Macroeconomic Policy

W e’ve just seen that the economy is self-correcting in the long run: it will eventually trend back to potential output. Most macroeconomists believe, however, that the process of self-correction typically takes a decade or more. In particular, if aggregate output is below potential output, the economy can suffer an extended period of depressed aggregate output and high unemployment before it returns to normal.

437

This belief is the background to one of the most famous quotations in economics: John Maynard Keynes’s declaration, “In the long run we are all dead.” We explain the context in which he made this remark in the accompanying For Inquiring Minds.

Stabilization policy is the use of government policy to reduce the severity of recessions and rein in excessively strong expansions.

Economists usually interpret Keynes as having recommended that governments not wait for the economy to correct itself. Instead, it is argued by many economists, but not all, that the government should use monetary and fiscal policy to get the economy back to potential output in the aftermath of a shift of the aggregate demand curve. This is the rationale for an active stabilization policy, which is the use of government policy to reduce the severity of recessions and rein in excessively strong expansions.

Keynes and the Long Run

The British economist Sir John Maynard Keynes (1883–1946), probably more than any other single economist, created the modern field of macroeconomics. One of his lasting contributions was a famous quote on the meaning of the long run.

In 1923 Keynes published A Tract on Monetary Reform, a small book on the economic problems of Europe after World War I. In it he decried the tendency of many of his colleagues to focus on how things work out in the long run—as in the long-run macroeconomic equilibrium we have just analyzed—while ignoring the often very painful and possibly disastrous things that can happen along the way. Here’s a fuller version of the quote:

This long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the sea is flat again.

Can stabilization policy improve the economy’s performance? If we re-examine Figure 14-6, the answer certainly appears to be yes. Under active stabilization policy, the U.S. economy returned to potential output in 1996 after an approximately five-year recessionary gap. Likewise, in 2001 it also returned to potential output after an approximately four-year inflationary gap. These periods are much shorter than the decade or more that economists believe it would take for the economy to self-correct in the absence of active stabilization policy. However, as we’ll see shortly, the ability to improve the economy’s performance is not always guaranteed. It depends on the kinds of shocks the economy faces.

Policy in the Face of Demand Shocks

Imagine that the economy experiences a negative demand shock, like the one shown in Figure 14-13. As we’ve discussed in this chapter, monetary and fiscal policy shift the aggregate demand curve. If policy makers react quickly to the fall in aggregate demand, they can use monetary or fiscal policy to shift the aggregate demand curve back to the right. And if policy were able to perfectly anticipate shifts of the aggregate demand curve, it could short-circuit the whole process shown in Figure 14-13. Instead of going through a period of low aggregate output and falling prices, the government could manage the economy so that it would stay at E1.

438

Why might a policy that short-circuits the adjustment shown in Figure 14-13 and maintains the economy at its original equilibrium be desirable? For two reasons. First, the temporary fall in aggregate output that would happen without policy intervention is a bad thing, particularly because such a decline is associated with high unemployment. Second, as we explained in Chapter 12, price stability is generally regarded as a desirable goal. So preventing deflation—a fall in the aggregate price level—is a good thing.

Does this mean that policy makers should always act to offset declines in aggregate demand? Not necessarily. As we’ll see in later chapters, some policy measures to increase aggregate demand, especially those that increase budget deficits, may have long-term costs in terms of lower long-run growth. Furthermore, in the real world policy makers aren’t perfectly informed, and the effects of their policies aren’t perfectly predictable. This creates the danger that stabilization policy will do more harm than good; that is, attempts to stabilize the economy may end up creating more instability. Despite these qualifications, most economists believe that a good case can be made for using macroeconomic policy to offset major negative shocks to the AD curve.

Should policy makers also try to offset positive shocks to aggregate demand? It may not seem obvious that they should. After all, even though inflation may be a bad thing, isn’t more output and lower unemployment a good thing? Not necessarily. Most economists now believe that any short-run gains from an inflationary gap must be paid back later. So policy makers today usually try to offset positive as well as negative demand shocks. For reasons we’ll explain in Chapter 17, attempts to eliminate recessionary gaps and inflationary gaps usually rely on monetary rather than fiscal policy. In 2007 and 2008 the Federal Reserve sharply cut interest rates in an attempt to head off a rising recessionary gap; earlier in the decade, when the U.S. economy seemed headed for an inflationary gap, it raised interest rates to generate the opposite effect.

