Severe Crisis, Slow Recovery

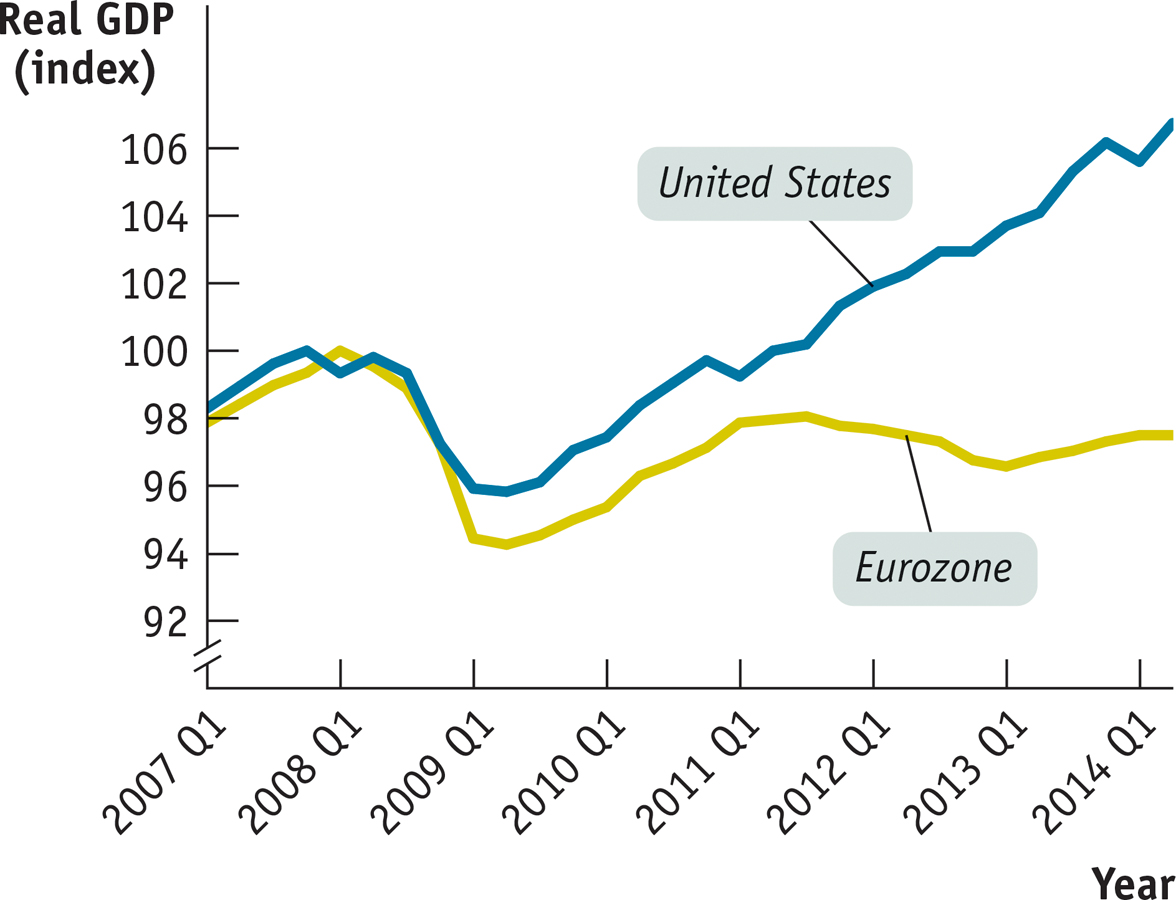

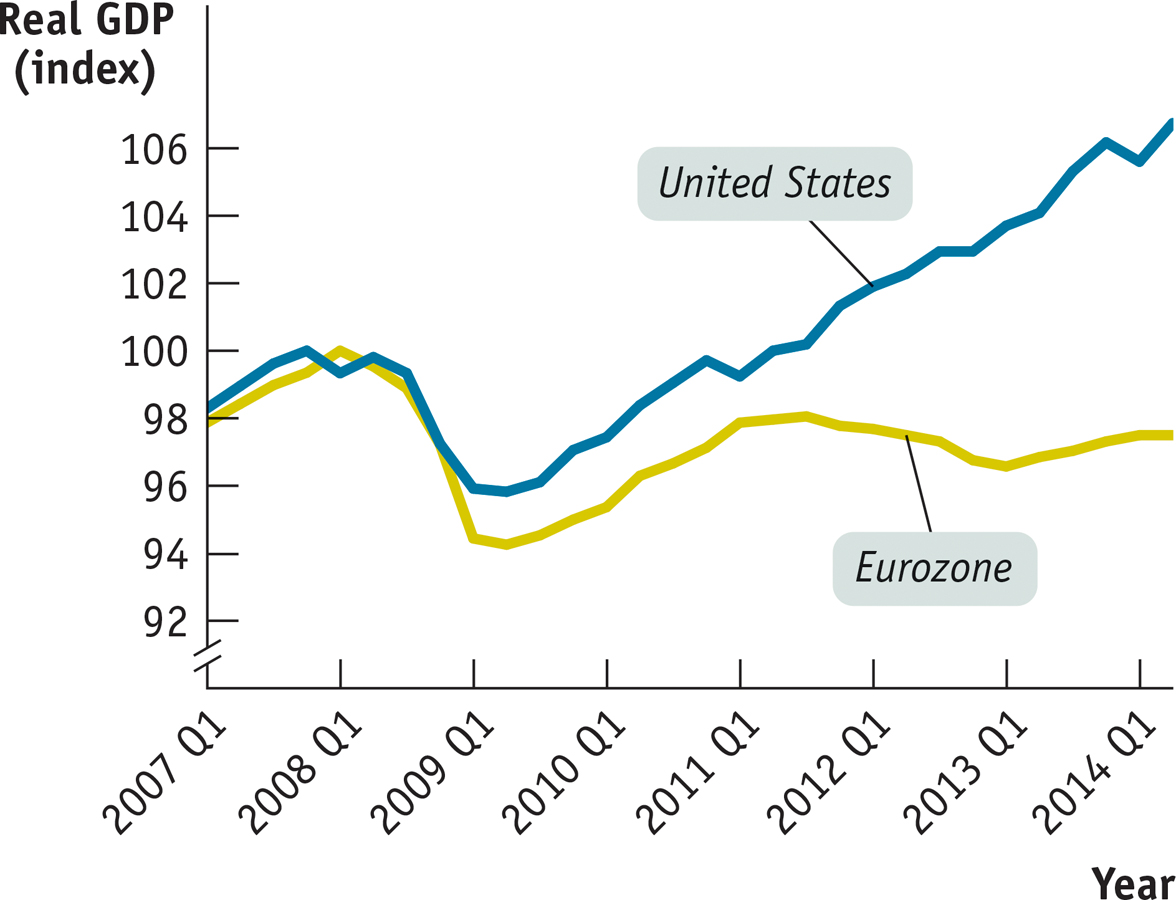

Crisis and Recovery in the United States and the Eurozone In the aftermath of the 2008 financial crisis, aggregate output in the eurozone and in the United States fell dramatically. In the United States, output then began a sluggish but sustained recovery. Europe, however, slid back into recession in 2011. Sources: Bureau of Economic Analysis; Eurostat.

Figure 17-6 shows real GDP during the crisis and aftermath in the United States and the eurozone—the group of countries using the euro as a shared currency, which together form an economy roughly the same size as that of the United States. For both economies real GDP is shown as an index with the peak pre-crisis quarter—the last quarter of 2007 for the United States, the first quarter of 2008 for the eurozone—set equal to 100. What you can see is that the United States experienced a steep downturn followed by a relatively slow recovery, and Europe did even worse, sliding back into recession in 2011.

