How Taxes Affect the Multiplier

When we introduced the analysis of the multiplier in Chapter 11, we simplified matters by assuming that a $1 increase in real GDP raises disposable income by $1. In fact, however, government taxes capture some part of the increase in real GDP that occurs in each round of the multiplier process, since most government taxes depend positively on real GDP. As a result, disposable income increases by considerably less than $1 once we include taxes in the model.

The increase in government tax revenue when real GDP rises isn’t the result of a deliberate decision or action by the government. It’s a consequence of the way the tax laws are written, which causes most sources of government revenue to increase automatically when real GDP goes up. For example, income tax receipts increase when real GDP rises because the amount each individual owes in taxes depends positively on his or her income, and households’ taxable income rises when real GDP rises. Sales tax receipts increase when real GDP rises because people with more income spend more on goods and services. And corporate profit tax receipts increase when real GDP rises because profits increase when the economy expands.

The effect of these automatic increases in tax revenue is to reduce the size of the multiplier. Remember, the multiplier is the result of a chain reaction in which higher real GDP leads to higher disposable income, which leads to higher consumer spending, which leads to further increases in real GDP. The fact that the government siphons off some of any increase in real GDP means that at each stage of this process, the increase in consumer spending is smaller than it would be if taxes weren’t part of the picture. The result is to reduce the multiplier. The appendix to this chapter shows how to derive the multiplier when taxes that depend positively on real GDP are taken into account.

Many macroeconomists believe it’s a good thing that in real life taxes reduce the multiplier. In Chapter 12 we argued that most, though not all, recessions are the result of negative demand shocks. The same mechanism that causes tax revenue to increase when the economy expands causes it to decrease when the economy contracts. Since tax receipts decrease when real GDP falls, the effects of these negative demand shocks are smaller than they would be if there were no taxes. The decrease in tax revenue reduces the adverse effect of the initial fall in aggregate demand.

Automatic stabilizers are government spending and taxation rules that cause fiscal policy to be automatically expansionary when the economy contracts and automatically contractionary when the economy expands.

The automatic decrease in government tax revenue generated by a fall in real GDP—

The rules that govern tax collection aren’t the only automatic stabilizers, although they are the most important ones. Some types of government transfers also play a stabilizing role. For example, more people receive unemployment insurance when the economy is depressed than when it is booming. The same is true of Medicaid and food stamps. So transfer payments tend to rise when the economy is contracting and fall when the economy is expanding. Like changes in tax revenue, these automatic changes in transfers tend to reduce the size of the multiplier because the total change in disposable income that results from a given rise or fall in real GDP is smaller.

As in the case of government tax revenue, many macroeconomists believe that it’s a good thing that government transfers reduce the multiplier. Expansionary and contractionary fiscal policies that are the result of automatic stabilizers are widely considered helpful to macroeconomic stabilization because they blunt the extremes of the business cycle.

Discretionary fiscal policy is fiscal policy that is the result of deliberate actions by policy makers rather than rules.

But what about fiscal policy that isn’t the result of automatic stabilizers? Discretionary fiscal policy is fiscal policy that is the direct result of deliberate actions by policy makers rather than automatic adjustment. For example, during a recession, the government may pass legislation that cuts taxes and increases government spending in order to stimulate the economy. In general, economists tend to support the use of discretionary fiscal policy only in special circumstances, such as an especially severe recession. We’ll explain why, and describe the debates among macroeconomists on the appropriate role of fiscal policy, in Chapter 18.

!worldview! ECONOMICS in Action: Austerity and the Multiplier

Austerity and the Multiplier

We’ve explained the logic of the fiscal multiplier, but what empirical evidence do economists have about multiplier effects in practice? Until a few years ago, the answer would have been that we didn’t have nearly as much evidence as we’d like.

