The Industry Supply Curve

The industry supply curve shows the relationship between the price of a good and the total output of the industry as a whole.

Why will an increase in the demand for organic tomatoes lead to a large price increase at first but a much smaller increase in the long run? The answer lies in the behavior of the industry supply curve—the relationship between the price and the total output of an industry as a whole. The industry supply curve is what we referred to in earlier chapters as the supply curve or the market supply curve. But here we take some extra care to distinguish between the individual supply curve of a single firm and the supply curve of the industry as a whole.

As you might guess from the previous section, the industry supply curve must be analyzed in somewhat different ways for the short run and the long run. Let’s start with the short run.

The Short-Run Industry Supply Curve

Recall that in the short run the number of producers in an industry is fixed—there is no entry or exit. And you may also remember from Chapter 3 that the industry supply curve is the horizontal sum of the individual supply curves of all producers—you find it by summing the total output across all suppliers at every given price. We will do that exercise here under the assumption that all the producers are alike—an assumption that makes the derivation particularly simple. So let’s assume that there are 100 organic tomato farms, each with the same costs as Jennifer and Jason’s farm.

225

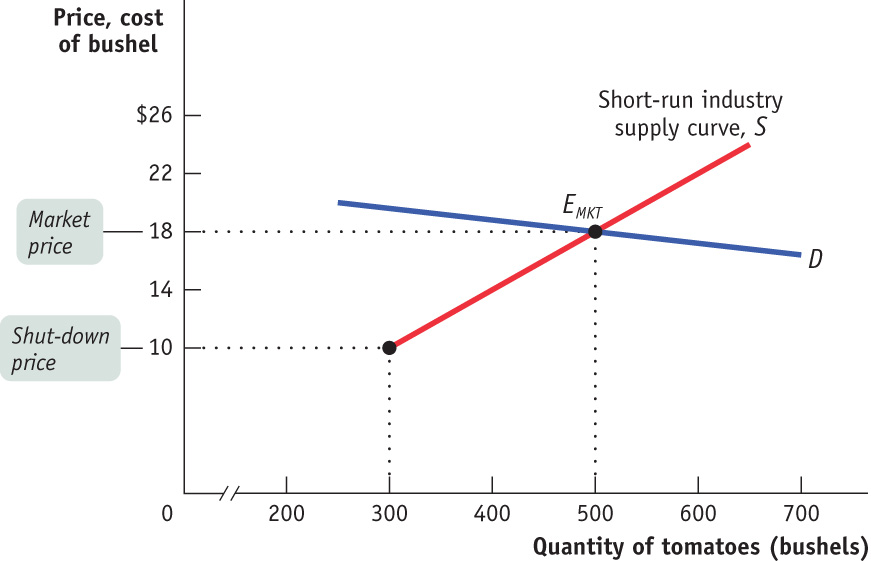

The short-run industry supply curve shows how the quantity supplied by an industry depends on the market price given a fixed number of producers.

Each of these 100 farms will have an individual short-run supply curve like the one in Figure 7-4. At a price below $10, no farms will produce. At a price of more than $10, each farm will produce the quantity of output at which its marginal cost is equal to the market price. As you can see from Figure 7-4, this will lead each farm to produce 4 bushels if the price is $14 per bushel, 5 bushels if the price is $18, and so on. So if there are 100 organic tomato farms and the price of organic tomatoes is $18 per bushel, the industry as a whole will produce 500 bushels, corresponding to 100 farms × 5 bushels per farm, and so on. The result is the short-run industry supply curve, shown as S in Figure 7-5. This curve shows the quantity that producers will supply at each price, taking the number of producers as given.

There is a short-run market equilibrium when the quantity supplied equals the quantity demanded, taking the number of producers as given.

