. . . But the Rate of Change of Prices Does

The conclusion that the level of prices doesn’t matter might seem to imply that the inflation rate doesn’t matter either. But that’s not true.

To see why, it’s crucial to distinguish between the level of prices and the inflation rate: the percent increase in the overall level of prices per year. Recall from Chapter 7 that the inflation rate is defined as follows:

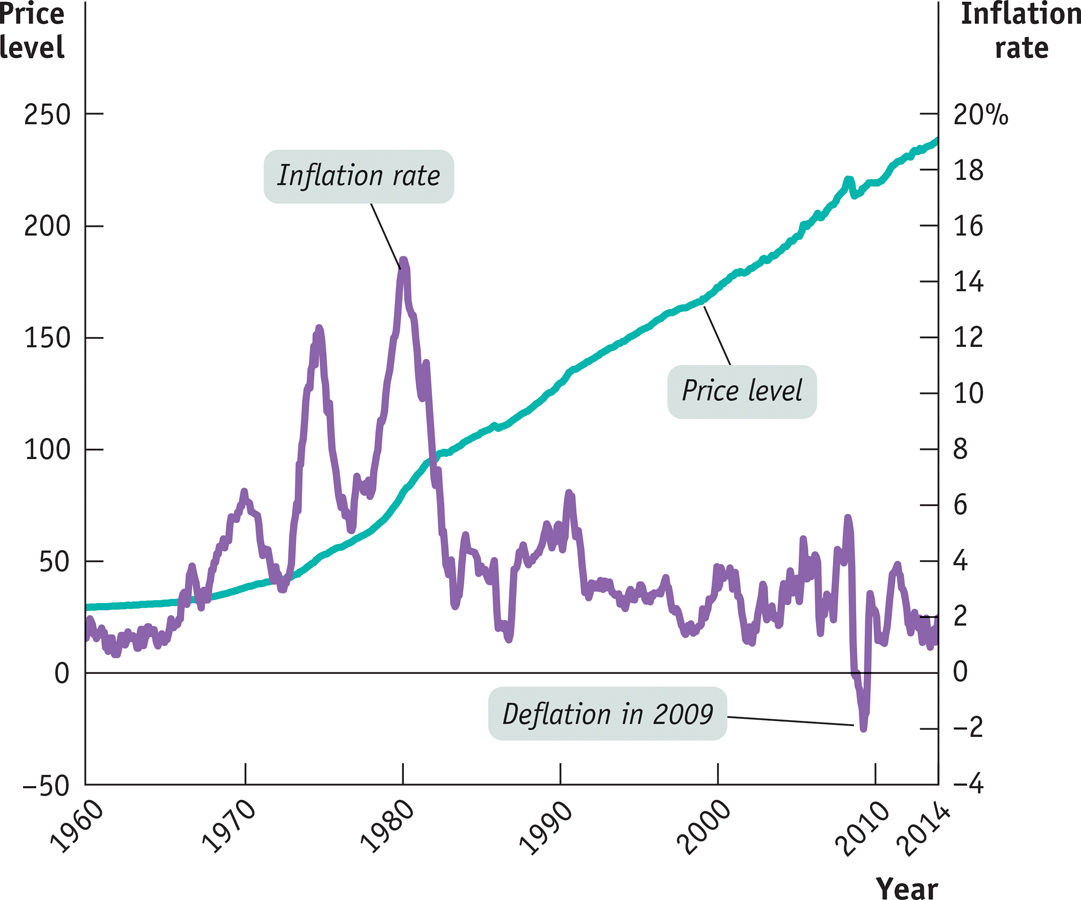

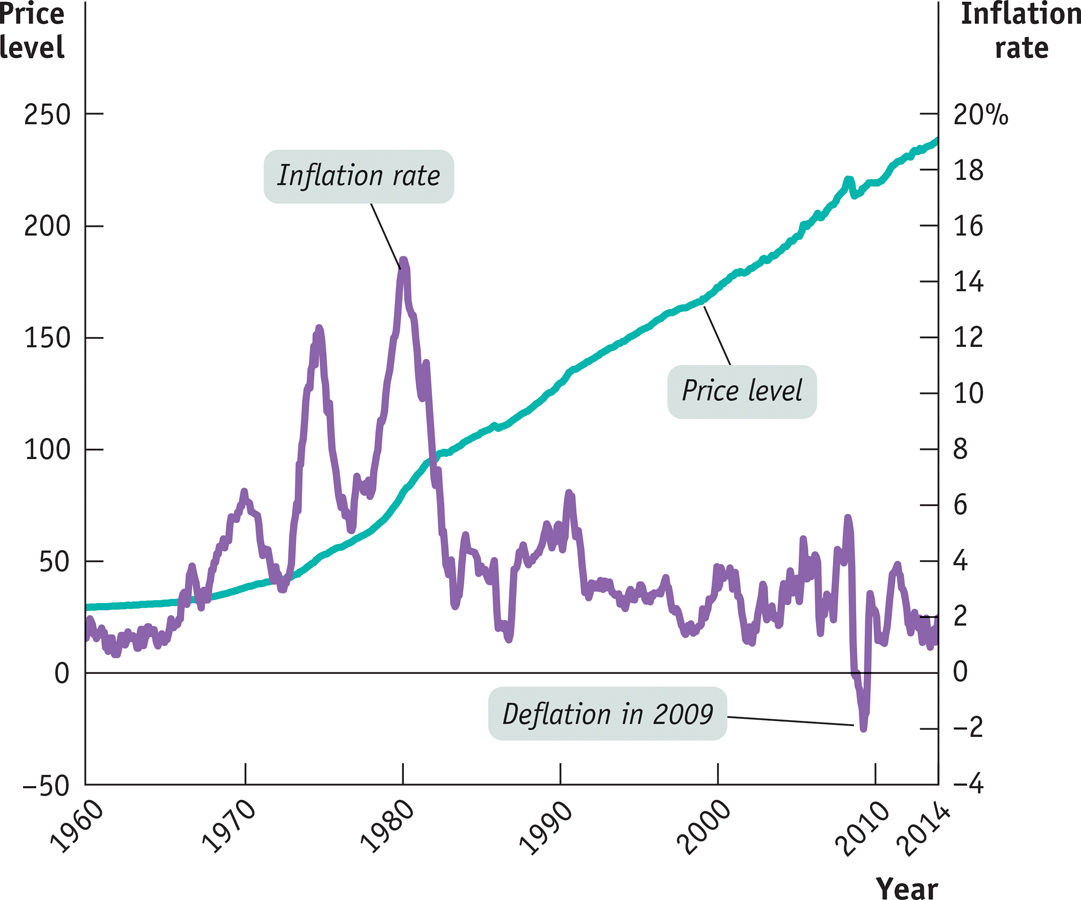

Figure 8-12 highlights the difference between the price level and the inflation rate in the United States over the last half-century, with the price level measured along the left vertical axis and the inflation rate measured along the right vertical axis. In the 2000s, the overall level of prices in America was much higher than it had been in 1960—but that, as we’ve learned, didn’t matter. The inflation rate in the 2000s, however, was much lower than in the 1970s—and that almost certainly made the economy richer than it would have been if high inflation had continued.

The Price Level versus the Inflation Rate, 1960–2014 With the exception of 2009, over the past half-century the price level has continuously increased. But the inflation rate—the rate at which prices are rising—has had both ups and downs. And in 2009, the inflation rate briefly turned negative, a phenomenon called deflation. Source: Bureau of Labor Statistics.

Economists believe that high rates of inflation impose significant economic costs. The most important of these costs are shoe-leather costs, menu costs, and unit-of-account costs. We’ll discuss each in turn.

Shoe-Leather Costs People hold money—cash in their wallets and bank deposits on which they can write checks—for convenience in making transactions. A high inflation rate, however, discourages people from holding money because the purchasing power of the cash in your wallet and the funds in your bank account steadily erode as the overall level of prices rises. This leads people to search for ways to reduce the amount of money they hold, often at considerable economic cost.

