Question 5.14

2. In each of the following cases, focus on the price elasticity of demand and use a diagram to illustrate the likely size—small or large—of the deadweight loss resulting from a tax. Explain your reasoning.

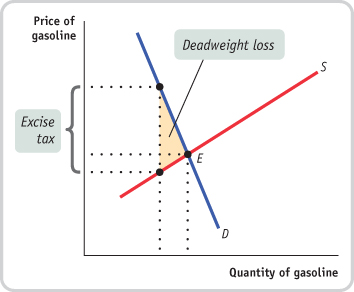

Gasoline

The demand for gasoline is inelastic because there is no close substitute for gasoline itself and it is difficult for drivers to arrange substitutes for driving, such as taking public transportation. As a result, the deadweight loss from a tax on gasoline would be relatively small, as shown in the accompanying diagram.

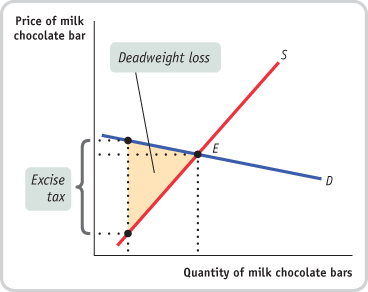

Milk chocolate bars

The demand for milk chocolate bars is elastic because there are close substitutes: dark chocolate bars, milk chocolate kisses, and so on. As a result, the deadweight loss from a tax on milk chocolate bars would be relatively large, as shown in the accompanying diagram.