Other Price Measures

The producer price index, or PPI, measures changes in the prices of goods purchased by producers.

There are two other price measures that are also widely used to track economy-

The GDP deflator for a given year is 100 times the ratio of nominal GDP to real GDP in that year.

The other widely used price measure is the GDP deflator; it isn’t exactly a price index, although it serves the same purpose. Recall how we distinguished between nominal GDP (GDP in current prices) and real GDP (GDP calculated using the prices of a base year). The GDP deflator for a given year is equal to 100 times the ratio of nominal GDP for that year to real GDP for that year. Since real GDP is currently expressed in 2005 dollars, the GDP deflator for 2005 is equal to 100. If nominal GDP doubles but real GDP does not change, the GDP deflator indicates that the aggregate price level doubled.

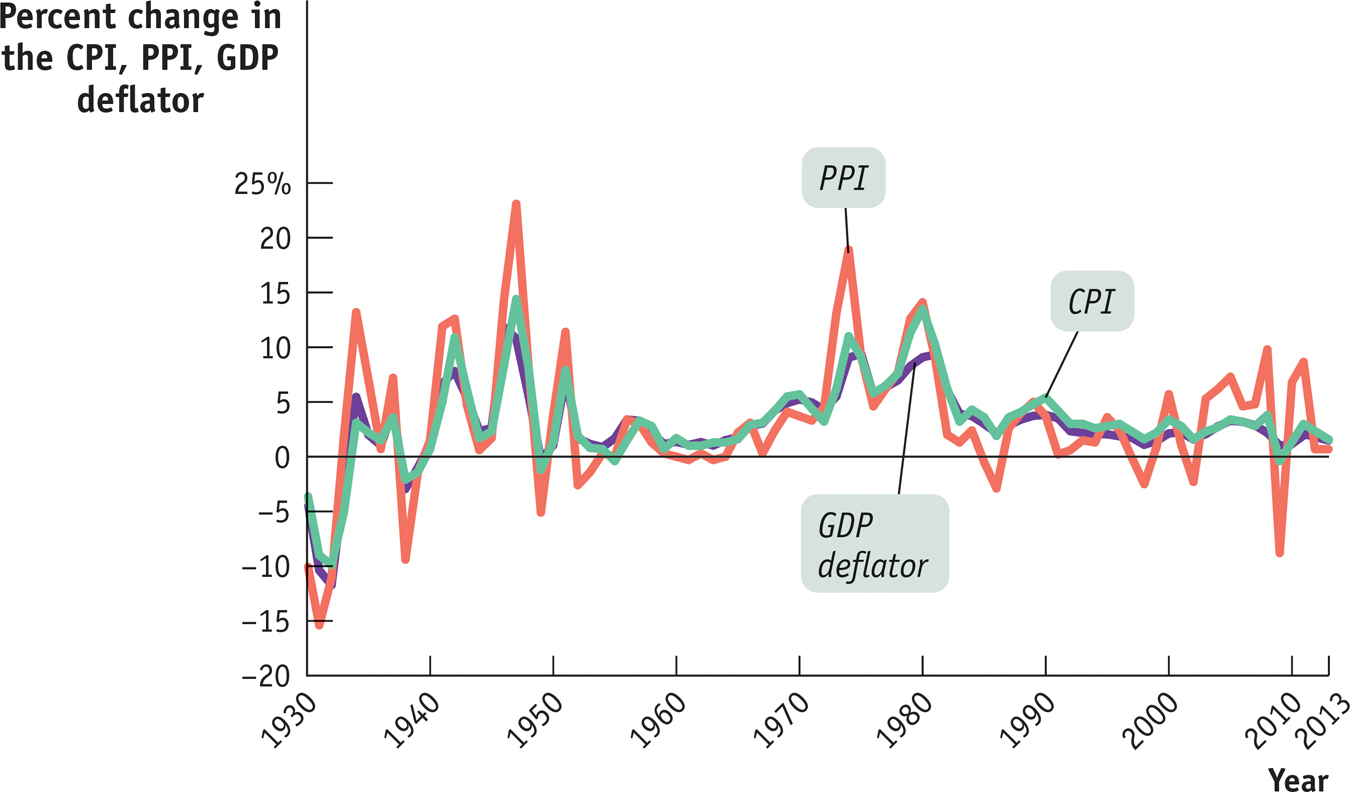

Perhaps the most important point about the different inflation rates generated by these three measures of prices is that they usually move closely together (although the producer price index tends to fluctuate more than either of the other two measures). Figure 7-7 shows the annual percent changes in the three indexes since 1930. By all three measures, the U.S. economy experienced deflation during the early years of the Great Depression, inflation during World War II, accelerating inflation during the 1970s, and a return to relative price stability in the 1990s. Notice, by the way, the dramatic ups and downs in producer prices from 2000 to 2013 on the graph; this reflects large swings in energy and food prices, which play a much bigger role in the PPI than they do in either the CPI or the GDP deflator.

