Investment Spending

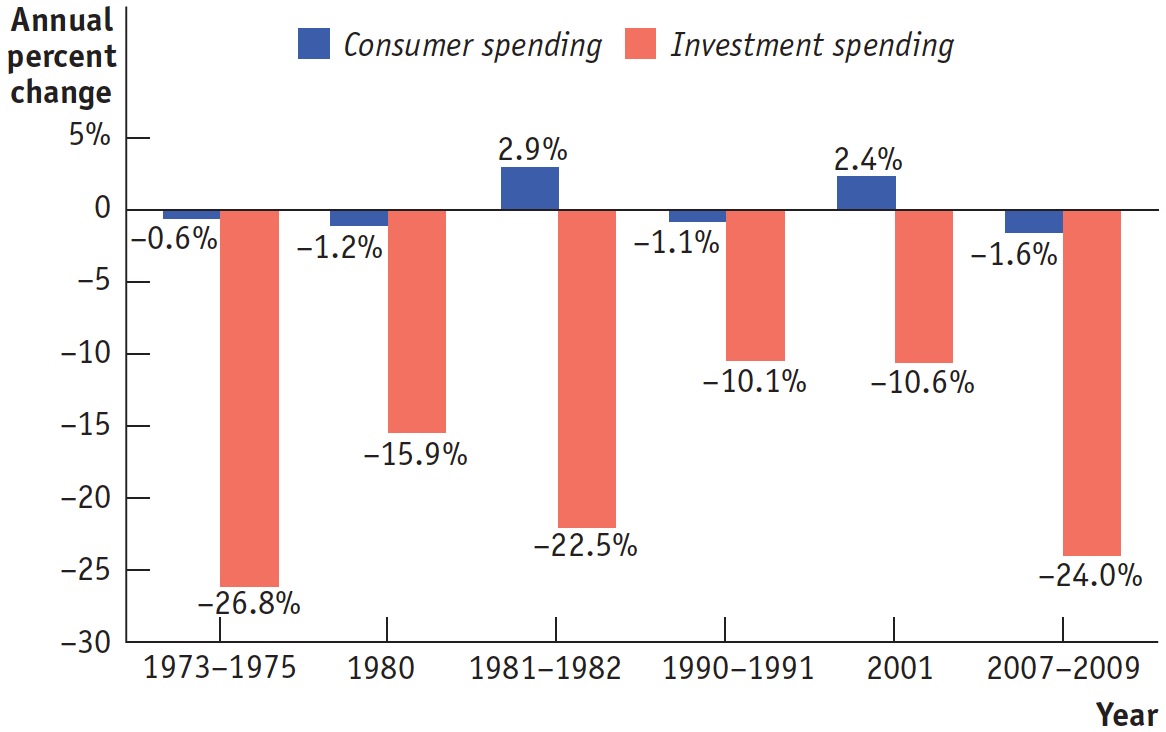

Although consumer spending is much greater than investment spending, booms and busts in investment spending tend to drive the business cycle. In fact, most recessions originate as a fall in investment spending. Figure 16.4 illustrates this point; it shows the annual percentage change of investment spending and consumer spending in the United States, both measured in 2005 dollars, during six recessions from 1973 to 2009. As you can see, swings in investment spending are much more dramatic than those in consumer spending. In addition, economists believe that declines in consumer spending are usually the result of slumps in investment spending that trigger the spending multiplier process. Soon we’ll examine in more detail how investment spending affects consumer spending.

Planned investment spending is the investment spending that businesses intend to undertake during a given period.

Before we do that, however, let’s analyze the factors that determine investment spending, which are somewhat different from those that determine consumer spending. Planned investment spending is the investment spending that firms intend to undertake during a given period. For reasons explained shortly, the level of investment spending that businesses actually carry out is sometimes not the same level as was planned. Planned investment spending depends on three principal factors: the interest rate, the expected future level of real GDP, and the current level of production capacity. First, we’ll analyze the effect of the interest rate.

