Monopoly

The De Beers monopoly of South Africa was created in the 1880s by Cecil Rhodes, a British businessman. By 1880, mines in South Africa already dominated the world’s supply of diamonds. However, there were many mining companies, all competing with each other. During the 1880s Rhodes bought the great majority of those mines and consolidated them into a single company, De Beers. By 1889, De Beers controlled almost all of the world’s diamond production.

In other words, De Beers became a monopolist. But what does it mean to be a monopolist? And what do monopolists do?

Defining Monopoly

As we mentioned earlier, the supply and demand model of a market is not universally valid. Instead, it’s a model of perfect competition, which is only one of several types of market structure. A market will be perfectly competitive only if there are many firms, all of which produce the same good. Monopoly is the most extreme departure from perfect competition.

A monopolist is the only producer of a good that has no close substitutes. An industry controlled by a monopolist is known as a monopoly.

576

A monopolist is a firm that is the only producer of a good that has no close substitutes. An industry controlled by a monopolist is known as a monopoly.

In practice, true monopolies are hard to find in the modern American economy, partly because of legal obstacles. A contemporary entrepreneur who tried to consolidate all the firms in an industry the way Rhodes did would soon find himself in court, accused of breaking antitrust laws, which are intended to prevent monopolies from emerging. However, monopolies do play an important role in some sectors of the economy.

Why Do Monopolies Exist?

AP® Exam Tip

Barriers to entry allow a monopoly to persist. Be prepared to identify the types of barriers that create a lasting monopoly.

To earn economic profits, a monopolist must be protected by a barrier to entry—something that prevents other firms from entering the industry.

A monopolist making profits will not go unnoticed by others. (Recall that this is “economic profit,” revenue over and above the opportunity costs of the firm’s resources.) But won’t other firms crash the party, grab a piece of the action, and drive down prices and profits in the long run? If possible, yes, they will. For a profitable monopoly to persist, something must keep others from going into the same business; that “something” is known as a barrier to entry. There are four principal types of barriers to entry: control of a scarce resource or input, economies of scale, technological superiority, and government-

Control of a Scarce Resource or Input A monopolist that controls a resource or input crucial to an industry can prevent other firms from entering its market. Cecil Rhodes made De Beers into a monopolist by establishing control over the mines that produced the great bulk of the world’s diamonds.

Economies of Scale Many Americans have natural gas piped into their homes for cooking and heating. Invariably, the local gas company is a monopolist. But why don’t rival companies compete to provide gas?

In the early nineteenth century, when the gas industry was just starting up, companies did compete for local customers. But this competition didn’t last long; soon local gas companies became monopolists in almost every town because of the large fixed cost of providing a town with gas lines. The cost of laying gas lines didn’t depend on how much gas a company sold, so a firm with a larger volume of sales had a cost advantage: because it was able to spread the fixed cost over a larger volume, it had a lower average total cost than smaller firms.

The natural gas industry is one in which average total cost falls as output increases, resulting in economies of scale and encouraging firms to grow larger. In an industry characterized by economies of scale, larger firms are more profitable and drive out smaller ones. For the same reason, established firms have a cost advantage over any potential entrant—

A natural monopoly exists when economies of scale provide a large cost advantage to a single firm that produces all of an industry’s output.

A monopoly created and sustained by economies of scale is called a natural monopoly. The defining characteristic of a natural monopoly is that it possesses economies of scale over the range of output that is relevant for the industry. The source of this condition is large fixed costs: when large fixed costs are required to operate, a given quantity of output is produced at lower average total cost by one large firm than by two or more smaller firms.

