Short-Run Macroeconomic Equilibrium

The economy is in short-run macroeconomic equilibrium when the quantity of aggregate output supplied is equal to the quantity demanded.

The short-run equilibrium aggregate price level is the aggregate price level in the short-run macroeconomic equilibrium.

Short-run equilibrium aggregate output is the quantity of aggregate output produced in the short-run macroeconomic equilibrium.

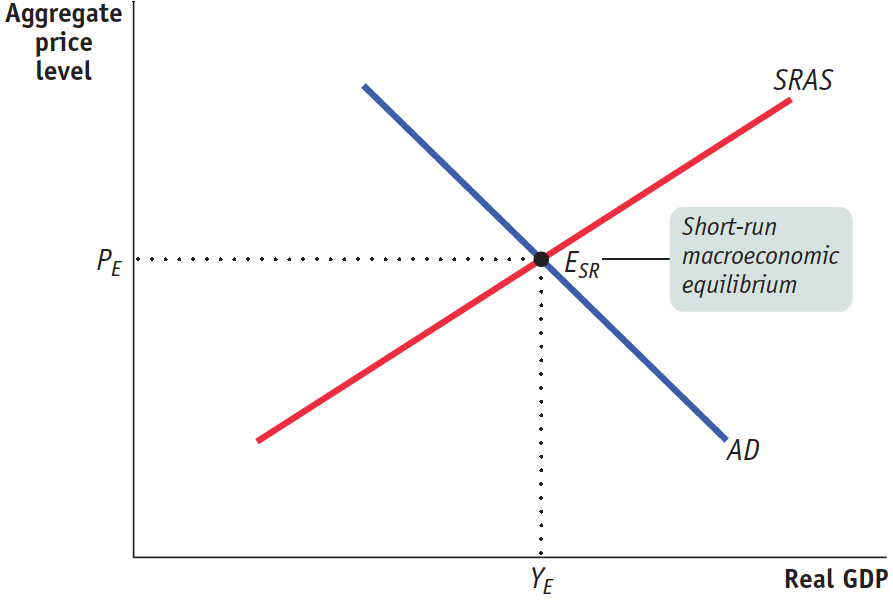

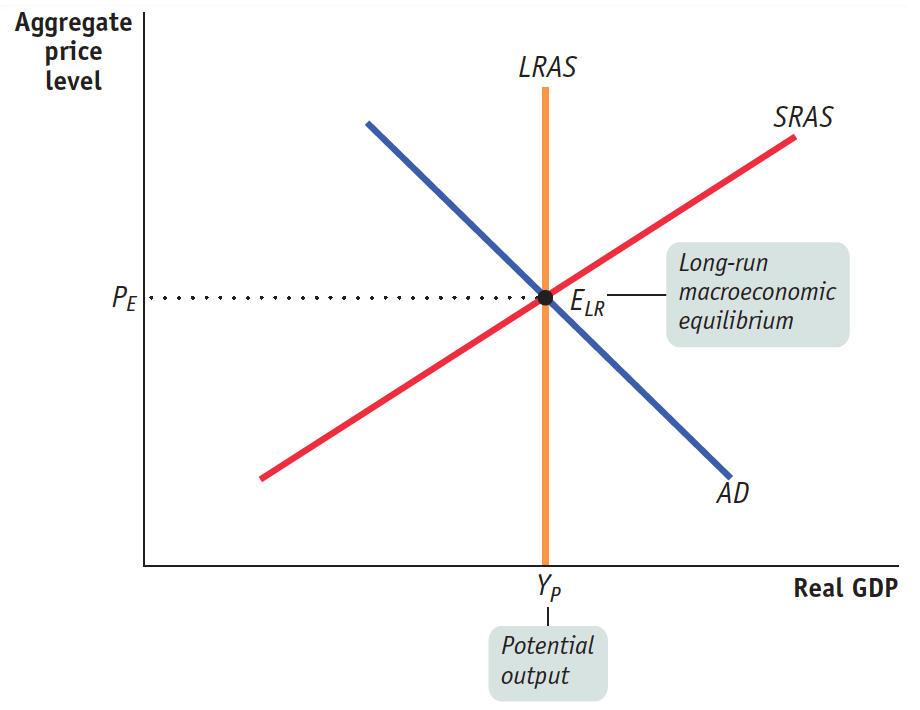

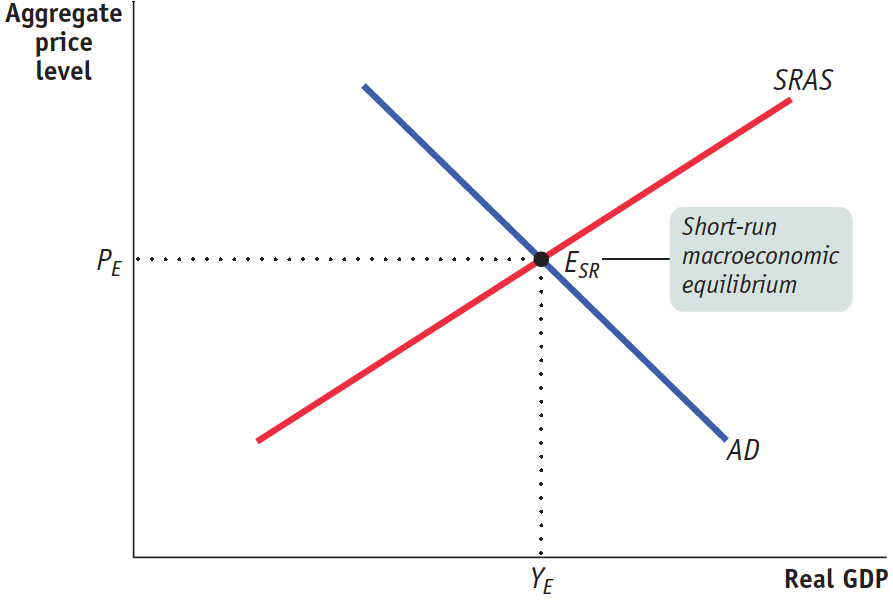

We’ll begin our analysis by focusing on the short run. Figure 19.1 shows the aggregate demand curve and the short-run aggregate supply curve on the same diagram. The point at which the AD and SRAS curves intersect, ESR, is the short-run macroeconomic equilibrium: the point at which the quantity of aggregate output supplied is equal to the quantity demanded by domestic households, businesses, the government, and the rest of the world. The aggregate price level at ESR, PE, is the short-run equilibrium aggregate price level. The level of aggregate output at ESR, YE, is the short-run equilibrium aggregate output.

