Opportunity Cost

The production possibility frontier is also useful as a reminder of the fundamental point that the true cost of any good isn’t the money it costs to buy, but what must be given up in order to get that good— = ¾ of a Dreamliner.

= ¾ of a Dreamliner.

Is the opportunity cost of an extra small jet in terms of Dreamliners always the same, no matter how many small jets and Dreamliners are currently produced? In the example illustrated by Figure 2-1, the answer is yes. If Boeing increases its production of small jets from 28 to 40, the number of Dreamliners it produces falls from 9 to zero. So Boeing’s opportunity cost per additional small jet is  = ¾ of a Dreamliner, the same as it was when Boeing went from 20 small jets produced to 28.

= ¾ of a Dreamliner, the same as it was when Boeing went from 20 small jets produced to 28.

However, the fact that in this example the opportunity cost of a small jet in terms of a Dreamliner is always the same is a result of an assumption we’ve made, an assumption that’s reflected in how Figure 2-1 is drawn. Specifically, whenever we assume that the opportunity cost of an additional unit of a good doesn’t change regardless of the output mix, the production possibility frontier is a straight line.

Moreover, as you might have already guessed, the slope of a straight-

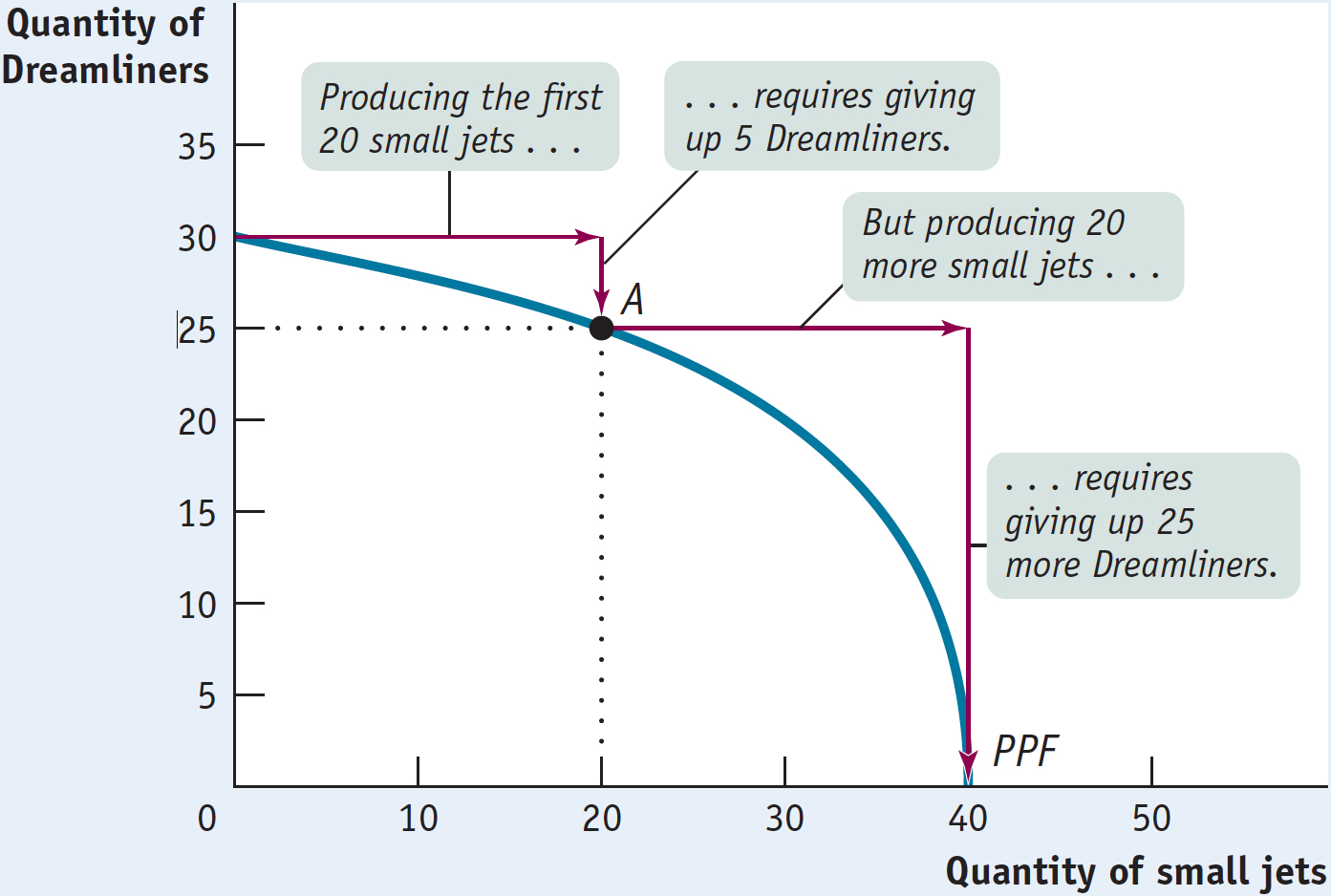

Figure 2-2 illustrates a different assumption, a case in which Boeing faces increasing opportunity cost. Here, the more small jets it produces, the more costly it is to produce yet another small jet in terms of forgone production of a Dreamliner. And the same holds true in reverse: the more Dreamliners Boeing produces, the more costly it is to produce yet another Dreamliner in terms of forgone production of small jets. For example, to go from producing zero small jets to producing 20, Boeing has to forgo producing 5 Dreamliners. That is, the opportunity cost of those 20 small jets is 5 Dreamliners. But to increase its production of small jets to 40—

Although it’s often useful to work with the simple assumption that the production possibility frontier is a straight line, economists believe that in reality opportunity costs are typically increasing. When only a small amount of a good is produced, the opportunity cost of producing that good is relatively low because the economy needs to use only those resources that are especially well suited for its production.

For example, if an economy grows only a small amount of corn, that corn can be grown in places where the soil and climate are perfect for corn-

Economic Growth Finally, the production possibility frontier helps us understand what it means to talk about economic growth. In the Introduction, we defined the concept of economic growth as the growing ability of the economy to produce goods and services. As we saw, economic growth is one of the fundamental features of the real economy. But are we really justified in saying that the economy has grown over time? After all, although the U.S. economy produces more of many things than it did a century ago, it produces less of other things—