The most visible natural monopolies in the modern economy are local utilities—

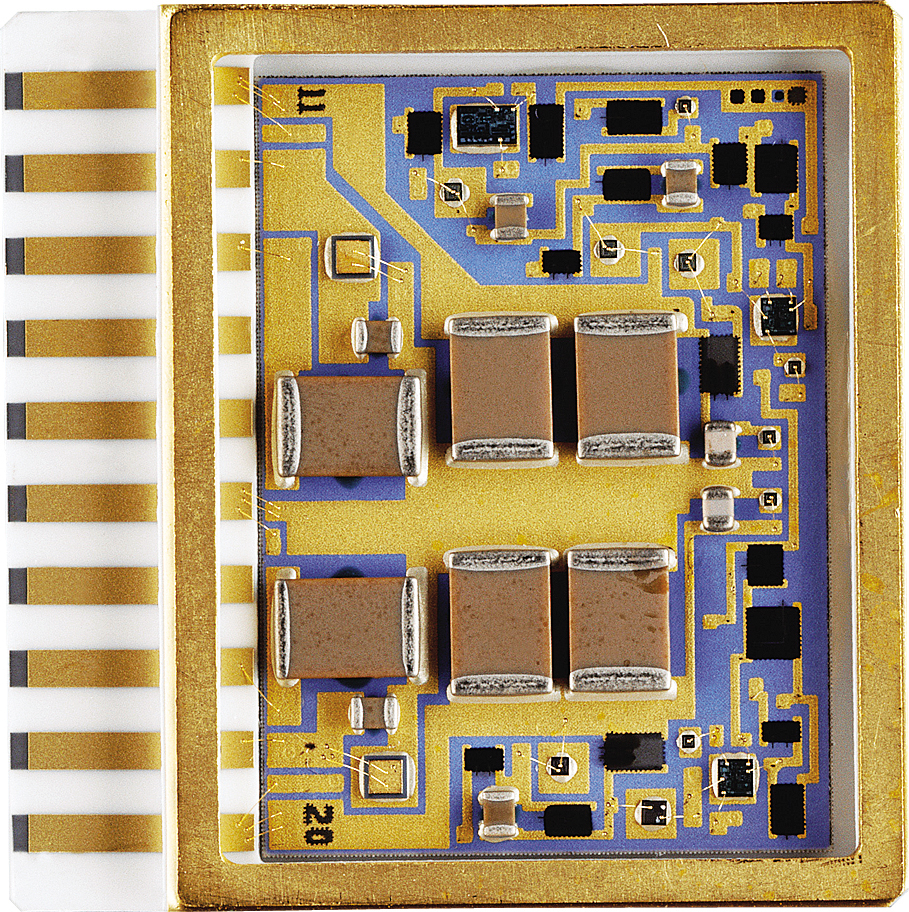

Technological Superiority A firm that maintains a consistent technological advantage over potential competitors can establish itself as a monopolist. For example, from the 1970s through the 1990s, the chip manufacturer Intel was able to maintain a consistent advantage over potential competitors in both the design and production of microprocessors, the chips that run computers. But technological superiority is typically not a barrier to entry over the longer term: over time competitors will invest in upgrading their technology to match that of the technology leader. In fact, in the last few years Intel found its technological superiority eroded by a competitor, Advanced Micro Devices (also known as AMD), which now produces chips approximately as fast and as powerful as Intel chips.

577

We should note, however, that in certain high-

Government-

A patent gives an inventor a temporary monopoly in the use or sale of an invention.

A copyright gives the creator of a literary or artistic work the sole right to profit from that work for a specified period of time.

The most important legally created monopolies today arise from patents and copyrights. A patent gives an inventor the sole right to make, use, or sell that invention for a period that in most countries lasts between 16 and 20 years. Patents are given to the creators of new products, such as drugs or mechanical devices. Similarly, a copyright gives the creator of a literary or artistic work the sole right to profit from that work, usually for a period equal to the creator’s lifetime plus 70 years.

The justification for patents and copyrights is a matter of incentives. If inventors were not protected by patents, they would gain little reward from their efforts: as soon as a valuable invention was made public, others would copy it and sell products based on it. And if inventors could not expect to profit from their inventions, then there would be no incentive to incur the costs of invention in the first place. Likewise for the creators of literary or artistic works. So the law allows a monopoly to exist temporarily by granting property rights that encourage invention and creation. Patents and copyrights are temporary because the law strikes a compromise. The higher price for the good that holds while the legal protection is in effect compensates inventors for the cost of invention; conversely, the lower price that results once the legal protection lapses benefits consumers.

Because the lifetime of the temporary monopoly cannot be tailored to specific cases, this system is imperfect and leads to some missed opportunities. In some cases there can be significant welfare issues. For example, the violation of American drug patents by pharmaceutical companies in poor countries has been a major source of controversy, pitting the needs of poor patients who cannot afford to pay retail drug prices against the interests of drug manufacturers who have incurred high research costs to discover these drugs. To solve this problem, some American drug companies and poor countries have negotiated deals in which the patents are honored but the American companies sell their drugs at deeply discounted prices. (This is an example of price discrimination, which we’ll learn more about later.)