Problems

- Which of the following questions are relevant for the study of macroeconomics and which for microeconomics?

Question

9bdo8RZiPHB9LrvZx6C03OPrBzDql6TmzartWRm2IH0TIBNUQwAOFA8Url+kw5UVfOlyPzm3hzrYmgoci3NUVaHl8BBD/KQb/WTk9LaJc0fjeGesn8XOSkvAWDkXd9XNrnyuvD0LOK2aqjrpduE7b6ChSQ7dlHpnsb3RucBp6P4=Prob 10 1a. How will Ms. Martin’s tips change when a large manufacturing plant near the restaurant where she works closes?Question

5arRKu6Zef+H2RTG7JnJfSkzgDgj7Og2IYgrbtOFDBkteNz4aVLkfmzR9Zs7MVWhXQbnSZfHnkNXoeyoZy9yjNJm1SNIm4NN5yXusOqjfhrIOVORzhA02OPLQ2hl3XmCProb 10 1b. What will happen to spending by consumers when the economy enters a downturn?Question

R6T0fyDI3ezwPbBZV+XfBqU1p3DT/kdoyrGk7d7tMPRKZjTkbvUWA+5YkK0IRAqT69ghyLBPgQJftqt4t82Y2ynfa+sdrIWRnsFeoJoRjtdQcUfLJiljpwmGJMAemnVsl+X6bfKNx6VaybimProb 10 1c. How will the price of oranges change when a late frost damages Florida’s orange groves?Question

X63tU9WzpmUyYhX/l1QtjNnWcD29YOoJjHWo/SU/EI2ns7onJlTOlJpbJFy5G9FZ/P4RniUmxevASzf4Ddi/ddLqEblr7zT+qJ4YYrRBM2vyaHfb7b93w+vPsULSN3+yProb 10 1d. How will wages at a manufacturing plant change when its workforce is unionized?Question

XFTIN+zH73XvWUjz5CC/CVHIFoNDB/JKQlz4mRCmx8kqRGsnfh+GIHT3LZA154hdLtiF5PVlZ0//6LSACpij6Xkh3jdMXys0BJ0s7yjmMhVdVn4DKiyNCxMnAAS+kylNfByiIVj6WLAQHiwJ1bHIm95rrv4=Prob 10 1e. What will happen to U.S. exports as the dollar becomes less expensive in terms of other currencies?Question

YEQkmTQdoqAiw2iPVce3JUG5/+dZZ7p0s7rjzI94izPrxR4dUx5vbdEa+JpZdlkrSvRViYPkuc+2g36FdOxsm8HCfPn7HM5f+gAUdzepqY/hx82Uu/vU6VrANKqRnUa61DT7kum9/Rw=Prob 10 1f. What is the relationship between a nation’s unemployment rate and its inflation rate?

Question

D/Lb7nbhEnGUVISbEAzEPeeO/IomPQ1B92PbnN9Pwda6aaAlrCgwCBrA7dapNv1KVE3cesGiVfynREMJyo1/qLhgarc2evMwy6MJ2ympeMc4/gMLzvW1KqsP3DFcQ3vEOjt61L1GvSCFHLXbmTodBT9fZTKypUXtg4TuEu4QpgtOHIdG/DWDlFqm2a3x1xbKaLlv7sUIKlgle8G6/t9B5hhLyYmTT52R16VqHY8+FjbYq7NVCQYcWbeS5QW3taVSIk3AwldBo1l22HF/Abkt1mhhwzaQ0tJfN8N8E4oule2G9nOXzKIsD9KxqlZVQ4CIJGP3IvMq3V46QY68BQQU0UuQCbiRxJ/P9o5fTMhWYkLcI/HDProb 10 2. When one person saves more, that person’s wealth is increased, meaning that he or she can consume more in the future. But when everyone saves more, everyone’s income falls, meaning that everyone must consume less today. Explain this seeming contradiction.- Before the Great Depression, the conventional wisdom among economists and policy makers was that the economy is largely self-regulating.

