Models in Economics: Some Important Examples

A model is a simplified representation of a real situation that is used to better understand real-

A model is any simplified representation of reality that is used to better understand real-

One possibility—

Another possibility is to simulate the workings of the economy on a computer. For example, when changes in tax law are proposed, government officials use tax models—large mathematical computer programs—

The other things equal assumption means that all other relevant factors remain unchanged.

Models are important because their simplicity allows economists to focus on the effects of only one change at a time. That is, they allow us to hold everything else constant and study how one change affects the overall economic outcome. So an important assumption when building economic models is the other things equal assumption, which means that all other relevant factors remain unchanged.

!worldview! FOR INQUIRING MINDS: The Model That Ate the Economy

A model is just a model, right? So how much damage can it do? Economists probably would have answered that question quite differently before the financial meltdown of 2008-

“The model that ate the economy” originated in finance theory, the branch of economics that seeks to understand what assets like stocks and bonds are worth. Financial theorists often get hired (at very high salaries, mind you) to devise complex mathematical models to help investment companies decide what assets to buy and sell and at what price.

The trouble began with an asset known as an MBS, which is short for mortgage-

In 2000, a Wall Street financial theorist announced that he had solved the problem by adopting a huge mathematical simplification. With it, he devised a simple model for estimating the risk of an MBS. Financial firms loved the model because it opened up a huge and extraordinarily profitable market for them in the selling of MBSs to investors. Using the model, financial firms were able to package and sell billions of dollars in MBSs, generating billions in profits for themselves.

Or investors thought they had calculated the risk of losing money on an MBS. Some financial experts—

The warnings fell on deaf ears—

Over the previous decade, American home prices had risen too high, and mortgages had been extended to many who were unable to pay. As home prices fell to earth, millions of homeowners didn’t pay their mortgages. With losses mounting for MBS investors, it became all too clear that the model had indeed underestimated the risks.

When investors and financial institutions around the world realized the extent of their losses, the worldwide economy ground to an abrupt halt.

People lost their homes, companies went bankrupt, and unemployment surged. The recovery over the past six years has been achingly slow, and it wasn’t until 2014 that the number of employed Americans returned to pre-

But you can’t always find or create a small-

In Chapter 1 we illustrated the concept of equilibrium with the example of how customers at a supermarket would rearrange themselves when a new cash register opens. Though we didn’t say it, this was an example of a simple model—

As the cash register story showed, it is often possible to describe and analyze a useful economic model in plain English. However, because much of economics involves changes in quantities—

Whatever form it takes, a good economic model can be a tremendous aid to understanding. The best way to grasp this point is to consider some simple but important economic models and what they tell us.

First, we will look at the production possibility frontier, a model that helps economists think about the trade-

offs every economy faces. We then turn to comparative advantage, a model that clarifies the principle of gains from trade—

trade both between individuals and between countries. We will also examine the circular-

flow diagram, a schematic representation that helps us understand how flows of money, goods, and services are channeled through the economy.

In discussing these models, we make considerable use of graphs to represent mathematical relationships. Graphs play an important role throughout this book. If you are already familiar with how graphs are used, you can skip the appendix to this chapter, which provides a brief introduction to the use of graphs in economics. If not, this would be a good time to turn to it.

Trade-offs: The Production Possibility Frontier

The first principle of economics introduced in Chapter 1 is that resources are scarce and that, as a result, any economy—

The production possibility frontier illustrates the trade-

To think about the trade-

Suppose, for a moment, that the United States was a one-

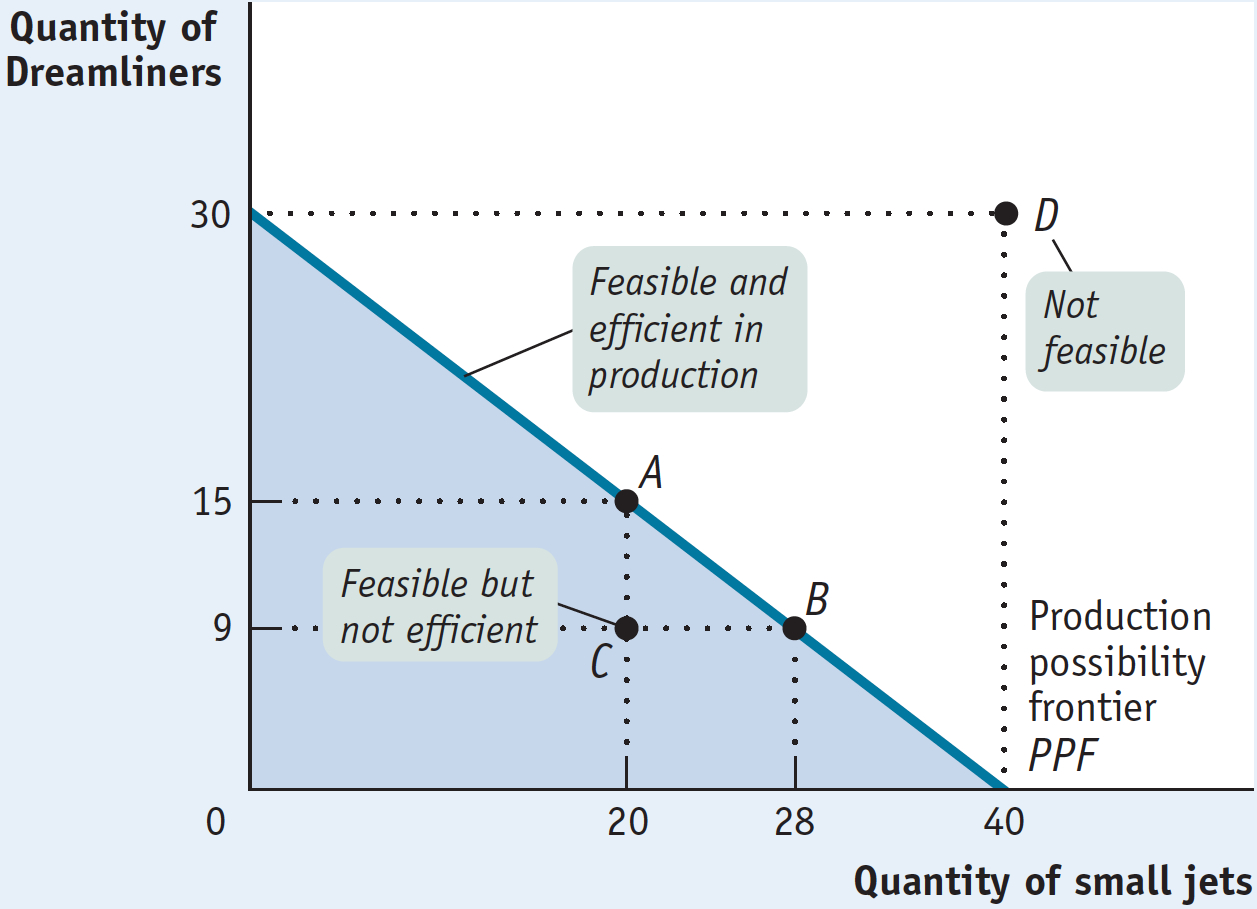

There is a crucial distinction between points inside or on the production possibility frontier (the shaded area) and outside the frontier. If a production point lies inside or on the frontier—