The demand curve D in Figure 7-5 crosses the short-run industry supply curve at EMKT, corresponding to a price of $18 and a quantity of 500 bushels. Point EMKT is a short-run market equilibrium: the quantity supplied equals the quantity demanded, taking the number of producers as given. But the long run may look quite different, because in the long run farms may enter or exit the industry.

The Long-Run Industry Supply Curve

Suppose that in addition to the 100 farms currently in the organic tomato business, there are many other potential producers. Suppose also that each of these potential producers would have the same cost curves as existing producers like Jennifer and Jason if it entered the industry.

When will additional producers enter the industry? Whenever existing producers are making a profit—that is, whenever the market price is above the break-even price of $14 per bushel, the minimum average total cost of production. For example, at a price of $18 per bushel, new firms will enter the industry.

What will happen as additional producers enter the industry? Clearly, the quantity supplied at any given price will increase. The short-run industry supply curve will shift to the right. This will, in turn, alter the market equilibrium and result in a lower market price. Existing firms will respond to the lower market price by reducing their output, but the total industry output will increase because of the larger number of firms in the industry.

226

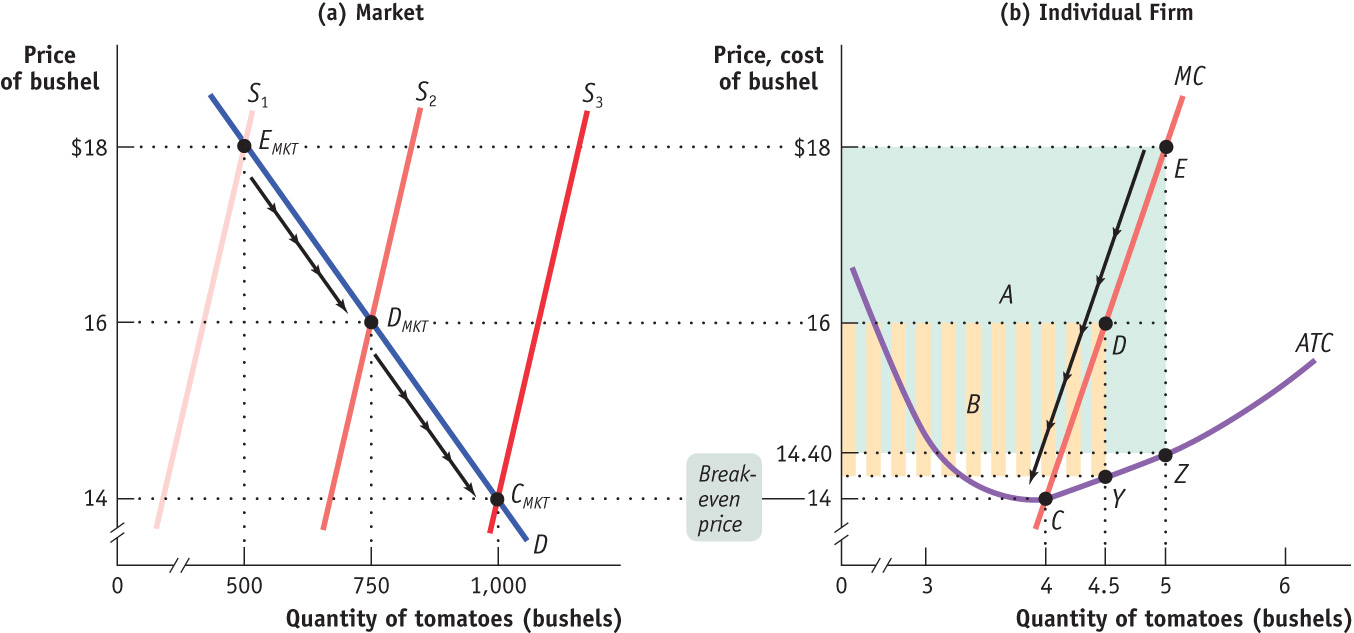

Figure 7-6 illustrates the effects of this chain of events on an existing firm and on the market; panel (a) shows how the market responds to entry, and panel (b) shows how an individual existing firm responds to entry. (Note that these two graphs have been rescaled in comparison to Figures 7-4 and 7-5 to better illustrate how profit changes in response to price.) In panel (a), S1 is the initial short-run industry supply curve, based on the existence of 100 producers. The initial short-run market equilibrium is at EMKT, with an equilibrium market price of $18 and a quantity of 500 bushels. At this price existing producers are profitable, which is reflected in panel (b): an existing firm makes a total profit represented by the green-shaded rectangle labeled A when market price is $18.

