The Natural Rate of Unemployment

Fast economic growth tends to reduce the unemployment rate. So how low can the unemployment rate go? You might be tempted to say zero, but that isn’t feasible. Over the past half-

How can there be so much unemployment even when many businesses are having a hard time finding workers? To answer this question, we need to examine the nature of labor markets and why they normally lead to substantial measured unemployment even when jobs are plentiful. Our starting point is the observation that even in the best of times, jobs are constantly being created and destroyed.

Job Creation and Job Destruction

Even during good times, most Americans know someone who has lost his or her job. In July 2007, the U.S. unemployment rate was only 4.7%, relatively low by historical standards. Yet in that month there were 4.5 million “job separations”—terminations of employment that occur because a worker is either fired or quits voluntarily.

There are many reasons for such job loss. One is structural change in the economy: industries rise and fall as new technologies emerge and consumers’ tastes change. For example, employment in high-

Continual job creation and destruction are a feature of modern economies, making a naturally occurring amount of unemployment inevitable. Within this naturally occurring amount, there are two types of unemployment—

Frictional Unemployment

When a worker loses a job involuntarily due to job destruction, he or she often doesn’t take the first new job offered. For example, suppose a skilled programmer, laid off because her software company’s product line was unsuccessful, sees a help-

Workers who spend time looking for employment are engaged in job search.

Economists say that workers who spend time looking for employment are engaged in job search. If all workers and all jobs were alike, job search wouldn’t be necessary; if information about jobs and workers was perfect, job search would be very quick. In practice, however, it’s normal for a worker who loses a job, or a young worker seeking a first job, to spend at least a few weeks searching.

Frictional unemployment is unemployment due to the time workers spend in job search.

Frictional unemployment is unemployment due to the time workers spend in job search. A certain amount of frictional unemployment is inevitable due to the constant process of economic change. Thus even in 2007, a year of low unemployment, there were 62 million “job separations,” in which workers left or lost their jobs. Total employment grew because these separations were more than offset by more than 63 million hires. Inevitably, some of the workers who left or lost their jobs spent at least some time unemployed, as did some of the workers newly entering the labor force.

