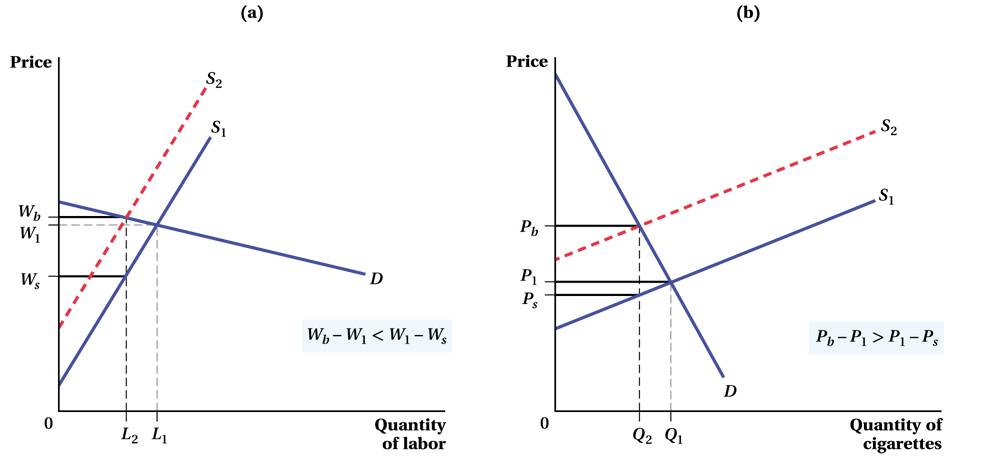

Figure 3.14 Tax Incidence and Elasticities

(b) In the market for cigarettes where demand is inelastic and supply elastic, we begin with supply curve S1, demand D, and equilibrium price and quantity (P1, Q1). The implementation of the tax, Pb – Ps, shifts the supply curve inward from S1 to S2 and decreases the equilibrium quantity of cigarettes from Q1 to Q2. Because smokers in this market are not very sensitive to price and cigarette companies are, the effect of the tax on the price consumers pay is much larger than its effect on the price companies receive, Pb – P1 > P1 – Ps.