Classical Macroeconomics

The term macroeconomics appears to have been coined in 1933 by the Norwegian economist Ragnar Frisch. The date, during the worst year of the Great Depression, is no accident. Still, there were economists analyzing what we now consider macroeconomic issues—

Money and the Price Level

In Chapter 31, we described the classical model of the price level. According to the classical model, prices are flexible, making the aggregate supply curve vertical even in the short run. In this model, an increase in the money supply leads, other things equal, to an equal proportional rise in the aggregate price level, with no effect on aggregate output. As a result, increases in the money supply lead to inflation, and that’s all. Before the 1930s, the classical model of the price level dominated economic thinking about the effects of monetary policy.

Did classical economists really believe that changes in the money supply affected only aggregate prices, without any effect on aggregate output? Probably not. Historians of economic thought argue that before 1930 most economists were aware that changes in the money supply affect aggregate output as well as aggregate prices in the short run—

The Business Cycle

Despite their lack of interest in the short run, classical economists were aware that the economy did not grow smoothly. The American economist Wesley Mitchell pioneered the quantitative study of business cycles. In 1920 he founded the National Bureau of Economic Research, an independent, nonprofit organization that to this day has the official role of declaring the beginnings of recessions and expansions. Thanks to Mitchell’s work, the measurement of business cycles was well advanced by 1930. But there was no widely accepted theory of what caused business cycles or what to do about them.

In the absence of any clear theory, conflicts arose among policy makers over how to respond to a recession. Some economists favored expansionary monetary and fiscal policies to fight a recession. Others believed that such policies would worsen the slump or merely postpone the inevitable. For example, in 1934 Harvard’s Joseph Schumpeter, now famous for his early recognition of the importance of technological change, warned that any attempt to alleviate the Great Depression with expansionary monetary policy “would, in the end, lead to a collapse worse than the one it was called in to remedy.” When the Great Depression hit, policy was paralyzed by this lack of consensus.

Necessity was, however, the mother of invention. As we’ll explain next, the Great Depression provided a strong incentive for economists to develop theories that could serve as a guide to policy—

!worldview! ECONOMICS in Action: When Did the Business Cycle Begin?

When Did the Business Cycle Begin?

The official chronology of past U.S. business cycles maintained by the National Bureau of Economic Research goes back only to 1854. There are two reasons for this. First, the farther back in time you go, the less economic data are available. Second, business cycles, in the modern sense, may have not occurred in the United States before 1854.

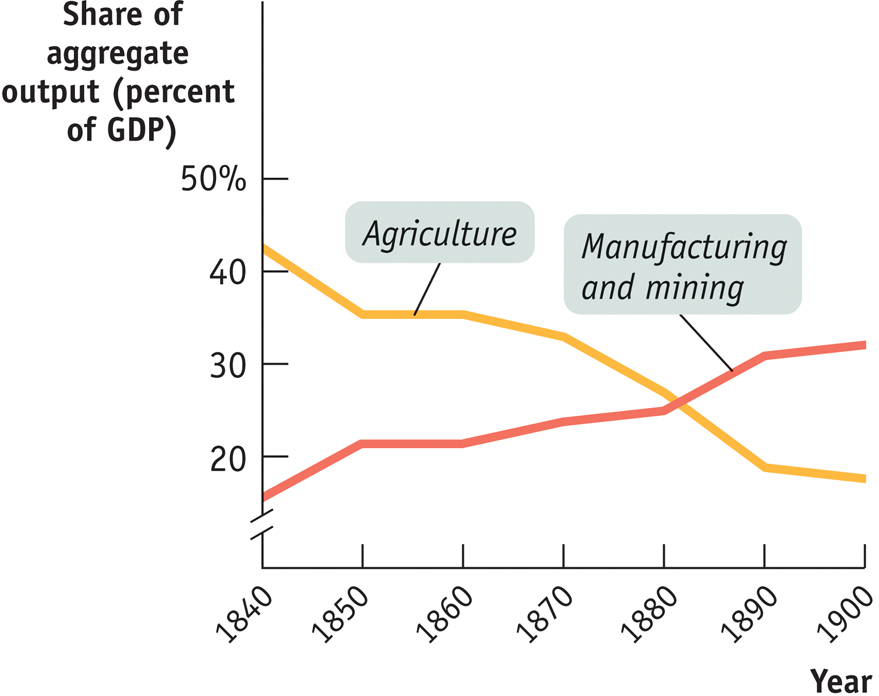

In the first half of the nineteenth century the United States had an overwhelmingly rural, agricultural economy. Figure 33-1 shows estimates of the percentage of GDP derived from agriculture and the percentage derived from manufacturing and mining over the period from 1840 to 1900. From it you can see that in 1840 agriculture dwarfed manufacturing. It took until the 1880s for manufacturing to overtake agriculture in economic importance.

Why does the relative importance of the agricultural sector versus the manufacturing sector in the economy matter? It turns out that fluctuations in aggregate output in agricultural economies are very different from the business cycles we know today. That’s because prices of agricultural goods tend to be highly flexible. As a result, the short-

The modern business cycle probably first appeared in Britain—

Quick Review

Classical macroeconomists focused on the long-

run effects of monetary policy on the aggregate price level, ignoring any short- run effects on aggregate output. By the time of the Great Depression, the measurement of business cycles was well advanced, but there was no widely accepted theory about why they happened.

33-1

Question 18.1

When Ben Bernanke, in his tribute to Milton Friedman, said that “Regarding the Great Depression…we did it,” he was referring to the fact that the Federal Reserve at the time did not pursue expansionary monetary policy. Why would a classical economist have thought that action by the Federal Reserve would not have made a difference in the length or depth of the Great Depression?

Solution appears at back of book.