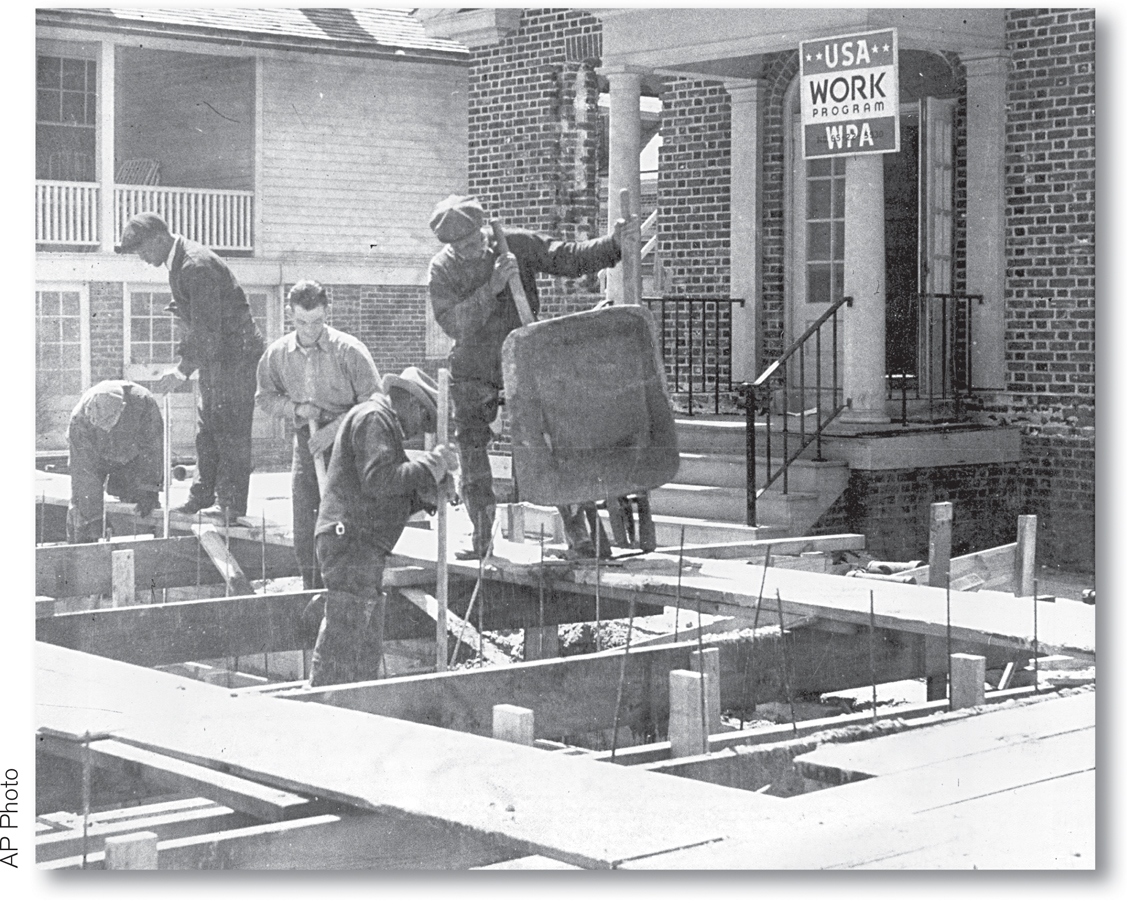

The problem was that large changes in fiscal policy are fairly rare, and usually happen at the same time other things are taking place, making it hard to separate the effects of spending and taxes from those of other factors. For example, the U.S. drastically increased spending during World War II—

Recent events have, however, offered considerable new evidence. As we explain later in this chapter, after 2009 several European countries found themselves facing debt crises, so they were forced to turn to the rest of Europe for aid. A condition of this aid was austerity—sharp cuts in spending plus tax increases. (We will explain austerity more fully in Chapter 17.) By comparing the economic performance of countries that were forced into austerity with that of countries that weren’t, we get a relatively clear view of the effects of changes in spending and taxes.