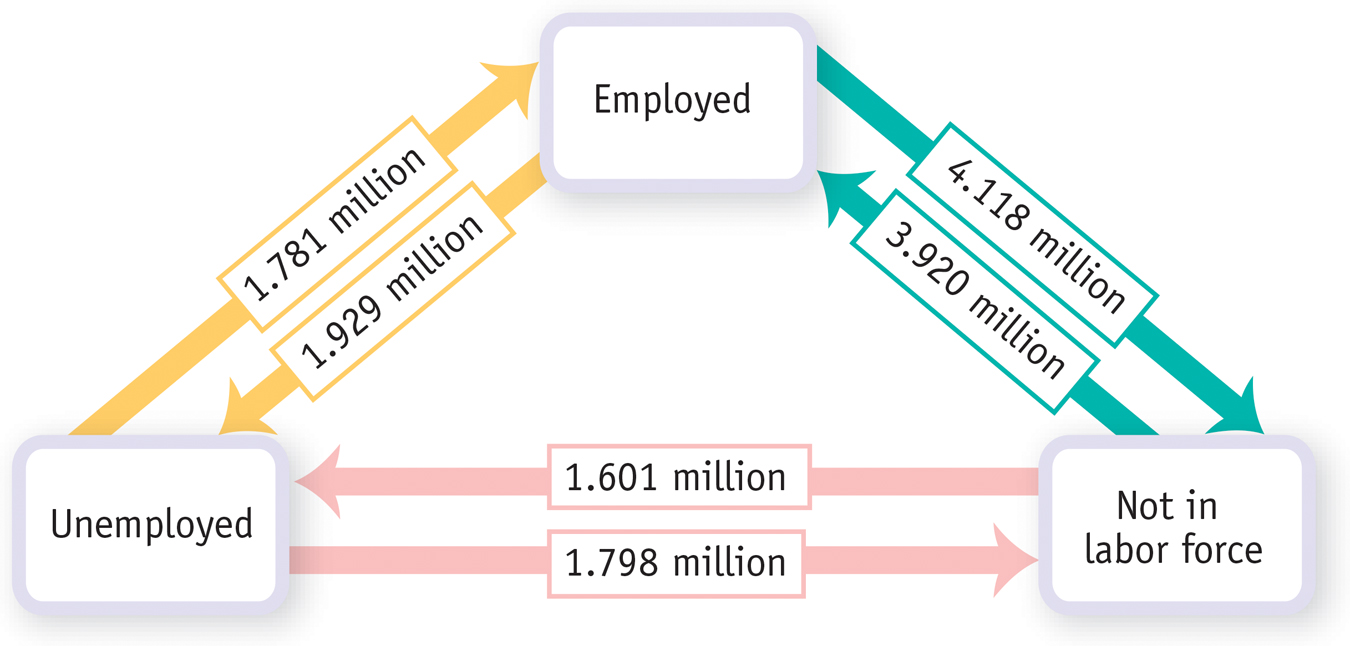

Figure 8-7 shows the average monthly flows of workers among three states: employed, unemployed, and not in the labor force during 2007, a year of relatively low unemployment. What the figure suggests is how much churning is constantly taking place in the labor market. An inevitable consequence of that churning is a significant number of workers who haven’t yet found their next job—

A limited amount of frictional unemployment is relatively harmless and may even be a good thing. The economy is more productive if workers take the time to find jobs that are well matched to their skills, and workers who are unemployed for a brief period while searching for the right job don’t experience great hardship. In fact, when there is a low unemployment rate, periods of unemployment tend to be quite short, suggesting that much of the unemployment is frictional.

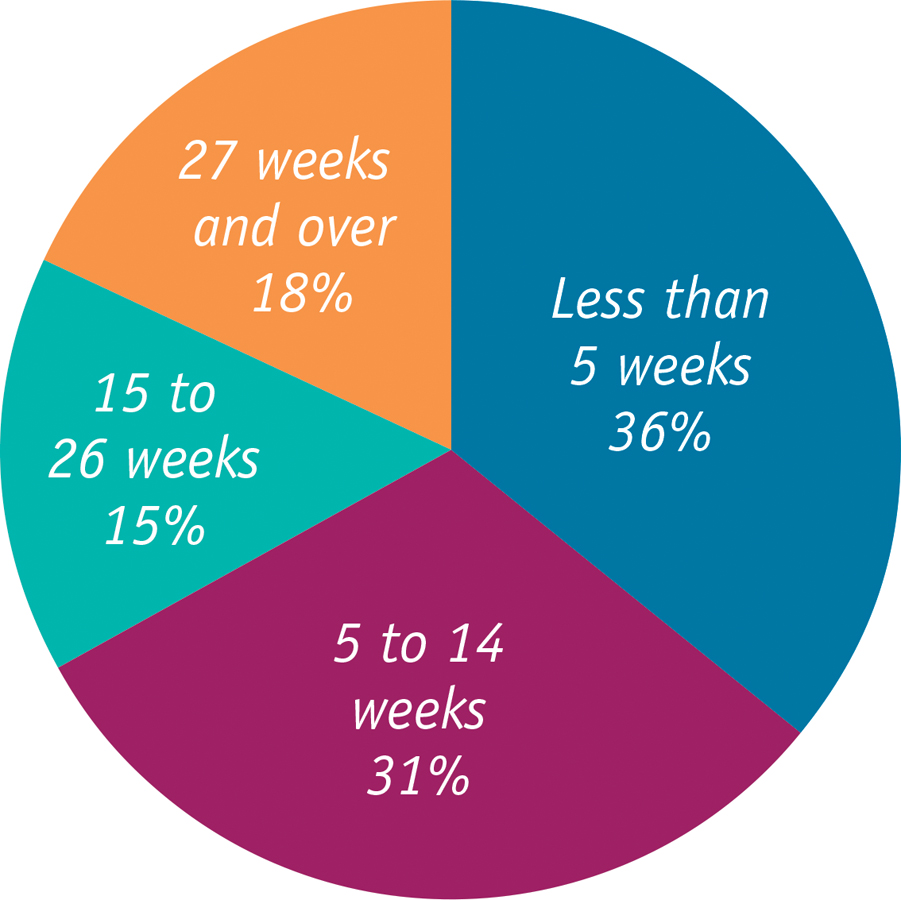

Figure 8-8 shows the composition of unemployment for all of 2007, when the unemployment rate was only 4.6%. Thirty-

