1.1 Module 1: The Study of Economics

WHAT YOU WILL LEARN

How scarcity and choice are central to the study of economics

How scarcity and choice are central to the study of economics

The importance of opportunity cost in individual choice and decision making

The importance of opportunity cost in individual choice and decision making

The difference between positive economics and normative economics

The difference between positive economics and normative economics

When economists agree and why they sometimes disagree

When economists agree and why they sometimes disagree

What makes macroeconomics different from microeconomics

What makes macroeconomics different from microeconomics

Individual Choice: The Core of Economics

Economics is the study of scarcity and choice.

Individual choice is decisions by individuals about what to do, which necessarily involve decisions about what not to do.

Economics is the study of scarcity and choice. Every economic issue involves, at its most basic level, individual choice—decisions by individuals about what to do and what not to do. In fact, you might say that it isn’t economics if it isn’t about choice.

Step into a big store such as Walmart or Target. There are thousands of different products available, and it is extremely unlikely that you—or anyone else—could afford to buy everything you might want to have. And anyway, there’s only so much space in your home. Given the limitations on your budget and your living space, you must choose which products to buy and which to leave on the shelf.

An economy is a system for coordinating a society’s productive and consumptive activities.

In a market economy, the decisions of individual producers and consumers largely determine what, how, and for whom to produce, with little government involvement in the decisions.

The fact that those products are on the shelf in the first place involves choice—the store manager chose to put them there, and the manufacturers of the products chose to produce them. The economy is a system that coordinates choices about production with choices about consumption, and distributes goods and services to the people who want them. The United States has a market economy, in which production and consumption are the result of decentralized decisions by many firms and individuals. There is no central authority telling people what to produce or where to ship it. Each individual producer makes what he or she thinks will be most profitable, and each consumer buys what he or she chooses.

All economic activities involve individual choice. Let’s take a closer look at what this means for the study of economics.

Resources Are Scarce

You can’t always get what you want. Almost everyone would like to have a beautiful house in a great location (and help with the housecleaning), two or three luxury cars, and frequent vacations in fancy hotels. But even in a rich country like the United States, not many families can afford all of that. So they must make choices—whether to go to Disney World this year or buy a better car, whether to make do with a small backyard or accept a longer commute in order to live where land is cheaper.

Limited income isn’t the only thing that keeps people from having everything they want. Time is also in limited supply: there are only 24 hours in a day. And because the time we have is limited, choosing to spend time on one activity also means choosing not to spend time on a different activity—spending time studying for an exam means forgoing a night at the movies. Indeed, many people feel so limited by the number of hours in the day that they are willing to trade money for time. For example, convenience stores usually charge higher prices than larger supermarkets. But they fulfill a valuable role by catering to customers who would rather pay more than spend the time traveling farther to a supermarket where they might also have to wait in longer lines.

A resource is anything that can be used to produce something else.

Land refers to all resources that come from nature, such as minerals, timber, and petroleum.

Labor is the effort of workers.

Physical capital refers to manufactured goods used to make other goods and services.

Human capital refers to the educational achievements and skills of the labor force, which enhance its productivity.

Why do individuals have to make choices? The ultimate reason is that resources are scarce. A resource is anything that can be used to produce something else. The economy’s resources, sometimes called factors of production, can be classified into four categories: land (including timber, water, minerals, and all other resources that come from nature), labor (the effort of workers), physical capital (machinery, buildings, tools, and all other manufactured goods used to make other goods and services), and human capital (the educational achievements and skills of the labor force, which enhance its productivity).

A scarce resource is not available in sufficient quantities to satisfy all the various ways a society wants to use it.

A resource is scarce when there is not enough of it available to satisfy the various ways a society wants to use it. For example, there are limited supplies of oil and coal, which currently provide most of the energy used to produce and deliver everything we buy. And in a growing world economy with a rapidly increasing human population, even clean air and water have become scarce resources.