The Interest Rate and Investment Spending

167

Interest rates have their clearest effect on one particular form of investment spending: spending on residential construction—

Interest rates also affect other forms of investment spending. Firms with investment spending projects will go ahead with a project only if they expect a rate of return higher than the cost of the funds they would have to borrow to finance that project. If the interest rate rises, fewer projects will pass that test, and, as a result, investment spending will be lower.

You might think that the trade-

So planned investment spending—

Expected Future Real GDP, Production Capacity, and Investment Spending

Suppose a firm has enough capacity to continue to produce the amount it is currently selling but doesn’t expect its sales to grow in the future. Then it will engage in investment spending only to replace existing equipment and structures that wear out or are rendered obsolete by new technologies. But if, instead, the firm expects its sales to grow rapidly in the future, it will find its existing production capacity insufficient for its future production needs. So the firm will undertake investment spending to meet those needs. This implies that, other things equal, firms will undertake more investment spending when they expect their sales to grow.

Now suppose that the firm currently has considerably more capacity than necessary to meet current production needs. Even if it expects sales to grow, it won’t have to undertake investment spending for a while—

168

If we put together the effects on investment spending of (1) growth in expected future sales and (2) the size of current production capacity, we can see one situation in which firms will most likely undertake high levels of investment spending: when they expect sales to grow rapidly. In that case, even excess production capacity will soon be used up, leading firms to resume investment spending.

What is an indicator of high expected growth in future sales? It’s a high expected future growth rate of real GDP. A higher expected future growth rate of real GDP results in a higher level of planned investment spending, but a lower expected future growth rate of real GDP leads to lower planned investment spending.

Inventories and Unplanned Investment Spending

AP® Exam Tip

An increase in unplanned inventories is preceded by a decrease in consumer spending. A decrease in unplanned inventories is preceded by an increase in consumer spending.

Most firms maintain inventories, stocks of goods held to satisfy future sales. Firms hold inventories so they can quickly satisfy buyers—

A firm that increases its inventories is engaging in a form of investment spending. Suppose, for example, that the U.S. auto industry produces 800,000 cars per month but sells only 700,000. The remaining 100,000 cars are added to the inventory at auto company warehouses or car dealerships, ready to be sold in the future.

Inventory investment is the value of the change in total inventories held in the economy during a given period.

Inventory investment is the value of the change in total inventories held in the economy during a given period. Unlike other forms of investment spending, inventory investment can actually be negative. If, for example, the auto industry reduces its inventory over the course of a month, we say that it has engaged in negative inventory investment.

Positive unplanned inventory investment occurs when actual sales are lower than businesses expected, leading to unplanned increases in inventories. Sales in excess of expectations result in negative unplanned inventory investment.

Actual investment spending is the sum of planned investment spending and unplanned inventory investment.

To understand inventory investment, think about a manager stocking the canned goods section of a supermarket. The manager tries to keep the store fully stocked so that shoppers can almost always find what they’re looking for. But the manager does not want the shelves too heavily stocked because shelf space is limited and products can spoil. Similar considerations apply to many firms and typically lead them to manage their inventories carefully. However, sales fluctuate. And because firms cannot always accurately predict sales, they often find themselves holding larger or smaller inventories than they had intended. When a firm’s inventories are higher than intended due to an unforeseen decrease in sales, the result is unplanned inventory investment. An unexpected increase in sales depletes inventories and causes the value of unplanned inventory investment to be negative.

So in any given period, actual investment spending is equal to planned investment spending plus unplanned inventory investment. If we let IUnplanned represent unplanned inventory investment, IPlanned represent planned investment spending, and I represent actual investment spending, then the relationship among all three can be represented as:

To see how unplanned inventory investment can occur, let’s continue to focus on the auto industry and make the following assumptions. First, let’s assume that the industry must determine each month’s production volume in advance, before it knows the volume of actual sales. Second, let’s assume that it anticipates selling 800,000 cars next month and that it plans neither to add to nor subtract from existing inventories. In that case, it will produce 800,000 cars to match anticipated sales.