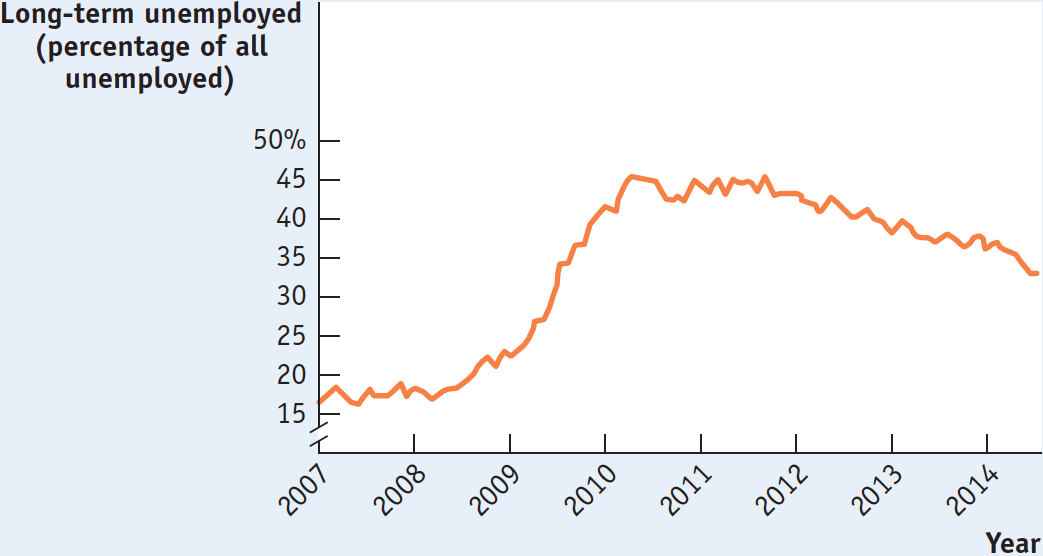

In periods of higher unemployment, however, workers tend to be jobless for longer periods of time, suggesting that a smaller share of unemployment is frictional. Figure 8-9 shows the fraction of the unemployed who had been out of work for six months or more from 2007 to mid-

Structural Unemployment

In structural unemployment, more people are seeking jobs in a particular labor market than there are jobs available at the current wage rate, even when the economy is at the peak of the business cycle.

Frictional unemployment exists even when the number of people seeking jobs is equal to the number of jobs being offered—

The supply and demand model tells us that the price of a good, service, or factor of production tends to move toward an equilibrium level that matches the quantity supplied with the quantity demanded. This is equally true, in general, of labor markets.