The upcoming Economics in Action describes how Israelis spent a lot of time at the bank during the periods of high inflation rates that afflicted Israel in 1984–1985. During the most famous of all inflations, the German hyperinflation of 1921–1923, merchants employed runners to take their cash to the bank many times a day to convert it into something that would hold its value, such as a stable foreign currency. In each case, in an effort to avoid having the purchasing power of their money eroded, people used up valuable resources, such as time for Israeli citizens and the labor of those German runners that could have been used productively elsewhere. During the German hyperinflation, so many banking transactions were taking place that the number of employees at German banks nearly quadrupled—from around 100,000 in 1913 to 375,000 in 1923.

More recently, Brazil experienced hyperinflation during the early 1990s; during that episode, the Brazilian banking sector grew so large that it accounted for 15% of GDP, more than twice the size of the financial sector in the United States measured as a share of GDP. The large increase in the Brazilian banking sector needed to cope with the consequences of inflation represented a loss of real resources to its society.

Shoe-leather costs are the increased costs of transactions caused by inflation.

Increased costs of transactions caused by inflation are known as shoe-leather costs, an allusion to the wear and tear caused by the extra running around that takes place when people are trying to avoid holding money. Shoe-leather costs are substantial in economies with very high inflation, as anyone who has lived in such an economy—say, one suffering inflation of 100% or more per year—can attest. Most estimates suggest, however, that the shoe-leather costs of inflation at the rates seen in the United States—which in peacetime has never had inflation above 15%—are quite small.

The menu cost is the real cost of changing a listed price.

Menu Costs In a modern economy, most of the things we buy have a listed price. There’s a price listed under each item on a supermarket shelf, a price printed on the back of a book, and a price listed for each dish on a restaurant’s menu. Changing a listed price has a real cost, called a menu cost. For example, to change prices in a supermarket requires sending clerks through the store to change the listed price under each item. In the face of inflation, of course, firms are forced to change prices more often than they would if the aggregate price level was more or less stable. This means higher costs for the economy as a whole.

