Private Goods—and Others

What’s the difference between installing a new bathroom in a house and building a municipal sewage system? What’s the difference between growing wheat and fishing in the open ocean?

These aren’t trick questions. In each case there is a basic difference in the characteristics of the goods involved. Bathroom fixtures and wheat have the characteristics necessary to allow markets to work efficiently. Public sewage systems and fish in the sea do not.

Let’s look at these crucial characteristics and why they matter.

Characteristics of Goods

Goods like bathroom fixtures or wheat have two characteristics that, as we’ll soon see, are essential if a good is to be efficiently provided by a market economy.

A good is excludable if the supplier of that good can prevent people who do not pay from consuming it.

They are excludable: suppliers of the good can prevent people who don’t pay from consuming it.

A good is rival in consumption if the same unit of the good cannot be consumed by more than one person at the same time.

They are rival in consumption: the same unit of the good cannot be consumed by more than one person at the same time.

A good that is both excludable and rival in consumption is a private good.

When a good is both excludable and rival in consumption, it is called a private good. Wheat is an example of a private good. It is excludable: the farmer can sell a bushel to one consumer without having to provide wheat to everyone in the county. And it is rival in consumption: if I eat bread baked with a farmer’s wheat, that wheat cannot be consumed by someone else.

When a good is nonexcludable, the supplier cannot prevent consumption by people who do not pay for it.

But not all goods possess these two characteristics. Some goods are nonexcludable—the supplier cannot prevent consumption of the good by people who do not pay for it. Fire protection is one example: a fire department that puts out fires before they spread protects the whole city, not just people who have made contributions to the Firemen’s Benevolent Association. An improved environment is another: the city of London couldn’t have ended the Great Stink for some residents while leaving the river Thames foul for others.

A good is nonrival in consumption if more than one person can consume the same unit of the good at the same time.

Nor are all goods rival in consumption. Goods are nonrival in consumption if more than one person can consume the same unit of the good at the same time. TV shows are nonrival in consumption: your decision to watch a show does not prevent other people from watching the same show.

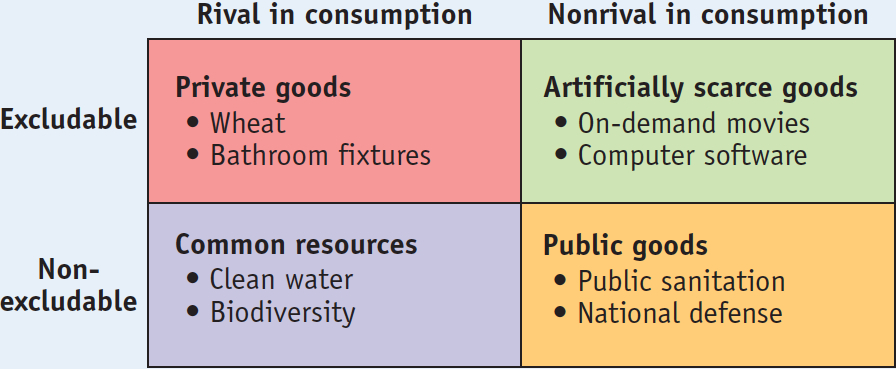

Because goods can be either excludable or nonexcludable, rival or nonrival in consumption, there are four types of goods, illustrated by the matrix in Figure 17-1:

Private goods, which are excludable and rival in consumption, like wheat

Public goods, which are nonexcludable and nonrival in consumption, like a public sewer system

Common resources, which are nonexcludable but rival in consumption, like clean water in a river

Artificially scarce goods, which are excludable but nonrival in consumption, like on-

demand movies on Netflix

There are, of course, many other characteristics that distinguish between types of goods—

Why Markets Can Supply Only Private Goods Efficiently

As we learned in earlier chapters, markets are typically the best means for a society to deliver goods and services to its members; that is, markets are efficient except in the case of the well-

To see why excludability is crucial, suppose that a farmer had only two choices: either produce no wheat or provide a bushel of wheat to every resident of the county who wants it, whether or not that resident pays for it. It seems unlikely that anyone would grow wheat under those conditions.

Yet the operator of a municipal sewage system faces pretty much the same problem as our hypothetical farmer. A sewage system makes the whole city cleaner and healthier—

Goods that are nonexcludable suffer from the free-

The general point is that if a good is nonexcludable, self-

Because of the free-

Goods that are excludable and nonrival in consumption, like on-

PITFALLS: MARGINAL COST OF WHAT EXACTLY?

MARGINAL COST OF WHAT EXACTLY?

In the case of a good that is nonrival in consumption, it’s easy to confuse the marginal cost of producing a unit of the good with the marginal cost of allowing a unit of the good to be consumed. For example, Netflix incurs a marginal cost in making an on-

This complication does not arise, however, when a good is rival in consumption. In that case, the resources used to produce a unit of the good are “used up” by a person’s consumption of it—

But if Netflix actually charges viewers $4 for on-

Now we can see why private goods are the only goods that can be efficiently produced and consumed in a competitive market. (That is, a private good will be efficiently produced and consumed in a market free of market power, externalities, or other instances of market failure.) Because private goods are excludable, producers can charge for them and so have an incentive to produce them. And because they are also rival in consumption, it is efficient for consumers to pay a positive price—

Fortunately for the market system, most goods are private goods. Food, clothing, shelter, and most other desirable things in life are excludable and rival in consumption, so markets can provide us with most things. Yet there are crucial goods that don’t meet these criteria—

!worldview! ECONOMICS in Action: From Mayhem to Renaissance

From Mayhem to Renaissance

Life during the European Middle Ages—

Think public goods, as the history of medieval Italian city-

Starting around the year 900 in Venice and 1100 in other city-

As a result, trade, commerce, and banking were able to flourish, as well as literacy, numeracy, and the arts. By 1300, the leading cities of Venice, Milan, and Florence had each grown to over 100,000 people. As resources and the standard of living increased, the rate of violent deaths diminished.

For example, the Republic of Venice was known as La Serenissima—

Also through stability, high literacy, and numeracy, Florence became the banking center of Italy. During the fifteenth century it was ruled by the Medici, an immensely wealthy banking family. And it was the patronage of the Medici to artists such as Leonardo da Vinci and Michelangelo that ushered in the Renaissance.

So Western Europe was able to move from mayhem to Renaissance through the creation of public goods like good governance and defense—

Quick Review

Goods can be classified according to two attributes: whether they are excludable and whether they are rival in consumption.

Goods that are both excludable and rival in consumption are private goods. Private goods can be efficiently produced and consumed in a competitive market.

When goods are nonexcludable, there is a free-

rider problem: consumers will not pay producers, leading to inefficiently low production. When goods are nonrival in consumption, the efficient price for consumption is zero. But if a positive price is charged to compensate producers for the cost of production, the result is inefficiently low consumption.

17-1

Question 17.1

Classify each of the following goods according to whether they are excludable and whether they are rival in consumption. What kind of good is each?

Use of a public space such as a park

A cheese burrito

Information from a website that is password-

protected Publicly announced information on the path of an incoming hurricane

Question 17.2

Which of the goods in Question 1 will be provided by a competitive market? Which will not be? Explain your answer.

Solutions appear at back of book.