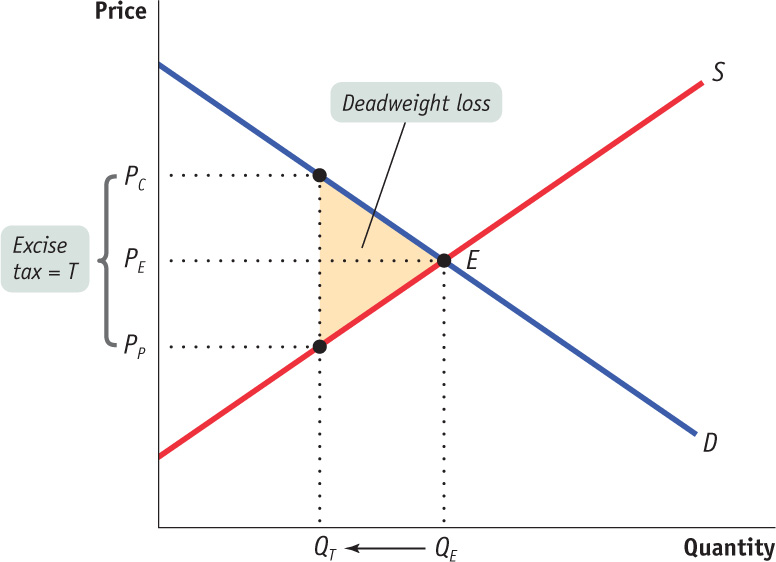

A tax leads to a deadweight loss because it creates inefficiency: some mutually beneficial transactions never take place because of the tax—namely, the transactions QE – QT. The yellow area here represents the value of the deadweight loss: it is the total surplus that would have been gained from the QE – QT transactions. If the tax had not discouraged transactions—had the number of transactions remained at QE—no deadweight loss would have been incurred.