Question

qDkJMHzGCijuv+FmfDh1KIYPg/yHJkM4EM6WU3gEqWOmLIBQK5s/2l+K5OLp6NqtQOnv8fEylvuZ6NRiwX6koASOnGpXBvanN9Dh6m9mufMQUG9fgzPfNElsCeI=Prob 10 3a. Is this view consistent or inconsistent with Keynesian economics? Explain.Question

vsCml8GwqNeH9R+uInmwk1C/CQWyWaCZNlQI63StDgBZQagH6rd85zO765+1jgUIag/NLfsqUInxkQqUyBShXwhWUgV3RZOwvaPpa1+XpVrWVbL+Prob 10 3b. What effect did the Great Depression have on conventional wisdom?Question

50e+gJkgjUrzw5Ygh3JLBr5B4vWbYldR6JZeqi8amU5oRHyTfezF0/0lAm9WxpBwsbFDyPO0d9bBoErrTDJw3JWQT8+IJLf+XTQeM9VXDN06xBAZVgc4rIVFBvHXOJi5AnFeKaTYVs7V17S05QDwppzxOpId+MLRUZg+Jo7HsBhYw67I7SWzRCEb75oVg6ziQkPxAbc/h9KWEHCp4wsXpCodnuQHEhRgGYKVNC8X4zPBQ003EWs6Qc9PxTSyzAvk5DJzkAKab4CwoKD3VDEJIM3cYb+9SwiX9HRvOi/T794fVQtblUpXl+0Y7or5s7z3aeSVANx/Zq/7lQXNJ7i7pQ2v6CqmdHkaWh/rXYpF48F1CQrXEb4WllhTyEVjiAd0U0aKG8sRXtHNDsi55oCK1bw0J3Ygvi28IhEiug==Prob 10 3c. Contrast the response of policy makers during the 2007–2009 recession to the actions of policy makers during the Great Depression. What would have been the likely outcome of the 2007–2009 recession if policy makers had responded in the same fashion as policy makers during the Great Depression?

Question

4mOlMCAZln/+WACi5qv5zfbzIRCCemUj3mLkrXAA0aEn9yA7x8y/WECl8WT7Xrwzgp/UE/VxIklol6puKezmD7nMS4a/7Lk0qM9tuelQfwzM90OvBq8jTwNww24Tjr7996PwVWIgE0vcpZVyQcVec61IXXcfr86u4dg7E6cma9mJYkfN99NcVNYoKEyczcTTaTaVmicL7XLrl56EQ9hPnGm8B+/a/zMhmfhABTywGQCflK53Prob 10 4. How do economists in the United States determine when a recession begins and when it ends? How do other countries determine whether or not a recession is occurring?- The U.S. Department of Labor reports statistics on employment and earnings that are used as key indicators by many economists to gauge the health of the economy. Figure 10-4 in the text plots historical data on the unemployment rate each month. Noticeably, the numbers were high during the recessions in the early 1990s, in 2001, and in 2007–2009.

Question

VOmHv2C6RCGlDQvODj1M/lLb1E1C/VPDUXsXKNJbNdCjx0oN0LIyJPIjhPWEQDDNuM906uwRvNgj+LFfeHCAiVSdLDE3NBO8kAN6+CSNFUCuBZhr8Ki/m2GCtjPxtLn0ZK6f8QdcB9UkcRiGrJEqiDfgXaV03qGAYJnW8kuUXxRZvQ5G5Z9gW0L7i9iRGUp5yhAYx6aTAmLpFE3MlEKdZtE5sV4bTdaRp8d563FlfV9kIwi/E6FUn7/UnAcW0kQ6dTE1x2x4RD6keAdR7/rZlr+aI9t5kLq47vbq58uvFnQkRe6glnY1ECl/8ps2t11j52oT0F3iRAl1pd13vkLuz6syAcDdhfwBjoMYhsSuxzl0MANRProb 10 5a.Locate the latest data on the national unemployment rate. (Hint: Go to the website of the Bureau of Labor Statistics, www.bls.gov, and locate the latest release of the Employment Situation.)Question

