Appendix Introduction

Chapter 9 Appendix: The Calculus of Profit Maximization

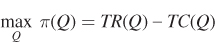

In Chapters 8 and 9, we saw that all firms—regardless of their degrees of market power—maximize their profits. In particular, the firm faces the optimization problem:

This problem is relatively straightforward compared to the cost-minimization and utility-maximization problems we’ve focused on previously. Why? Look closely at the problem we wrote above, and you’ll notice that there aren’t any constraints on it. In fact, profit maximization is an unconstrained optimization problem and, as such, is much simpler to solve than the constrained optimization problems we’ve been dealing with so far.

What is more, the profit-maximization problem only has one choice variable, its output Q. Every other variable that factors into a firm’s decisions—the quantities and prices of productive inputs, as well as the market price of the good—has already been accounted for in the equations for total revenue and total cost. How? First, total cost is determined only after a firm minimizes its costs, meaning it incorporates information about a firm’s productive inputs. Next, consider total revenue, which is the product of price and quantity. For the perfectly competitive firm, price is constant, so given the market price, total revenue only varies with quantity. Firms with market power face variable prices, but we saw that those prices are a function of quantity sold. Therefore, total cost, total revenue, and—by extension—profit are all functions of quantity, holding all else constant.12

12We could be very explicit about these functions and always write profit, total revenue, and total cost as π(Q), TR(Q), and TC(Q); however, this becomes a little cumbersome. So in this appendix, we’ll just write π, TR, and TC and remind you now and then that each is a function of Q.