Just as individuals must make choices, the scarcity of resources means that society as a whole must make choices. One way for a society to make choices is simply to allow them to emerge as the result of many individual choices. For example, there are only so many hours in a week, and Americans must decide how to spend their time. How many hours will they spend going to supermarkets to get lower prices rather than saving time by shopping at convenience stores? The answer is the sum of individual decisions: each of the millions of individuals in the economy makes his or her own choice about where to shop, and society’s choice is simply the sum of those individual decisions.

For various reasons, there are some decisions that a society decides are best not left to individual choice. For example, two of the authors live in an area that until recently was mainly farmland but is now being rapidly built up. Most local residents feel that the community would be a more pleasant place to live if some of the land were left undeveloped. But no individual has an incentive to keep his or her land as open space, rather than sell it to a developer. So a trend has emerged in many communities across the United States of local governments purchasing undeveloped land and preserving it as open space. Decisions about how to use scarce resources are often best left to individuals but sometimes should be made at a higher, community-wide, level.

Opportunity Cost: The Real Cost of Something Is What You Must Give Up to Get It

It is the last term before you graduate, and your class schedule allows you to take only one elective. There are two, however, that you would really like to take: Intro to Computer Graphics and History of Jazz.

The real cost of an item is its opportunity cost: what you must give up in order to get it.

Suppose you decide to take the History of Jazz course. What’s the cost of that decision? It is the fact that you can’t take the computer graphics class, your next best alternative choice. Economists call that kind of cost—what you must give up in order to get an item you want—the opportunity cost of that item. So the opportunity cost of taking the History of Jazz class is the benefit you would have derived from the Intro to Computer Graphics class.

The concept of opportunity cost is crucial to understanding individual choice because, in the end, all costs are opportunity costs. That’s because every choice you make means forgoing some other alternative. Sometimes critics claim that economists are concerned only with costs and benefits that can be measured in dollars and cents. But that is not true. Much economic analysis involves cases like our elective course example, where it costs no extra tuition to take one elective course—that is, there is no direct monetary cost. Nonetheless, the elective you choose has an opportunity cost—the other desirable elective course that you must forgo because your limited time permits taking only one. More specifically, the opportunity cost of a choice is what you forgo by not choosing your next best alternative.

You might think that opportunity cost is an add-on—that is, something additional to the monetary cost of an item. Suppose that an elective class costs additional tuition of $750; now there is a monetary cost to taking History of Jazz. Is the opportunity cost of taking that course something separate from that monetary cost?

Well, consider two cases. First, suppose that taking Intro to Computer Graphics also costs $750. In this case, you would have to spend that $750 no matter which class you take. So what you give up to take the History of Jazz class is still the computer graphics class, period—you would have to spend that $750 either way. But suppose there isn’t any fee for the computer graphics class. In that case, what you give up to take the jazz class is the benefit from the computer graphics class plus the benefit you could have gained from spending the $750 on other things.

Either way, the real cost of taking your preferred class is what you must give up to get it. As you expand the set of decisions that underlie each choice—whether to take an elective or not, whether to finish this term or not, whether to drop out or not—you’ll realize that all costs are ultimately opportunity costs.

Sometimes the money you have to pay for something is a good indication of its opportunity cost. But many times it is not. One very important example of how poorly monetary cost can indicate opportunity cost is the cost of attending college. Tuition and housing are major monetary expenses for most students; but even if these things were free, attending college would still be an expensive proposition because most college students, if they were not in college, would have a job. That is, by going to college, students forgo the income they could have earned if they had worked instead. This means that the opportunity cost of attending college is what you pay for tuition and housing plus the forgone income you would have earned in a job.

It’s easy to see that the opportunity cost of going to college is especially high for people who could be earning a lot during what would otherwise have been their college years. That is why star athletes like LeBron James and entrepreneurs like Mark Zuckerberg, founder of Facebook, often skip or drop out of college.

GOT A PENNY?

At many cash registers there is a little basket full of pennies. People are encouraged to use the basket to round their purchases up or down. If an item costs $5.02, you give the cashier $5.00 and take two pennies from the basket to give to the cashier. If an item costs $4.99, you pay $5.00 and the cashier throws a penny into the basket. It makes everyone’s life a bit easier. Of course, it would be easier still if we just abolished the penny, a step that some economists have urged.

