Inflation and Deflation

In January 1980 the average production worker in the United States was paid $6.57 an hour. By January 2014, the average hourly earnings for such a worker had risen to $20.18 an hour. Three cheers for economic progress!

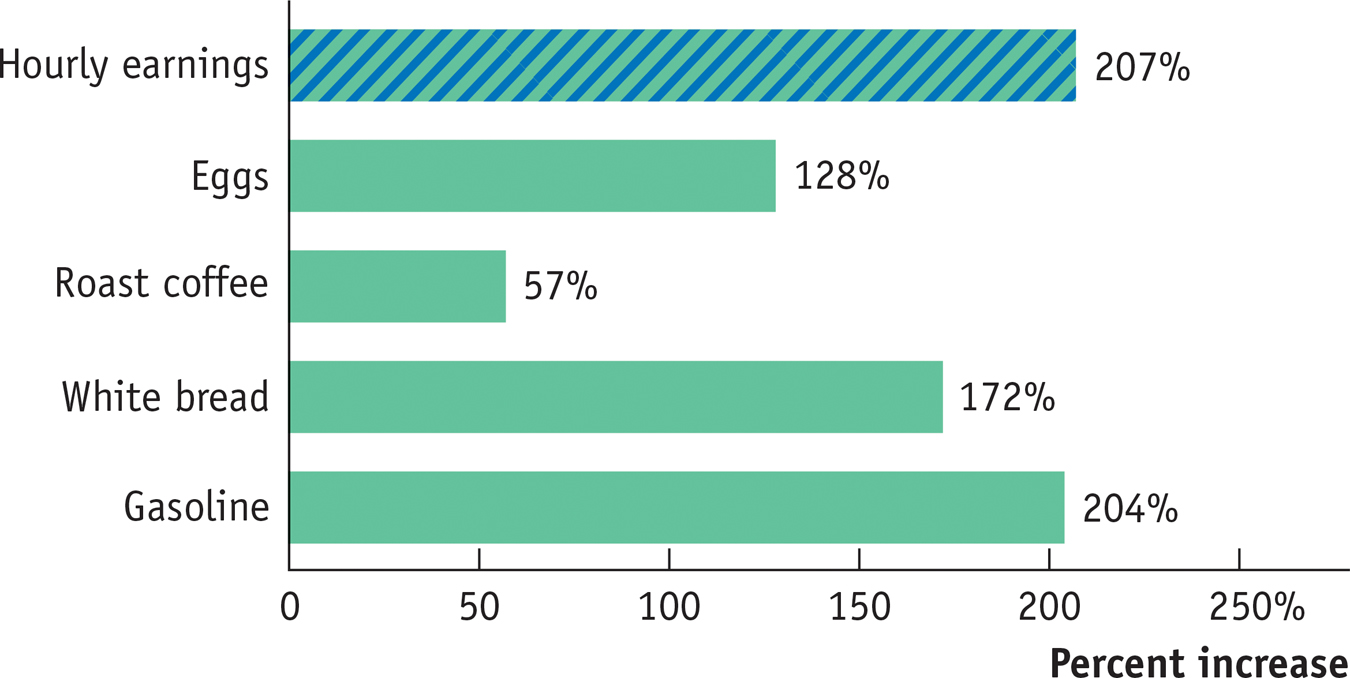

But wait. American workers were paid much more in 2014, but they also faced a much higher cost of living. In January 1980, a dozen eggs cost only about $0.88; by January 2014, that was up to $2.01. The price of a loaf of white bread went from about $0.50 to $1.37. And the price of a gallon of gasoline rose from just $1.13 to $3.38.

Figure 6-8 compares the percentage increase in hourly earnings between 1980 and 2014 with the increases in the prices of some standard items: the average worker’s paycheck went farther in terms of some goods, but less far in terms of others. Overall, the rise in the cost of living wiped out many, if not all, of the wage gains of the typical American worker from 1980 to 2014. In other words, once inflation is taken into account, the living standard of the typical American worker barely rose from 1980 to the present.

A rising overall level of prices is inflation.

A falling overall level of prices is deflation.

The point is that between 1980 and 2014 the economy experienced substantial inflation: a rise in the overall level of prices. Understanding the causes of inflation and its opposite, deflation—

The Causes of Inflation and Deflation

You might think that changes in the overall level of prices are just a matter of supply and demand. For example, higher gasoline prices reflect the higher price of crude oil, and higher crude oil prices reflect such factors as the exhaustion of major oil fields, growing demand from China and other emerging economies as more people grow rich enough to buy cars, and so on. Can’t we just add up what happens in each of these markets to find out what happens to the overall level of prices?

The answer is no, we can’t. Supply and demand can only explain why a particular good or service becomes more expensive relative to other goods and services. It can’t explain why, for example, the price of chicken has risen over time in spite of the facts that chicken production has become more efficient (you don’t want to know) and that chicken has become substantially cheaper compared to other goods.

What causes the overall level of prices to rise or fall? As we’ll learn in Chapter 8, in the short run, movements in inflation are closely related to the business cycle. When the economy is depressed and jobs are hard to find, inflation tends to fall; when the economy is booming, inflation tends to rise. For example, prices of most goods and services fell sharply during the terrible recession of 1929–

In the long run, by contrast, the overall level of prices is mainly determined by changes in the money supply, the total quantity of assets that can be readily used to make purchases. As we’ll see in Chapter 16, hyperinflation, in which prices rise by thousands or hundreds of thousands of percent, invariably occurs when governments print money to pay a large part of their bills.

The Pain of Inflation and Deflation

Both inflation and deflation can pose problems for the economy. Here are two examples: inflation discourages people from holding onto cash, because cash loses value over time if the overall price level is rising. That is, the amount of goods and services you can buy with a given amount of cash falls. In extreme cases, people stop holding cash altogether and turn to barter. Deflation can cause the reverse problem. If the price level is falling, cash gains value over time. In other words, the amount of goods and services you can buy with a given amount of cash increases. So holding on to it can become more attractive than investing in new factories and other productive assets. This can deepen a recession.

The economy has price stability when the overall level of prices changes slowly or not at all.

We’ll describe other costs of inflation and deflation in Chapters 8 and 16. For now, let’s just note that, in general, economists regard price stability—

ECONOMICS in Action: A Fast (Food) Measure of Inflation

A Fast (Food) Measure of Inflation

The original McDonald’s opened in 1954. It offered fast service—

No—

Quick Review

A dollar today doesn’t buy what it did in 1980, because the prices of most goods have risen. This rise in the overall price level has wiped out most if not all of the wage increases received by the typical American worker over the past 34 years.

One area of macroeconomic study is in the overall level of prices. Because either inflation or deflation can cause problems for the economy, economists typically advocate maintaining price stability.

6-4

Question 6.7

Which of these sound like inflation, which sound like deflation, and which are ambiguous?

Gasoline prices are up 10%, food prices are down 20%, and the prices of most services are up 1–

2%. Gas prices have doubled, food prices are up 50%, and most services seem to be up 5% or 10%.

Gas prices haven’t changed, food prices are way down, and services have gotten cheaper, too.

Solutions appear at back of book.