However, a production point that lies outside the frontier—

In Figure 2-1 the production possibility frontier intersects the horizontal axis at 40 small jets. This means that if Boeing dedicated all its production capacity to making small jets, it could produce 40 small jets per year but could produce no Dreamliners. The production possibility frontier intersects the vertical axis at 30 Dreamliners. This means that if B oeing dedicated all its production capacity to making Dreamliners, it could produce 30 Dreamliners per year but no small jets.

The figure also shows less extreme trade-

Thinking in terms of a production possibility frontier simplifies the complexities of reality. The real-

By simplifying reality, the production possibility frontier helps us understand some aspects of the real economy better than we could without the model: efficiency, opportunity cost, and economic growth.

Efficiency First of all, the production possibility frontier is a good way to illustrate the general economic concept of efficiency. Recall from Chapter 1 that an economy is efficient if there are no missed opportunities—

One key element of efficiency is that there are no missed opportunities in production—

But suppose for some reason that Boeing was operating at point C, making 20 small jets and 9 Dreamliners. In this case, it would not be operating efficiently and would therefore be inefficient: it could be producing more of both planes.

Although we have used an example of the production choices of a one-

If, however, the economy could produce more of some things without producing less of others—

Although the production possibility frontier helps clarify what it means for an economy to be efficient in production, it’s important to understand that efficiency in production is only part of what’s required for the economy as a whole to be efficient. Efficiency also requires that the economy allocate its resources so that consumers are as well off as possible. If an economy does this, we say that it is efficient in allocation.

To see why efficiency in allocation is as important as efficiency in production, notice that points A and B in Figure 2-1 both represent situations in which the economy is efficient in production, because in each case it can’t produce more of one good without producing less of the other. But these two situations may not be equally desirable from society’s point of view. Suppose that society prefers to have more small jets and fewer Dreamliners than at point A; say, it prefers to have 28 small jets and 9 Dreamliners, corresponding to point B. In this case, point A is inefficient in allocation from the point of view of the economy as a whole because it would rather have Boeing produce at point B rather than at point A.

This example shows that efficiency for the economy as a whole requires both efficiency in production and efficiency in allocation: to be efficient, an economy must produce as much of each good as it can given the production of other goods, and it must also produce the mix of goods that people want to consume. And it must also deliver those goods to the right people: an economy that gives small jets to international airlines and Dreamliners to commuter airlines serving small rural airports is inefficient, too.

In the real world, command economies, such as the former Soviet Union, are notorious for inefficiency in allocation. For example, it was common for consumers to find stores well stocked with items few people wanted but lacking such basics as soap and toilet paper.

Opportunity Cost The production possibility frontier is also useful as a reminder of the fundamental point that the true cost of any good isn’t the money it costs to buy, but what must be given up in order to get that good— = ¾ of a Dreamliner.

= ¾ of a Dreamliner.

Is the opportunity cost of an extra small jet in terms of Dreamliners always the same, no matter how many small jets and Dreamliners are currently produced? In the example illustrated by Figure 2-1, the answer is yes. If Boeing increases its production of small jets from 28 to 40, the number of Dreamliners it produces falls from 9 to zero. So Boeing’s opportunity cost per additional small jet is  = ¾ of a Dreamliner, the same as it was when Boeing went from 20 small jets produced to 28.

= ¾ of a Dreamliner, the same as it was when Boeing went from 20 small jets produced to 28.