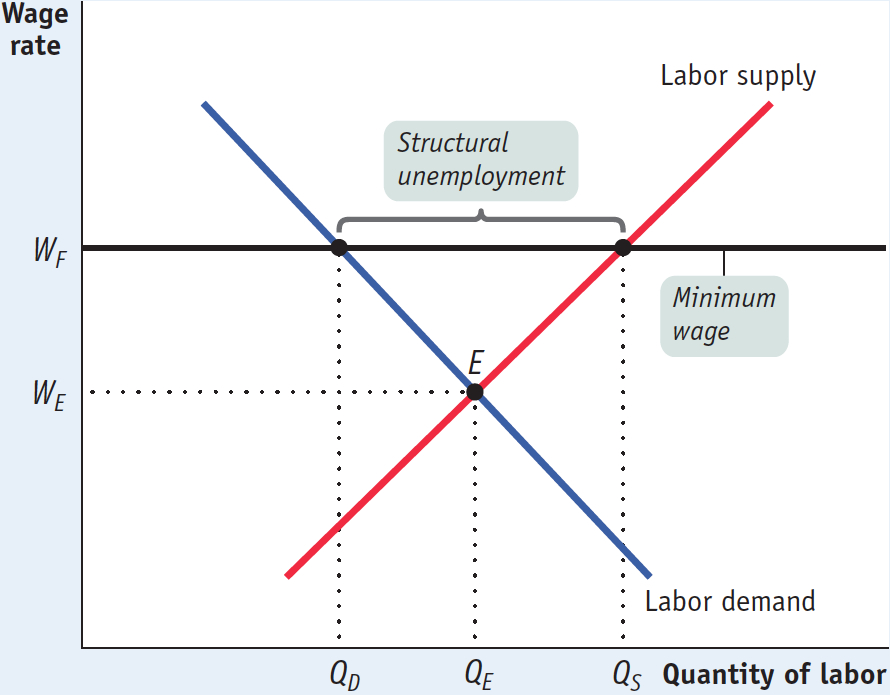

Figure 8-10 shows a typical market for labor. The labor demand curve indicates that when the price of labor—

Even at the equilibrium wage rate WE, there will still be some frictional unemployment. That’s because there will always be some workers engaged in job search even when the number of jobs available is equal to the number of workers seeking jobs. But there wouldn’t be any structural unemployment in this labor market. Structural unemployment occurs when the wage rate is, for some reason, persistently above WE. Several factors can lead to a wage rate in excess of WE, the most important being minimum wages, labor unions, efficiency wages, the side effects of government policies, and mismatches between employees and employers.

Minimum Wages A minimum wage is a government-

Figure 8-10 shows the effect of a binding minimum wage. In this market, there is a legal floor on wages, WF, which is above the equilibrium wage rate, WE. This leads to a persistent surplus in the labor market: the quantity of labor supplied, QS, is larger than the quantity demanded, QD. In other words, more people want to work than can find jobs at the minimum wage, leading to structural unemployment.

Given that minimum wages—

Although economists broadly agree that a high minimum wage has the employment-

In addition, some researchers have produced evidence showing that increases in the minimum wage actually lead to higher employment when, as was the case in the United States at one time, the minimum wage is low compared to average wages. They argue that firms that employ low-

Labor Unions The actions of labor unions can have effects similar to those of minimum wages, leading to structural unemployment. By bargaining collectively for all of a firm’s workers, unions can often win higher wages from employers than workers would have obtained by bargaining individually. This process, known as collective bargaining, is intended to tip the scales of bargaining power more toward workers and away from employers. Labor unions exercise bargaining power by threatening firms with a labor strike, a collective refusal to work. The threat of a strike can have serious consequences for firms. In such cases, workers acting collectively can exercise more power than they could if acting individually.

Employers have acted to counter the bargaining power of unions by threatening and enforcing lockouts—

When workers have increased bargaining power, they tend to demand and receive higher wages. Unions also bargain over benefits, such as health care and pensions, which we can think of as additional wages. Indeed, economists who study the effects of unions on wages find that unionized workers earn higher wages and more generous benefits than non-

Efficiency wages are wages that employers set above the equilibrium wage rate as an incentive for better employee performance.

Efficiency Wage Actions by firms can contribute to structural unemployment. Firms may choose to pay efficiency wages—

Employers may feel the need for such incentives for several reasons. For example, employers often have difficulty observing directly how hard an employee works. They can, however, elicit more work effort by paying above-

When many firms pay efficiency wages, the result is a pool of workers who want jobs but can’t find them. So the use of efficiency wages by firms leads to structural unemployment.

