Filing an IncomeTax Return

By April 15th of each year you must complete and file, by mail or electronically, a federal tax return to the IRS for income from the prior year. Most states also require a state tax return at the same time. Whether you must file a tax return depends on your income, tax filing status, age, and whether or not you are a dependent. The filing requirements apply even if you don’t owe any tax.

If you don’t file taxes on time, you’ll be charged a late payment penalty, plus interest on any amount owed. Willfully failing to file a return is a serious matter because it’s against the law and may result in criminal prosecution.

FLH-

If you are an unmarried dependent student, you must file a tax return if your earned or unearned income exceeds certain limits. You may also owe tax on certain scholarships and fellowships for education. Tax rules are subject to change each year, so be sure to visit irs.gov and review IRS Publication 501, Exemptions, Standard Deduction and Filing Information, for income limits and up-

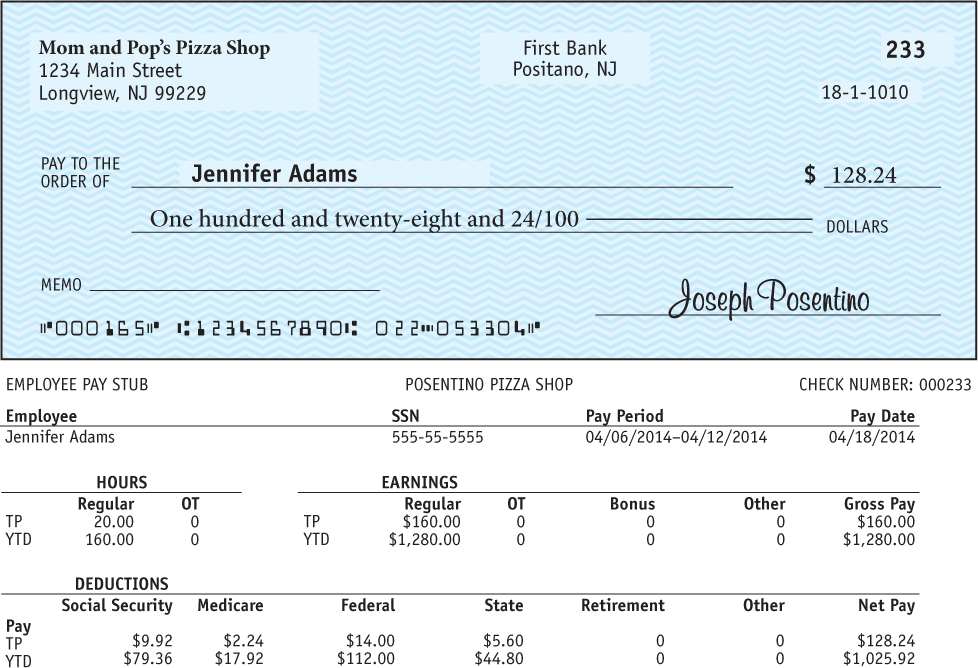

In January and February each year, you’ll receive official forms, like the sample shown below, from institutions that paid you, such as your employer, bank, or investment brokerage or firm. These forms provide the data you need to complete your taxes. Even if you don’t receive these official tax documents, you must still declare all your income on a tax return. So be sure to request any missing information.

Even if your income is below a threshold set by the IRS and you do not have to file, you should file a tax return each year if you may be owed a refund—

In addition to individuals and families, the IRS (and certain states) also tax corporations, trusts, and estates.

How Much Income Tax Do You Pay?

The United States has a marginal or progressive tax system, which means that people with more earned income pay tax at a higher rate or percentage. A tax bracket is a range of income that’s taxed at a certain rate. Currently, there are seven federal tax brackets that range from 10% up to 39.6%. So, someone with very little income may pay 10% while someone with high income could pay as much as 39.6% on their highest range of income for just federal income tax.

Every year the IRS adjusts many tax provisions as the cost of living goes up or down. They use the Consumer Price Index (CPI) to calculate the prior year’s inflation rate and adjust income limits for tax brackets, tax deduction amounts, and tax credit values accordingly. All of these variables affect the net amount of tax you must pay.

FLH-

Finance Tip

Use an online calculator at taxfoundation.org to find out how much federal tax you really pay (your effective tax rate) based on your income and tax filing status.

Here’s a table showing the federal income tax brackets and rates for 2014 for some different types of taxpayers:

2014 Federal Income Tax Brackets and Rates

| Tax Rate | Single Filers | Married Joint Filers | Head Of Household Filers |

| 10% | $0 - $9,075 | $0 - $18,150 | $0 - $12,950 |

| 15% | $9,076 - $36,900 | $18,151 - $73,800 | $12,951 - $49,400 |

| 25% | $36,901 - $89,350 | $73,801 - $148,850 | $49,401 - $127,550 |

| 28% | $89,351 - $186,350 | $148,851 - $226,850 | $127,551 - $206,600 |

| 33% | $186,351 - $405,100 | $226,851 - $405,100 | $206,601 - $405,100 |

| 35% | $405,101 - $406,750 | $405,101 - $457,600 | $405,101 - $432,200 |

| 39.6% | $406,751 + | $457,601 + | $432,201 + |

You’ll notice that if you’re single and earn $40,000, you’re in the 25% tax bracket for 2014. However, the following shows that your effective or net rate of federal tax rate would be only 15%:

| Income Tax Bracket | Income Taxed | Federal Tax Rate | Federal Tax Due |

| $0 - $9,075 | $9,075 | 10% | $908 |

| $9,076 - $36,900 | $27,825 | 15% | $4,174 |

| $36,901 - $40,000 | $3,100 | 25% | $775 |

| Totals | $40,000 | $5,857 |

Effective tax rate = $5,857 ÷ $40,000 = 15%

Although earning $40,000 means you’re in the 25% tax bracket, your entire income is not taxed at this rate. A portion is taxed at 10%, another at 15%, and another at 25%, which generally makes your effective or net tax rate lower than your tax bracket rate.

There are four ways to file your federal and state tax returns:

Free File is tax preparation software provided free of charge at irs.gov for individuals with income below a certain amount. You’re guided through a series of questions to calculate your tax liability, and your federal and state returns are filed electronically.

Fillable forms are free online tax forms at irs.gov that you can complete and file electronically without the help of software, regardless of your income. State tax forms are not included.

Tax software can be purchased to help you prepare your federal and state returns and file them electronically.

Tax preparers are tax professionals who prepare your federal and state returns and file electronically. Visit irs.gov for a list of authorized e-

file providers or ask people you know to recommend a reputable tax accountant.

Not Every State Collects Income Tax

In addition to federal taxes, you may have to pay state tax on your income. Each state has its own tax system. The following nine states don’t collect any tax from income that individuals earn: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.