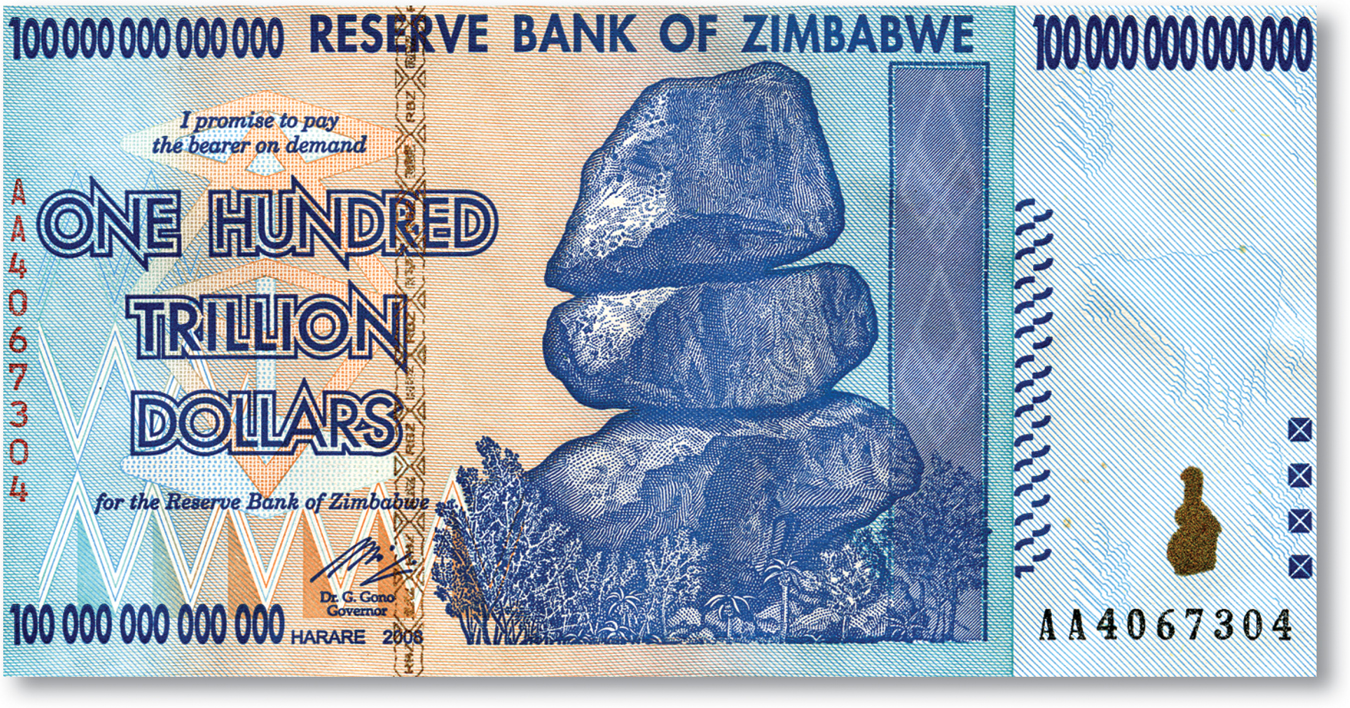

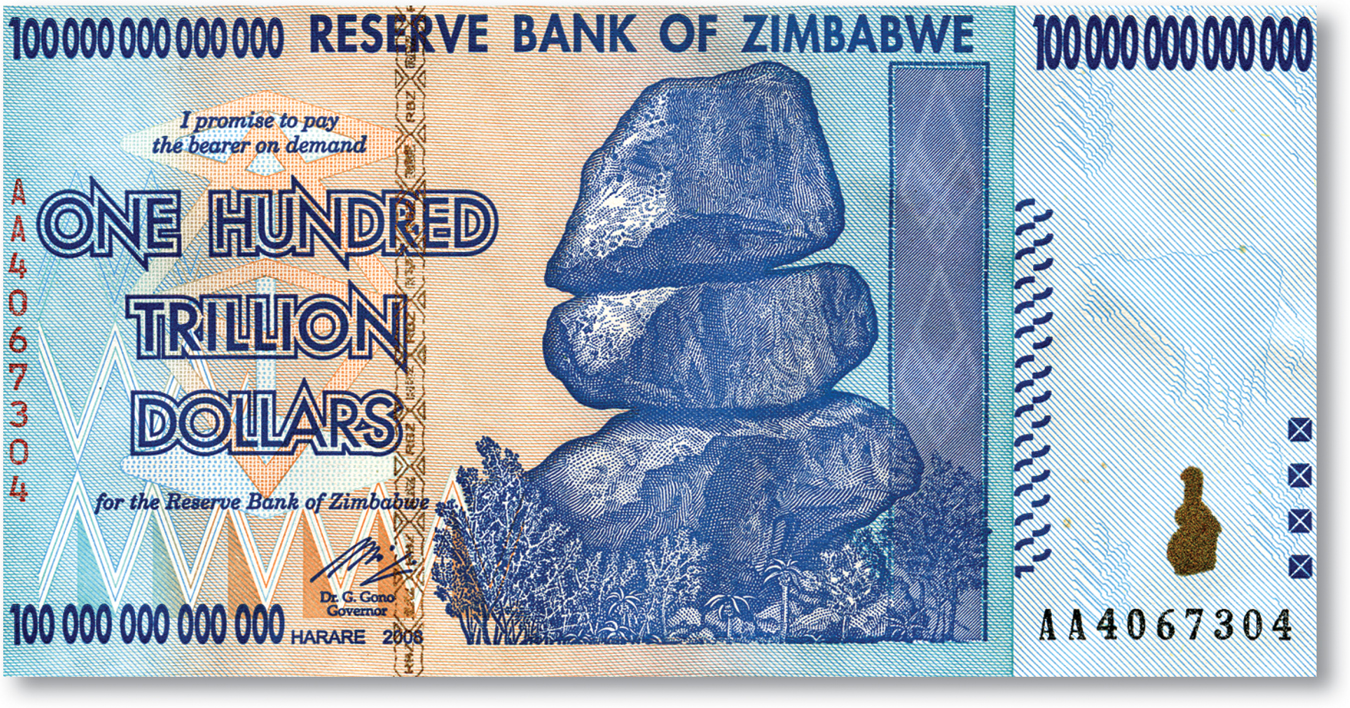

In times of very high inflation, menu costs can be substantial. During the Brazilian inflation of the early 1990s, for instance, supermarket workers reportedly spent half of their time replacing old price stickers with new ones. When inflation is high, merchants may decide to stop listing prices in terms of the local currency and use either an artificial unit—in effect, measuring prices relative to one another—or a more stable currency, such as the U.S. dollar. This is exactly what the Israeli real estate market began doing in the mid-1980s: prices were quoted in U.S. dollars, even though payment was made in Israeli shekels. And this is also what happened in Zimbabwe when, in May 2008, official estimates of the inflation rate reached 1,694,000%. By 2009, the government had suspended the Zimbabwean dollar, allowing Zimbabweans to buy and sell goods using foreign currencies.

When one hundred trillion dollar bills are in circulation as they were in Zimbabwe, menu costs are substantial.

Menu costs are also present in low-inflation economies, but they are not severe. In low-inflation economies, businesses might update their prices only sporadically—not daily or even more frequently, as is the case in high-inflation or hyperinflation economies. Also, with the growing popularity of online shopping, menu costs are becoming less and less important, since prices can be changed electronically and fewer merchants attach price stickers to merchandise.

Unit-of-Account Costs In the Middle Ages, contracts were often specified “in kind”: a tenant might, for example, be obliged to provide his landlord with a certain number of cattle each year (the phrase in kind actually comes from an ancient word for cattle). This may have made sense at the time, but it would be an awkward way to conduct modern business. Instead, we state contracts in monetary terms: a renter owes a certain number of dollars per month, a company that issues a bond promises to pay the bondholder the dollar value of the bond when it comes due, and so on. We also tend to make our economic calculations in dollars: a family planning its budget, or a small business owner trying to figure out how well the business is doing, makes estimates of the amount of money coming in and going out.