These profits will induce new producers to enter the industry, shifting the short-run industry supply curve to the right. For example, the short-run industry supply curve when the number of producers has increased to 167 is S2. Corresponding to this supply curve is a new short-run market equilibrium labeled DMKT, with a market price of $16 and a quantity of 750 bushels. At $16, each firm produces 4.5 bushels, so that industry output is 167 × 4.5 = 750 bushels (rounded). From panel (b) you can see the effect of the entry of 67 new producers on an existing firm: the fall in price causes it to reduce its output, and its profit falls to the area represented by the striped rectangle labeled B.

Although diminished, the profit of existing firms at DMKT means that entry will continue and the number of firms will continue to rise. If the number of producers rises to 250, the short-run industry supply curve shifts out again to S3, and the market equilibrium is at CMKT, with a quantity supplied and demanded of 1,000 bushels and a market price of $14 per bushel.

227

A market is in long-run market equilibrium when the quantity supplied equals the quantity demanded, given that sufficient time has elapsed for entry into and exit from the industry to occur.

Like EMKT and DMKT, CMKT is a short-run equilibrium. But it is also something more. Because the price of $14 is each firm’s break-even price, an existing producer makes zero economic profit—neither a profit nor a loss, earning only the opportunity cost of the resources used in production—when producing its profit-maximizing output of 4 bushels. At this price there is no incentive either for potential producers to enter or for existing producers to exit the industry. So CMKT corresponds to a long-run market equilibrium—a situation in which quantity supplied equals the quantity demanded given that sufficient time has elapsed for producers to either enter or exit the industry. In a long-run market equilibrium, all existing and potential producers have fully adjusted to their optimal long-run choices; as a result, no producer has an incentive to either enter or exit the industry.