Side Effects of Government Policies In addition, government policies designed to help workers who lose their jobs can lead to structural unemployment as an unintended side effect. Most economically advanced countries provide benefits to laid-

Mismatches Between Employees and Employers It takes time for workers and firms to adjust to shifts in the economy. The result can be a mismatch between what employees have to offer and what employers are looking for. A skills mismatch is one form; for example, in the aftermath of the housing bust of 2009, there were more construction workers looking for jobs than were available. Another form is geographic as in Michigan, which has had a long-

The Natural Rate of Unemployment

The natural rate of unemployment is the unemployment rate that arises from the effects of frictional plus structural unemployment.

Cyclical unemployment is the deviation of the actual rate of unemployment from the natural rate due to downturns in the business cycle.

Because some frictional unemployment is inevitable and because many economies also suffer from structural unemployment, a certain amount of unemployment is normal, or “natural.” Actual unemployment fluctuates around this normal level. The natural rate of unemployment is the normal unemployment rate around which the actual unemployment rate fluctuates. It is the rate of unemployment that arises from the effects of frictional plus structural unemployment. Cyclical unemployment is the deviation of the actual rate of unemployment from the natural rate; that is, it is the difference between the actual and natural rates of unemployment. As the name suggests, cyclical unemployment is the share of unemployment that arises from the downturns of the business cycle.

Natural Unemployment Around the OECD

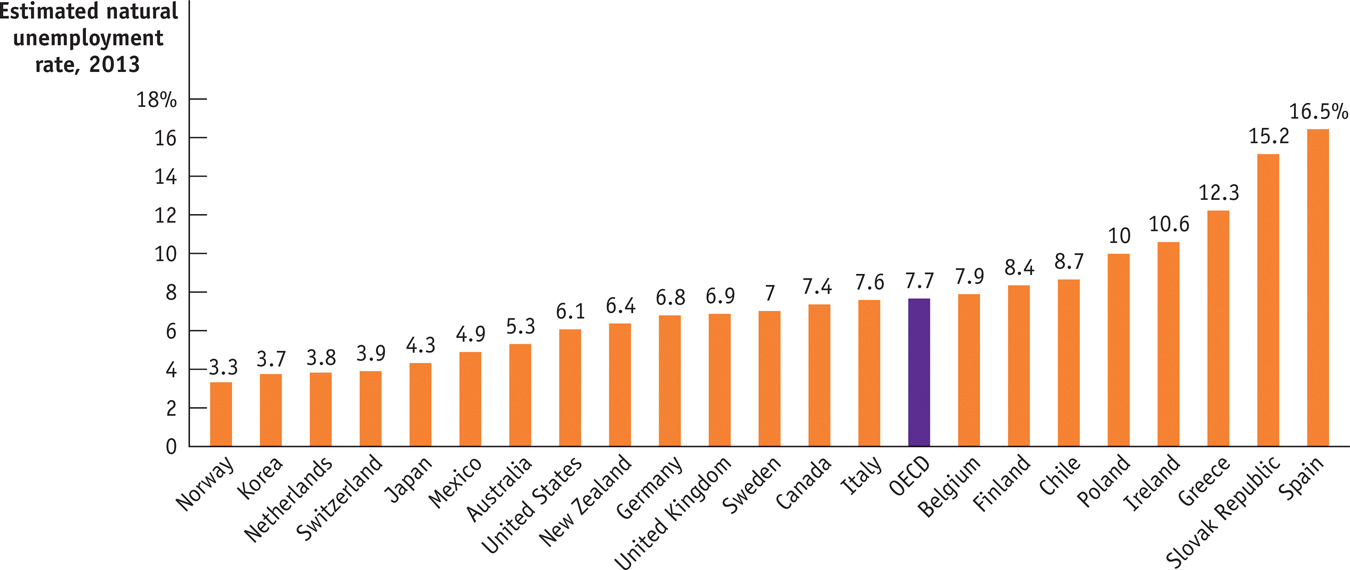

The Organization for Economic Cooperation and Development (OECD) is an association of relatively wealthy countries in Europe and North America that also includes Japan, Korea, New Zealand, and Australia. Among other activities, the OECD makes estimates of the natural rate of unemployment. The figure shows these estimates for 2013. The population-

While the U.S. natural rate of unemployment at 6.1% is below the OECD average of 7.7%, those of many European countries (including the major economies of Germany, Italy, and France) are above average. Many economists think that persistently high European unemployment rates are the result of government policies, such as high minimum wages and generous unemployment benefits, which discourage employers from offering jobs and discourage workers from accepting jobs, leading to high rates of structural unemployment.