But how should macroeconomic policy respond to supply shocks?

Responding to Supply Shocks

We’ve now come full circle to the story that began this chapter. We can now explain why people in Ben Bernanke’s position dread stagflation.

Back in panel (a) of Figure 14-11 we showed the effects of a negative supply shock: in the short run such a shock leads to lower aggregate output but a higher aggregate price level. As we’ve noted, policy makers can respond to a negative demand shock by using monetary and fiscal policy to return aggregate demand to its original level. But what can or should they do about a negative supply shock?

In contrast to the aggregate demand curve, there are no easy policies that shift the short-run aggregate supply curve. That is, there is no government policy that can easily affect producers’ profitability and so compensate for shifts of the shortrun aggregate supply curve. So the policy response to a negative supply shock cannot aim to simply push the curve that shifted back to its original position.

And if you consider using monetary or fiscal policy to shift the aggregate demand curve in response to a supply shock, the right response isn’t obvious. Two bad things are happening simultaneously: a fall in aggregate output, leading to a rise in unemployment, and a rise in the aggregate price level. Any policy that shifts the aggregate demand curve helps one problem only by making the other worse. If the government acts to increase aggregate demand and limit the rise in unemployment, it reduces the decline in output but causes even more inflation. If it acts to reduce aggregate demand, it curbs inflation but causes a further rise in unemployment.

439

It’s a trade-off with no good answer. In the end, the United States and other economically advanced nations suffering from the supply shocks of the 1970s eventually chose to stabilize prices even at the cost of higher unemployment. But being an economic policy maker in the 1970s, or in early 2008, meant facing even harder choices than usual.

Is Stabilization Policy Stabilizing?

We’ve described the theoretical rationale for stabilization policy as a way of responding to demand shocks. But does stabilization policy actually stabilize the economy? One way we might try to answer this question is to look at the long-term historical record. Before World War II, the U.S. government didn’t really have a stabilization policy, largely because macroeconomics as we know it didn’t exist, and there was no consensus about what to do. Since World War II, and especially since 1960, active stabilization policy has become standard practice.

So here’s the question: has the economy actually become more stable since the government began trying to stabilize it? The answer is a qualified yes. It’s qualified for two reasons. One is that data from the pre–World War II era are less reliable than more modern data. The other is that the severe and protracted slump that began in 2007 has shaken confidence in the effectiveness of government policy. Still, there seems to have been a reduction in the size of fluctuations.

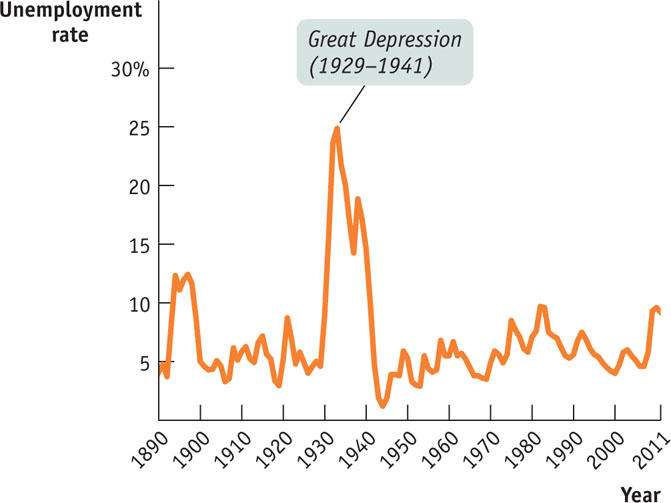

Figure 14-16 shows the number of unemployed as a percentage of the nonfarm labor force since 1890. (We focus on nonfarm workers because farmers, though they often suffer economic hardship, are rarely reported as unemployed.) Even ignoring the huge spike in unemployment during the Great Depression, unemployment seems to have varied a lot more before World War II than after. It’s also worth noticing that the peaks in postwar unemployment, in 1975, 1982, and, as we described earlier, to some extent in 2010, corresponded to major supply shocks—the kind of shock for which stabilization policy has no good answer.

It’s possible that the greater stability of the economy reflects good luck rather than policy. But on the face of it, the evidence suggests that stabilization policy is indeed stabilizing.