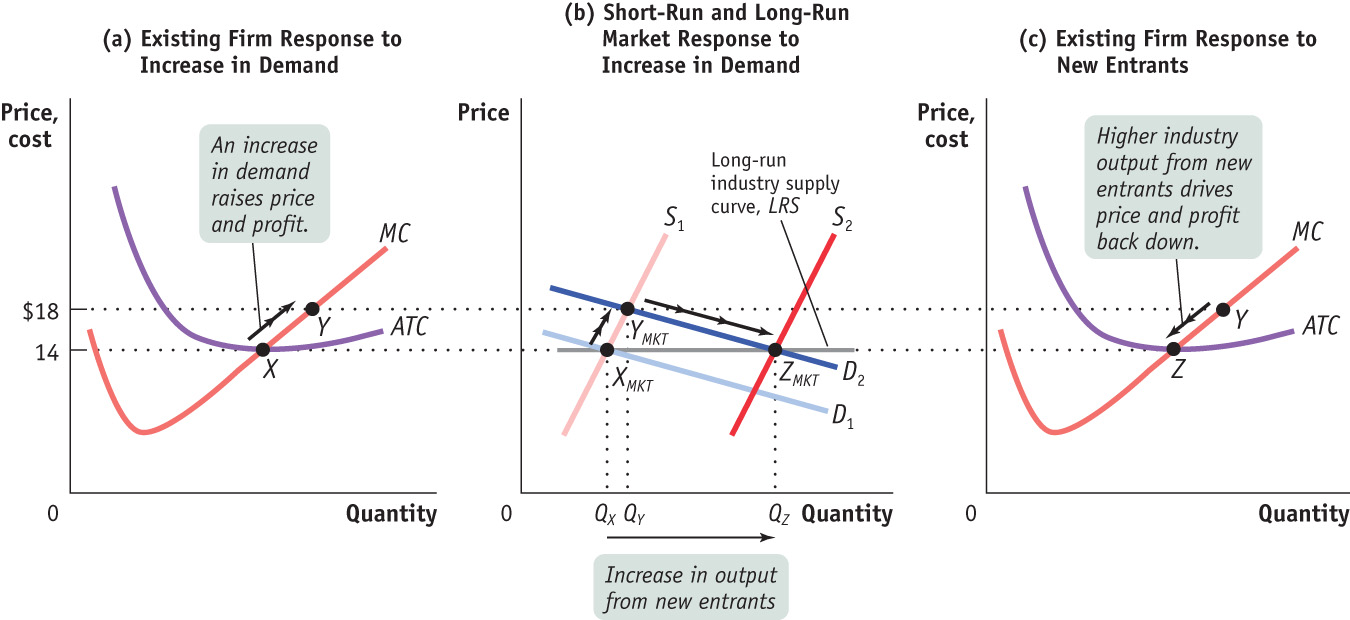

To explore further the significance of the difference between short-run and long-run equilibrium, consider the effect of an increase in demand on an industry with free entry that is initially in long-run equilibrium. Panel (b) in Figure 7-7 shows the market adjustment; panels (a) and (c) show how an existing individual firm behaves during the process.

228

In panel (b) of Figure 7-7, D1 is the initial demand curve and S1 is the initial short-run industry supply curve. Their intersection at point XMKT is both a short-run and a long-run market equilibrium because the equilibrium price of $14 leads to zero economic profit—and therefore neither entry nor exit. It corresponds to point X in panel (a), where an individual existing firm is operating at the minimum of its average total cost curve.

Now suppose that the demand curve shifts out for some reason to D2. As shown in panel (b), in the short run, industry output moves along the short-run industry supply curve S1 to the new short-run market equilibrium at YMKT, the intersection of S1 and D2. The market price rises to $18 per bushel, and industry output increases from QX to QY. This corresponds to an existing firm’s movement from X to Y in panel (a) as the firm increases its output in response to the rise in the market price.

But we know that YMKT is not a long-run equilibrium, because $18 is higher than minimum average total cost, so existing producers are making economic profits. This will lead additional firms to enter the industry. Over time entry will cause the short-run industry supply curve to shift to the right. In the long run, the short-run industry supply curve will have shifted out to S2, and the equilibrium will be at ZMKT—with the price falling back to $14 per bushel and industry output increasing yet again, from QY to QZ. Like XMKT before the increase in demand, ZMKT is both a short-run and a long-run market equilibrium.

The effect of entry on an existing firm is illustrated in panel (c), in the movement from Y to Z along the firm’s individual supply curve. The firm reduces its output in response to the fall in the market price, ultimately arriving back at its original output quantity, corresponding to the minimum of its average total cost curve. In fact, every firm that is now in the industry—the initial set of firms and the new entrants—will operate at the minimum of its average total cost curve, at point Z. This means that the entire increase in industry output, from QX to QZ, comes from production by new entrants.

The long-run industry supply curve shows how the quantity supplied responds to the price once producers have had time to enter or exit the industry.

The line LRS that passes through XMKT and ZMKT in panel (b) is the long-run industry supply curve. It shows how the quantity supplied by an industry responds to the price given that producers have had time to enter or exit the industry.

