Investment Spending

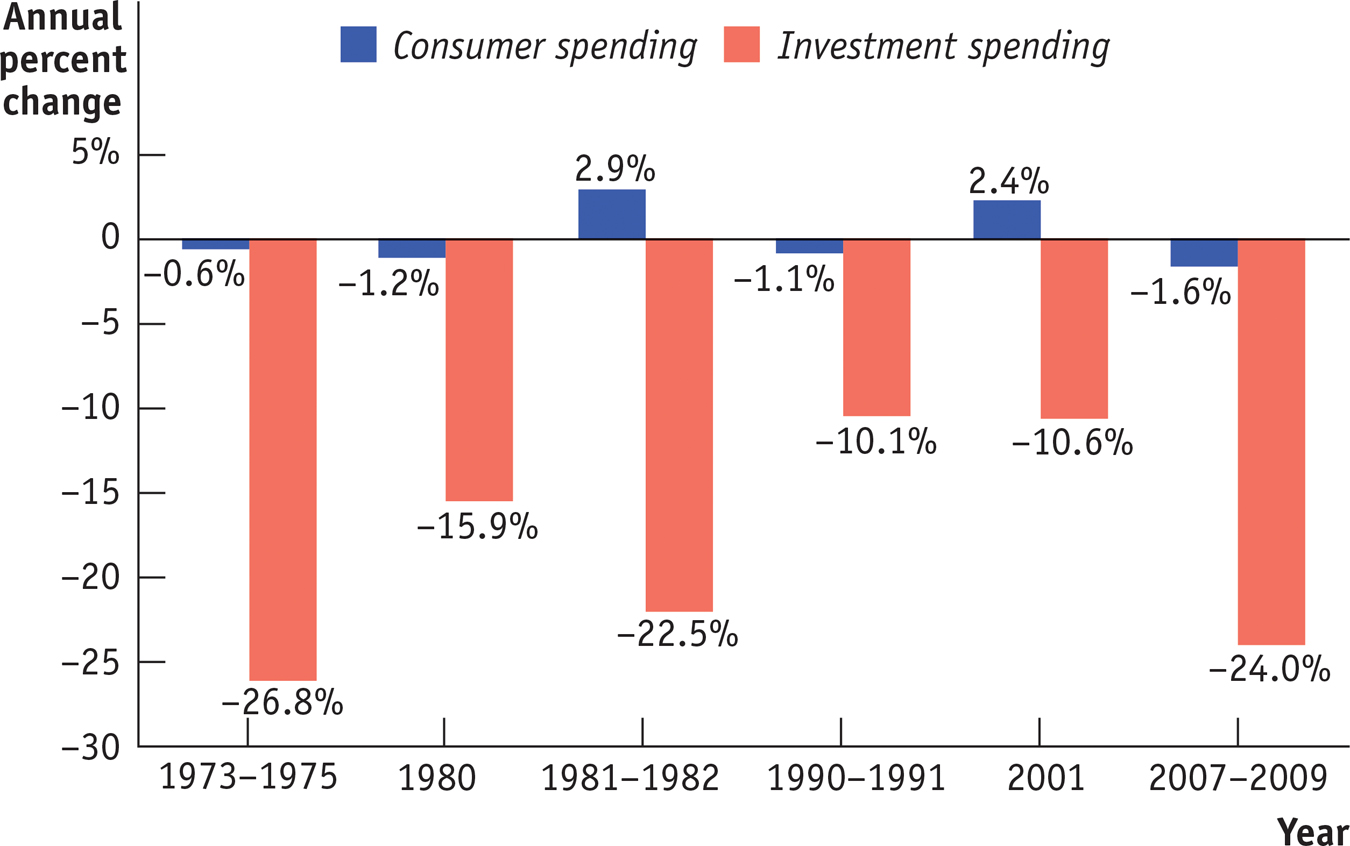

Although consumer spending is much larger than investment spending, booms and busts in investment spending tend to drive the business cycle. In fact, most recessions originate as a fall in investment spending. Figure 11-7 illustrates this point; it shows the annual percent change of investment spending and consumer spending in the United States, measured in real terms, during six recessions from 1973 to 2009. As you can see, swings in investment spending are much more dramatic than those in consumer spending. In addition, due to the multiplier process, economists believe that declines in consumer spending are usually the result of a process that begins with a slump in investment spending. Soon we’ll examine in more detail how a slump in investment spending generates a fall in consumer spending through the multiplier process.

Planned investment spending is the investment spending that businesses intend to undertake during a given period.

Before we do that, however, let’s analyze the factors that determine investment spending, which are somewhat different from those that determine consumer spending. The most important ones are the interest rate and expected future real GDP. We’ll also revisit a fact that we noted in Chapter 10: the level of investment spending businesses actually carry out is sometimes not the same level as planned investment spending, the investment spending that firms intend to undertake during a given period. Planned investment spending depends on three principal factors: the interest rate, the expected future level of real GDP, and the current level of production capacity. First, we’ll analyze the effect of the interest rate.