Chapter Introduction

231

Monopoly

CHAPTER 8

![]() EVERYBODY MUST GET STONES

EVERYBODY MUST GET STONES

What You Will Learn in This Chapter

The significance of monopoly, where a single monopolist is the only producer of a good

How a monopolist determines its profit-

maximizing output and price The difference between monopoly and perfect competition, and the effects of that difference on society’s welfare

How policy makers address the problems posed by monopoly

What price discrimination is, and why it is so prevalent when producers have market power

| interactive activity

| interactive activity

A FEW YEARS AGO DE BEERS, the world’s main supplier of diamonds, ran an ad urging men to buy their wives diamond jewelry. “She married you for richer, for poorer,” read the ad. “Let her know how it’s going.”

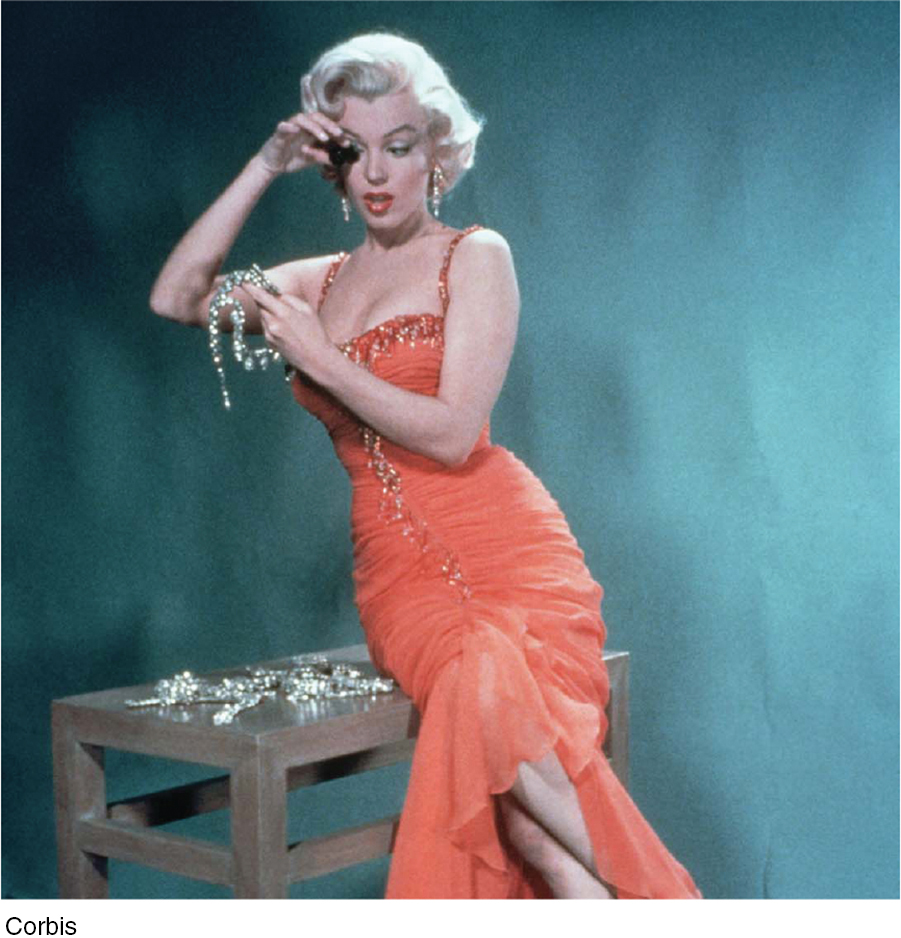

Crass? Yes. Effective? No question. For generations diamonds have been a symbol of luxury, valued not only for their appearance but also for their rarity. Diamonds were famously idolized in song by Marilyn Monroe in the film “Gentlemen Prefer Blondes,” where we learn that diamonds are “a girl’s best friend.”

But geologists will tell you that diamonds aren’t all that rare. In fact, according to the Dow Jones-

Why do diamonds seem rarer than other gems? Part of the answer is a brilliant marketing campaign. But mainly diamonds seem rare because De Beers makes them rare: the company controls most of the world’s diamond mines and limits the quantity of diamonds supplied to the market.

Up to now we have concentrated exclusively on perfectly competitive markets—

Monopoly is one type of market structure in which firms have the ability to raise prices. Oligopoly and monopolistic competition are two other types of market structures—