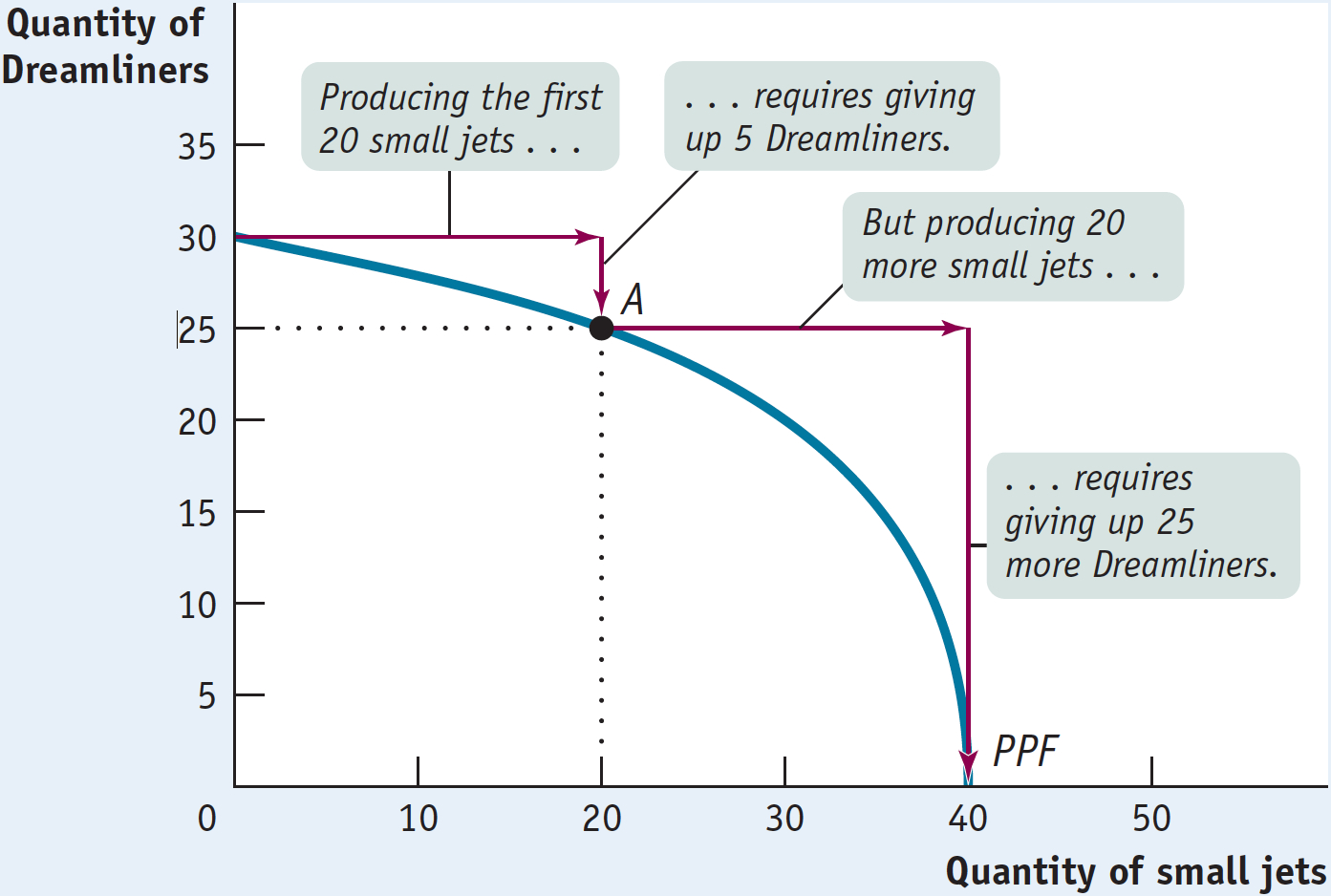

However, the fact that in this example the opportunity cost of a small jet in terms of a Dreamliner is always the same is a result of an assumption we’ve made, an assumption that’s reflected in how Figure 2-1 is drawn. Specifically, whenever we assume that the opportunity cost of an additional unit of a good doesn’t change regardless of the output mix, the production possibility frontier is a straight line.

Moreover, as you might have already guessed, the slope of a straight-

Figure 2-2 illustrates a different assumption, a case in which Boeing faces increasing opportunity cost. Here, the more small jets it produces, the more costly it is to produce yet another small jet in terms of forgone production of a Dreamliner. And the same holds true in reverse: the more Dreamliners Boeing produces, the more costly it is to produce yet another Dreamliner in terms of forgone production of small jets. For example, to go from producing zero small jets to producing 20, Boeing has to forgo producing 5 Dreamliners. That is, the opportunity cost of those 20 small jets is 5 Dreamliners. But to increase its production of small jets to 40—

Although it’s often useful to work with the simple assumption that the production possibility frontier is a straight line, economists believe that in reality opportunity costs are typically increasing. When only a small amount of a good is produced, the opportunity cost of producing that good is relatively low because the economy needs to use only those resources that are especially well suited for its production.

For example, if an economy grows only a small amount of corn, that corn can be grown in places where the soil and climate are perfect for corn-

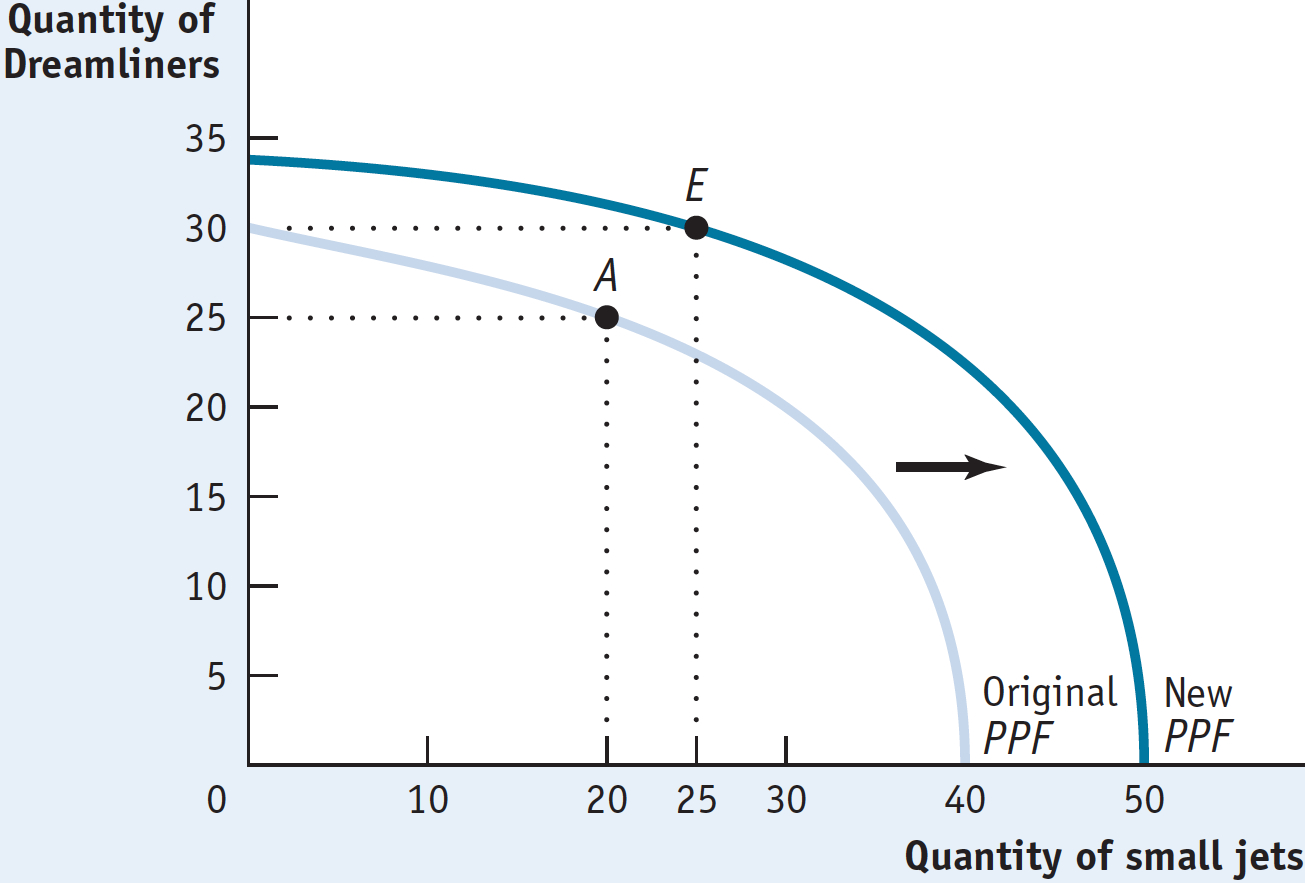

Economic Growth Finally, the production possibility frontier helps us understand what it means to talk about economic growth. In the Introduction, we defined the concept of economic growth as the growing ability of the economy to produce goods and services. As we saw, economic growth is one of the fundamental features of the real economy. But are we really justified in saying that the economy has grown over time? After all, although the U.S. economy produces more of many things than it did a century ago, it produces less of other things—

The answer is illustrated in Figure 2-3, where we have drawn two hypothetical production possibility frontiers for the economy. In them we have assumed once again that everyone in the economy works for Boeing and, consequently, the economy produces only two goods, Dreamliners and small jets. Notice how the two curves are nested, with the one labeled “Original PPF” lying completely inside the one labeled “New PPF.” Now we can see graphically what we mean by economic growth of the economy: economic growth means an expansion of the economy’s production possibilities; that is, the economy can produce more of everything.

