Gross Domestic Product

Final goods and services are goods and services sold to the final, or end, user.

A consumer’s purchase of a new car from a dealer is one example of a sale of final goods and services: goods and services sold to the final, or end, user. But an automobile manufacturer’s purchase of steel from a steel foundry or glass from a glassmaker is an example of purchasing intermediate goods and services: goods and services that are inputs for production of final goods and services. In the case of intermediate goods and services, the purchaser—

Intermediate goods and services are goods and services—

Gross domestic product, or GDP, is the total value of all final goods and services produced in the economy during a given year.

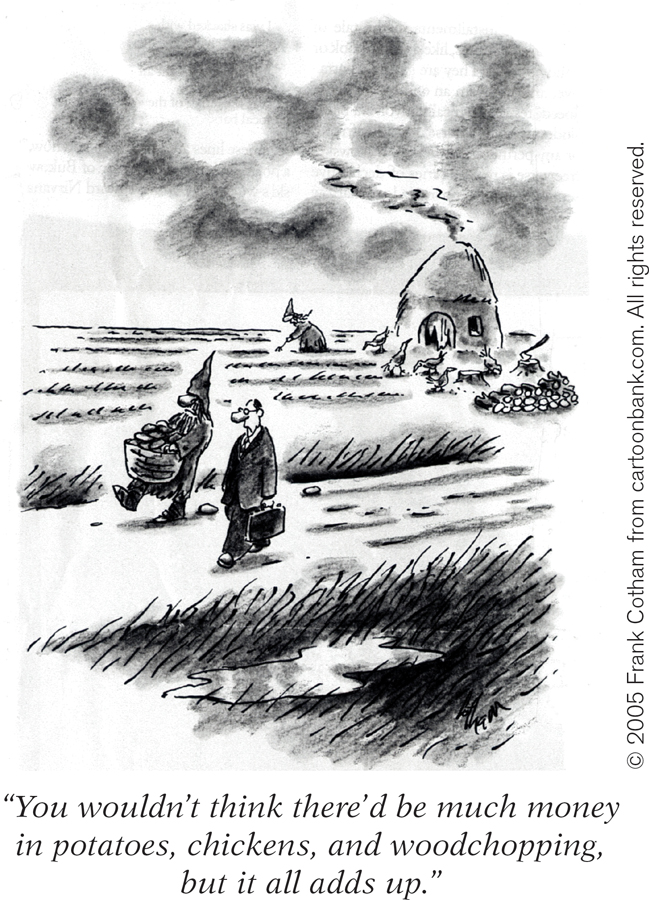

Gross domestic product, or GDP, is the total value of all final goods and services produced in an economy during a given period, usually a year. In 2013 the GDP of the United States was $16,800 billion, or about $53,000 per person. If you are an economist trying to construct a country’s national accounts, one way to calculate GDP is to calculate it directly: survey firms and add up the total value of their production of final goods and services. We’ll explain in detail in the next section why intermediate goods, and some other types of goods as well, are not included in the calculation of GDP.

But adding up the total value of final goods and services produced isn’t the only way of calculating GDP. There is another way, based on total spending on final goods and services. Since GDP is equal to the total value of final goods and services produced in the economy, it must also equal the flow of funds received by firms from sales in the goods and services market.

Aggregate spending, the sum of consumer spending, investment spending, government purchases of goods and services, and exports minus imports, is the total spending on domestically produced final goods and services in the economy.

If you look again at the circular-

And there is yet a third way of calculating GDP, based on total income earned in the economy. Firms, and the factors of production that they employ, are owned by households. So firms must ultimately pay out what they earn to households. The flow from firms to the factor markets is the factor income paid out by firms to households in the form of wages, profit, interest, and rent. Again, by accounting rules, the value of the flow of factor income from firms to households must be equal to the flow of money into firms from the markets for goods and services. And this last value, we know, is the total value of production in the economy—

Why is GDP equal to the total value of factor income paid by firms in the economy to households? Because each sale in the economy must accrue to someone as income—