Quick Review

- Stabilization policy is the use of fiscal or monetary policy to offset demand shocks. There can be drawbacks, however. Such policies may lead to a long-term rise in the budget deficit and lower long-run growth because of crowding out. And, due to incorrect predictions, a misguided policy can increase economic instability.

- Negative supply shocks pose a policy dilemma because fighting the slump in aggregate output worsens inflation and fighting inflation worsens the slump.

Check Your Understanding 14-4

Question

Ltu+xLNpi5TyAfHkT9/0gG5Ea7LiSTshILsSAiInBkDYk0rAM3vq6RC2zAlKCa16nSnLb5eRM4XBoXtnVDvRG/Y2jxl5g5D7rV2F6Q/u8XaNFFbgq52tC6pgxMXQCmcipxOJc9HV0amX89A5tmKGPW3vvMeKh8ywwVj2fWYXb3eO8bVwkQultOhdulnbPDIgy3f8xSfPYrxsnRz5M3u5rEdwkrMnFyAIqjXuWbEKEM1thEMAVfSZgyQjvJaZZOqiL+OMJtzwf2X5er/8PScUhwZMGepO447B0VH6x0QlrvRmsVYDn40bTH0k3rXx/Vhe+BLYXJ244HWEprR/pJMw/CkVDjecwT5Nqp6Ebe1cbD9VyPgFzKduoLYaeXicnjjNWNy9Te34am/GMzWeUPElJJ5y+HVO5BZ/DADKMnF9s3yoBC+9+AgfA9OkDkjMzqQf72UzSx0HeTOVexbQaBo2pZT9S0MejrNU9D68ZAb2yAPlpRms6jFGbN+UH5yPsbZDmyHxfeNfheHDQrwWgyN66e+wp8aOuSZi81AtUvLv3Kau5/TWguiIOO+Xq9o8bOcH3XxhkgedwzUAYboEN3JUrJ/2JMbkQ89j98wBQ1as/XzpO7eu88Yy77XYyvkXj4lxFmx68SiargMyiTPLYgocjla9acWkWyZr2dLqPNNagGeplPpG4E88JkK+XqAlzWE2OFEchF6bOYm0SBOkTE8RuHklb3wUtr6oQfRncyROYI9g9gLAC3QdpRyF6qKt1BvkN46usQHhbQXng/vXl8Itxu984OwvbD0PkRhbKofFgQ9dn94O1LdpYFMTCLireXDhHQDILAT3sySLFSDq1dPOls9bGUlZg5UVHyitPxtNmmvw+lO9ngzO7DlyZoQv4LqaG2U6SzdDX5RRaSMUbPfaQfsZtPQQ2JXMjdfmsRrkvP9cKOeDFbZ7CUdvXokp1woFX+1GbiA4UpDp6VMqiUdL5tErWbX4Yj2TqehkogTv7vgxHU3osoZkSb81XsJrOTOjLGNUquPlMG7VruDSSltLHIki6baQypPp5GWazkDYkyKoDcPFn6BQIhGo7L+DS+Yt6PQ3f7IK9FFdrrIZtcCtFprfdAeGo+uCbcKIqlCJiONl1AJBAn economy is overstimulated when an inflationary gap is present. This will arise if an expansionary monetary or fiscal policy is implemented when the economy is currently in longrun macroeconomic equilibrium. This shifts the aggregate demand curve to the right, in the short run raising the aggregate price level and aggregate output and creating an inflationary gap. Eventually nominal wages will rise and shift the short-run aggregate supply curve to the left, and aggregate output will fall back to potential output. This is the scenario envisaged by the speaker.Question

101jLA5KbvJiZVkhK/pDht7wfnAaYo/oEMQVlbrVlv9VCRBd0VETsXZuztNsKq2HBtwq/rOSSypsSa2shsfc5noblBeJFC9YPzN++BS6NM+UB0TDyaqyLGFXg4DoVmFMYuhn7r3woStsMC49bgBnGyPFKL6e2DRGFAVC4WrkxYeNzS7gIqCC9OPMNcP7ESNyeYkO2Z9Z0pVQ/XFmwG4odfFjS+PzVAQHNDc6iBk0zvgSdooLOHGpTkK6p7Sa4tYkjYqMbsw+5Le6V3n7AbUHhRGI8Q2ENypD+KLEobdbKeIAk8Wpvu3YfvPWEyCNp/ze9gw0Rjb/tSPTRg+FwTz4ZTI2J+H62aC1MY740ig8JREzCe/5PMaFCpj+f+sKZ0Tz9X/opUII+yVrEd0PAARxz4Gvm1OrRmY/okGW7iJxgPm/j8GldpIXHA==No, this is not a valid argument. When the economy is not currently in longrun macroeconomic equilibrium, an expansionary monetary or fiscal policy does not lead to the outcome described above. Suppose a negative demand shock has shifted the aggregate demand curve to the left, resulting in a recessionary gap. An expansionary monetary or fiscal policy can shift the aggregate demand curve back to its original position in long-run macroeconomic equilibrium. In this way, the short-run fall in aggregate output and deflation caused by the original negative demand shock can be avoided. So, if used in response to demand shocks, fiscal or monetary policy is an effective policy tool