qJgNOWcKQfHFWSI+89BCB2b7W1sTmRv9Bj/A7bpY3Q4IVCiNjO2t+jwm3tGdZE6LldT7l/f5vYAo7/mvabPoz1W6sREnZ2c7DWlTEyXHsxd/JNYB9vr2vmnO6SH2GiqoX14eVeJhZ7xX9FpSoUIL834fFpiADtowWUPPPWAcUrPt12iKAQxXQN75JjvB0qF2fHjIA6l+2pk5/DrTttq0H0GZ17RSdCmi4HlPg/KbKDcUxj4O1ETGBZ/6Qs6mZidTDhIORjuc839rPRjv4q0fLZpqlR48XEcFtwniADMPV0Fi6S4QoW3OXJFdFp6+r/FGnLIbCyBQ89iSDP9ItsrAOkXXs4k7IgyPProb 10 5b. Compare the current numbers with the recessions in the early 1990s, in 2001, and in 2007–2009 as well as with the periods of relatively high economic growth just before the recessions. Are the current numbers indicative of a recessionary trend?

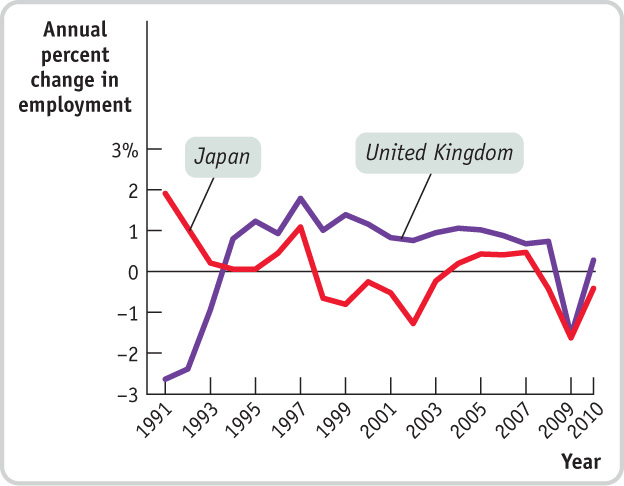

- The accompanying figure shows the annual rate of growth in employment for the United Kingdom and Japan from 1991 to 2010. (The annual growth rate is the percent change in each year’s employment over the previous year.)

Question

ak6WEYA92tvVDC734evNJc8bOHPvPowONnQhBfUk7A1h7u5vN3x/MWyyeR7kiw06u5ltNJfsH0h39X0JAYdxfFB7MeuvXhdxIfyrtowwUJp8wv3h6qmtKgiTwlZ9Re6XYcBerYlZzPqEflIuXL+Smn+E7Xs4urFeProb 10 6a. Comment on the business cycles of these two economies. Are their business cycles similar or dissimilar?Question

ejyQS8Ulmi2SYIpT4Trxme9p/wpHZJcJl9ODXEUFLb2bFx4Fa0FdVOnd16tWZhNwjJb3K+sG15LwcyUb7Vygewo4Pqu2PW+FN48TwkT0WYnJ74A0V9WVe46SqEP2GorCC+YWNzks/w0g/EFBR3jvVVP/kZca3JIAEDtnvhzLwk/zt5EjHD2cLQyGJa8bSoG/prO5MZ8FgsjV6ybZG56ZiX9mKHIouE28eoy4CrkixluQOq8h0+DHnPZndg8v9txFvZrws7O+dzXaoozKrxXpvAblo/JC9KM6W80JUovnSmJCFukM9O9s3gkkmk2KbjEKyOKRFQ==Prob 10 6b. Use the accompanying figure and the figure in the Global Comparison on international business cycles in the chapter to compare the business cycles of each of these two economies with those of the United States and the euro area.