In this particular case, the long-run industry supply curve is horizontal at $14. In other words, in this industry supply is perfectly elastic in the long run: given time to enter or exit, producers will supply any quantity that consumers demand at a price of $14. Perfectly elastic long-run supply is actually a good assumption for many industries. In this case we speak of there being constant costs across the industry: each firm, regardless of whether it is an incumbent or a new entrant, faces the same cost structure (that is, they each have the same cost curves). Industries that satisfy this condition are industries in which there is a perfectly elastic supply of inputs—industries like agriculture or bakeries.

In other industries, however, even the long-run industry supply curve slopes upward. The usual reason for this is that producers must use some input that is in limited supply (that is, inelastically supplied). As the industry expands, the price of that input is driven up. Consequently, later entrants in the industry find that they have a higher cost structure than early entrants. An example is beach-front resort hotels, which must compete for a limited quantity of prime beachfront property. Industries that behave like this are said to have increasing costs across the industry.

It is possible for the long-run industry supply curve to slope downward. This can occur when an industry faces increasing returns to scale, in which average costs fall as output rises. Notice we said that the industry faces increasing returns. However, when increasing returns apply at the level of the individual firm, the industry usually ends up dominated by a small number of firms (an oligopoly) or a single firm (a monopoly). In some cases, the advantages of large scale for an entire industry accrue to all firms in that industry. For example, the costs of new technologies such as solar panels tend to fall as the industry grows because that growth leads to improved knowledge, a larger pool of workers with the right skills, and so on.

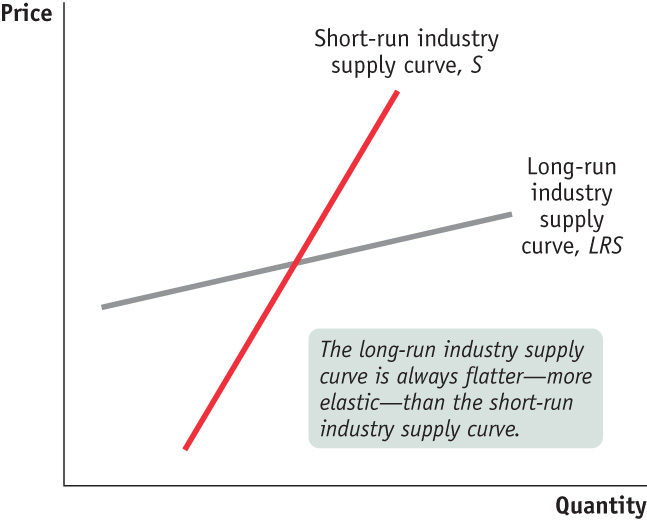

Regardless of whether the long-run industry supply curve is horizontal or upward sloping or even down-ward sloping, the long-run price elasticity of supply is higher than the short-run price elasticity whenever there is free entry and exit. As shown in Figure 7-8, the long-run industry supply curve is always flatter than the short-run industry supply curve. The reason is entry and exit: a high price caused by an increase in demand attracts entry by new producers, resulting in a rise in industry output and an eventual fall in price; a low price caused by a decrease in demand induces existing firms to exit, leading to a fall in industry output and an eventual increase in price.

229

The distinction between the short-run industry supply curve and the long-run industry supply curve is very important in practice. We often see a sequence of events like that shown in Figure 7-7: an increase in demand initially leads to a large price increase, but prices return to their initial level once new firms have entered the industry. Or we see the sequence in reverse: a fall in demand reduces prices in the short run, but they return to their initial level as producers exit the industry.

The Cost of Production and Efficiency in Long-Run Equilibrium

Our analysis leads us to three conclusions about the cost of production and efficiency in the long-run equilibrium of a perfectly competitive industry. These results will be important in our discussion in Chapter 8 of how monopoly gives rise to inefficiency.

First, in a perfectly competitive industry in equilibrium, the value of marginal cost is the same for all firms. That’s because all firms produce the quantity of output at which marginal cost equals the market price, and as price-takers they all face the same market price.

