The Pain of Recession

Not many people complain about the business cycle when the economy is expanding. Recessions, however, create a great deal of pain.

The most important effect of a recession is its effect on the ability of workers to find and hold jobs. The most widely used indicator of conditions in the labor market is the unemployment rate. We’ll explain how that rate is calculated in Chapter 8, but for now it’s enough to say that a high unemployment rate tells us that jobs are scarce and a low unemployment rate tells us that jobs are easy to find.

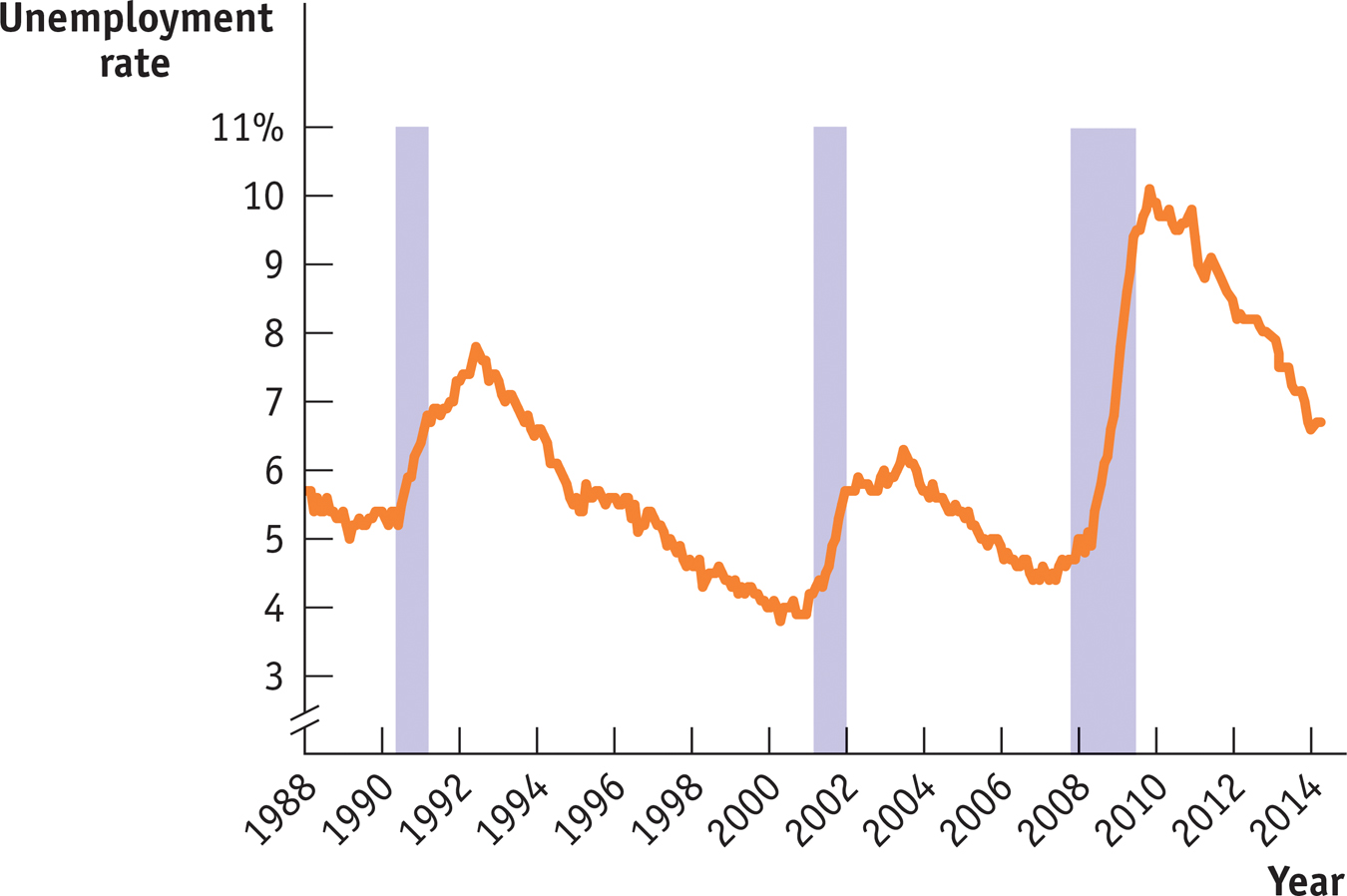

Figure 6-4 shows the unemployment rate from 1988 to 2014. As you can see, the U.S. unemployment rate surged during and after each recession but eventually fell during periods of expansion. The rising unemployment rate in 2008 was a sign that a new recession might be under way, which was later confirmed by the NBER to have begun in December 2007.

Source: Bureau of Labor Statistics.

Because recessions cause many people to lose their jobs and also make it hard to find new ones, recessions hurt the standard of living of many families. Recessions are usually associated with a rise in the number of people living below the poverty line, an increase in the number of people who lose their houses because they can’t afford the mortgage payments, and a fall in the percentage of Americans with health insurance coverage.

You should not think, however, that workers are the only group that suffers during a recession. Recessions are also bad for firms: like employment and wages, profits suffer during recessions, with many small businesses failing.

All in all, then, recessions are bad for almost everyone. Can anything be done to reduce their frequency and severity?

!worldview! FOR INQUIRING MINDS: Defining Recessions and Expansions

Some readers may be wondering exactly how recessions and expansions are defined. The answer is that there is no exact definition!

In many countries, economists adopt the rule that a recession is a period of at least two consecutive quarters (a quarter is three months) during which the total output of the economy shrinks. The two-

Sometimes, however, this definition seems too strict. For example, an economy that has three months of sharply declining output, then three months of slightly positive growth, then another three months of rapid decline, should surely be considered to have endured a nine-

In the United States, we try to avoid such misclassifications by assigning the task of determining when a recession begins and ends to an independent panel of experts at the National Bureau of Economic Research (NBER). This panel looks at a variety of economic indicators, with the main focus on employment and production. But, ultimately, the panel makes a judgment call.

Sometimes this judgment is controversial. In fact, there is lingering controversy over the 2001 recession. According to the NBER, that recession began in March 2001 and ended in November 2001 when output began rising. Some critics argue, however, that the recession really began several months earlier, when industrial production began falling. Other critics argue that the recession didn’t really end in 2001 because employment continued to fall and the job market remained weak for another year and a half.