Question

HmUxCPEv0aiZfpPTErTI6LhUPcc6m9QP6fhIwm+bIZZPIDrg0vAy9+cY/pQInNYbcvuY0zMA9Ervurm9Y+H2AbjLWtYqJ6y+LMODT5zXNd/6v3N9jWxy/oVNSWzV/ek1RQ5eLw/p4oGO65UaWKvovG3opSuied8lBJLqGZcZTQSm/bokFh8hVbsXc/jHfCQu5I5S2ogclXdv5nKAjpUNmxPyVjgyE7wWsiKsgGLm0dPeYBeCAz4/DZGx4EdyxO5OvtcEut3/OVhDMjF0ql0SvqV5qkykeNDeR3eGonyhaYFG0If+DWm/kJscPF7J9x3Z/hC7u2syLFUHpHh50sFZKgVTVGFIH+fGLubZRZ9h0fHVy8RjEQibLUu3A62Yj4hRkjQaElLO8C4IPgsQIeeDF+M35u/6f/rFHgo62Tna9gVCRWjfKkEHdfPFy2nFuDBUcH4C5Z8VNCdRTMTi+Rd0T0GLUaok+lmO0DT6Qz2a+I1AML5fhyIDW53xmFQMyjfUlm2qXde37h4aC1RanLADLTFySceW63FnPwWt/o4KZ05QWmGK3fOlTBIYA6uouthJvQW8/1qhBMKOXzATcUNBkzByjj8zEzxCvPbhYzSgoI5AVocADqsE1bC9wSpGTgLO7b4OpIZcKCZLVQPlOMYZEnt8PaVwn+LzBAA6tjYYqILkqwRlwm5Kyyd9a0qLDmJHVtQLcdMjMgfCtmKLJl5PtsI8pv3ESpF4S3kWb1GsyHL8csvR6xlIuy+uVAexc7/5p4HOx79WngwUtOLl8nffc7WTuXSxzF5ASwU7eTWcjVyXK5addPStDSMSB15vXpRVyDI3YyNQdRPIhB1A459ZzEfGACKpLtiLuTUkfeZCMBxVjn5RXHrCwdqycyWowz/vKM0+llaY1ulO3vU0gigikQIPA3D1F3ixmS0yCDZHc2hN9TXMFIHAhHLhpmv/T8909fVSUOXZ0e1hkR6rwzrdmY+2aQzdPpfrEXoFPzZ7cupwhOVD1HGW7DfwM3N8qSv0YxB9ceU8T91hTzkj7yDSThsuwKJFYE5UYht7/Hr+dN/r510Odl4JqEFU88F3lr6T59s/iSGKDUoVIQzklqYm1OmmLlXThNDg4TgdbKXoUIVbL7VShm1RlVkSWB1eahON9AkLF7s7QnqCF5kh44P1l+CZm7CAIDCgNb3Me7SeatuV9+GYQkRvN4Godi/z24M0aKFb/2QOZBJ4rSauMw+kmaGQvpU=Those within the Fed who advocated lowering interest rates were focused on boosting aggregate demand in order to counteract the negative demand shock caused by the collapse of the housing bubble. Lowering interest rates will result in a rightward shift of the aggregate demand curve, increasing aggregate output, but raising the aggregate price level. Those within the Fed who advocated holding interest rates steady were focused on the fact that fighting the slump in aggregate demand in the face of a negative supply shock could result in a rise in inflation. Holding interest rates steady relies on the ability of the economy to selfcorrect in the long run, with the aggregate price level and aggregate output only gradually returning to their levels before the negative supply shock.

Solutions appear at back of book.

440