Unit-of-account costs arise from the way inflation makes money a less reliable unit of measurement.

This role of the dollar as a basis for contracts and calculation is called the unit-of-account role of money. It’s an important aspect of the modern economy. Yet it’s a role that can be degraded by inflation, which causes the purchasing power of a dollar to change over time—a dollar next year is worth less than a dollar this year. The effect, many economists argue, is to reduce the quality of economic decisions: the economy as a whole makes less efficient use of its resources because of the uncertainty caused by changes in the unit of account, the dollar. The unit-of-account costs of inflation are the costs arising from the way inflation makes money a less reliable unit of measurement.

Unit-of-account costs may be particularly important in the tax system because inflation can distort the measures of income on which taxes are collected. Here’s an example: assume that the inflation rate is 10%, so the overall level of prices rises 10% each year. Suppose that a business buys an asset, such as a piece of land, for $100,000, then resells it a year later for $110,000. In a fundamental sense, the business didn’t make a profit on the deal: in real terms, it got no more for the land than it paid for it. But U.S. tax law would say that the business made a capital gain of $10,000, and it would have to pay taxes on that phantom gain.

During the 1970s, when the United States had relatively high inflation, the distorting effects of inflation on the tax system were a serious problem. Some businesses were discouraged from productive investment spending because they found themselves paying taxes on phantom gains. Meanwhile, some unproductive investments became attractive because they led to phantom losses that reduced tax bills. When inflation fell in the 1980s—and tax rates were reduced—these problems became much less important.