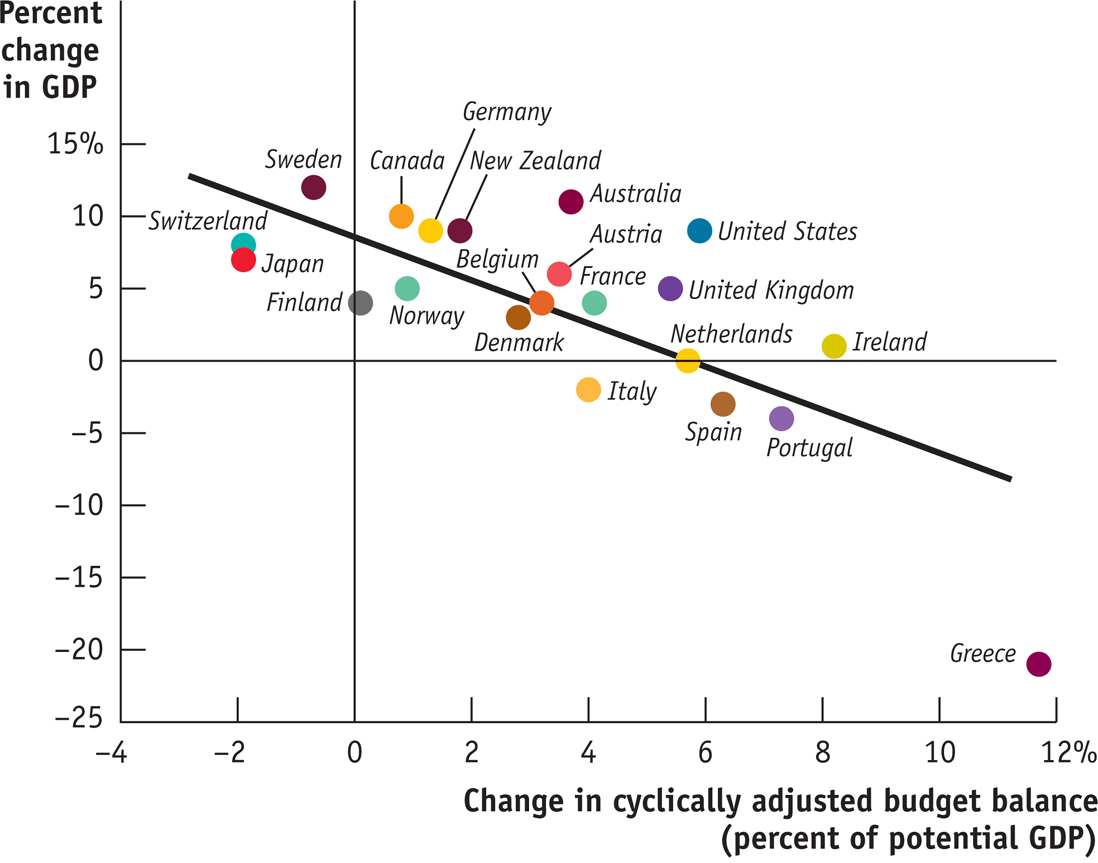

Figure 13-7 compares the amount of austerity imposed in a number of countries between 2009 and 2013 with the growth in their GDP over the same period. Austerity is measured by the change in the cyclically adjusted budget balance, defined later in this chapter. Greece—

As you might expect, economists have offered a number of qualifications and caveats to this result, coming from the fact that this wasn’t truly a controlled experiment. Overall, however, recent experience seems to support the notion that fiscal policy does indeed move GDP in the predicted direction, with a multiplier of more than 1.

Quick Review

The amount by which changes in government purchases raise real GDP is determined by the multiplier.

Changes in taxes and government transfers also move real GDP, but by less than equal-

sized changes in government purchases. Taxes reduce the size of the multiplier unless they are lump-

sum taxes. Taxes and some government transfers act as automatic stabilizers as tax revenue responds positively to changes in real GDP and some government transfers respond negatively to changes in real GDP. Many economists believe that it is a good thing that they reduce the size of the multiplier. In contrast, the use of discretionary fiscal policy is more controversial.

13-2

Question 13.4

Explain why a $500 million increase in government purchases of goods and services will generate a larger rise in real GDP than a $500 million increase in government transfers.

Question 13.5

Explain why a $500 million reduction in government purchases of goods and services will generate a larger fall in real GDP than a $500 million reduction in government transfers.

Question 13.6

The country of Boldovia has no unemployment insurance benefits and a tax system using only lump-

sum taxes. The neighboring country of Moldovia has generous unemployment benefits and a tax system in which residents must pay a percentage of their income. Which country will experience greater variation in real GDP in response to demand shocks, positive and negative? Explain.

Solutions appear at back of book.