For example, if the economy initially produces at point A (25 Dreamliners and 20 small jets), economic growth means that the economy could move to point E (30 Dreamliners and 25 small jets). E lies outside the original frontier; so in the production possibility frontier model, growth is shown as an outward shift of the frontier.

Factors of production are resources used to produce goods and services.

What can lead the production possibility frontier to shift outward? There are basically two sources of economic growth. One is an increase in the economy’s factors of production, the resources used to produce goods and services. Economists usually use the term factor of production to refer to a resource that is not used up in production. For example, in traditional airplane manufacture workers used riveting machines to connect metal sheets when constructing a plane’s fuselage; the workers and the riveters are factors of production, but the rivets and the sheet metal are not. Once a fuselage is made, a worker and riveter can be used to make another fuselage, but the sheet metal and rivets used to make one fuselage cannot be used to make another.

Broadly speaking, the main factors of production are the resources land, labor, physical capital, and human capital. Land is a resource supplied by nature; labor is the economy’s pool of workers; physical capital refers to created resources such as machines and buildings; and human capital refers to the educational achievements and skills of the labor force, which enhance its productivity. Of course, each of these is really a category rather than a single factor: land in North Dakota is quite different from land in Florida.

To see how adding to an economy’s factors of production leads to economic growth, suppose that Boeing builds another construction hangar that allows it to increase the number of planes—

Technology is the technical means for producing goods and services.

The other source of economic growth is progress in technology, the technical means for the production of goods and services. Composite materials had been used in some parts of aircraft before the Boeing Dreamliner was developed. But Boeing engineers realized that there were large additional advantages to building a whole plane out of composites. The plane would be lighter, stronger, and have better aerodynamics than a plane built in the traditional way. It would therefore have longer range, be able to carry more people, and use less fuel, in addition to being able to maintain higher cabin pressure. So in a real sense Boeing’s innovation—

istockphoto/Thinkstock

Comstock/Thinkstock

istockphoto/Thinkstock

Because improved jet technology has pushed out the production possibility frontier, it has made it possible for the economy to produce more of everything, not just jets and air travel. Over the past 30 years, the biggest technological advances have taken place in information technology, not in construction or food services. Yet Americans have chosen to buy bigger houses and eat out more than they used to because the economy’s growth has made it possible to do so.

The production possibility frontier is a very simplified model of an economy. Yet it teaches us important lessons about real-

Comparative Advantage and Gains from Trade

Among the twelve principles of economics described in Chapter 1 was the principle of gains from trade—the mutual gains that individuals can achieve by specializing in doing different things and trading with one another. Our second illustration of an economic model is a particularly useful model of gains from trade—

One of the most important insights in all of economics is that there are gains from trade—

How can we model the gains from trade? Let’s stay with our aircraft example and once again imagine that the United States is a one-