Figure 19.1: The AD–AS ModelThe AD–AS model combines the aggregate demand curve and the short-run aggregate supply curve. Their point of intersection, ESR, is the point of short-run macroeconomic equilibrium where the quantity of aggregate output demanded is equal to the quantity of aggregate output supplied. PE is the short-run equilibrium aggregate price level, and YE is the short-run equilibrium level of aggregate output.

We have seen that a shortage of any individual good causes its market price to rise and a surplus of the good causes its market price to fall. These forces ensure that the market reaches equilibrium. The same logic applies to short-run macroeconomic equilibrium. If the aggregate price level is above its equilibrium level, the quantity of aggregate output supplied exceeds the quantity of aggregate output demanded. This leads to a fall in the aggregate price level and pushes it toward its equilibrium level. If the aggregate price level is below its equilibrium level, the quantity of aggregate output supplied is less than the quantity of aggregate output demanded. This leads to a rise in the aggregate price level, again pushing it toward its equilibrium level. In the discussion that follows, we’ll assume that the economy is always in short-run macroeconomic equilibrium.

AP® Exam Tip

When asked to graph the effect of a change, graph the first thing that happens in the short-run unless the question tells you to look at the long-run.

We’ll also make another important simplification based on the observation that, in reality, there is a long-term upward trend in both aggregate output and the aggregate price level. We’ll assume that a fall in either variable really means a fall compared to the long-run trend. For example, if the aggregate price level normally rises 4% per year, a year in which the aggregate price level rises only 3% would count, for our purposes, as a 1% decline. In fact, since the Great Depression there have been very few years in which the aggregate price level of any major nation actually declined—Japan’s period of deflation from 1995 to 2005 is one of the few exceptions (which we will explain later). However, there have been many cases in which the aggregate price level fell relative to the long-run trend.

The short-run equilibrium aggregate output and the short-run equilibrium aggregate price level can change because of shifts of either the AD curve or the SRAS curve. Let’s look at each case in turn.

Shifts of Aggregate Demand: Short-Run Effects

An event that shifts the aggregate demand curve is a demand shock.

An event that shifts the aggregate demand curve, such as a change in expectations or wealth, the effect of the size of the existing stock of physical capital, or the use of fiscal or monetary policy, is known as a demand shock. The Great Depression was caused by a negative demand shock, the collapse of wealth and of business and consumer confidence that followed the stock market crash of 1929 and the banking crises of 1930–1931. The Depression was ended by a positive demand shock—the huge increase in government purchases during World War II. In 2008, the U.S. economy experienced another significant negative demand shock as the housing market turned from boom to bust, leading consumers and firms to scale back their spending.

