Types of Market Structure

In the real world, there is a mind-boggling array of different markets. We observe widely different behavior patterns by producers across markets: in some markets producers are extremely competitive; in others, they seem somehow to coordinate their actions to avoid competing with one another; and, as we have just described, some markets are monopolies in which there is no competition at all. In order to develop principles and make predictions about markets and how producers will behave in them, economists have developed four principal models of market structure: perfect competition, monopoly, oligopoly, and monopolistic competition.

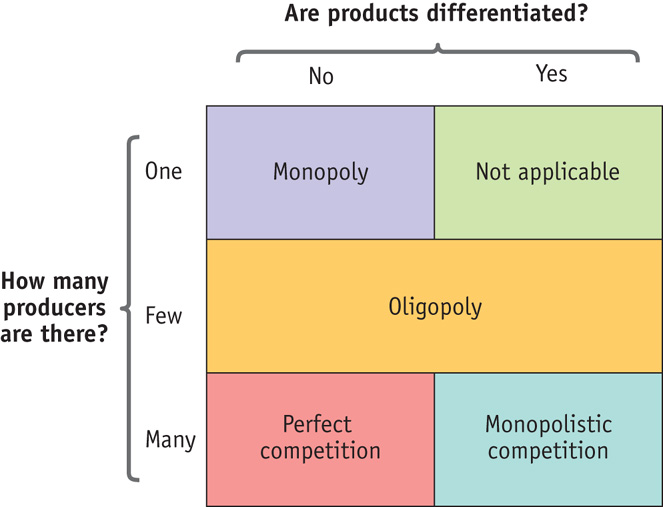

This system of market structures is based on two dimensions:

- The number of producers in the market (one, few, or many)

- Whether the goods offered are identical or differentiated

Differentiated goods are goods that are different but considered somewhat substitutable by consumers (think Coke versus Pepsi).

Figure 8-1 provides a simple visual summary of the types of market structure classified according to the two dimensions. In monopoly, a single producer sells a single, undifferentiated product. In oligopoly, a few producers—more than one but not a large number—sell products that may be either identical or differentiated. In monopolistic competition, many producers each sell a differentiated product (think of producers of economics textbooks). And finally, as we know, in perfect competition many producers each sell an identical product.

You might wonder what determines the number of firms in a market: whether there is one (monopoly), a few (oligopoly), or many (perfect competition and monopolistic competition). We won’t answer that question here because it will be covered in detail later in this chapter. We will just briefly note that in the long run it depends on whether there are conditions that make it difficult for new firms to enter the market, such as control of necessary resources or inputs, increasing returns to scale in production, technological superiority, a network externality, or government regulations. When these conditions are present, industries tend to be monopolies or oligopolies; when they are not present, industries tend to be perfectly competitive or monopolistically competitive.

241

In the next section, we will define monopoly and review the conditions that make it possible. We will see how a monopolist can increase profit by limiting the quantity supplied to a market—behavior that is good for the producer but bad for consumers. We then turn to two other forms of market structure, oligopoly and monopolistic competition. The same conditions that, in less extreme form, give rise to monopoly also give rise to oligopoly, and certain characteristics of monopoly are relevant for both oligopoly and monopolistic competition. Finally, we will take a look at how monopolistic competition gives rise to product differentiation.