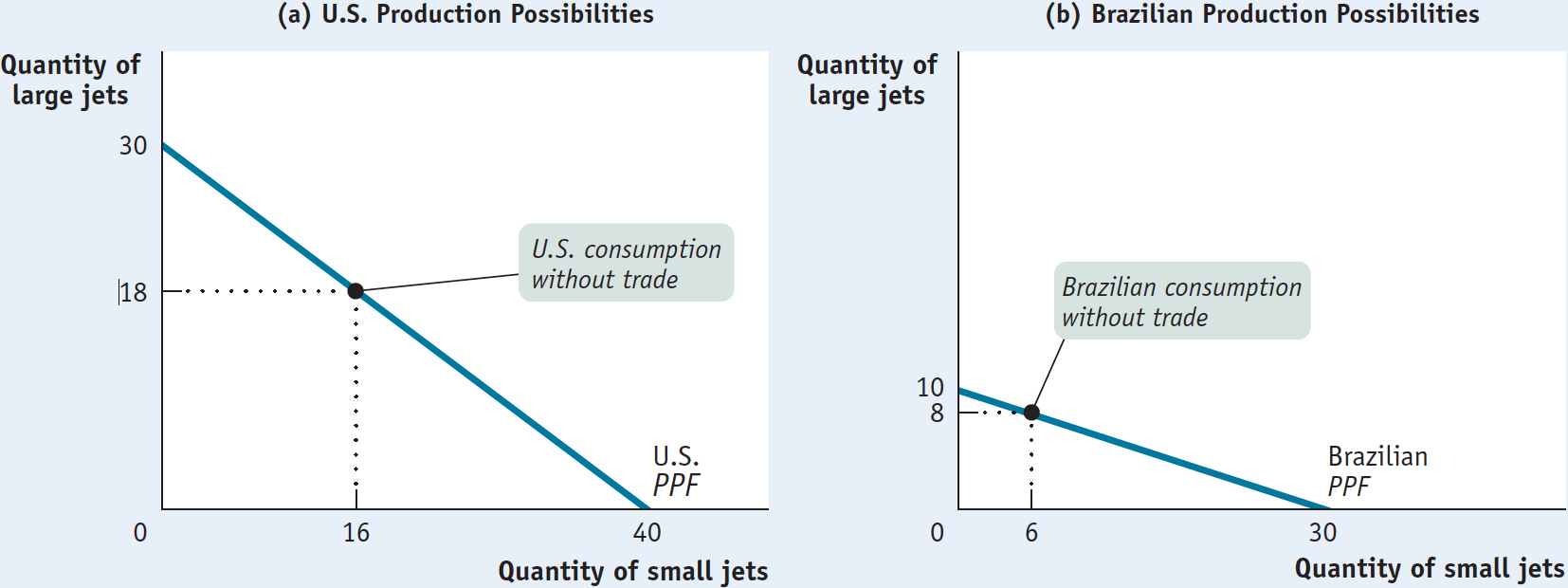

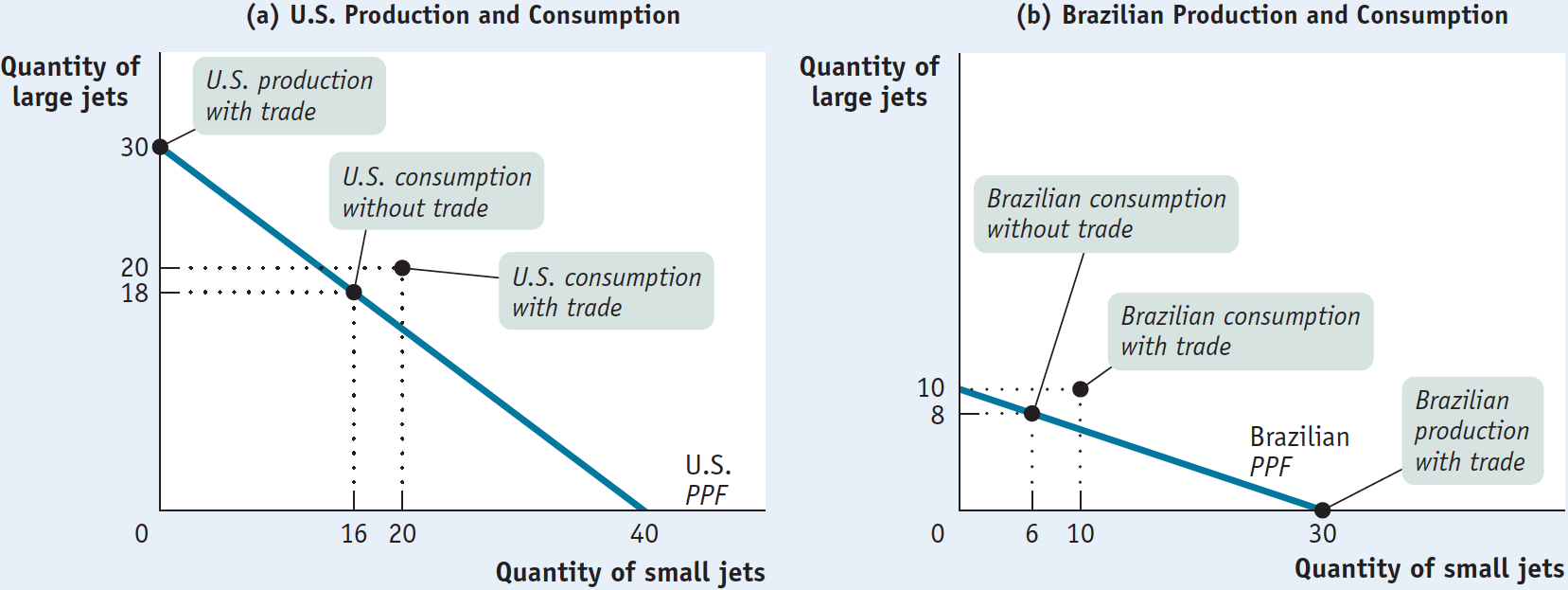

In our example, the only two goods produced are large jets and small jets. Both countries could produce both kinds of jets. But as we’ll see in a moment, they can gain by producing different things and trading with each other. For the purposes of this example, let’s return to the simpler case of straight-

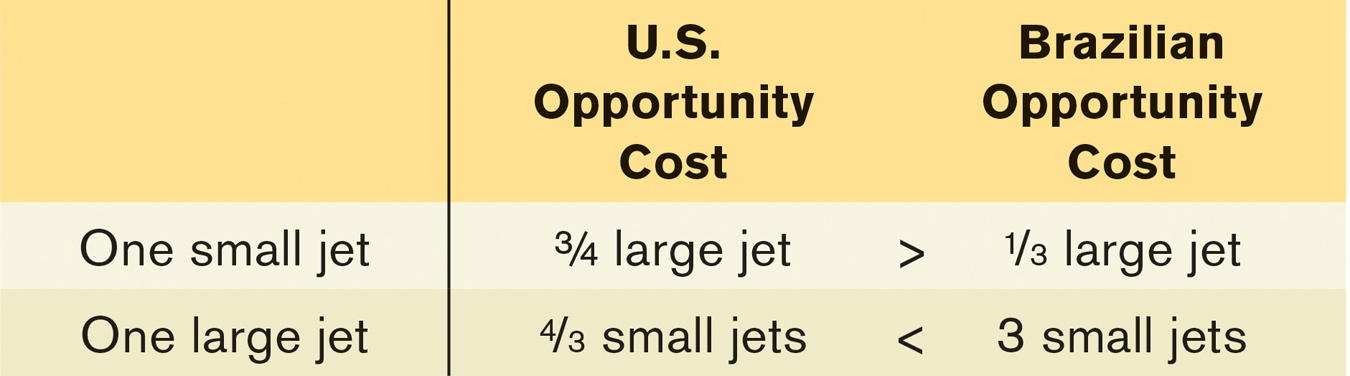

Panel (b) of Figure 2-4 shows Brazil’s production possibilities. Like the United States, Brazil’s production possibility frontier is a straight line, implying a constant opportunity cost of a small jet in terms of large jets. Brazil’s production possibility frontier has a constant slope of -⅓. Brazil can’t produce as much of anything as the United States can: at most it can produce 30 small jets or 10 large jets. But it is relatively better at manufacturing small jets than the United States; whereas the United States sacrifices ¾ of a large jet per small jet produced, for Brazil the opportunity cost of a small jet is only ⅓ of a large jet. Table 2-1 summarizes the two countries’ opportunity costs of small jets and large jets.

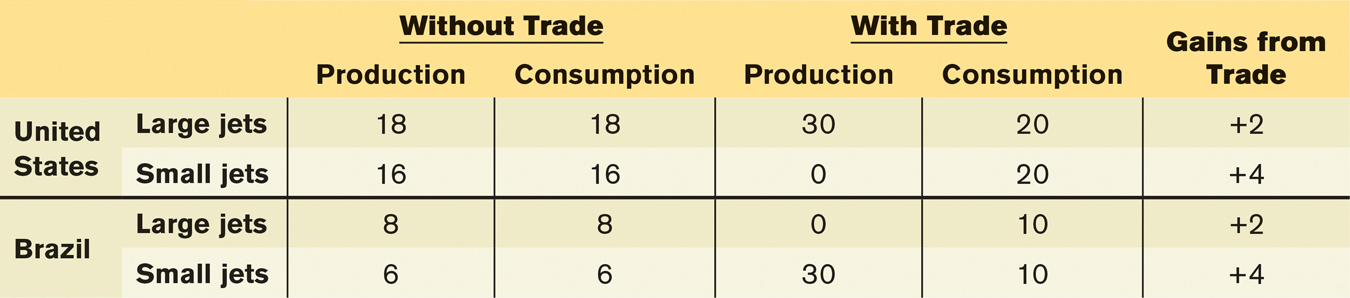

Now, the United States and Brazil could each choose to make their own large and small jets, not trading any airplanes and consuming only what each produced within its own country. (A country “consumes” an airplane when it is owned by a domestic resident.) Let’s suppose that the two countries start out this way and make the consumption choices shown in Figure 2-4: in the absence of trade, the United States produces and consumes 16 small jets and 18 large jets per year, while Brazil produces and consumes 6 small jets and 8 large jets per year.

