International Trade and Wages

So far we have focused on the effects of international trade on producers and consumers in a particular industry. For many purposes this is a very helpful approach. However, producers and consumers are not the only parts of society affected by trade—

Moreover, the effects of trade aren’t limited to just those industries that export or compete with imports because factors of production can often move between industries. So now we turn our attention to the long-

To begin our analysis, consider the position of Maria, an accountant at West Coast Phone Production, Inc. If the economy is opened up to imports of phones from China, the domestic phone industry will contract, and it will hire fewer accountants. But accounting is a profession with employment opportunities in many industries, and Maria might well find a better job in the automobile industry, which expands as a result of international trade. So it may not be appropriate to think of her as a producer of phones who is hurt by competition from imported parts. Rather, we should think of her as an accountant who is affected by phone imports only to the extent that these imports change the wages of accountants in the economy as a whole.

The wage rate of accountants is a factor price—the price employers have to pay for the services of a factor of production. One key question about international trade is how it affects factor prices—

Earlier in this chapter we described the Heckscher–

We won’t work this out in detail, but the idea is simple. The prices of factors of production, like the prices of goods and services, are determined by supply and demand. If international trade increases the demand for a factor of production, that factor’s price will rise; if international trade reduces the demand for a factor of production, that factor’s price will fall.

Exporting industries produce goods and services that are sold abroad.

Now think of a country’s industries as consisting of two kinds: exporting industries, which produce goods and services that are sold abroad, and import-

Import-

In addition, the Heckscher–

In other words, international trade tends to redistribute income toward a country’s abundant factors and away from its less abundant factors.

U.S. exports tend to be human-

This effect has been a source of much concern in recent years. Wage inequality—

How important are these effects? In some historical episodes, the impacts of international trade on factor prices have been very large. As we explain in the following Economics in Action, the opening of transatlantic trade in the late nineteenth century had a large negative impact on land rents in Europe, hurting landowners but helping workers and owners of capital.

The effects of trade on wages in the United States have generated considerable controversy in recent years. Most economists who have studied the issue agree that growing imports of labor-

!worldview! ECONOMICS in Action: TRADE, WAGES, AND LAND PRICES IN THE NINETEENTH CENTURY