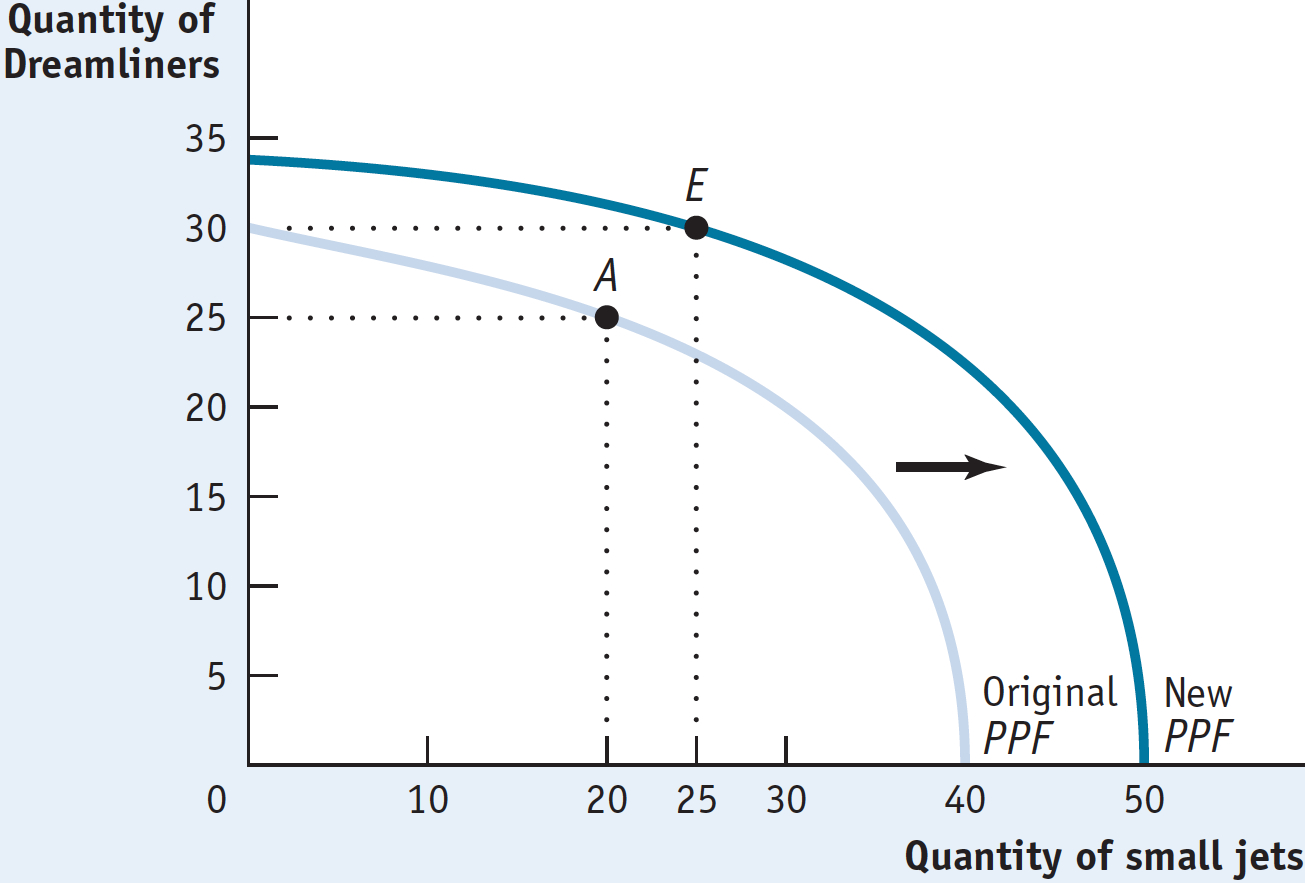

The answer is illustrated in Figure 2-3, where we have drawn two hypothetical production possibility frontiers for the economy. In them we have assumed once again that everyone in the economy works for Boeing and, consequently, the economy produces only two goods, Dreamliners and small jets. Notice how the two curves are nested, with the one labeled “Original PPF” lying completely inside the one labeled “New PPF.” Now we can see graphically what we mean by economic growth of the economy: economic growth means an expansion of the economy’s production possibilities; that is, the economy can produce more of everything.

For example, if the economy initially produces at point A (25 Dreamliners and 20 small jets), economic growth means that the economy could move to point E (30 Dreamliners and 25 small jets). E lies outside the original frontier; so in the production possibility frontier model, growth is shown as an outward shift of the frontier.

Factors of production are resources used to produce goods and services.

What can lead the production possibility frontier to shift outward? There are basically two sources of economic growth. One is an increase in the economy’s factors of production, the resources used to produce goods and services. Economists usually use the term factor of production to refer to a resource that is not used up in production. For example, in traditional airplane manufacture workers used riveting machines to connect metal sheets when constructing a plane’s fuselage; the workers and the riveters are factors of production, but the rivets and the sheet metal are not. Once a fuselage is made, a worker and riveter can be used to make another fuselage, but the sheet metal and rivets used to make one fuselage cannot be used to make another.