Second, in a perfectly competitive industry with free entry and exit, each firm will have zero economic profit in long-run equilibrium. Each firm produces the quantity of output that minimizes its average total cost—corresponding to point Z in panel (c) of Figure 7-7. So the total cost of production of the industry’s output is minimized in a perfectly competitive industry. (The exception is an industry with increasing costs across the industry. Given a sufficiently high market price, early entrants make positive economic profits, but the last entrants do not. Costs are minimized for later entrants, but not necessarily for the early ones.)

The third and final conclusion is that the long-run market equilibrium of a perfectly competitive industry is efficient: no mutually beneficial transactions go unexploited. All consumers who have a willingness to pay greater than or equal to sellers’ costs actually get the good.

Economic Profit, Again

Some readers may wonder why a firm would want to enter an industry if the market price is only slightly greater than the break-even price. Wouldn’t a firm prefer to go into another business that yields a higher profit?

The answer is that here, as always, when we calculate cost, we mean opportunity cost—that is, cost that includes the return a firm could get by using its resources elsewhere. And so the profit that we calculate is economic profit; if the market price is above the break-even level, no matter how slightly, the firm can earn more in this industry than they could elsewhere.

230

So in the long-run equilibrium of a perfectly competitive industry, production is efficient: costs are minimized and no resources are wasted. In addition, the allocation of goods to consumers is efficient: every consumer willing to pay the cost of producing a unit of the good gets it. Indeed, no mutually beneficial transaction is left unexploited. Moreover, this condition tends to persist over time as the environment changes: the force of competition makes producers responsive to changes in consumers’ desires and to changes in technology.

Baling In, Bailing Out

“King Cotton is back,” proclaimed a 2010 article in the Los Angeles Times, describing a cotton boom that had “turned great swaths of Central California a snowy white during harvest season.” Cotton prices were soaring: they more than tripled between early 2010 and early 2011. And farmers responded by planting more cotton.

What was behind the price rise? As we learned in Chapter 3, it was partly caused by temporary factors, notably severe floods in Pakistan that destroyed much of that nation’s cotton crop. But there was also a big rise in demand, especially from China, whose burgeoning textile and clothing industries demanded ever more raw cotton to weave into cloth. And all indications were that higher demand was here to stay.

So is cotton farming going to be a highly profitable business from now on? The answer is no, because when an industry becomes highly profitable, it draws in new producers, and that brings prices down. And the cotton industry was following the standard script.

For it wasn’t just the Central Valley of California that had turned “snowy white.” Farmers around the world were moving into cotton growing. “This summer, cotton will stretch from Queensland through northern NSW [New South Wales] all the way down to the Murrumbidgee valley in southern NSW,” declared an Australian report.

And by 2012 the entry of all these new producers was having a big effect. By the summer of 2012, cotton prices were only about a third of their peak in early 2011. It was clear that the cotton boom had reached its limit—and that at some point in the not too distant future some of the farmers who had rushed into the industry would leave it again.

Quick Review

- The industry supply curve corresponds to the supply curve of earlier chapters. In the short run, the time period over which the number of producers is fixed, the short-run market equilibrium is given by the intersection of the short-run industry supply curve and the demand curve. In the long run, the time period over which producers can enter or exit the industry, the long-run market equilibrium is given by the intersection of the long-run industry supply curve and the demand curve. In the long-run market equilibrium, no producer has an incentive to enter or exit the industry.

- The long-run industry supply curve is often horizontal, although it may slope upward when a necessary input is in limited supply. It is always more elastic than the short-run industry supply curve.

- In the long-run market equilibrium of a perfectly competitive industry, each firm produces at the same marginal cost, which is equal to the market price, and the total cost of production of the industry’s output is minimized. It is also efficient.