TRADE, WAGES, AND LAND PRICES IN THE NINETEENTH CENTURY

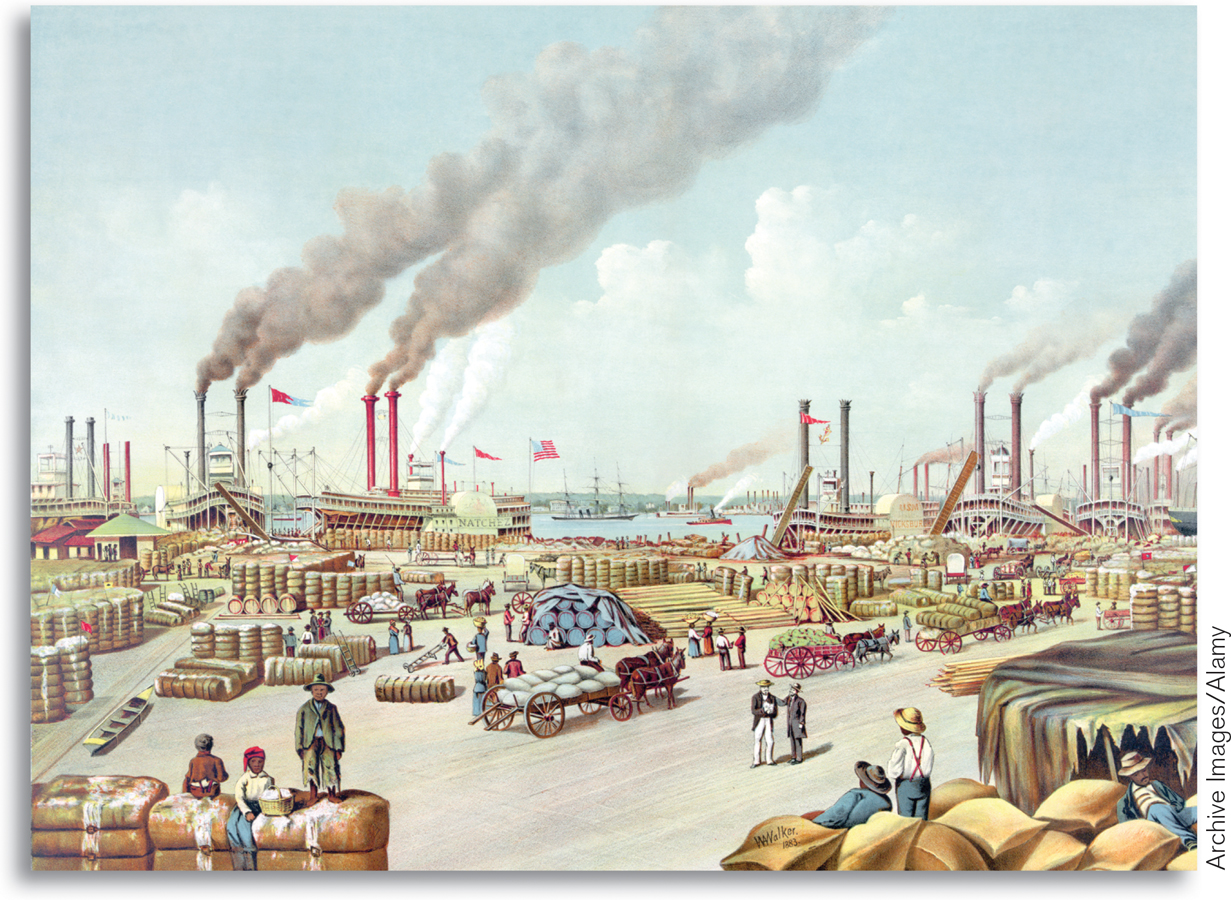

Beginning around 1870, there was an explosive growth of world trade in agricultural products, based largely on the steam engine. Steam-

This opening up of international trade led to higher prices of agricultural products, such as wheat, in exporting countries and a decline in their prices in importing countries. Notably, the difference between wheat prices in the midwestern United States and England plunged.

The change in agricultural prices created winners and losers on both sides of the Atlantic as factor prices adjusted. In England, land prices fell by half compared with average wages; landowners found their purchasing power sharply reduced, but workers benefited from cheaper food. In the United States, the reverse happened: land prices doubled compared with wages. Landowners did very well, but workers found the purchasing power of their wages dented by rising food prices.

Quick Review

The intersection of the domestic demand curve and the domestic supply curve determines the domestic price of a good. When a market is opened to international trade, the domestic price is driven to equal the world price.

If the world price is lower than the autarky price, trade leads to imports and the domestic price falls to the world price. There are overall gains from international trade because the gain in consumer surplus exceeds the loss in producer surplus.

If the world price is higher than the autarky price, trade leads to exports and the domestic price rises to the world price. There are overall gains from international trade because the gain in producer surplus exceeds the loss in consumer surplus.

Trade leads to an expansion of exporting industries, which increases demand for a country’s abundant factors, and a contraction of import-

competing industries, which decreases demand for its scarce factors.

5-2

Question 5.3

Due to a strike by truckers, trade in food between the United States and Mexico is halted. In autarky, the price of Mexican grapes is lower than that of U.S. grapes. Using a diagram of the U.S. domestic demand curve and the U.S. domestic supply curve for grapes, explain the effect of the strike on the following.

U.S. grape consumers’ surplus

U.S. grape producers’ surplus

U.S. total surplus

Question 5.4

What effect do you think the strike will have on Mexican grape producers? Mexican grape pickers? Mexican grape consumers? U.S. grape pickers?

Solutions appear at back of book.