Monetary Policy and the Interest Rate

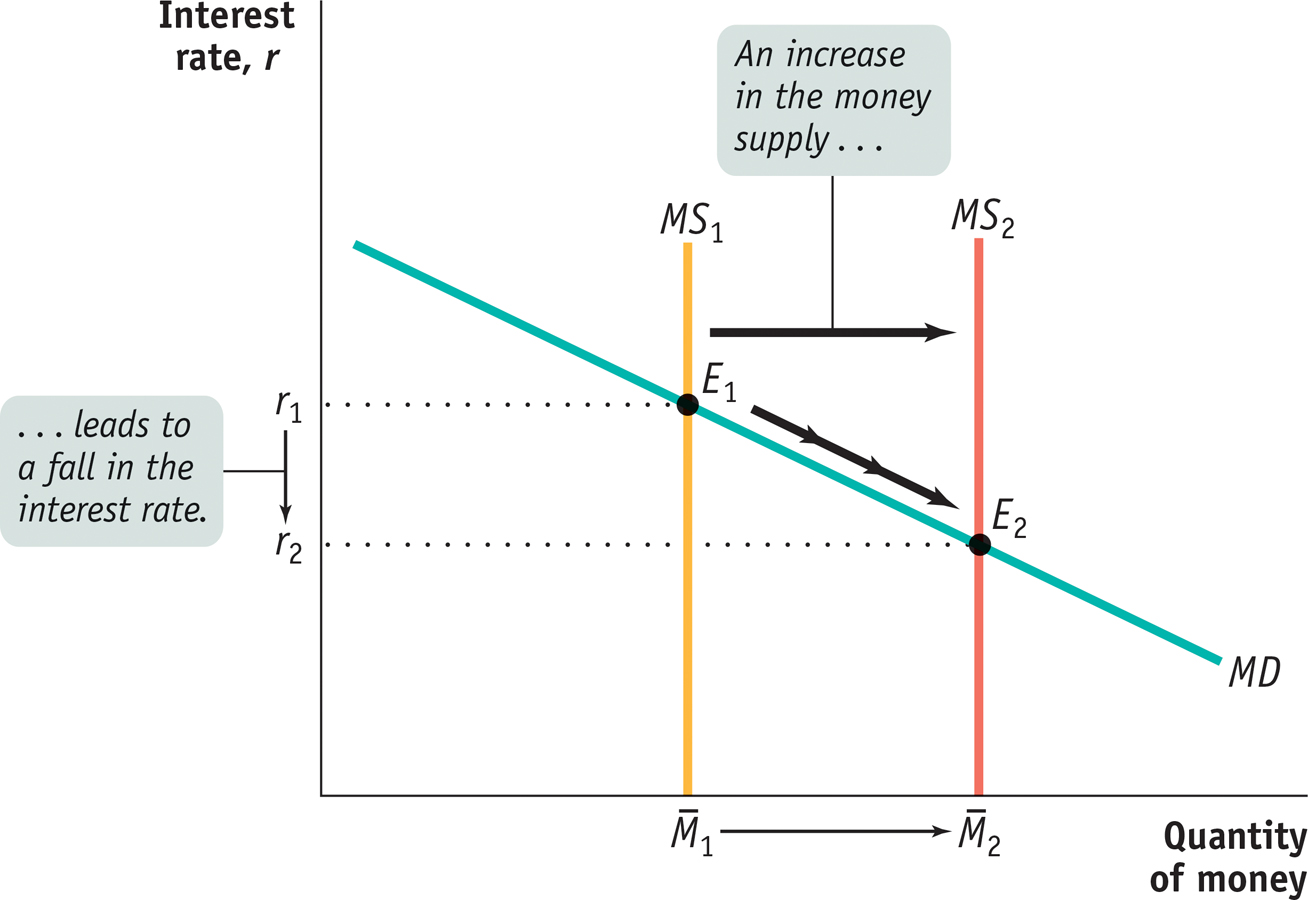

Let’s examine how the Federal Reserve can use changes in the money supply to change the interest rate. Figure 15-4 shows what happens when the Fed increases the money supply from  to

to  . The economy is originally in equilibrium at E1, with an equilibrium interest rate of r1 and money supply,

. The economy is originally in equilibrium at E1, with an equilibrium interest rate of r1 and money supply,  . An increase in the money supply by the Fed to

. An increase in the money supply by the Fed to  shifts the money supply curve to the right, from MS1 to MS2, and leads to a fall in the equilibrium interest rate to r2. Why? Because r2 is the only interest rate at which the public is willing to hold the quantity of money actually supplied,

shifts the money supply curve to the right, from MS1 to MS2, and leads to a fall in the equilibrium interest rate to r2. Why? Because r2 is the only interest rate at which the public is willing to hold the quantity of money actually supplied,  .

.

to

to  . In order to induce people to hold the larger quantity of money, the interest rate must fall from r1 to r2.