Source: OECD.

We’ll see in Chapter 16 that an economy’s natural rate of unemployment is a critical policy variable because a government cannot keep the unemployment rate persistently below the natural rate without leading to accelerating inflation.

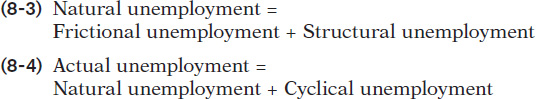

We can summarize the relationships between the various types of unemployment as follows:

Perhaps because of its name, people often imagine that the natural rate of unemployment is a constant that doesn’t change over time and can’t be affected by government policy. Neither proposition is true. Let’s take a moment to stress two facts: the natural rate of unemployment changes over time, and it can be affected by government policies.

Changes in the Natural Rate of Unemployment

Private-

What causes the natural rate of unemployment to change? The most important factors are changes in labor force characteristics, changes in labor market institutions, and changes in government policies. Let’s look briefly at each factor.

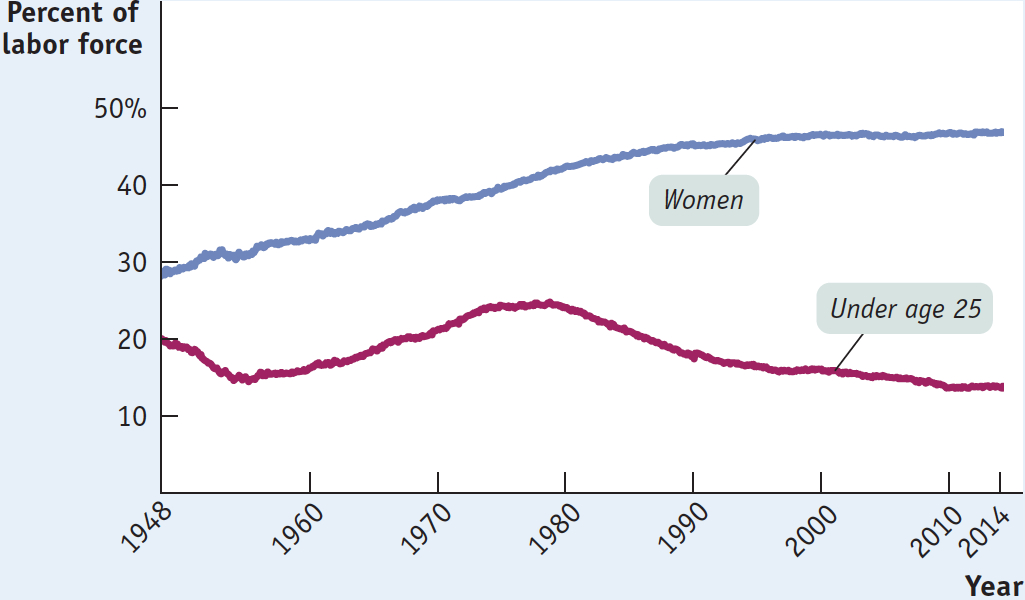

Changes in Labor Force Characteristics In 2007 the rate of unemployment in the United States was 4.6%. Young workers, however, had much higher unemployment rates: 15.7% for teenagers and 8.2% for workers aged 20 to 24. Workers aged 25 to 54 had an unemployment rate of only 3.7%.

In general, unemployment rates tend to be lower for experienced than for inexperienced workers. Because experienced workers tend to stay in a given job longer than do inexperienced ones, they have lower frictional unemployment. Also, because older workers are more likely than young workers to be family breadwinners, they have a stronger incentive to find and keep jobs.