Check Your Understanding 7-3

Question

nmeLsjW2eo6EQeqDUzoFHSuH59qfTaFi71QxFv8dqA5AJNW8bvc21q+KzFAPgglCSgXXoXGadwbR0nPFPvfwmQ1N52STGVa3bA9N5kuw6Kp10JKvoDyUl95XUxgVrFVkFLtmIhYRRFCjPtKOS6e/DiYqXy40U1G+CwLa/wFdCNBL/0C86Ol6mXo2ZBIcOx9a/VYgvCx1FItRXx71Qn2yXf/pO7XZeGvq4jueP8dtJBDmAs84bg5WyZHOtRN0dUG62O98a9wXjfvo6UQZjUbpwCIiwQFTzSw/1ZSkhQ2Jvy2Ei23yIvwK8OKrROuuYvuKgtZMTg==A fall in the fixed cost of production generates a fall in the average total cost of production and, in the short run, an increase in each firm’s profit at the current output level. So in the long run new firms will enter the industry. The increase in supply drives down price and profits. Once profits are driven back to zero, entry will cease.Question

N0yuvTT9OlpKWN0mlf5eajU2PRgpxzQOSsWa5tYAwRuod0xNMFxRMwvFogZI71Lo7lO1k4UdBuJ4x6p13hgqMR6xP84h2LMv0w7eUG/TJHF9DilpNRsdncdggzs4TCIeevJC+F6A5ovmakQS4g1WWysZuyC02pBF/lni3WFgdeWgVIr5v0Ckk1J2+oKJYU2YKME7Q/4WKXAyjN8hwLcy+3qASGsMXzYrMW2J9h/hk++7gjw7/AZ0UXKT7ZK4yvdDe4IIesm4hhyiY7ZPcSGM1W3se/D4RhyQj2eSXG0HGGX7cYKjmlTGvw==An increase in wages generates an increase in the average variable and the average total cost of production at every output level. In the short run, firms incur losses at the current output level, and so in the long run some firms will exit the industry. (If the average variable cost rises sufficiently, some firms may even shut down in the short run.) As firms exit, supply decreases, price rises, and losses are reduced. Exit will cease once losses return to zero.Question

hAQYjQQEnbk0RTno1bioRKfvxVGn+RT/4X3tK32krxJbcpNx7EiASjvG8xC2974+Ua1LJmM0V+nU9SUHNHo0d1KNuaG2ArXilivUbZy7saLtExu69MWGeNF9OXgthcZoAPujOC3fnMC7GXmAAzrn1Vc0I9Q43LuAl87BpGvHV2lM2vUCDM+0H/fzNyB6RI14KMI6ijoQSUxrnqbt8nKr8BAbImgY1jCIGotyLe/pr4aO+CODNTaswPxE72tWov6CDr/e5BFhOvfwnv/Zc2F/6RMLhz5CySVfPEAXjg==Price will rise as a result of the increased demand, leading to a short-run increase in profits at the current output level. In the long run, firms will enter the industry, generating an increase in supply, a fall in price, and a fall in profits. Once profits are driven back to zero, entry will cease.Question

OOErUY8bW+9vTEzPHcejnX2DBjxU36+5DyEUPxoyABbsci0GBZLC+/Rdp0Dd9Zm5zABxE85qcF5KlJn3cK7x6C9wT2MIXWxK+bnh5Fadfcp8kJnlQ5IMJ8bbw9Af27+T0YScsC9cJho85n9vXLwyXb70DYqjpEhRq0QlnXHADHqpjGBlJ8QF4sP9z2nO979WJJHuCEuS70Ut4moGwnTQGc58MhUw0oTqEuCSMkuEVVu4IZ8gL8wPRs7jM9SVqMRg3VSCJRy/BW0L6JCrdpcZWY2IK+SgtgZjUQZR8ErE/XI=The shortage of a key input causes that input’s price to increase, resulting in an increase in average variable and average total costs for producers. Firms incur losses in the short run, and some firms will exit the industry in the long run. The fall in supply generates an increase in price and decreased losses. Exit will cease when losses have returned to zero.

Solutions appear at back of book.

231