Question

M04nLchWQ+K3DjecTeytiQKeuXVcMoMVynccs4eQBQ7lsvEn6zvhToZ2WXk/AnQYbNwjOW4dUHlW1dFarM3KkprPczOXIOMYS26qsxDU5klNcFQ+HJiOR2C82ynXAgS+eOxLQCj2+Io2MEx8+8Lg4X3P72JU+Tr/atKUEGdoaEFWSgFGs/mZwx5lo8G42JVicNvQ4Eqr8zc0YBHJxhJg8A==Prob 10 7a. What three measures of the economy tend to move together during the business cycle? Which way do they move during an upturn? During a downturn?Question

dOWaLu0P0Zvn2NxLgsYXEX6+mUABkAm71SRiAMspPXwff2fXtw9yTk4YtRI8DpFfF1eJSHNvXMwl/kKq7toH3cxcWEQ=Prob 10 7b. Who in the economy is hurt during a recession? How?Question

b4OvB53W2wBgRQTctbyTuy94xkb0cfehDv0oOWKj7xhomJMLvodUGiK3v5qBzud2Gctzc8JSvUaxIV/xSlY7R0ebynxXgjwxiGnQrtTIzF4t7tfkB9YQvtR2UQ4Msjy25y+Lx8fhkZhe2TnKW2RHYtuYRveqz1hlQtb3OfiCS5jYknQH2T3sjHMGkBrz5VCJqhnTXckzHatxWrSwXqb2WiZUWKJKllQP+ndhwE30Ag1KSEIUhgtCPIW0UnRhF599xuHYC4ypp9nwDSKSUnX0o22CzW9aSaWfVZ3zM6zVhY0=Prob 10 7c. How did Milton Friedman alter the consensus that had developed in the aftermath of the Great Depression on how the economy should be managed? What is the current goal of policy makers in managing the economy?

Question

fpc4cOYfxO5qtOlBiohb/JxqH6SaUKq97VY5sAGzcXA10NUfiojoIyINWQlFtlvOflz/r6zKVG4B+fJWAZ3Fbvy1wnYt6K4QUbGE5b0dDAfQdJPZig1rjWEwJz2gV0Z3e36MkLa6hGeYJXA9UOS9X7rkAQdlch2V7696aElSlp1xTsHnXoUiTFJX8htpa5KUE7idb6ehFY2AeMFqCFzRCLwgedyD5xdLMRlWo51Qx8tssDC36kIj/8VzyZTozm4LOycDZK51il5FbocQuU6NUmwOBC01vAgTSPt5MJ4PEICJuE8uProb 10 8 . Why do we consider a business-cycle expansion different from long-run economic growth? Why do we care about the size of the long-run growth rate of real GDP versus the size of the growth rate of the population?Question

B1c80yXrJshnH7EDIg+uWPLS3qoVI8RAYq+m96nEiKR96BnGdjGsFImpkXkCBdOdglow7XcOzNMmpr15iKI1aYwUto/97yYxh+jQwm2X1sYYZKY+h9cvZQ/77YpZ+rFf9S+bFsHUAqcGY69Bs3kPRfgqldT9qYY+fMIpfX2z0d1yiC1FBnugq7IN+UYX2jyX855HglQ8ZvNE12/Sg48Rq2h1da102bmjGraAVC+kupcG2oHilagOWHszIO+OCZ5j17MYJaNPDivKZqIMXUFmdwhzgnse8yGRsUVyaOjWKgvbNxIX5Nf3dWLmMHBwIGB4vwOvMBhckHNWNngg7vwkO8V5lMmTrAfX2/6wFwDRo9Mts8CNy9jP14uqbgtBE0kk0AcTetlmGi/vrqSGkvPI5/WUMFRDO3w2uxJS41QhSmwtfXGR0jutTo+51E+a6S9nSrX4kHxSv7ab0yu9KvJbBCcdAOOFDJvtB/WYeY4aXFJPFEGC96N8AAqCAVyunAjp+EPz/NfiyYlEqxllI5E/HeSDRjuFNnP80uIn/ViLgA29qrUD/rkjsRRtZsSLL7pOVPjhfWDgMNT9jgH8Erbc3EIY/hCg98954fRThk+F5ai7t+QLeC+6011p8Qu3g3/r4/GERusH4RxFWdMM1PTulOCLboLHcShlXbKcqD5sueSCsaYvGCAAIkic2WcIE69xVH0kNf/K5Z++7DIsbIlZhtad2sn2Fulc41YOQoHHMx+oavo1rvHKQ3y7rEg=Prob 10 9. In 1798, Thomas Malthus’s Essay on the Principle of Population was published. In it, he wrote: “Population, when unchecked, increases in a geometrical ratio. Subsistence increases only in an arithmetical ratio…. This implies a strong and constantly operating check on population from the difficulty of subsistence.” Malthus was saying that the growth of the population is limited by the amount of food available to eat; people will live at the subsistence level forever. Why didn’t Malthus’s description apply to the world after 1800?Question