But why do we have pennies in the first place? If it’s too small a sum to worry about, why calculate prices that precisely?

The answer is that a penny wasn’t always such a negligible sum: the purchasing power of a penny has been greatly reduced by inflation, a general rise in the prices of all goods and services over time. Forty years ago, a penny had more purchasing power than a nickel does today.

Why does this matter? Well, remember the saying “A penny saved is a penny earned”? Of course, there are other ways to earn money, so you must decide whether saving a penny is a productive use of your time. Could you earn more by devoting that time to other uses?

Almost seventy years ago, the average wage was about $1.20 an hour. A penny was equivalent to 30 seconds’ worth of work, so it was worth saving a penny if doing so took less than 30 seconds. But wages have risen along with overall prices, so that the average worker is now paid more than $23 per hour. A penny is therefore equivalent to just a little under 2 seconds of work, so it’s not worth the opportunity cost of the time it takes to worry about a penny more or less.

In short, the rising opportunity cost of time in terms of money has turned a penny from a useful coin into a nuisance.

Microeconomics versus Macroeconomics

Microeconomics is the study of how people make decisions and how those decisions interact.

We have presented economics as the study of choices and described how, at its most basic level, economics is about individual choice. The branch of economics concerned with how individuals make decisions and how these decisions interact is called microeconomics. Microeconomics focuses on choices made by individuals, households, or firms—the smaller parts that make up the economy as a whole.

Macroeconomics is concerned with the overall ups and downs in the economy.

Economic aggregates are economic measures that summarize data across many different markets.

Macroeconomics focuses on the bigger picture—the overall ups and downs of the economy. When you study macroeconomics, you learn how economists explain these fluctuations and how governments can use economic policy to minimize the damage they cause. Macroeconomics focuses on economic aggregates—economic measures such as the unemployment rate, the inflation rate, and gross domestic product—that summarize data across many different markets.

Table 1-1 lists some typical questions that involve economics. A microeconomic version of the question appears on the left, paired with a similar macroeconomic question on the right. By comparing the questions, you can begin to get a sense of the difference between microeconomics and macroeconomics.

| Microeconomic Questions | Macroeconomic Questions |

|---|---|

| Should I go to business school or take a job right now? | How many people are employed in the economy as a whole this year? |

| What determines the salary offered by Citibank to Cherie Camajo, a new MBA? | What determines the overall salary levels paid to workers in a given year? |

| What determines the cost to a university or college of offering a new course? | What determines the overall level of prices in the economy as a whole? |

| What government policies should be adopted to make it easier for low-income students to attend college? | What government policies should be adopted to promote employment and growth in the economy as a whole? |

| What determines whether Citibank opens a new office in Shanghai? | What determines the overall trade in goods, services, and financial assets between the United States and the rest of the world? |

As these questions illustrate, microeconomics focuses on how individuals and firms make decisions, and the consequences of those decisions. For example, a school will use microeconomics to determine how much it would cost to offer a new course, which includes the instructor’s salary, the cost of class materials, and so on. By weighing the costs and benefits, the school can then decide whether or not to offer the course. Macroeconomics, in contrast, examines the overall behavior of the economy—how the actions of all of the individuals and firms in the economy interact to produce a particular economy-wide level of economic performance. For example, macroeconomics is concerned with the general level of prices in the economy and how high or low they are relative to prices last year, rather than with the price of a particular good or service.

