1.1 Module 43: The Cost-Minimizing Input Combination

(right) iStockphoto

WHAT YOU WILL LEARN

How firms determine the optimal input mix

How firms determine the optimal input mix

The cost-

The cost-minimizing rule for hiring inputs

In the previous section we discussed the markets for factors of production and how firms determine the optimal quantity of each factor to hire. But firms don’t determine how much of each input to hire separately. Production requires multiple inputs, and firms must decide what combination of inputs to use to produce their output. In this module, we will look at how firms decide the optimal combination of factors for producing the desired level of output.

Alternative Input Combinations

In many instances a firm can choose among a number of alternative combinations of inputs that will produce a given level of output. For example, on George and Martha’s wheat farm, the decision might involve labor and capital. To produce their optimal quantity of wheat, they could choose to have a relatively capital-

The same amount of wheat can be produced using many different combinations of capital and labor. George and Martha must determine which combination of inputs will maximize their profits.

To begin our study of the optimal combination of inputs, we’ll look at the relationship between the inputs used for production. Depending on the situation, inputs can be either substitutes or complements.

Substitutes and Complements in Factor Markets

Early in this book we discussed substitutes and complements in the context of the supply and demand model. Two goods are substitutes if a rise in the price of one good makes consumers more willing to buy the other good. For example, an increase in the price of oranges will cause some buyers to switch from purchasing oranges to purchasing tangerines.

When buyers tend to consume two goods together, the goods are known as complements. For example, cereal and milk are considered complements because many people consume them together. If the price of cereal increases, people will buy less cereal and therefore need less milk. The decision about how much of a good to buy is influenced by the prices of related goods.

The concepts of substitutes and complements also apply to a firm’s purchase of inputs. And just as the price of related goods affects consumers’ purchasing decisions, the price of other inputs can affect a firm’s decision about how much of an input it will use. In some situations, capital and labor are substitutes. For example, George and Martha can produce the same amount of wheat by substituting more tractors for fewer farm workers. Likewise, ATM machines can substitute for bank tellers.

Capital and labor can also be complements when more of one increases the marginal product of the other. For example, a farm worker is more productive when George and Martha buy a tractor, and each tractor requires a worker to drive it. Office workers are more productive when they can use faster computers, and doctors are more productive with modern X-

Given the relationship between inputs, how does a firm determine which of the possible combinations to use?

Determining the Optimal Input Mix

If several alternative input combinations can be used to produce the optimal level of output, a profit-

Cost Minimization

How does a firm determine the combination of inputs that maximizes profits? Let’s consider this question using an example.

Imagine you manage a grocery store chain and you need to decide the right combination of self-

| Capital (self- |

Labor (cashiers) | |

|---|---|---|

| Rental rate = $1,000/month | Wage rate = $1,600/month | |

| a. | 20 | 4 |

| b. | 10 | 10 |

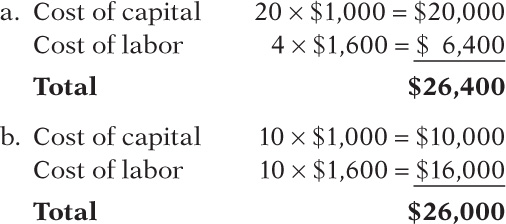

If you can check out the same number of customers using either of these combinations of capital and labor, how do you decide which combination of inputs to use? By finding the input combination that costs the least—

Assume that the cost to rent, operate, and maintain a self-

Clearly, your firm would choose the lower cost combination, combination b, and hire 10 cashiers and put in 10 self-

When firms must choose between alternative combinations of inputs, they evaluate the cost of each combination and select the one that minimizes the cost of production. This can be done by calculating the total cost of each alternative combination of inputs, as shown in this example. However, because the number of possible combinations can be very large, it is more practical to use marginal analysis to find the cost-

The Cost-Minimization Rule

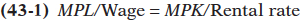

We already know that the additional output that results from hiring an additional unit of an input is the marginal product (MP) of that input. Firms want to receive the highest possible marginal product from each dollar spent on inputs. To do this, firms adjust their hiring of inputs until the marginal product per dollar is equal for all inputs. This is the cost-

A firm determines the cost-

To understand why cost minimization occurs when the marginal product per dollar is equal for all inputs, let’s start by looking at two counterexamples. Consider a situation in which the marginal product of labor per dollar is greater than the marginal product of capital per dollar. This situation is described by Equation 43-

Suppose the marginal product of labor is 20 units and the marginal product of capital is 100 units. If the wage is $10 and the rental rate for capital is $100, then the marginal product per dollar will be 20/$10 = 2 units of output per dollar for labor and 100/$100 = 1 unit of output per dollar for capital. The firm is receiving 2 additional units of output for each dollar spent on labor and only 1 additional unit of output for each dollar spent on capital. In this case, the firm gets more additional output for its money by hiring labor, so it should hire more labor and less capital.