© Bettmann/CORBIS

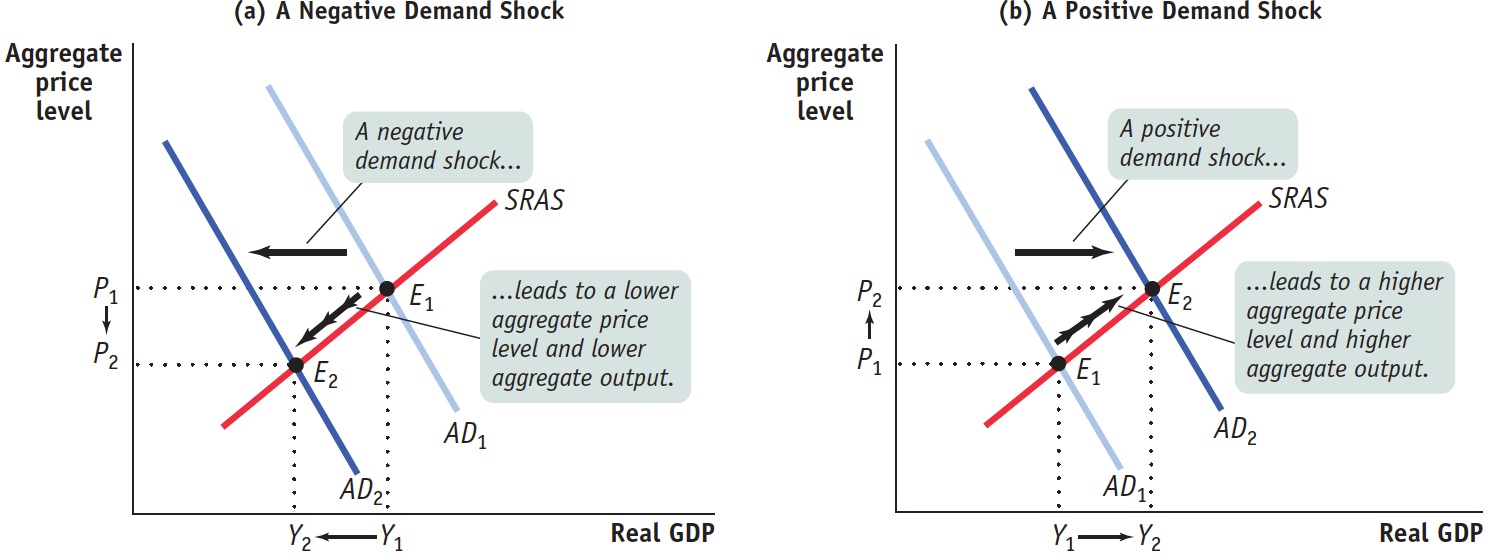

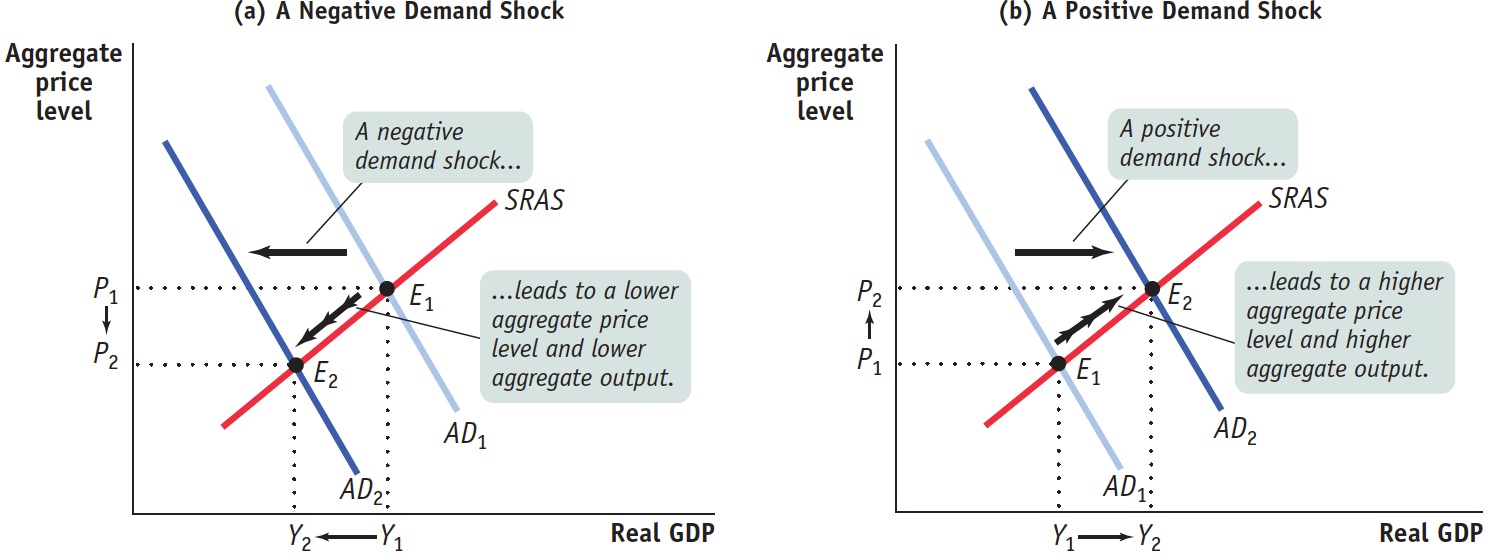

Figure 19.2 shows the short-run effects of negative and positive demand shocks. A negative demand shock shifts the aggregate demand curve, AD, to the left, from AD1 to AD2, as shown in panel (a). The economy moves down along the SRAS curve from E1 to E2, leading to lower short-run equilibrium aggregate output and a lower short-run equilibrium aggregate price level. A positive demand shock shifts the aggregate demand curve, AD, to the right, as shown in panel (b). Here, the economy moves up along the SRAS curve, from E1 to E2. This leads to higher short-run equilibrium aggregate output and a higher short-run equilibrium aggregate price level. Demand shocks cause aggregate output and the aggregate price level to move in the same direction.

Figure 19.2: Demand ShocksA demand shock shifts the aggregate demand curve, moving the aggregate price level and aggregate output in the same direction. In panel (a), a negative demand shock shifts the aggregate demand curve leftward from AD1 to AD2, reducing the aggregate price level from P1 to P2 and aggregate output from Y1 to Y2. In panel (b), a positive demand shock shifts the aggregate demand curve rightward, increasing the aggregate price level from P1 to P2 and aggregate output from Y1 to Y2.

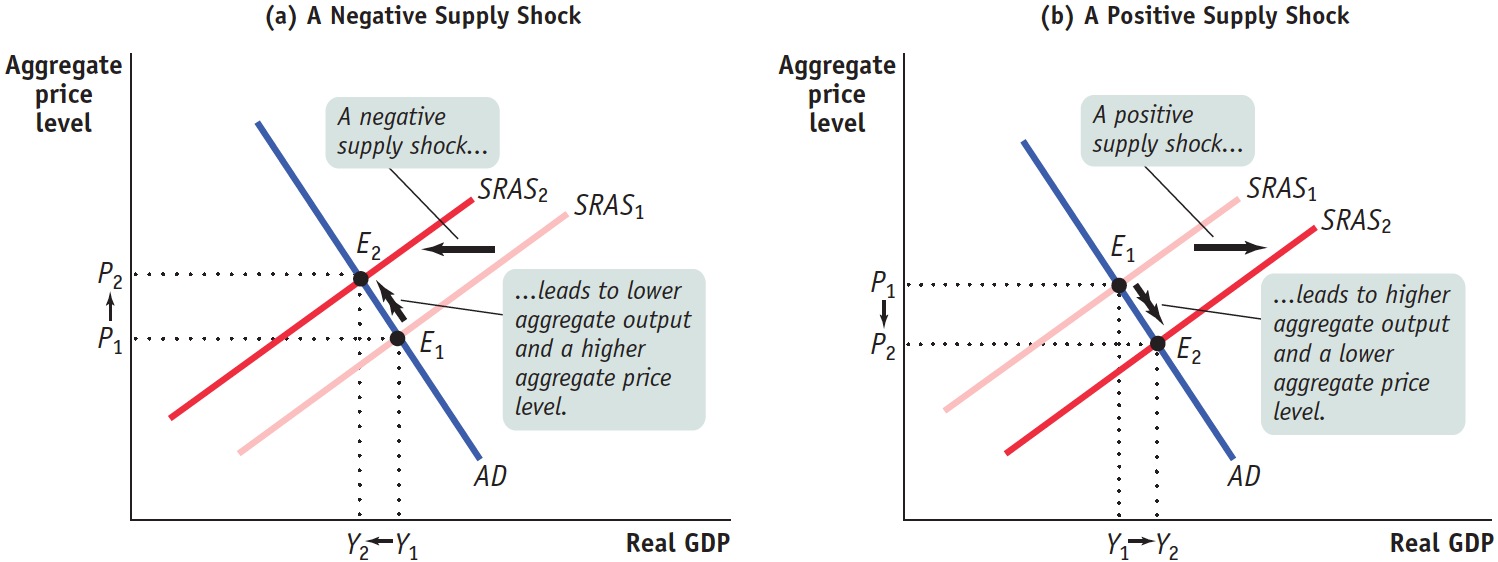

Shifts of the SRAS Curve

An event that shifts the short-run aggregate supply curve is a supply shock.