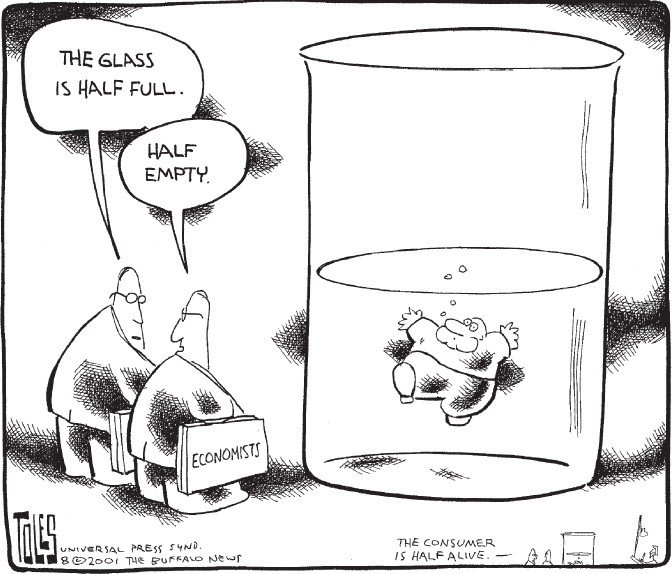

Positive versus Normative Economics

Positive economics is the branch of economic analysis that describes the way the economy actually works.

Normative economics makes prescriptions about the way the economy should work.

Economic analysis, as we will see throughout this book, draws on a set of basic economic principles. But how are these principles applied? That depends on the purpose of the analysis. Economic analysis that is used to answer questions about the way the world works, questions that have definite right and wrong answers, is known as positive economics. In contrast, economic analysis that involves saying how the world should work is known as normative economics.

Imagine that you are an economic adviser to the governor of your state and the governor is considering a change to the toll charged along the state turnpike. Below are three questions the governor might ask you.

- How much revenue will the tolls yield next year?

- How much would that revenue increase if the toll were raised from $1.00 to $1.50?

- Should the toll be raised, bearing in mind that a toll increase would likely reduce traffic and air pollution near the road but impose some financial hardship on frequent commuters?

There is a big difference between the first two questions and the third one. The first two are questions about facts. Your forecast of next year’s toll revenue without any increase will be proved right or wrong when the numbers actually come in. Your estimate of the impact of a change in the toll is a little harder to check—the increase in revenue depends on other factors besides the toll, and it may be hard to disentangle the causes of any change in revenue. Still, in principle there is only one right answer.

But the question of whether or not tolls should be raised may not have a “right” answer—two people who agree on the effects of a higher toll could still disagree about whether raising the toll is a good idea. For example, someone who lives near the turnpike but doesn’t commute on it will care a lot about noise and air pollution but not so much about commuting costs. A regular commuter who doesn’t live near the turnpike will have the opposite priorities.

This example highlights a key distinction between the two roles of economic analysis and presents another way to think about the distinction between positive and normative analysis: positive economics is about description, and normative economics is about prescription. Positive economics occupies most of the time and effort of the economics profession.

Looking back at the three questions the governor might ask, it is worth noting a subtle but important difference between questions 1 and 2. Question 1 asks for a simple prediction about next year’s revenue—a forecast. Question 2 is a “what if” question, asking how revenue would change if the toll were to change. Economists are often called upon to answer both types of questions. Economic models, which provide simplified representations of reality such as graphs or equations, are especially useful for answering “what if” questions.

The answers to such questions often serve as a guide to policy, but they are still predictions, not prescriptions. That is, they tell you what will happen if a policy is changed, but they don’t tell you whether or not that result is good. Suppose that your economic model tells you that the governor’s proposed increase in highway tolls will raise property values in communities near the road but will tax or inconvenience people who currently use the turnpike to get to work. Does that information make this proposed toll increase a good idea or a bad one? It depends on whom you ask. As we’ve just seen, someone who is very concerned with the communities near the road will support the increase, but someone who is very concerned with the welfare of drivers will feel differently. That’s a value judgment—it’s not a question of positive economic analysis.

Still, economists often do engage in normative economics and give policy advice. How can they do this when there may be no “right” answer? One answer is that economists are also citizens, and we all have our opinions. But economic analysis can often be used to show that some policies are clearly better than others, regardless of individual opinions.