Because of diminishing returns, as the firm hires more labor, the marginal product of labor falls and as it hires less capital, the marginal product of capital rises. The firm will continue to substitute labor for capital until the falling marginal product of labor per dollar meets the rising marginal product of capital per dollar and the two are equivalent. That is, the firm will adjust its hiring of capital and labor until the marginal product per dollar spent on each input is equal, as in Equation 43-

Next, consider a situation in which the marginal product of capital per dollar is greater than the marginal product of labor per dollar. This situation is described by Equation 43-

Let’s continue with the assumption that the marginal product of labor for the last unit of labor hired is 20 units and the marginal product of capital for the last unit of capital hired is 100 units. If the wage is $10 and the rental rate for capital is $25, then the marginal product per dollar will be 20/$10 = 2 units of output per dollar for labor and 100/$25 = 4 units of output per dollar for capital. The firm is receiving 4 additional units of output for each dollar spent on capital and only 2 additional units of output for each dollar spent on labor. In this case, the firm gets more additional output for its money by hiring capital, so it should hire more capital and less labor.

Because of diminishing returns, as the firm hires more capital, the marginal product of capital falls, and as it hires less labor, the marginal product of labor rises. The firm will continue to hire more capital and less labor until the falling marginal product of capital per dollar meets the rising marginal product of labor per dollar to satisfy the cost-

The cost-

Module 43 Review

Solutions appear at the back of the book.

Check Your Understanding

1. A firm produces its output using only capital and labor. Labor costs $100 per worker per day and capital costs $200 per unit per day. If the marginal product of the last worker employed is 500 and the marginal product of the last unit of capital employed is 1,000, is the firm employing the cost-

Multiple-

Question

m6VB3MwhUPPCJ20WaKrnv3EJI6dgl0DLbBjNdd/Zm9NjwE1qyH8y9ErO2l8NMxNQKtvB2U9eSwEXuNXciocsGyL69dC66zYaTSOYEOa/jJWq2Y3v7PbP/p3/tXDjS9wBc/YqhZcunOhwRWmvXHWqKhuoa3Lzp+DmzXbK2i5ulpS7xelIgNxIlR6z9uq3I6me21fbJ0xDQ0qiUj7L6NJXjw8zwmZuVFG4I4nfTRXwz+hABhxKGGiWGrb2YCI+e1jyQ1v8hd7nX1qqaF02ye0vGCoBpVguVSpyMdrHVX1uOigTqrISEj3a6v8XprWqvfiHwq52kAko4MegPZgIq3Agczw3H1fZc8kq8R4/rNko9VapPHI2/9VnkBLc/1leCx7+BUYTL1J4Bhs5JPzf+KyoveCyudCwEoIzQJ4/RfPu4EnicwHTQNIvXfGg1fFZXSFLeXhw+4G+4qPSA1bqPHY+jyGyXig=Question

3v3zdM+MsNuPpCYAc0qivWmkJn0ECDEKPO9PcikpuE4ShzWM4G6m0ej9Wg0XWHV4P7G0Kk6j986MTS/DJwWarTmdSR6OInx3QbCZHunWOd+U0RSLNDgerYCJKX71zS8vXJ3XbN4nO9oc+HyfuSok0Z5C5vFZSVFSauJp/EIwqL91FsfCWV9BcAQpaV1yPj4gOeBCG8H+nSrNxjrkaAwUWV9ixZJSSww+hVMgP/DOthEVJc7yrjS7r/93biNyGV7RPHKERlh8CumwbaokiYbtABEuw2QKxKzaW8B+S2zTAksyAHI6V0LctP2JH3Y2W9FHIEyXDFEMGL267zzgiWnbGe9sPW8igL1z2A61ZnpTxEuqdQ/dsjaxlKlbw3DG+rG4+uHf1rR0VSiwT/0gVDTDeg==Question