An event that shifts the short-run aggregate supply curve, such as a change in commodity prices, nominal wages, or productivity, is known as a supply shock. A negative supply shock raises production costs and reduces the quantity producers are willing to supply at any given aggregate price level, leading to a leftward shift of the short-run aggregate supply curve. The U.S. economy experienced severe negative supply shocks following disruptions to world oil supplies in 1973 and 1979. In contrast, a positive supply shock reduces production costs and increases the quantity supplied at any given aggregate price level, leading to a rightward shift of the short-run aggregate supply curve. The United States experienced a positive supply shock between 1995 and 2000, when the increasing use of the Internet and other information technologies caused productivity growth to surge.

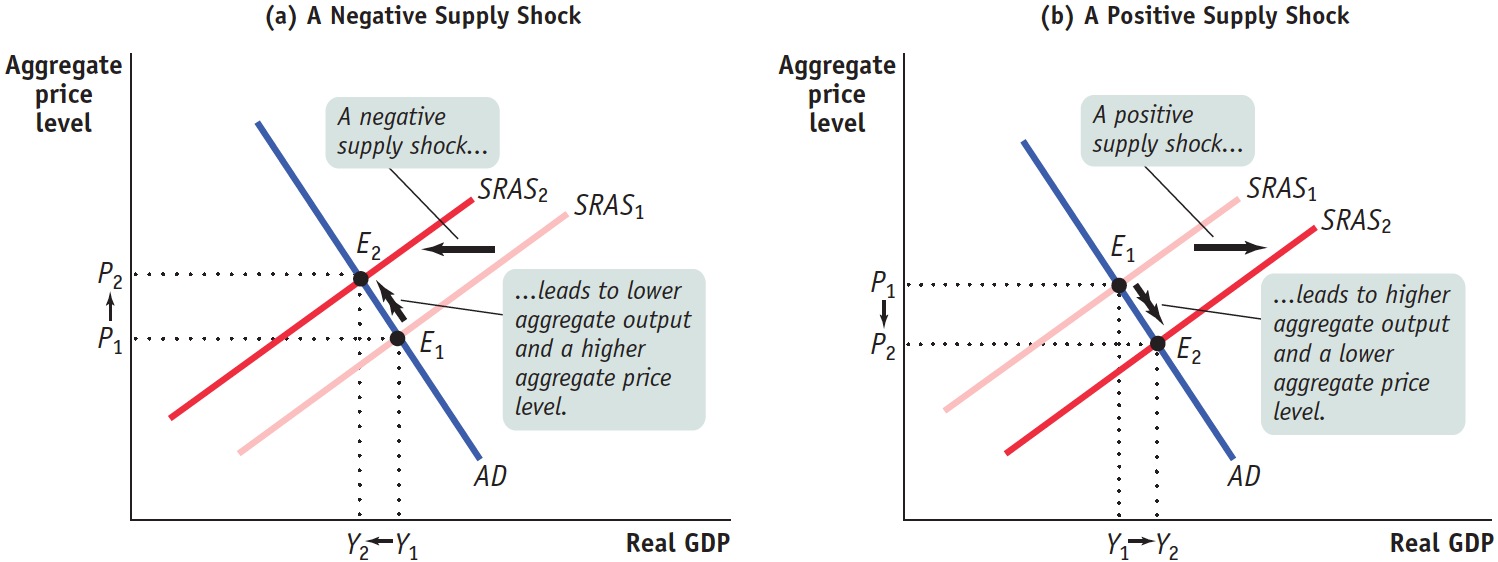

The effects of a negative supply shock are shown in panel (a) of Figure 19.3. The initial equilibrium is at E1, with aggregate price level P1 and aggregate output Y1. The disruption in the oil supply causes the short-run aggregate supply curve to shift to the left, from SRAS1 to SRAS2. As a consequence, aggregate output falls and the aggregate price level rises, an upward movement along the AD curve. At the new equilibrium, E2, the short-run equilibrium aggregate price level, P2, is higher, and the short-run equilibrium aggregate output level, Y2, is lower than before.

Figure 19.3: Supply ShocksA supply shock shifts the short-run aggregate supply curve, moving the aggregate price level and aggregate output in opposite directions. Panel (a) shows a negative supply shock, which shifts the short-run aggregate supply curve leftward and causes stagflation—lower aggregate output and a higher aggregate price level. Here, the short-run aggregate supply curve shifts from SRAS1 to SRAS2, and the economy moves from E1 to E2. The aggregate price level rises from P1 to P2, and aggregate output falls from Y1 to Y2. Panel (b) shows a positive supply shock, which shifts the short-run aggregate supply curve rightward, generating higher aggregate output and a lower aggregate price level. The short-run aggregate supply curve shifts from SRAS1 to SRAS2, and the economy moves from E1 to E2. The aggregate price level falls from P1 to P2, and aggregate output rises from Y1 to Y2.

Producers are vulnerable to dramatic changes in the price of oil, a cause of supply shocks.

Bloomberg via Getty Images

Stagflation is the combination of inflation and stagnating (or falling) aggregate output.

The combination of inflation and falling aggregate output shown in panel (a) has a special name: stagflation, for “stagnation plus inflation.” When an economy experiences stagflation, it’s very unpleasant: falling aggregate output leads to rising unemployment, and people feel that their purchasing power is squeezed by rising prices. Stagflation in the 1970s led to a mood of national pessimism. As we’ll see shortly, it also poses a dilemma for policy makers.

A positive supply shock, shown in panel (b), has exactly the opposite effects. A rightward shift of the SRAS curve, from SRAS1 to SRAS2 results in a rise in aggregate output and a fall in the aggregate price level, a downward movement along the AD curve. The favorable supply shocks of the late 1990s led to a combination of full employment and declining inflation. That is, the aggregate price level fell compared with the long-run trend. For a few years, this combination produced a great wave of national optimism.

The distinctive feature of supply shocks, both negative and positive, is that, unlike demand shocks, they cause the aggregate price level and aggregate output to move in opposite directions.

There’s another important contrast between supply shocks and demand shocks. As we’ve seen, monetary policy and fiscal policy enable the government to shift the AD curve, meaning that governments are in a position to create the kinds of shocks shown in Figure 19.2. It’s much harder for governments to shift the AS curve. Are there good policy reasons to shift the AD curve? We’ll turn to that question soon. First, however, let’s look at the difference between short-run macroeconomic equilibrium and long-run macroeconomic equilibrium.