But is this the best the two countries can do? No, it isn’t. Given that the two producers—

Table 2-2 shows how such a deal works: the United States specializes in the production of large jets, manufacturing 30 per year, and sells 10 to Brazil. Meanwhile, Brazil specializes in the production of small jets, producing 30 per year, and sells 20 to the United States. The result is shown in Figure 2-5. The United States now consumes more of both small jets and large jets than before: instead of 16 small jets and 18 large jets, it now consumes 20 small jets and 20 large jets. Brazil also consumes more, going from 6 small jets and 8 large jets to 10 small jets and 10 large jets. As Table 2-2 also shows, both the United States and Brazil reap gains from trade, consuming more of both types of plane than they would have without trade.

Both countries are better off when they each specialize in what they are good at and trade. It’s a good idea for the United States to specialize in the production of large jets because its opportunity cost of a large jet is smaller than Brazil’s:  < 3. Correspondingly, Brazil should specialize in the production of small jets because its opportunity cost of a small jet is smaller than the United States: ⅓ < ¾.

< 3. Correspondingly, Brazil should specialize in the production of small jets because its opportunity cost of a small jet is smaller than the United States: ⅓ < ¾.

A country has a comparative advantage in producing a good or service if its opportunity cost of producing the good or service is lower than other countries’. Likewise, an individual has a comparative advantage in producing a good or service if his or her opportunity cost of producing the good or service is lower than for other people.

What we would say in this case is that the United States has a comparative advantage in the production of large jets and Brazil has a comparative advantage in the production of small jets. A country has a comparative advantage in producing something if the opportunity cost of that production is lower for that country than for other countries. The same concept applies to firms and people: a firm or an individual has a comparative advantage in producing something if its, his, or her opportunity cost of production is lower than for others.

One point of clarification before we proceed further. You may have wondered why the United States traded 10 large jets to Brazil in return for 20 small jets. Why not some other deal, like trading 10 large jets for 12 small jets? The answer to that question has two parts. First, there may indeed be other trades that the United States and Brazil might agree to. Second, there are some deals that we can safely rule out—

To understand why, reexamine Table 2-1 and consider the United States first. Without trading with Brazil, the U.S. opportunity cost of a small jet is ¾ of a large jet. So it’s clear that the United States will not accept any trade that requires it to give up more than ¾ of a large jet for a small jet. Trading 10 jets in return for 12 small jets would require the United States to pay an opportunity cost of  = ⅚ of a large jet for a small jet. Because ⅚ > than ¾, this is a deal that the United States would reject. Similarly, Brazil won’t accept a trade that gives it less than ⅓ of a large jet for a small jet.

= ⅚ of a large jet for a small jet. Because ⅚ > than ¾, this is a deal that the United States would reject. Similarly, Brazil won’t accept a trade that gives it less than ⅓ of a large jet for a small jet.

The point to remember is that the United States and Brazil will be willing to trade only if the “price” of the good each country obtains in the trade is less than its own opportunity cost of producing the good domestically. Moreover, this is a general statement that is true whenever two parties—

While our story clearly simplifies reality, it teaches us some very important lessons that apply to the real economy, too.

First, the model provides a clear illustration of the gains from trade: through specialization and trade, both countries produce more and consume more than if they were self-

Second, the model demonstrates a very important point that is often overlooked in real-

A country has an absolute advantage in producing a good or service if the country can produce more output per worker than other countries. Likewise, an individual has an absolute advantage in producing a good or service if he or she is better at producing it than other people. Having an absolute advantage is not the same thing as having a comparative advantage.

Crucially, in our example it doesn’t matter if, as is probably the case in real life, U.S. workers are just as good as or even better than Brazilian workers at producing small jets. Suppose that the United States is actually better than Brazil at all kinds of aircraft production. In that case, we would say that the United States has an absolute advantage in both large-

But we’ve just seen that the United States can indeed benefit from trading with Brazil because comparative, not absolute, advantage is the basis for mutual gain. It doesn’t matter whether it takes Brazil more resources than the United States to make a small jet; what matters for trade is that for Brazil the opportunity cost of a small jet is lower than the U.S. opportunity cost. So Brazil, despite its absolute disadvantage, even in small jets, has a comparative advantage in the manufacture of small jets. Meanwhile the United States, which can use its resources most productively by manufacturing large jets, has a comparative disadvantage in manufacturing small jets.

Comparative Advantage and International Trade, in Reality

Look at the label on a manufactured good sold in the United States, and there’s a good chance you will find that it was produced in some other country—

Should all this international exchange of goods and services be celebrated, or is it cause for concern? Politicians and the public often question the desirability of international trade, arguing that the nation should produce goods for itself rather than buying them from foreigners. Industries around the world demand protection from foreign competition: Japanese farmers want to keep out American rice, American steelworkers want to keep out European steel. And these demands are often supported by public opinion.

Economists, however, have a very positive view of international trade. Why? Because they view it in terms of comparative advantage. As we learned from our example of U.S. large jets and Brazilian small jets, international trade benefits both countries. Each country can consume more than if it didn’t trade and remained self-

PITFALLS: MISUNDERSTANDING COMPARATIVE ADVANTAGE

MISUNDERSTANDING COMPARATIVE ADVANTAGE

Students do it, pundits do it, and politicians do it all the time: they confuse comparative advantage with absolute advantage. For example, back in the 1980s, when the U.S. economy seemed to be lagging behind that of Japan, one often heard commentators warn that if we didn’t improve our productivity, we would soon have no comparative advantage in anything.

What those commentators meant was that we would have no absolute advantage in anything—

But just as Brazil, in our example, was able to benefit from trade with the United States (and vice versa) despite the fact that the United States was better at manufacturing both large and small jets, in real life nations can still gain from trade even if they are less productive in all industries than the countries they trade with.