Broadly speaking, the main factors of production are the resources land, labor, physical capital, and human capital. Land is a resource supplied by nature; labor is the economy’s pool of workers; physical capital refers to created resources such as machines and buildings; and human capital refers to the educational achievements and skills of the labor force, which enhance its productivity. Of course, each of these is really a category rather than a single factor: land in North Dakota is quite different from land in Florida.

To see how adding to an economy’s factors of production leads to economic growth, suppose that Boeing builds another construction hangar that allows it to increase the number of planes—

Technology is the technical means for producing goods and services.

The other source of economic growth is progress in technology, the technical means for the production of goods and services. Composite materials had been used in some parts of aircraft before the Boeing Dreamliner was developed. But Boeing engineers realized that there were large additional advantages to building a whole plane out of composites. The plane would be lighter, stronger, and have better aerodynamics than a plane built in the traditional way. It would therefore have longer range, be able to carry more people, and use less fuel, in addition to being able to maintain higher cabin pressure. So in a real sense Boeing’s innovation—

istockphoto/Thinkstock

Comstock/Thinkstock

istockphoto/Thinkstock

Because improved jet technology has pushed out the production possibility frontier, it has made it possible for the economy to produce more of everything, not just jets and air travel. Over the past 30 years, the biggest technological advances have taken place in information technology, not in construction or food services. Yet Americans have chosen to buy bigger houses and eat out more than they used to because the economy’s growth has made it possible to do so.

The production possibility frontier is a very simplified model of an economy. Yet it teaches us important lessons about real-