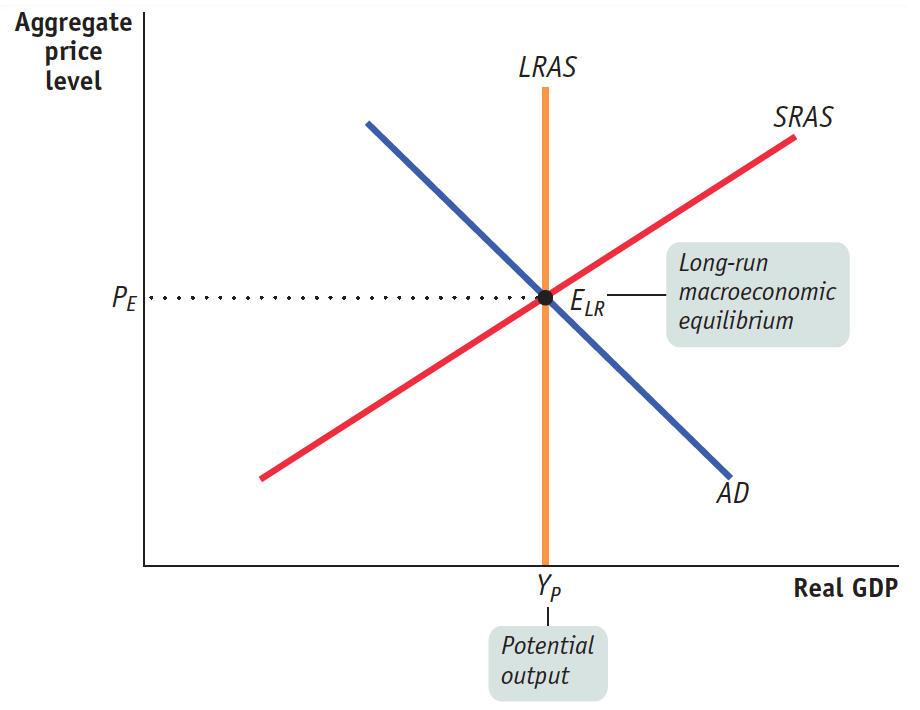

Long-Run Macroeconomic Equilibrium

The economy is in long-run macroeconomic equilibrium when the point of short-run macroeconomic equilibrium is on the long-run aggregate supply curve.

Figure 19.4 combines the aggregate demand curve with both the short-run and long-run aggregate supply curves. The aggregate demand curve, AD, crosses the short-run aggregate supply curve, SRAS, at ELR. Here we assume that enough time has elapsed that the economy is also on the long-run aggregate supply curve, LRAS. As a result, ELR is at the intersection of all three curves—SRAS, LRAS, and AD. So short-run equilibrium aggregate output is equal to potential output, YP. Such a situation, in which the point of short-run macroeconomic equilibrium is on the long-run aggregate supply curve, is known as long-run macroeconomic equilibrium.

Figure 19.4: Long-Run Macroeconomic EquilibriumHere the point of short-run macroeconomic equilibrium also lies on the long-run aggregate supply curve, LRAS. As a result, short-run equilibrium aggregate output is equal to potential output, YP. The economy is in long-run macroeconomic equilibrium at ELR.