Pajama Republics

In April 2013, a terrible industrial disaster made world headlines: in Bangladesh, a building housing five clothing factories collapsed, killing more than a thousand garment workers trapped inside. Attention soon focused on the substandard working conditions in those factories, as well as the many violations of building codes and safety procedures-

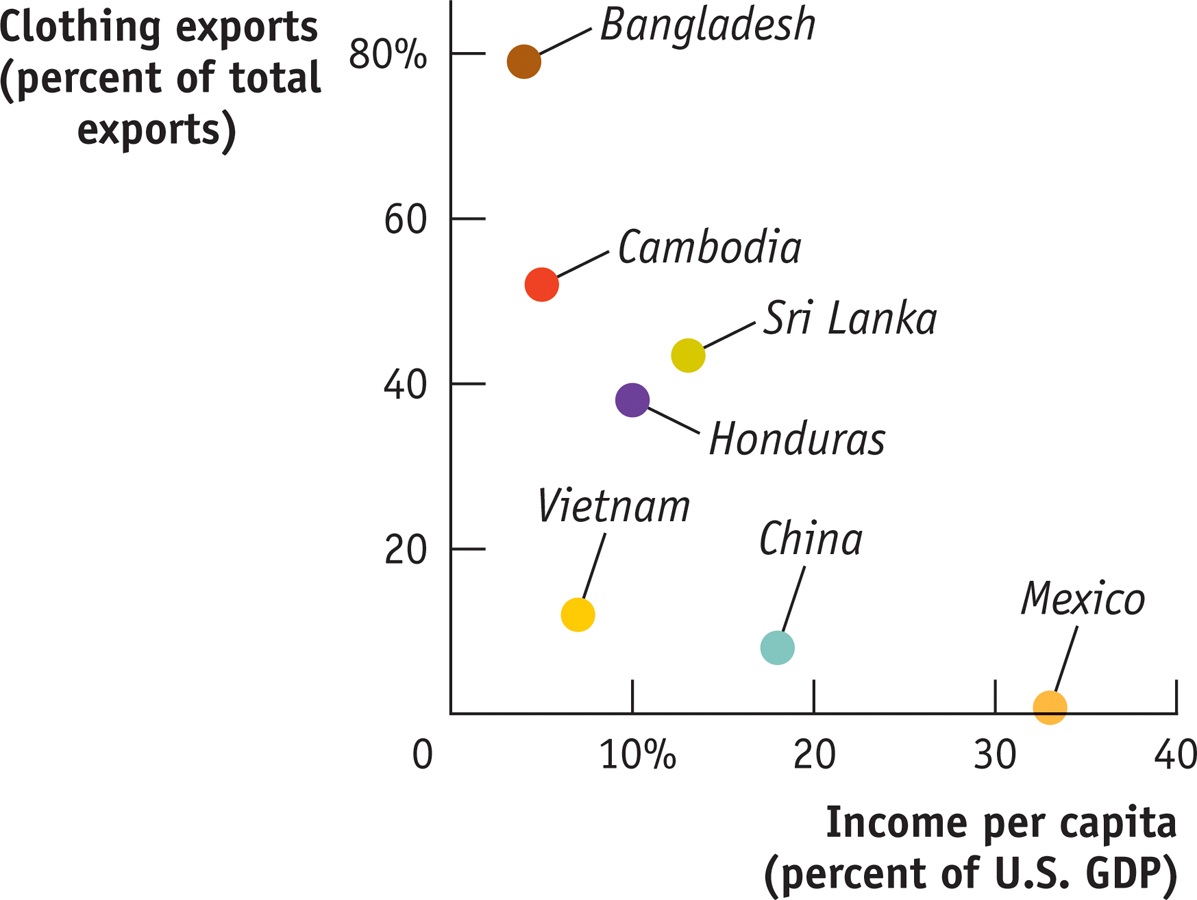

While the story provoked a justified outcry, it also highlighted the remarkable rise of Bangladesh’s clothing industry, which has become a major player in world markets—

It’s not that Bangladesh has especially high productivity in clothing manufacturing. In fact, recent estimates by the consulting firm McKinsey and Company suggest that it’s about a quarter less productive than China. Rather, it has even lower productivity in other industries, giving it a comparative advantage in clothing manufacturing. This is typical in poor countries, which often rely heavily on clothing exports during the early phases of their economic development. An official from one such country once joked, “We are not a banana republic—

The figure plots the per capita income of several such “pajama republics” (the total income of the country divided by the size of the population) against the share of total exports accounted for by clothing; per capita income is measured as a percentage of the U.S. level in order to give you a sense of just how poor these countries are. As you can see, they are very poor indeed—

It’s worth pointing out, by the way, that relying on clothing exports is by no means necessarily a bad thing, despite tragedies like the Bangladesh factory disaster. Indeed, Bangladesh, although still desperately poor, is more than twice as rich as it was two decades ago, when it began its dramatic rise as a clothing exporter. (Also see the upcoming Economics in Action on Bangladesh.)

Source: WTO.

Transactions: The Circular-Flow Diagram

Trade takes the form of barter when people directly exchange goods or services that they have for goods or services that they want.