. In order to induce people to hold the larger quantity of money, the interest rate must fall from r1 to r2.So an increase in the money supply drives the interest rate down. Similarly, a reduction in the money supply drives the interest rate up. By adjusting the money supply up or down, the Fed can set the interest rate.

PITFALLS: THE TARGET VERSUS THE MARKET?

THE TARGET VERSUS THE MARKET?

Over the years, the Federal Reserve has changed the way in which monetary policy is implemented. In the late 1970s and early 1980s, it set a target level for the money supply and altered the monetary base to achieve that target. Under this operating procedure, the federal funds rate fluctuated freely. Today the Fed uses the reverse procedure, setting a target for the federal funds rate and allowing the money supply to fluctuate as it pursues that target.

A common mistake is to imagine that these changes in the way the Federal Reserve operates alter the way the money market works. That is, you’ll sometimes hear people say that the interest rate no longer reflects the supply and demand for money because the Fed sets the interest rate.

In fact, the money market works the same way as always: the interest rate is determined by the supply and demand for money. The only difference is that now the Fed adjusts the supply of money to achieve its target interest rate. It’s important not to confuse a change in the Fed’s operating procedure with a change in the way the economy works.

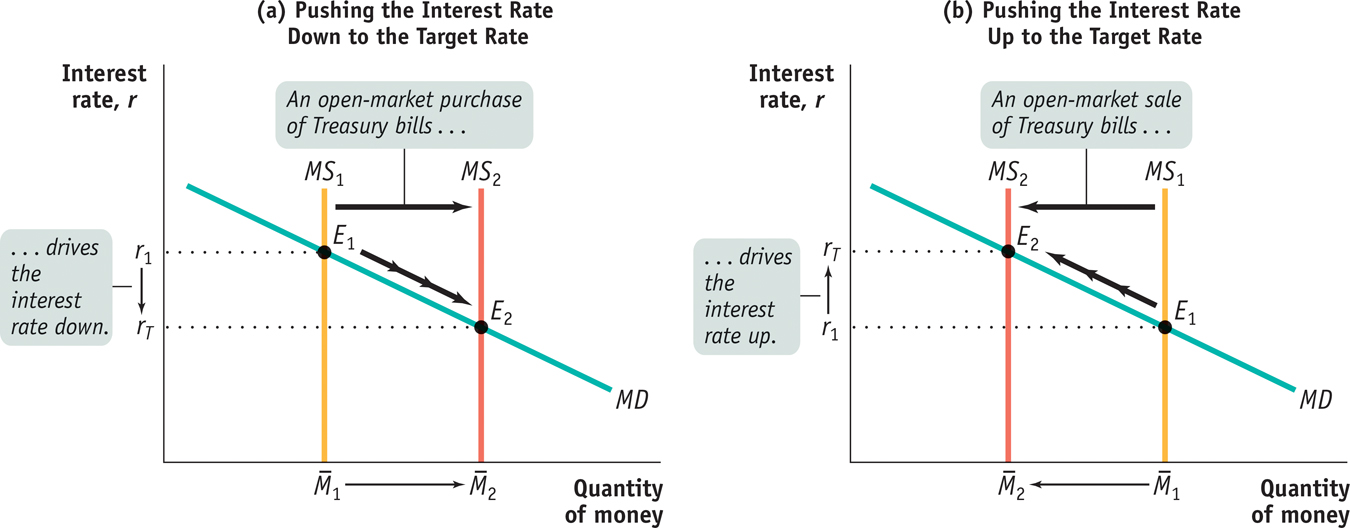

The target federal funds rate is the Federal Reserve’s desired federal funds rate.

In practice, at each meeting the Federal Open Market Committee decides on the interest rate to prevail for the next six weeks, until its next meeting. The Fed sets a target federal funds rate, a desired level for the federal funds rate. This target is then enforced by the Open Market Desk of the Federal Reserve Bank of New York —in those two small rooms we mentioned in the opening story—

Figure 15-5 shows how this works. In both panels, rT is the target federal funds rate. In panel (a), the initial money supply curve is MS1 with money supply  , and the equilibrium interest rate, r1, is above the target rate. To lower the interest rate to rT, the Fed makes an open-

, and the equilibrium interest rate, r1, is above the target rate. To lower the interest rate to rT, the Fed makes an open- . This drives the equilibrium interest rate down to the target rate, rT.

. This drives the equilibrium interest rate down to the target rate, rT.

Panel (b) shows the opposite case. Again, the initial money supply curve is MS1 with money supply  . But this time the equilibrium interest rate, r1, is below the target federal funds rate, rT. In this case, the Fed will make an open-

. But this time the equilibrium interest rate, r1, is below the target federal funds rate, rT. In this case, the Fed will make an open- via the money multiplier. The money supply curve shifts leftward from MS1 to MS2, driving the equilibrium interest rate up to the target federal funds rate, rT.

via the money multiplier. The money supply curve shifts leftward from MS1 to MS2, driving the equilibrium interest rate up to the target federal funds rate, rT.