jClkr3k2pRYf7eE3P4wj12zPysk03lQUYK6AubjzYAepzqqiVswLYfRKxhGSFW/sbmbGwfKYY0Oh/lPzR+Mj8v9VgAQbA/a/msVU9W61RROd0q0yfJTq9NOLZ6dk4PcBJd6p50EJEMDWCj9sT5Iatqj9D7+WMrgxDDJxErMDpmrFAuz6W2B+v8KAi7JkNEbRy+g8geCSOcVEKGgDR3a5cB8z/oH8mdWBXghx3zt7841skGy/YNgGEjRBsZT+hpfiDEWGxl1VsOvDsE4mZ1yAUEXMQKwEv+U5lZWUmNld+K3PCnbhVQEi0Ig8d8Qz5Lto1gXQfoUXhYkMDz7MPd44X6fZQZ7x8zUb+83koe0PWWSh6jhjMbvpVmlSLyR5L1ZiV7OJzA/AglAipA2Xr6zIFuSDJlmLBzD2akUTz4+0uWaVuaGYVfGZFP9q90e7ryjx4ZEXGfbNw7mO0HdEGCwG9OhJ8RAa9ZwnJr3ZDb8Oi3tYF2hzi+EEEa7RMIttOAPXoVOQw49BCKLO3ArQp0gQEf7+CWJ84QaPFTio0Xy0g+ugGQhxQa6r1sHhtuSH2OrFJJYtz6iXljawFKbuyH5J7aWNbAkTc9nack0BGyXXEsg/X+Uw09bn8VkZqnzX0JBzExbqmTIA2mjFfX7yCgrg1j/CFZPWu38xjT4E49uk39NFwJatLIn/9f8+i4mSV4LtdnpMiJw7JcHzFP9Xz4iRJWOctAOwS8KKNY1/PoJkZ9UmWh/aDws5xX4p1aIcVV2MHMFsfR+O9l5utqdH/7JdJXloDunM1vW45c+VYo8E/rcymE2MYTK+ynZGNEUioqNmQ3VPP4+1sKf3bWwYklxTKj9hkaJhQKWbBdooLxL13glwr7qUyfN66Az2oYCCHtNdZlk/ZFSTIXxsObp5upNWIs/Hfwi6WexevUVNOw==Prob 10 10. College tuition has risen significantly in the last few decades. From the 1979–1980 academic year to the 2009–2010 academic year, total tuition, room, and board paid by full-time undergraduate students went from $2,327 to $15,041 at public institutions and from $5,013 to $35,061 at private institutions. This is an average annual tuition increase of 6.4% at public institutions and 6.7% at private institutions. Over the same time, average personal income after taxes rose from $7,956 to $35,088 per year, which is an average annual rate of growth of personal income of 5.0%. Have these tuition increases made it more difficult for the average student to afford college tuition?- Each year, The Economist publishes data on the price of the Big Mac in different countries and exchange rates. The accompanying table shows some data used for the index from 2007 and 2011. Use this information to answer the following questions.