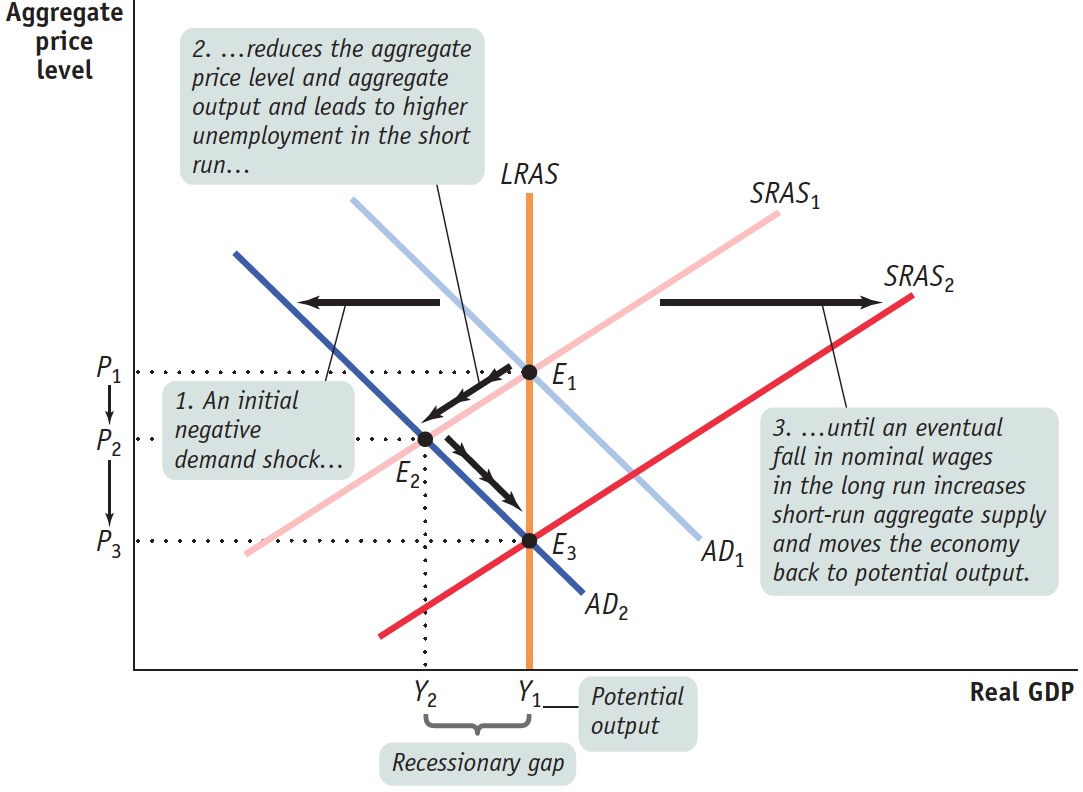

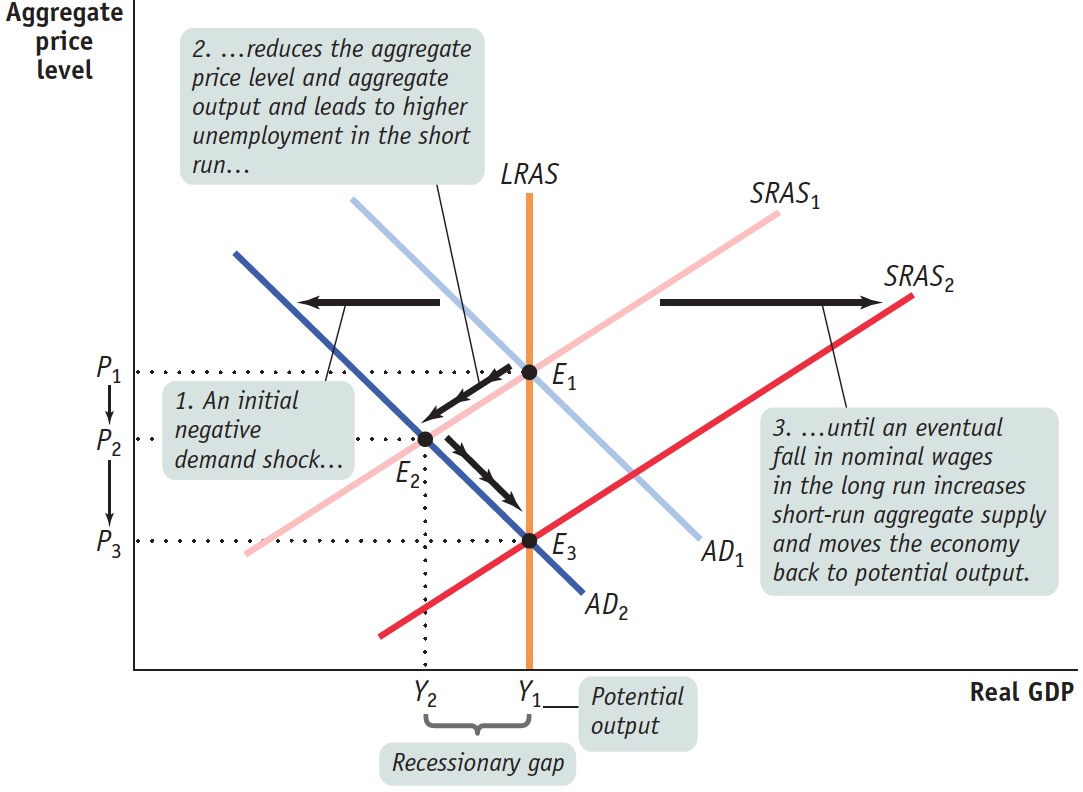

To see the significance of long-run macroeconomic equilibrium, let’s consider what happens if a demand shock moves the economy away from long-run macroeconomic equilibrium. In Figure 19.5, we assume that the initial aggregate demand curve is AD1 and the initial short-run aggregate supply curve is SRAS1. So the initial macroeconomic equilibrium is at E1, which lies on the long-run aggregate supply curve, LRAS. The economy, then, starts from a point of short-run and long-run macroeconomic equilibrium, and short-run equilibrium aggregate output equals potential output at Y1.

Figure 19.5: Short-Run Versus Long-Run Effects of a Negative Demand ShockIn the long run the economy is self-correcting: demand shocks have only a short-run effect on aggregate output. Starting at E1, a negative demand shock shifts AD1 leftward to AD2. In the short run the economy moves to E2 and a recessionary gap arises: the aggregate price level declines from P1 to P2, aggregate output declines from Y1 to Y2, and unemployment rises. But in the long run nominal wages fall in response to high unemployment at Y2, and SRAS1 shifts rightward to SRAS2. Aggregate output rises from Y2 to Y1, and the aggregate price level declines again, from P2 to P3. Long-run macroeconomic equilibrium is eventually restored at E3.

Now suppose that for some reason—such as a sudden worsening of business and consumer expectations—aggregate demand falls and the aggregate demand curve shifts leftward to AD2. This results in a lower equilibrium aggregate price level at P2 and a lower equilibrium aggregate output level at Y2 as the economy settles in the short run at E2. The short-run effect of such a fall in aggregate demand is what the U.S. economy experienced in 1929–1933: a falling aggregate price level and falling aggregate output.

There is a recessionary gap when aggregate output is below potential output.

Aggregate output in this new short-run equilibrium, E2, is below potential output. When this happens, the economy faces a recessionary gap. A recessionary gap inflicts a great deal of pain because it corresponds to high unemployment. The large recessionary gap that had opened up in the United States by 1933 caused intense social and political turmoil. And the devastating recessionary gap that opened up in Germany at the same time played an important role in Hitler’s rise to power.

AP® Exam Tip

If you have drawn a recessionary gap correctly, the intersection of AD and SRAS will be to the left of LRAS and potential output.

But this isn’t the end of the story. In the face of high unemployment, nominal wages eventually fall, as do any other sticky prices, ultimately leading producers to increase output. As a result, a recessionary gap causes the short-run aggregate supply curve to gradually shift to the right. This process continues until SRAS1 reaches its new position at SRAS2, bringing the economy to equilibrium at E3, where AD2, SRAS2, and LRAS all intersect. At E3, the economy is back in long-run macroeconomic equilibrium; it is back at potential output Y1 but at a lower aggregate price level, P3, reflecting a long-run fall in the aggregate price level. The economy is self-correcting in the long run.