Suppose that policies A and B achieve the same goal, but policy A makes everyone better off than policy B—or at least makes some people better off without making other people worse off. Then A is clearly more efficient than B. That’s not a value judgment: we’re talking about how best to achieve a goal, not about the goal itself.

For example, two different policies have been used to help low-income families obtain housing: rent control, which limits the rents landlords are allowed to charge, and rent subsidies, which provide families with additional money with which to pay rent. Almost all economists agree that subsidies are the more efficient policy. (In a later module we’ll see why this is so.) And so the great majority of economists, whatever their personal politics, favor subsidies over rent control.

When policies can be clearly ranked in this way, then economists generally agree. But it is no secret that economists sometimes disagree.

When and Why Economists Disagree

Economists have a reputation for arguing with each other. Where does this reputation come from?

One important answer is that media coverage tends to exaggerate the real differences in views among economists. If nearly all economists agree on an issue—for example, the proposition that rent controls lead to housing shortages—reporters and editors are likely to conclude that there is no story worth covering, and so the professional consensus tends to go unreported. But when there is some issue on which prominent economists take opposing sides—for example, whether cutting taxes right now would help the economy—that does make a good news story. So you hear much more about the areas of disagreement among economists than you do about the many areas of agreement.

It is also worth remembering that economics is, unavoidably, often tied up in politics. On a number of issues, powerful interest groups know what opinions they want to hear. Therefore, they have an incentive to find and promote economists who profess those opinions, which gives these economists a prominence and visibility out of proportion to their support among their colleagues.

Although the appearance of disagreement among economists exceeds the reality, it remains true that economists often do disagree about important things. For example, some highly respected economists argue vehemently that the U.S. government should replace the income tax with a value-added tax (a national sales tax, which is the main source of government revenue in many European countries). Other equally respected economists disagree. What are the sources of this difference of opinion?

One important source of differences is in values: as in any diverse group of individuals, reasonable people can differ. In comparison to an income tax, a value-added tax typically falls more heavily on people with low incomes. So an economist who values a society with more social and income equality will likely oppose a value-added tax. An economist with different values will be less likely to oppose it.

A second important source of differences arises from the way economists conduct economic analysis. Economists base their conclusions on models formed by making simplifying assumptions about reality. Two economists can legitimately disagree about which simplifications are appropriate—and therefore arrive at different conclusions.

WHEN ECONOMISTS AGREE

“If all the economists in the world were laid end to end, they still couldn’t reach a conclusion.” So goes one popular economist joke. But do economists really disagree that much?

Not according to a classic survey of members of the American Economic Association, reported in the May 1992 issue of the American Economic Review. The authors asked respondents to agree or disagree with a number of statements about the economy; what they found was a high level of agreement among professional economists on many of the statements. At the top of the list, with more than 90% of the economists agreeing, were the statements “Tariffs and import quotas usually reduce general economic welfare” and “A ceiling on rents reduces the quantity and quality of housing available.” What’s striking about these two statements is that many noneconomists disagree: tariffs and import quotas to keep out foreign-produced goods are favored by many voters, and proposals to do away with rent control in cities like New York and San Francisco have met fierce political opposition.

So is the stereotype of quarreling economists a myth? Not entirely. Economists do disagree quite a lot on some issues, especially in macroeconomics, but there is a large area of common ground.

Suppose that the U.S. government was considering a value-added tax. Economist A may rely on a simplification of reality that focuses on the administrative costs of tax systems—that is, the costs of monitoring compliance, processing tax forms, collecting the tax, and so on. This economist might then point to the well-known high costs of administering a value-added tax and argue against the change. But economist B may think that the right way to approach the question is to ignore the administrative costs and focus on how the proposed law would change individual savings behavior. This economist might point to studies suggesting that value-added taxes promote higher consumer saving, a desirable result. Because the economists have made different simplifying assumptions, they find themselves on different sides of the issue.

Most such disputes are eventually resolved by the accumulation of evidence that shows which of the various simplifying assumptions made by economists does a better job of fitting the facts. However, in economics, as in any science, it can take a long time before research settles important disputes—decades, in some cases. And since the economy is always changing in ways that make old approaches invalid or raise new policy questions, there are always new issues on which economists disagree. The policy maker must then decide which economist to believe.