169

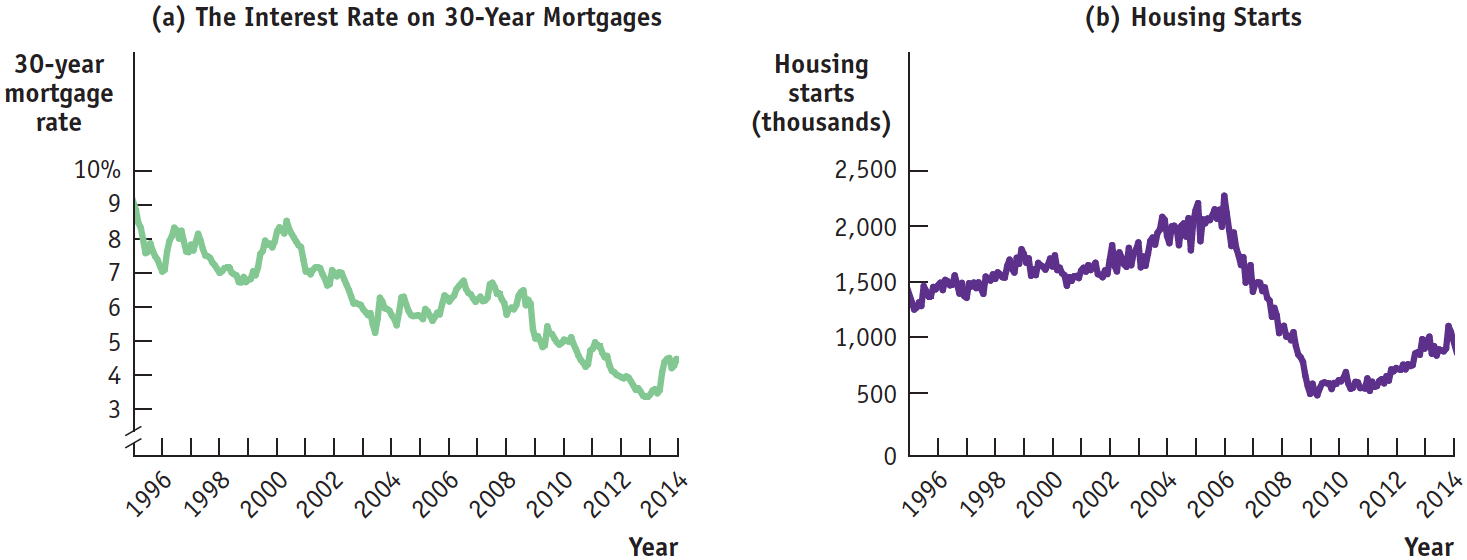

Interest Rates and the U.S. Housing Boom

Interest rates in the United States dropped from roughly 7.5% to 5.5% between the late 1990s and 2003, helping set off a nationwide housing boom. There is little question that this housing boom was caused, in the first instance, by low interest rates.

The figure below shows the interest rate on 30-

The low interest rates led to a large increase in residential investment spending, reflected in a surge of housing starts, shown in panel (b). This rise in investment spending drove an overall economic expansion, both through its direct effects and through the spending multiplier process.

Unfortunately, the housing boom eventually turned into too much of a good thing. By 2006, it was clear that the U.S. housing market was experiencing a bubble: people were buying housing based on unrealistic expectations about future price increases. When the bubble burst, housing—

Now imagine that next month’s actual sales are less than expected, only 700,000 cars. As a result, the value of 100,000 cars will be added to investment spending as unplanned inventory investment.

The auto industry will, of course, eventually adjust to this slowdown in sales and the resulting unplanned inventory investment. It is likely that it will cut next month’s production volume in order to reduce inventories. In fact, economists who study macroeconomic variables in an attempt to determine the future path of the economy pay careful attention to changes in inventory levels. Rising inventories typically indicate positive unplanned inventory investment and a slowing economy, as sales are less than had been forecast. Falling inventories typically indicate negative unplanned inventory investment and a growing economy, as sales are greater than forecast. In the next section, we will see how production adjustments in response to fluctuations in sales and inventories ensure that the value of final goods and services actually produced is equal to desired purchases of those final goods and services.