One reason the natural rate of unemployment rose during the 1970s was a large rise in the number of new workers—

Changes in Labor Market Institutions As we pointed out earlier, unions that negotiate wages above the equilibrium level can be a source of structural unemployment. Some economists believe that the high natural rate of unemployment in Europe, discussed in the Global Comparison, is caused, in part, by strong labor unions. In the United States, a sharp fall in union membership after 1980 may have been one reason the natural rate of unemployment fell between the 1970s and the 1990s.

Other institutional changes may also be at work. For example, some labor economists believe that temporary employment agencies, which have proliferated in recent years, have reduced frictional unemployment by helping match workers to jobs. Furthermore, as discussed in the Business Case at the end of the chapter, websites such as Elance-

Technological change, coupled with labor market institutions, can also affect the natural rate of unemployment. Technological change tends to increase the demand for skilled workers who are familiar with the relevant technology and reduce the demand for unskilled workers. Economic theory predicts that wages should increase for skilled workers and decrease for unskilled workers as technology advances. But if wages for unskilled workers cannot go down—

Changes in Government Policies A high minimum wage can cause structural unemployment. Generous unemployment benefits can increase both structural and frictional unemployment. So government policies intended to help workers can have the undesirable side effect of raising the natural rate of unemployment.

Some government policies, however, may reduce the natural rate. Two examples are job training and employment subsidies. Job-

!worldview! ECONOMICS in Action: Structural Unemployment in East Germany

Structural Unemployment in East Germany

In one of the most dramatic events in world history, a spontaneous popular uprising in 1989 overthrew the communist dictatorship in East Germany. Citizens quickly tore down the wall that had divided Berlin, and in short order East and West Germany united into one democratic nation.

Then the trouble started.

After reunification, employment in East Germany plunged and the unemployment rate soared. This high unemployment rate has gradually come down, but remains well above the rate in the rest of Germany. In late 2014 the unemployment rate in what was formerly East Germany was more than 9%, compared with 5.6% in the former West Germany. Other parts of formerly communist Eastern Europe have done much better. For example, the Czech Republic, which was often cited along with East Germany as a relatively successful communist economy, had an unemployment rate of only 5.7% in October 2014. What went wrong in East Germany?

The answer is that, through nobody’s fault, East Germany found itself suffering from severe structural unemployment. When Germany was reunified, it became clear that workers in East Germany were much less productive than their cousins in the west. Yet unions initially demanded and received wage rates equal to those in West Germany. These wage rates have been slow to come down because East German workers objected to being treated as inferior to their West German counterparts. Meanwhile, productivity in the former East Germany remains well below West German levels, in part because of decades of misguided investment under the former dictatorship. The result has been a persistently large mismatch between the number of workers demanded and the number of those seeking jobs, and persistently high structural unemployment in the former East Germany.

Quick Review

Frictional unemployment occurs because unemployed workers engage in job search, making some amount of unemployment inevitable.

A variety of factors—

minimum wages, unions, efficiency wages, the side effects of government policies such as unemployment benefits, and mismatches between employees and employers— lead to structural unemployment. Frictional plus structural unemployment equals natural unemployment, yielding a natural rate of unemployment. In contrast, cyclical unemployment changes with the business cycle. Actual unemployment is equal to the sum of natural unemployment and cyclical unemployment.

The natural rate of unemployment can shift over time, due to changes in labor force characteristics and institutions. Government policies designed to help workers are believed to be one reason for high natural rates of unemployment in Europe.

8-2

Question 8.4

Explain the following statements.

Frictional unemployment is higher when the pace of technological advance quickens.

Structural unemployment is higher when the pace of technological advance quickens.

Frictional unemployment accounts for a larger share of total unemployment when the unemployment rate is low.

Question 8.5

Why does collective bargaining have the same general effect on unemployment as a minimum wage? Illustrate your answer with a diagram.

Question 8.6

Suppose that at the peak of the business cycle the United States dramatically increases benefits for unemployed workers. Explain what will happen to the natural rate of unemployment.

Solutions appear at back of book.