Module 1 Review

Solutions appear at the back of the book.

Check Your Understanding

1. What are the four categories of resources? Give an example of a resource from each category.

2. What type of resource is each of the following?

-

a. time spent flipping hamburgers at a restaurant

-

b. a bulldozer

-

c. a river

3. You make $45,000 per year at your current job with Whiz Kids Consultants. You are considering a job offer from Brainiacs, Inc., which would pay you $50,000 per year. Which of the following are elements of the opportunity cost of accepting the new job at Brainiacs, Inc.? Answer yes or no, and explain your answer.

-

a. the increased time spent commuting to your new job

-

b. the $45,000 salary from your old job

-

c. the more spacious office at your new job

4. Identify each of the following statements as positive or normative, and explain your answer.

-

a. Society should take measures to prevent people from engaging in dangerous personal behavior.

-

b. People who engage in dangerous personal behavior impose higher costs on society through higher medical costs.

Multiple-Choice Questions

Question

q55BBlN7nSG0SiVfSFiyMGFD0TzNfuNo5FGdy6NB7SQHnYaAq32RWC34657XhAKW7c/hkBmp9GP+ER7rwNaxu/f1Dp2H74uxu1kBvkq+uiAN1/9VrHnY8FZ29zB7xYots4w+uxd8ENwrlAFDZDjeyOs2nHVT4q3DBfQAhg7pckf/LC91un0dCXaXuIpfCMawhY+Og+yt89VbIcY+WUD4OubW+ZsZzAxbPwtHk1Y2khi153LXFWZWEiYrLHkKHeFjG4uBO9G1uSOIyXayjY6ebD4r224VI6225fiImz6bReQDHUgjIPr0NUMuBhWrQHyH0QJAth73g0wHohY+4VIM2L2PnBcHEgnJ8MX4Sy1eZKdI651zbXxA9N0hyC4J8C4knSVExqSGirTgcwKcBmAOFOHhSHs2rp/YQuestion

gKvvk3CXHFmfPZ9MBhvquH2HPhnP3mJlGJh8iOmzHdE2+X0U6ixhoKk0sqi2wrXB+ki8TyxXyyyob9uMsZLgx2bplAdOyRM1aHVJDpAxa2vn6FKSEDrm1Zbu8DR9+AdsYxs9PRNfz4ZzSwQSvACndRia+XW6uVVhnrzH7+TmO22Mg7Ic2GMTf52UE80St0IPfP6oWv5Ouk7yQ/5/3s4mNQgo7aW7UMeTRCHjFvWB6md+fIqdNM25aeOriCASAb72LjrNi5oy3l8AGis88xTlPuefFu7QMpnXhuEApgHLMnmSL0FZnv8CobqGbmzpCGHWcfMD++ZvjpDC7ZlOjvXqyZT6rz5MfzNg3Fgq7ZKXRw8XrkRSj6Gb1NcpaTNXveDqNBJV8rSFvizgNeQxULr7pbPxgK7fcCxoGugrIn4Anq+ay7pUSsI7/CSPNVscdBiNT0lOVpcFy1gI5Uw1/Jqe8ZRT5gsbTdxHEhLkoUmTHcBSxLqE+ZaYxgJmT4QiJP55ElP3hS97OyeV6XJv/+Sfw7/82DMamo6VZoNGmaWNks773iuNFmuiXLpK8u3/UgeRoA68l4zjIZVINhjpt96SGgy+uLKV3NxsUtzzPaCpdN6W3v1S+ZOKEA==Question