ECONOMICS in Action: Indexing to the CPI

Indexing to the CPI

Although GDP is a very important number for shaping economic policy, official statistics on GDP don’t have a direct effect on people’s lives. The CPI, by contrast, has a direct and immediate impact on millions of Americans.

The reason is that many payments are tied, or “indexed,” to the CPI—

The practice of indexing payments to consumer prices goes back to the dawn of the United States as a nation. In 1780 the Massachusetts State Legislature recognized that the pay of its soldiers fighting the British needed to be increased because of inflation that occurred during the Revolutionary War. The legislature adopted a formula that made a soldier’s pay proportional to the cost of a market basket, consisting of 5 bushels of corn,  pounds of beef, 10 pounds of sheep’s wool, and 16 pounds of shoe leather.

pounds of beef, 10 pounds of sheep’s wool, and 16 pounds of shoe leather.

Today, 54 million people receive payments from Social Security, a national retirement program that accounts for almost a quarter of current total federal spending—

Other government payments are also indexed to the CPI. In addition, income tax brackets, the bands of income levels that determine a taxpayer’s income tax rate, are also indexed to the CPI. (An individual in a higher income bracket pays a higher income tax rate in a progressive tax system like ours.) Indexing also extends to the private sector, where many private contracts, including some wage settlements, contain cost-

Because the CPI plays such an important and direct role in people’s lives, it’s a politically sensitive number. The Bureau of Labor Statistics, which calculates the CPI, takes great care in collecting and interpreting price and consumption data. It uses a complex method in which households are surveyed to determine what they buy and where they shop, and a carefully selected sample of stores are surveyed to get representative prices.

Quick Review

Changes in the aggregate price level are measured by the cost of buying a particular market basket during different years. A price index for a given year is the cost of the market basket in that year normalized so that the price index equals 100 in a selected base year.

The inflation rate is calculated as the percent change in a price index. The most commonly used price index is the consumer price index, or CPI, which tracks the cost of a basket of consumer goods and services. The producer price index, or PPI, does the same for goods and services used as inputs by firms. The GDP deflator measures the aggregate price level as the ratio of nominal to real GDP times 100. These three measures normally behave quite similarly.

7-3

Question 7.6

Consider Table 7-3 but suppose that the market basket is composed of 100 oranges, 50 grapefruit, and 200 lemons. How does this change the pre-

frost and post- frost price indexes? Explain. Generalize your explanation to how the construction of the market basket affects the price index. Question 7.7

For each of the following events, how would an economist using a 10-

year- old market basket create a bias in measuring the change in the cost of living today? A typical family owns more cars than it would have a decade ago. Over that time, the average price of a car has increased more than the average prices of other goods.

Virtually no households had broadband internet access a decade ago. Now many households have it, and the price has regularly fallen each year.

Question 7.8

The consumer price index in the United States (base period 1982–

1984) was 226.229 in 2012 and 229.324 in 2013. Calculate the inflation rate from 2012 to 2013.

Solutions appear at back of book.

Getting a Jump on GDP

GDP matters. Investors and business leaders are always anxious to get the latest numbers. When the Bureau of Economic Analysis releases its first estimate of each quarter’s GDP, normally on the 27th or 28th day of the month after the quarter ends, it’s invariably a big news story.

In fact, many companies and other players in the economy are so eager to know what’s happening to GDP that they don’t want to wait for the official estimate. So a number of organizations produce numbers that can be used to predict what the official GDP number will say. Let’s talk about two of those organizations, the economic consulting firm Macroeconomic Advisers and the nonprofit Institute of Supply Management.

Macroeconomic Advisers takes a direct approach: it produces its own estimates of GDP based on raw data from the U.S. government. But whereas the Bureau of Economic Analysis estimates GDP only on a quarterly basis, Macroeconomic Advisers produces monthly estimates. This means that clients can, for example, look at the estimates for January and February and make a pretty good guess at what first-

The Institute for Supply Management (ISM) takes a very different approach. It relies on monthly surveys of purchasing managers—

Responses to the surveys are released in the form of indexes showing the percentage of companies that are expanding. Obviously, these indexes don’t directly tell you what is happening to GDP. But historically, the ISM indexes have been strongly correlated with the rate of growth of GDP, and this historical relationship can be used to translate ISM data into “early warning” GDP estimates.

So if you just can’t wait for those quarterly GDP numbers, you’re not alone. The private sector has responded to demand, and you can get your data fix every month.

QUESTIONS FOR THOUGHT

Question 7.9

Why do businesses care about GDP to such an extent that they want early estimates?

Question 7.10

How do the methods of Macroeconomic Advisers and the Institute for Supply Management fit into the three different ways to calculate GDP?

Question 7.11

If private firms are producing GDP estimates, why do we need the Bureau of Economic Analysis?