The model economies that we’ve studied so far—

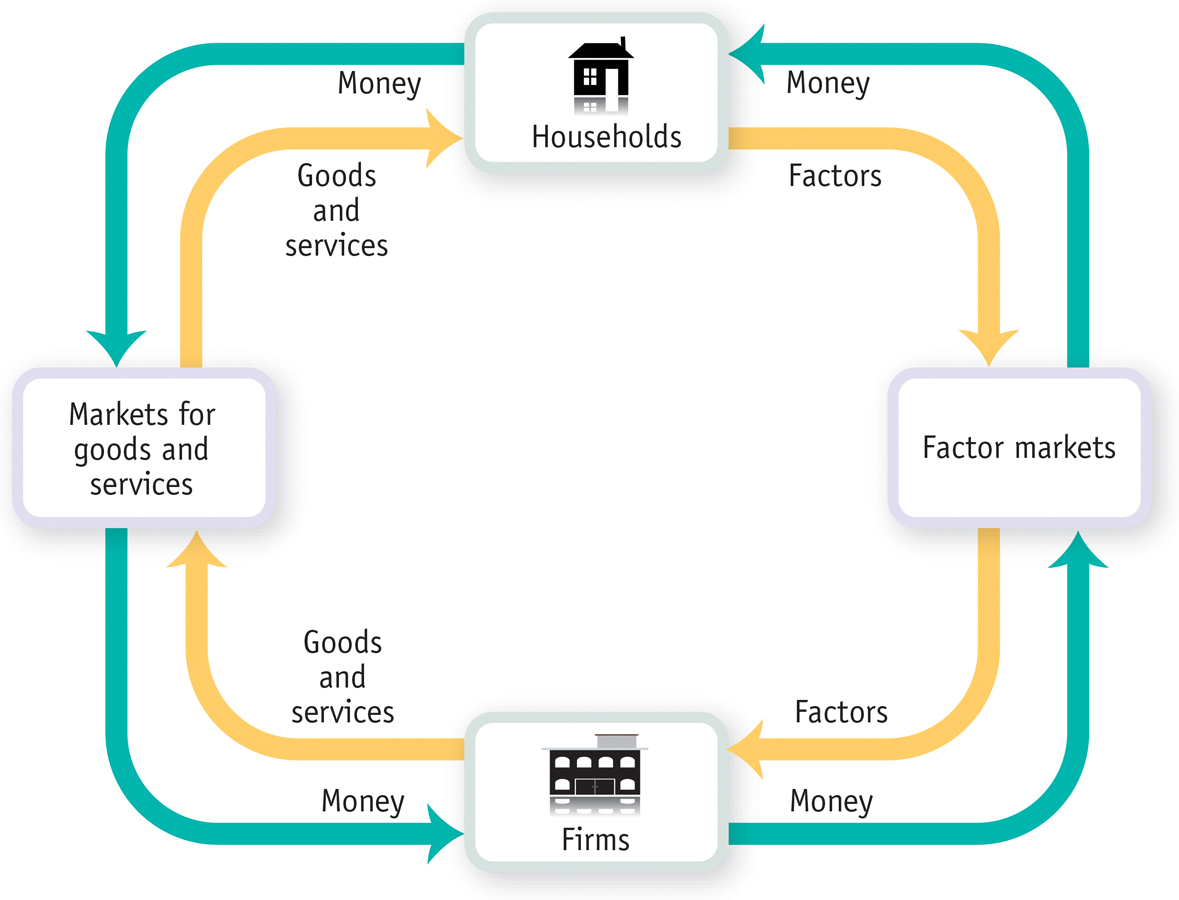

And they both sell and buy a lot of different things. The U.S. economy is a vastly complex entity, with more than a hundred million workers employed by millions of companies, producing millions of different goods and services. Yet you can learn some very important things about the economy by considering the simple graphic shown in Figure 2-6, the circular-

The circular-

A household is a person or a group of people that share their income.

The simplest circular-

A firm is an organization that produces goods and services for sale.

Firms sell goods and services that they produce to households in markets for goods and services.

As you can see in Figure 2-6, there are two kinds of markets in this simple economy. On one side (here the left side) there are markets for goods and services in which households buy the goods and services they want from firms. This produces a flow of goods and services to households and a return flow of money to firms.

Firms buy the resources they need to produce goods and services in factor markets.

On the right side, there are factor markets in which firms buy the resources they need to produce goods and services. Recall from earlier that the main factors of production are land, labor, physical capital, and human capital.

An economy’s income distribution is the way in which total income is divided among the owners of the various factors of production.

The factor market most of us know best is the labor market, in which workers sell their services. In addition, we can think of households as owning and selling the other factors of production to firms. For example, when a firm buys physical capital in the form of machines, the payment ultimately goes to the households that own the machine-

The circular-

In the real world, the distinction between firms and households isn’t always that clear-

cut. Consider a small, family- run business— a farm, a shop, a small hotel. Is this a firm or a household? A more complete picture would include a separate box for family businesses. Many of the sales firms make are not to households but to other firms; for example, steel companies sell mainly to other companies such as auto manufacturers, not to households. A more complete picture would include these flows of goods, services, and money within the business sector.

The figure doesn’t show the government, which in the real world diverts quite a lot of money out of the circular flow in the form of taxes but also injects a lot of money back into the flow in the form of spending.

Figure 2-6, in other words, is by no means a complete picture either of all the types of inhabitants of the real economy or of all the flows of money and physical items that take place among these inhabitants.

Despite its simplicity, the circular-

!worldview! ECONOMICS in Action: Rich Nation, Poor Nation

Rich Nation, Poor Nation

Try taking off your clothes—

Why are these countries so much poorer than we are? The immediate reason is that their economies are much less productive—firms in these countries are just not able to produce as much from a given quantity of resources as comparable firms in the United States or other wealthy countries. Why countries differ so much in productivity is a deep question—

But if the economies of these countries are so much less productive than ours, how is it that they make so much of our clothing? Why don’t we do it for ourselves?

The answer is “comparative advantage.” Just about every industry in Bangladesh is much less productive than the corresponding industry in the United States. But the productivity difference between rich and poor countries varies across goods; it is very large in the production of sophisticated goods like aircraft but not that large in the production of simpler goods like clothing. So Bangladesh’s position with regard to clothing production is like Embraer’s position with respect to producing small jets: it’s not as good at it as Boeing, but it’s the thing Embraer does comparatively well.

Bangladesh, though it is at an absolute disadvantage compared with the United States in almost everything, has a comparative advantage in clothing production. This means that both the United States and Bangladesh are able to consume more because they specialize in producing different things, with Bangladesh supplying our clothing and the United States supplying Bangladesh with more sophisticated goods.

Quick Review

Most economic models are “thought experiments” or simplified representations of reality that rely on the other things equal assumption.

The production possibility frontier model illustrates the concepts of efficiency, opportunity cost, and economic growth.

Every person and every country has a comparative advantage in something, giving rise to gains from trade. Comparative advantage is often confused with absolute advantage.

In the simplest economies people barter rather than transact with money. The circular-

flow diagram illustrates transactions within the economy as flows of goods and services, factors of production, and money between households and firms. These transactions occur in markets for goods and services and factor markets. Ultimately, factor markets determine the economy’s income distribution.

2-1

Question 2.1

True or false? Explain your answer.

An increase in the amount of resources available to Boeing for use in producing Dreamliners and small jets does not change its production possibility frontier.

A technological change that allows Boeing to build more small jets for any amount of Dreamliners built results in a change in its production possibility frontier.

The production possibility frontier is useful because it illustrates how much of one good an economy must give up to get more of another good regardless of whether resources are being used efficiently.

Question 2.2

In Italy, an automobile can be produced by 8 workers in one day and a washing machine by 3 workers in one day. In the United States, an automobile can be produced by 6 workers in one day and a washing machine by 2 workers in one day.

Which country has an absolute advantage in the production of automobiles? In washing machines?

Which country has a comparative advantage in the production of washing machines? In automobiles?

What pattern of specialization results in the greatest gains from trade between the two countries?

Question 2.3

Using the numbers from Table 2-1, explain why the United States and Brazil are willing to engage in a trade of 10 large jets for 15 small jets.

Question 2.4

Use the circular-

flow diagram to explain how an increase in the amount of money spent by households results in an increase in the number of jobs in the economy. Describe in words what the circular- flow diagram predicts.

Solutions appear at back of book.