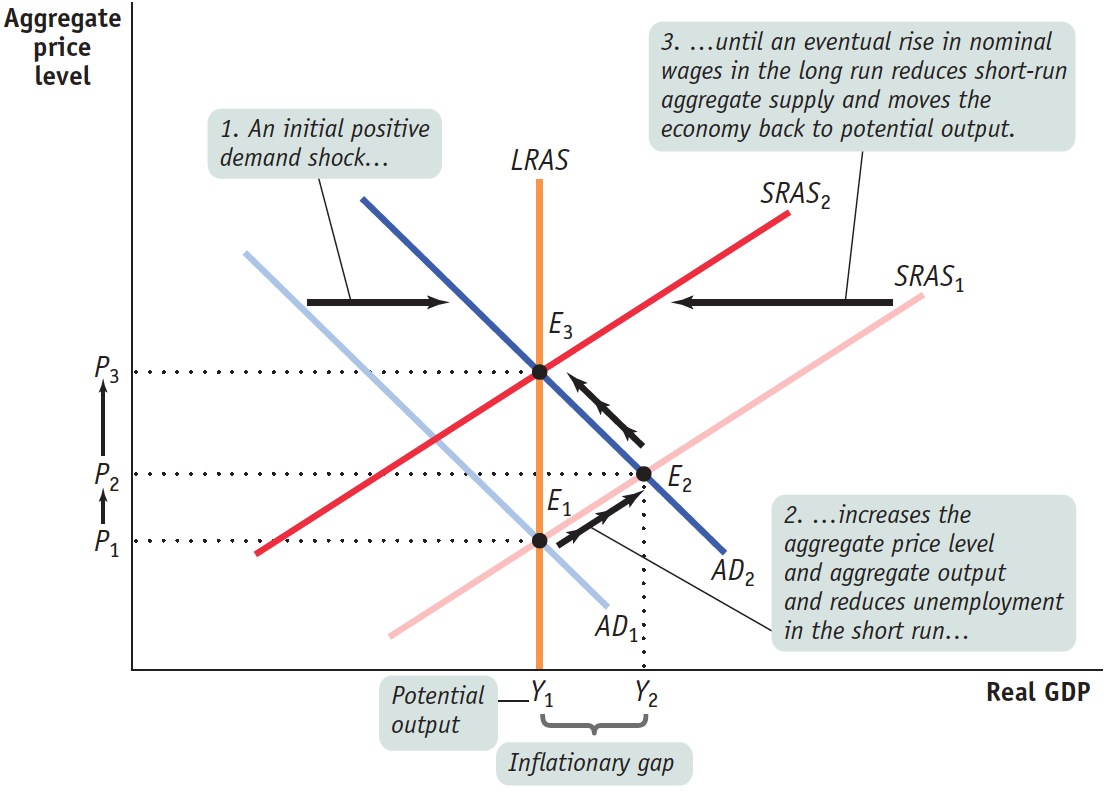

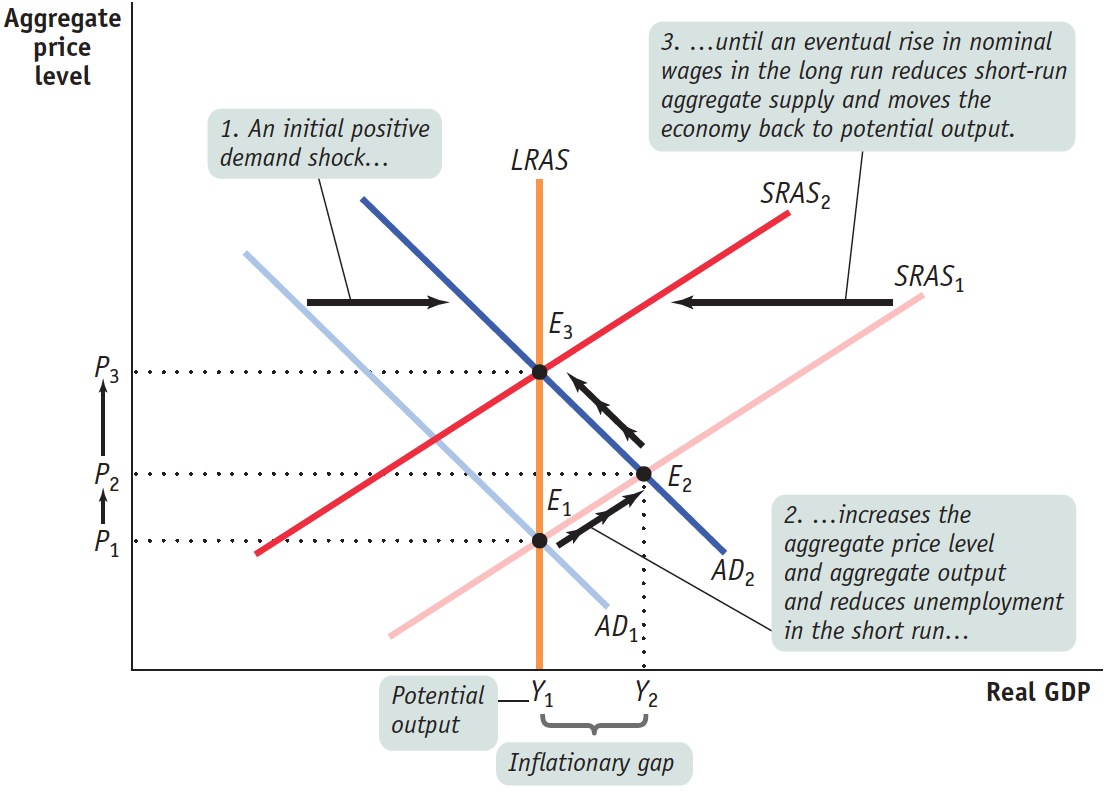

What if, instead, there was an increase in aggregate demand? The results are shown in Figure 19.6, where we again assume that the initial aggregate demand curve is AD1 and the initial short-run aggregate supply curve is SRAS1. The initial macroeconomic equilibrium, at E1, lies on the long-run aggregate supply curve, LRAS. Initially, then, the economy is in long-run macroeconomic equilibrium.

Figure 19.6: Short-Run Versus Long-Run Effects of a Positive Demand ShockStarting at E1, a positive demand shock shifts AD1 rightward to AD2, and the economy moves to E2 in the short run. This results in an inflationary gap as aggregate output rises from Y1 to Y2, the aggregate price level rises from P1 to P2, and unemployment falls to a low level. In the long run, SRAS1 shifts leftward to SRAS2 as nominal wages rise in response to low unemployment at Y2. Aggregate output falls back to Y1, the aggregate price level rises again to P3, and the economy self-corrects as it returns to long-run macroeconomic equilibrium at E3.

There is an inflationary gap when aggregate output is above potential output.