mjmsxorS7wby1hp5FBjhTVJgEicTYTTyOISHodrOUGbMImxTL1vhIFU9NF2ConkFmxnP+lC/W5D2KRqMQvZPTq2cWwSHstYrhHfGt9+/1XMn02Xfw8v9IIBgBjtq7JQq600vD0//cxGiQtzwqp98Jz5LG9Q0udAmgojPOg3xND+aE1Y+B9M2MwVZ8TmVgovm6nKu5TPqW+oeZzxo7Y0bJ7Z+sIy/2PZdr/kA0epDcsWVUt9b2CN7GeitsREgGVArPp2PEHXBETtf0phTTxkrFyIdr0MKRCJ1CCzAYfBRH2sCkGaCH/DJhDkjoPyKvjuops74CtpZpKLfgHcJGtsZTCFxtXxecFbmsAUiNgWxZp4OdUPApXGQDzKCLYcO4SXKfKW4UdpMDCzhRS8oqgxMLzsXDNjKPmO4Y8f1EW9qzPzfEik0cb02MG6g3gfimpZ6WbX1aZTOX5oQahNggF75sqZVK6EpNZ+yfKwCYkLsUU1QdIuIQuestion

2LvzgxsbpaqPFQsILSMJn8qrmMm4EFBHHoIXVXidqBU/b+ZIZR7Hybe4/DRWsmD9L3wHrAR24SFAl2OBQHMK/4+El29huD090aU7JOMyFKE/Jd5NV0I6bLrVr2QyUzKxeDVX4/V/J0YCLO0gBau6qKvTSOlarx+BGQV3kSrwDSb4zZRcLpx+Zrf/NmwClA9FGhpZ8AaOVvQLYU1UzcTODOVN24yrPmUr/SPspi4SeRUxDYmgW/XIKreW9uNnmSwQfPVkcmda4vHis0nIIuYNyi8DCiFkPvjmYGRAnkeIxynNsJzuS5bNeQHvUHGS3usuj2GF3ezzp4dSv4dDcnHfdH9xaz0OD8eVVifEZ80qddpkdYNRsw0mmH8HUj2DZ83MLYzTPBxi+m1UHyoyrRCEZqZaSumc8HAbKdohf5CXk6U/4+p5fNmK0UBBV1YiemVQHDTsVOn9MkImwpyABWLBIeRa5/PC1eBYXorXmHqf5u6eBPgRrzVFZE5frOA2qBzl4Qn4woSTqCz3ygwYaXF7qg==Question

GVzCR52FXdEO2AkqTti8jg5MI4DrSUL6xnlTCwSgbM0vnZvNHIqrp76VhLfPnjzt7kIf33Vj/sP1/Dc6vKQAWftMDRQkOC4QVX5Sr3Gz152rFnuk5t+FKFSGKzCVy0DvlJOF0faFeQulLBtoIfcgXnlnbUtP5Fwt2O82U6nmEzVi4NgaXupM9wug7viwTk4qlusc6vS1WM4GKrur3rghG/EOClrV9uNPA+aKmq7rZ196Mxg6icbNSUzUS3aDmld+rl99mMa2RaxzEeswyl4TXB7c4y30GZTPeHOYqFTPrmMljHIZZ/Kkmp3u934fI8M2WHpEgDXyJmQZ3w7ocU+PLuoVGyCDKMj/8sbpjJ8sQ3r4a1gsW0QSXjVSgRhRcJQhqU4ZQ5R6SBZmtmCiAz28tdLD4u33D/oh5NSvTPfBCc7s21cbqMvz53eDc5BRpwNcpYa6+F57goJcEYYdqs4FKrzGUbRT6OHL9EY/ISjTe9zjIm33WBeAv9wk9shfLUr1xelLECwz2R9UEM39tFKdInm3jSwojXUjdV+Vdkz8kpcLBV7SBlZvzBe6mIGv0f8q1SzeMdETNikgd5m9l8sefHeamtOTKqqTQE0aToF6ncSuhmyKimLPmN6+w2FQzQj7f1Zz+HBySmWoxVyeG8Az2cl90ve6wvv4Q5gVgg==Critical-

Refer to the accompanying table to answer the questions. Assume that the wage is $10 per day and the price of pencils is $1.

| Quantity of labor (workers) | Quantity produced (pencils) |

|---|---|

| 0 | 0 |

| 1 | 40 |

| 2 | 90 |

| 3 | 120 |

| 4 | 140 |

| 5 | 150 |

| 6 | 160 |

| 7 | 166 |

1. What is the MPL of the 4th worker?

2. What is the MPL per dollar of the 5th worker?

3. How many workers would the firm hire if it hired every worker for whom the marginal product per dollar is greater than or equal to 1 pencil per dollar?

4. If the marginal product per dollar spent on labor is 1 pencil per dollar, the marginal product of the last unit of capital hired is 100 pencils per dollar, and the rental rate is $50 per day, is the firm minimizing its cost? Explain.