Question

BYYcVeNVG4/KORf0uQPRSw2mfa5L85MFBMXB8+7BHQ24K0ZBQ/bWA6FgbjLd5YX5iVCjyECiL8AQcMr6wxTmeQPblPGSaZptre+LozoKckc=Prob 10 11a. Where was it cheapest to buy a Big Mac in U.S. dollars in 2007?Question

roEk8EiC+i1D6jKygcfNErqzdYQLfwF4MoQCdcuPpjOiTbrNNjCQYEkGbOla70HB6xTG+igDfQMz8RQ9qaftbA7WPAAR2cq8cjZKJia+J0M=Prob 10 11b. Where was it cheapest to buy a Big Mac in U.S. dollars in 2011?Question

Ww8FlZGotZ8lSHatKzqUAAmv1G+FRhJPvlPx2xS0Z18GPm420nAjnx2v19e1J5xp8Jc5x/elzIrTT++/TdGHTzyjbXcTmsJE/l+dxPSU+X/Elvud52ZLJ5nxcsMwu7CYV2bxr4XHEQDgYDaa1m5P9bbA9A2XDbFPajM770VSZHLVxIg+6V1E4THUjZot5hCgiLYXYEm81NCHaHzzvQeAVkhIvpSNIfykWXbd2PIEvgtBcOde9uwy+aFC4xWsOoifsYAK2MD2aY8SIVGy/yH5EWqfBGow57shauezGOFUlhFNpLX1DjG2A42mC1jeO9SibufxRRbT8KzQdie2AgiU+2hPmmI=Prob 10 11c. Using the increase in the local currency price of the Big Mac in each country to measure the percent change in the overall price level from 2007 to 2011, which nation experienced the most inflation? Did any of the nations experience deflation?

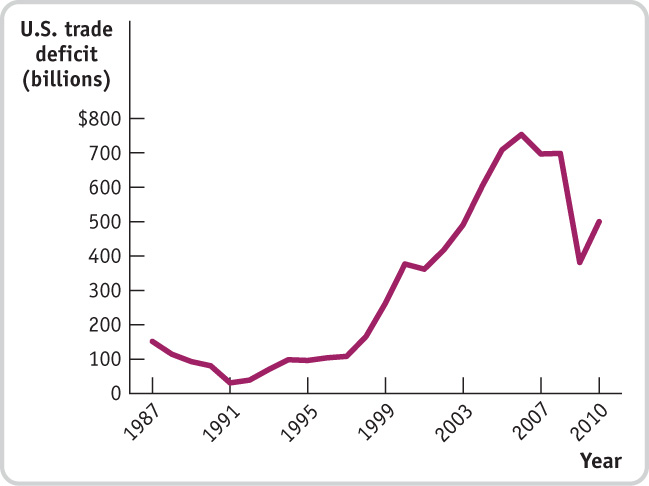

- The accompanying figure illustrates the trade deficit of the United States since 1987. The United States has been consistently and, on the whole, increasingly importing more goods than it has been exporting. One of the countries it runs a trade deficit with is China. Which of the following statements are valid possible explanations of this fact? Explain.

326

Question

JJDlb6xVHE5mI+KC5Y7OiQmluwRzctuXFOFVswTXBNYpfPSWaR0U6Gq0ETVWKptLn1nQeZEAI3SkE2XpQxho3+eEpGvZphLTIzLV/YztaRTS7XDTcRfyABFdnUctqUp6UZ6Yr58jZ7rjHlIUyN2WNn6jZhC8Ogdag4tP1Pp0RGpc5PBGjqZUdw==Prob 10 12a. Many products, such as televisions, that were formerly manufactured in the United States are now manufactured in China.Question

mQlUsfQD+ggnSVbkX3MiqhdvrqNNSPA8S6wf83HVXIeeaZAnzdEfePFo6cMcCmZVXizryTk81gPg6UAP5Bi25CGz4EvjphtER6cQLeHPw3NSndICE1L92iFI+IjOszR42zNxJ4IIyuH1fkeLZBk+nWT9k3A=Prob 10 12b. The wages of the average Chinese worker are far lower than the wages of the average American worker.Question

taPqSVxPNC2qpCwdP429Ar4ZV4Brkn9E8Y5LUnrkOH5NbeHomv/uMh7kWanEqCxsKZovJSv+/GifMPsgzNC1Hbs+Kj7KtEYXhkEhdDgzxtpD0mKEyyAyAN3XcnqEe10LtS5i6A==Prob 10 12c. Investment spending in the United States is high relative to its level of savings.