Chapter Introduction

377

Unemployment and Inflation

CHAPTER 14

HITTING THE BRAKING POINT

What You Will Learn in This Chapter

How unemployment is measured and how the unemployment rate is calculated

The significance of the unemployment rate for the economy

The relationship between the unemployment rate and economic growth

The factors that determine the natural rate of unemployment

The economic costs of inflation

How inflation and deflation create winners and losers

Why policy makers try to maintain a stable rate of inflation

| interactive activity

| interactive activity

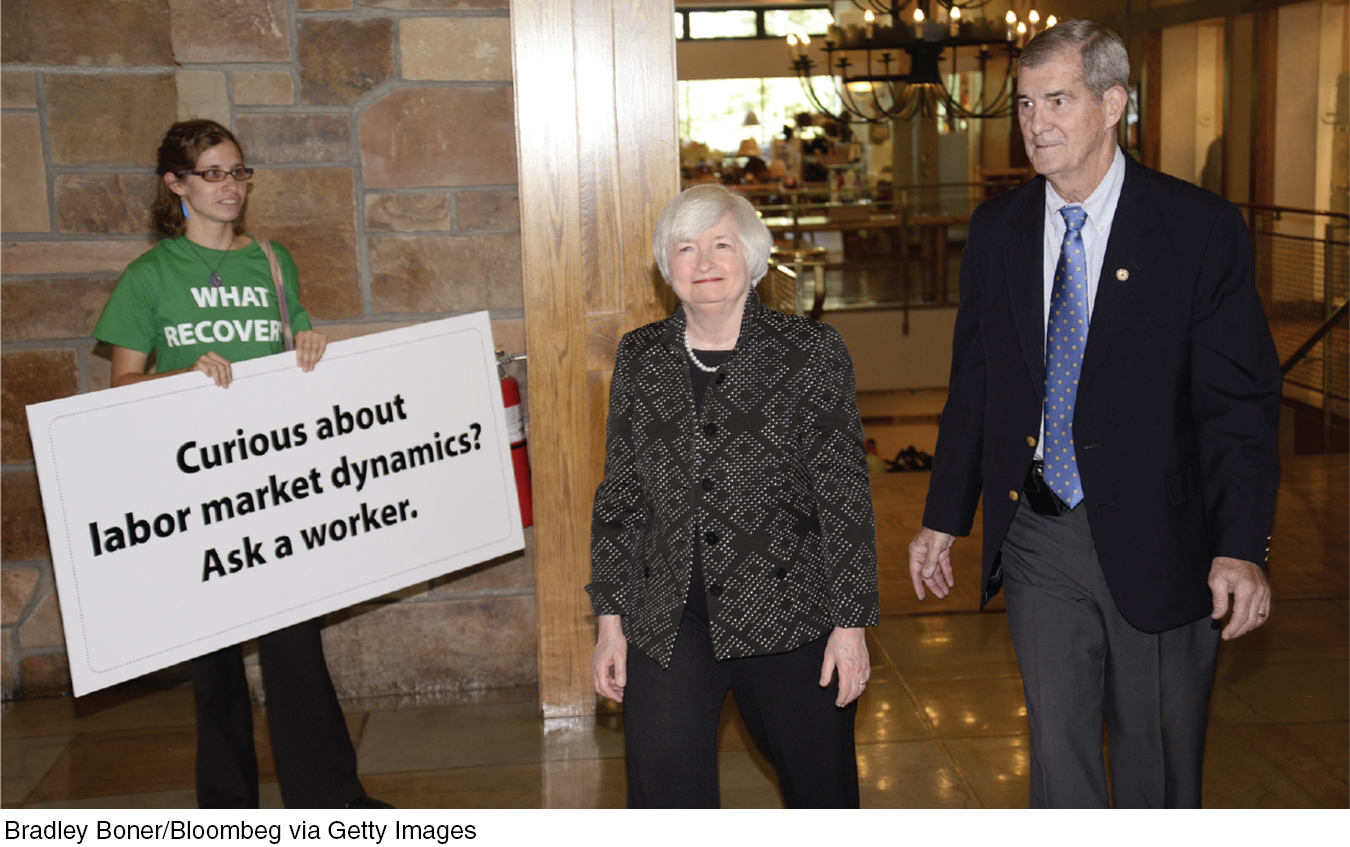

EVERY AUGUST MANY OF THE world’s most powerful financial officials and many influential economists gather in Jackson Hole, Wyoming, for a conference sponsored by the Federal Reserve Bank of Kansas City. Financial journalists come too, hoping to get clues about the future direction of policy. It’s always an interesting scene—

What was different about that year’s conclave? One answer was that the Federal Reserve’s Board of Governors, which makes U.S. monetary policy, had a new chair—

Beyond the historic first, however, there was a widespread sense that August that U.S. monetary policy might be approaching a critical moment. For almost six years the Fed’s goal had been simple, if hard to accomplish: boost the U.S. economy out of a sustained job drought that had kept unemployment high. By the summer of 2014, however, the unemployment rate had fallen much of the way back toward historically normal levels. At some point, almost everyone agreed, it would be time for the Fed to take its foot off the gas and hit the brakes instead, raising interest rates that had been close to zero for years. But when?

It was a fraught question. Some Fed officials—

Only time would tell who was right about the timing. As it turns out, it wasn’t until December 2015 that the Fed raised short-

But the dispute in 2014 highlighted the key concerns of macroeconomic policy. Unemployment and inflation are the two great evils of macroeconomics. So the two principal goals of macroeconomic policy are low unemployment and price stability, usually defined as a low but positive rate of inflation. Unfortunately, these goals sometimes seem to be in conflict with each other: economists often warn that policies intended to reduce unemployment run the risk of increasing inflation; conversely, policies intended to bring down inflation can raise unemployment.

The nature of the trade-