Now suppose that aggregate demand rises, and the AD curve shifts rightward to AD2. This results in a higher aggregate price level, at P2, and a higher aggregate output level, at Y2, as the economy settles in the short run at E2. Aggregate output in this new short-run equilibrium is above potential output, and unemployment is low in order to produce this higher level of aggregate output. When this happens, the economy experiences an inflationary gap. As in the case of a recessionary gap, this isn’t the end of the story. In the face of low unemployment, nominal wages will rise, as will other sticky prices. An inflationary gap causes the short-run aggregate supply curve to shift gradually to the left as producers reduce output in the face of rising nominal wages. This process continues until SRAS1 reaches its new position at SRAS2, bringing the economy into equilibrium at E3, where AD2, SRAS2, and LRAS all intersect. At E3, the economy is back in long-run macroeconomic equilibrium. It is back at potential output, but at a higher price level, P3, reflecting a long-run rise in the aggregate price level. Again, the economy is self-correcting in the long run.

AP® Exam Tip

If you have drawn an inflationary gap correctly, the intersection of AD and SRAS will be to the right of LRAS and potential output.

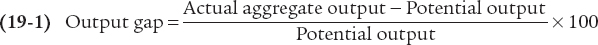

The output gap is the percentage difference between actual aggregate output and potential output.

To summarize the analysis of how the economy responds to recessionary and inflationary gaps, we can focus on the output gap, the percentage difference between actual aggregate output and potential output. The output gap is calculated as follows:

Our analysis says that the output gap always tends toward zero.

The economy is self-correcting when shocks to aggregate demand affect aggregate output in the short run, but not the long run.

If there is a recessionary gap, so that the output gap is negative, nominal wages eventually fall, moving the economy back to potential output and bringing the output gap back to zero. If there is an inflationary gap, so that the output gap is positive, nominal wages eventually rise, also moving the economy back to potential output and again bringing the output gap back to zero. So in the long run the economy is self-correcting: shocks to aggregate demand affect aggregate output in the short run but not in the long run.

Supply Shocks Versus Demand Shocks in Practice

How often do supply shocks and demand shocks, respectively, cause recessions? The verdict of most, though not all, macroeconomists is that recessions are mainly caused by demand shocks. But when a negative supply shock does happen, the resulting recession tends to be particularly severe.

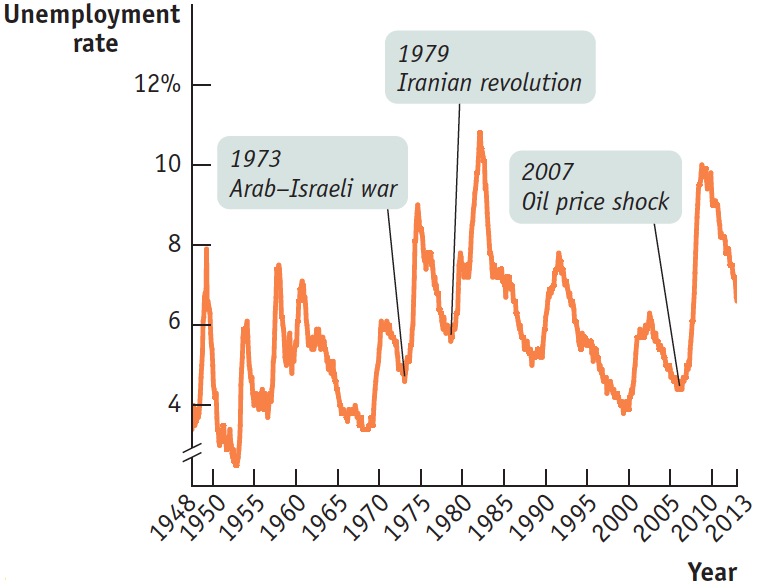

Let’s get specific. Officially there have been twelve recessions in the United States since World War II. However, two of these, in 1979–1980 and 1981–1982, are often treated as a single “double-dip” recession, bringing the total number down to 11. Of these 11 recessions, only two—the recession of 1973–1975 and the double-dip recession of 1979–1982—showed the distinctive combination of falling aggregate output and a surge in the price level that we call stagflation. In each case, the cause of the supply shock was political turmoil in the Middle East—the Arab–Israeli war of 1973 and the Iranian revolution of 1979—that disrupted world oil supplies and sent oil prices skyrocketing. In fact, economists sometimes refer to the two slumps as “OPEC I” and “OPEC II,” after the Organization of Petroleum Exporting Countries, the world oil cartel. A third recession that began in December 2007and ended in June 2009 was at least partially caused by a spike in oil prices.

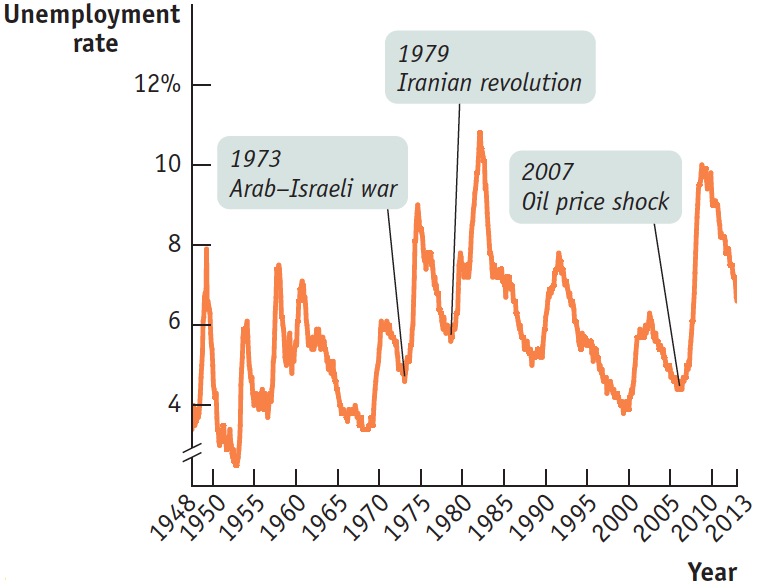

So 8 of 11 postwar recessions were purely the result of demand shocks, not supply shocks. The few supply-shock recessions, however, were the worst as measured by the unemployment rate. The figure shows the U.S. unemployment rate since 1948, with the dates of the 1973 Arab–Israeli war, the 1979 Iranian revolution, and the 2007 oil price shock marked on the graph. As you can see, the three highest unemployment rates since World War II came after these big negative supply shocks.

There’s a reason the aftermath of a supply shock tends to be particularly severe for the economy: macroeconomic policy has a much harder time dealing with supply shocks than with demand shocks, as explained in the next module.

Source: Bureau of Labor Statistics.