0frknYh7NR+U+n0s9ocpxBgDX5pRLdQjyl2nMprM5k1Wlwj43OkuZtcpbrizpetwtrs9y9lzxvbD0LrSD6oxJJ5gcHL/++80XQ093V8F0o1OcvA0fTuggfLMINSC91c6SamCSeqgM84XhPlo8lkUsCX9LozkOWuPoFKWS1hfdx5w6a5ECj9Aa677EGZHu00qSQqZtbLExrcMoPe6yNnvF+PM6FlBvk9iUza31QwePwufiFBB026X0MAnF5r6loDO0DUOPHul4fQaZJr5qoacVvWQ1DuHOPaZqLJm/cEWj8ssgWwFNEwULeItn25Azwr9qm3YEsHfFaULDBEHuz++xZTdPA9DKh8N0K9eA5N+anRArjJJxXUQ3/6SnVBoJWPFmib93u7jy7rJ/ul2M1EmJk5Tkz5eQR62ExsHfWnBKTY8BiPuEpePU9Tyr+OmOSjEexDSx7wmo37ixzaxFbEa0gxIv8NCBt+851taP0+qfk2CzZ4x5dRzbidegktEptc7netIYg8B8qY=Question

0uI10XwfYpC2C3TWHPo0rAv8ytLcG+90YXrND72QkGF+XfW/WoOQMvwWaOtE8KG2bn0MU9AnP4jhcmx1/88bLrOpUJnkqRR5iP/bXu4M+/mLYvn/dr3LO8hc80QNUi1vQwXtyRoS3pIJXD+Z21Mgb7VsNbXb6WX14frbd8zaJlp2KAklehE7XEtdWzb8ZOQR++H3Q7ttIUU76vYlLgx6hCzMvLhVWik/HYyjGIQRgyW4poZeSCZAokrWv+7gLLmPy5giqmfKBh0G8ZWZq1o1KDRnvx2AsvC/0YUwuLe6xxxaNS1XAQuKBdpv/XkfEDf1brWqsZYFLnSQNnbUeBGyCRGCvVwvwbsUzr4DJ1z6mxilR0Yekl3kzh03AJ3v9j/XSsAsDX/c1/UdUhp4+r+bq2p4mkyZ9ab0QmUOGJMe4A75TBmp2qZELXJoJ8/wW9dkrxYuiRCTEVIp/G5h2CnzxVJ+a92aBHMO0jWeYnkZvkKYZV7ttlA10Gc7Mhb8kgn2SJlj+l0dueE=Question

MiJsMnC9560VWMtwEbwU9xv6NTNaPSd1zPp41Aql0tBbk+q1xRQUekIjo3abucZYYuFrxwJITLKrDoyt4YdrxHu2a7eQ6CiuOkA/q1d4/lT2HvO5wQNQbXOG5wNMQFFhzX29jA71e+W9qjpPxdoPVMgh4JeUYASYxjtzOcIoeYwYSc2B4RknmQrkQjnrFlxlCyzvj4ZKxnL8e/vah1Ot///KW0CnZZQJE6neyDguPJfqQpQCIpX7vcJ6HwNd2EvVdNL+dxu2vUnkEabp86CB8z+PAy7PqJFVLC5jKImInCqU38wDdrZM3um7MtzM28DH2OO7X/h5VoTh/GiYGLPrM76y7cWVd3O9eYoLn5+YCUGglvJCvGocoayTODqIOH1X5h/ElONN7+q25g8j+KsmrUzEY2L2dPqN7lILafvE4y14ZIOaZzVCP27VtN8z8baxhbDAWiuNp2N8Ext3Ouih+M7pACXHGXkz13DpHUPsPaixDPFoa565OO5igj858G9o4Z377ZAME+7GiaNrshai7MZ1PryqF5vFrTsCiOjumuY6v+Yoq7XuIkWzYoqsntYgwCe6RaxtiI1zzm/V7Ga2qfkIVPp65c7mJ9A7AR54LGLfN+SjhTp1qGDvJzHIjLDi5Jr4tAXdxGqeSVv2IYsho5rlqeM=Critical-Thinking Question

In what type of economic analysis do questions have a “right” or “wrong” answer? In what type of economic analysis do questions not necessarily have a “right” answer? On what type of economic analysis do economists tend to disagree most frequently? Why might economists disagree? Explain.