Worked Problem: The Ups (and Downs) of Oil Prices

Call it a cartel that does not need to meet in secret. The Organization of Petroleum Exporting Countries, usually referred to as OPEC, includes 12 national governments (Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela), and it controls 40% of the world’s oil exports and 80% of its proven resources. Two other oil-exporting countries, Norway and Mexico, are not formally part of the cartel but act as if they were. (Russia, also an important oil exporter, has not yet become part of the club.) Unlike corporations, which are often legally prohibited by governments from reaching agreements about production and prices, national governments can talk about whatever they like. OPEC members routinely meet to set targets for production.

268

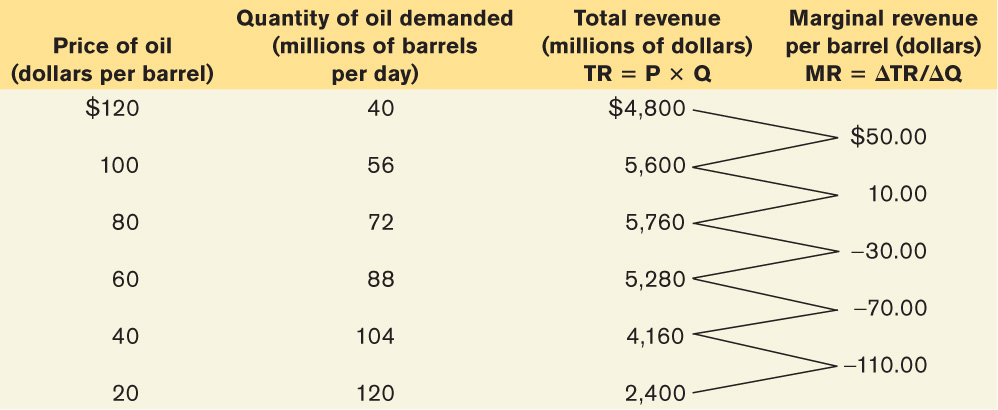

The following table gives a hypothetical demand schedule for the OPEC cartel.

| Price of oil(dollars per barrel) | Quantity of oil demand(millions of barrels per day) |

|---|---|

| $120 | 40 |

| 100 | 56 |

| 80 | 72 |

| 60 | 88 |

| 40 | 104 |

| 20 | 120 |

Suppose that, with current technology, the marginal cost of extracting a barrel of oil from the ground is $30. If the cartel colludes and acts as a monopolist, how many barrels of oil should it sell in total, and at what price? If the members of the cartel split production equally, how much oil would each of the 12 members produce, and what is each producer’s profit [assuming no fixed costs]?

In order to find the cartel’s optimal quantity and price, we first need to find the marginal revenue schedule for the cartel.

Study the section, “The Monopolist’s Demand Curve and Marginal Revenue,” beginning on p. 245. (Pay close attention to Table 8-1 on page 247).

The total revenue is found by multiplying price and quantity (TR = P × Q). The marginal revenue is the change in total revenue divided by the change in quantity (MR = ΔTR/ΔQ). Thus, in the table below, the total revenue ($4,800) on the first line is found by multiplying $120 by 40. The first entry for marginal revenue in the last column is ($5,600 − $4,800)/(56 − 40) = $50.

How many barrels of oil should the cartel sell in total and at what price?

Study the section, “The Monopolist’s Profit-Maximizing Output and Price,” beginning on p. 249.

We need to find the quantity and price where marginal revenue (MR) = marginal cost (MC). As we can see from the table above, OPEC’s profit will be maximized when the cartel sells 56 million barrels of oil per day, since for the first 56 barrels, its marginal revenue exceeds its marginal cost of $30 per barrel, and after that, its marginal revenue is less than its marginal cost. OPEC will charge $100 per barrel.

269

If the members of the cartel split production equally, how much oil would each of the 12 members produce, and what is each producer’s profit?

This situation is similar to the example discussed in the section “A Duopoly Example,” on page 254, except that in this case there are 12 producers, each of which produces 1/12 of the cartel’s output.

Each producer produces 1/12 of the cartel’s output. So, each member produces 4.67 million barrels for a profit of 4.67 million × ($100 − $30) = $326.67 million, assuming no fixed costs.