How to Calculate the Present Value of One-Year Projects

Recall that the symbol r represents the interest rate, either as a percentage or decimal (that is, r = 5% = 0.05). Rather than work with units of $1,000, we will calculate present value for the simplest case, units of $1.

If you lend X, at the end of one year you will receive:

From Equation 10A-

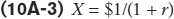

Solving for X by dividing both sides of Equation 10A-

As we explained in the chapter, X is the present value of $1 given an interest rate of r: it is the amount of money you would need today in order to generate a given amount of money one year from now given the interest rate r. Because r is greater than zero, X is less than $1; $1 to be delivered in the future is worth less than $1 delivered today.

Also recall from the chapter that as the interest rate goes up, the present value of a dollar delivered in the future falls. For example, the present value of $1 when r = 0.10 is $1/(1 + 0.10) = $1/1.10 = $0.91, and the present value of $1 when r = 0.02 is $1/(1 + 0.02) = $1/1.02 = $0.98.