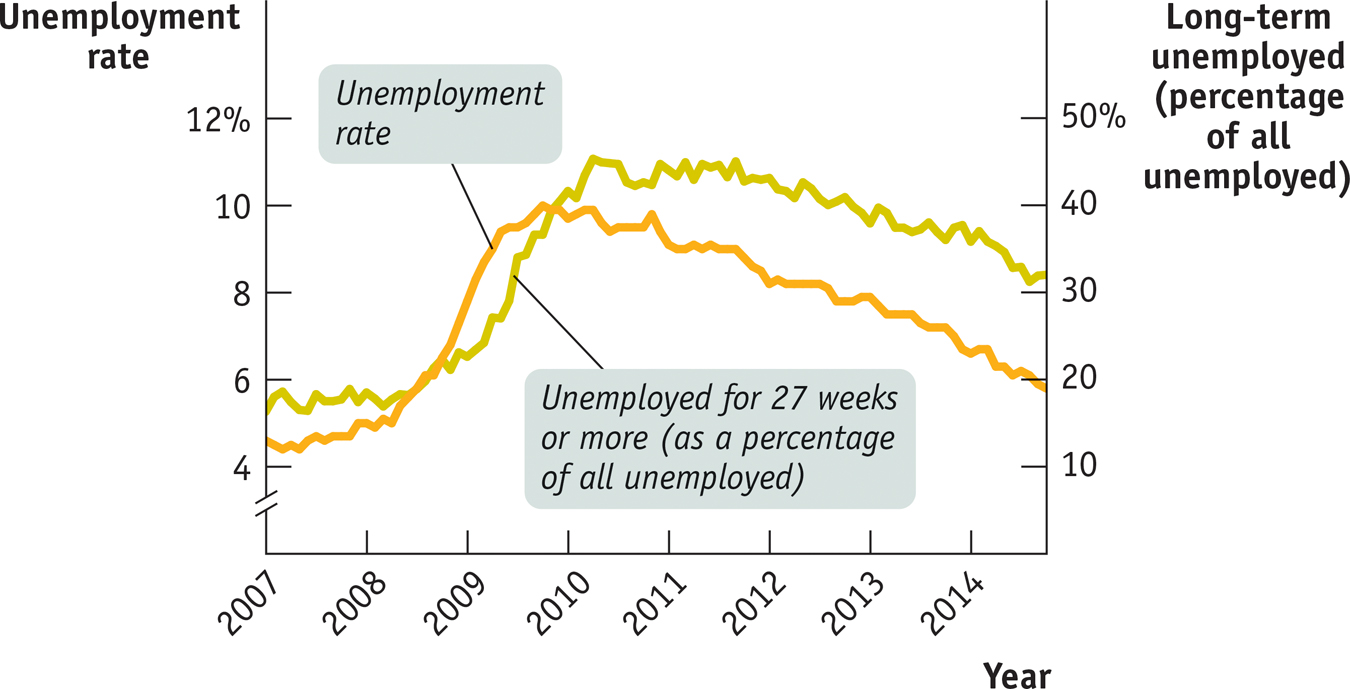

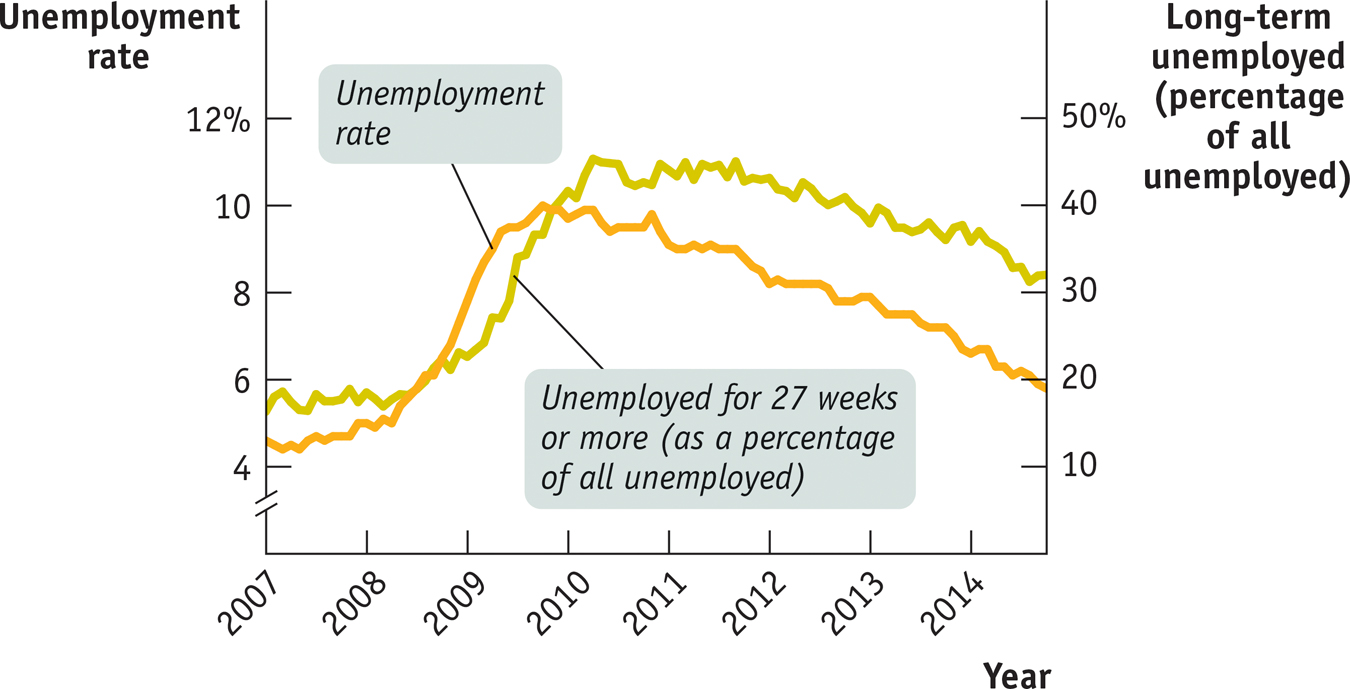

The severe slump and the slow recovery in the United States were very bad news for workers, since a healthy job market depends on an economy growing fast enough to accommodate both a growing workforce and rising productivity. Figure 17-7 shows two indicators of unemployment in the United States—the overall unemployment rate and the percentage of the unemployed who had been out of work 27 weeks or more. Both measures shot up during the crisis and remained very high years later, indicating a labor market in which it remained very hard to find a job.

U.S. Unemployment in the Aftermath of the 2008 Crisis After 2008, the unemployment rate in the United States increased dramatically and remained high. Long-term unemployment, measured by the percentage of the unemployed who were out of work for 27 weeks or longer, increased at the same time. By 2011, almost half of all unemployed American workers were long-term unemployed. Source: Federal Reserve Bank of St. Louis.

This outcome was, sad to say, about what one should have expected given the severity of the initial financial shock and the historical experience with such shocks. Look back at Figure 17-2: compared with either the Panic of 1893 or the aftermath of the Swedish banking crisis of 1991, the U.S. experience after 2008, the Great Recession, has if anything been better. The United States, observed Kenneth Rogoff (whose work we cited earlier), has experienced a “garden variety severe financial crisis.”