1.3 Module 7: Changes in Equilibrium

WHAT YOU WILL LEARN

How equilibrium price and quantity are affected when there is a change in either supply or demand

How equilibrium price and quantity are affected when there is a change in either supply or demand

How equilibrium price and quantity are affected when there is a simultaneous change in both supply and demand

How equilibrium price and quantity are affected when there is a simultaneous change in both supply and demand

Changes in Supply and Demand

The 2010 floods in Pakistan came as a surprise, but the subsequent increase in the price of cotton was no surprise at all. Suddenly there was a fall in supply: the quantity of cotton available at any given price fell. Predictably, a fall in supply raises the equilibrium price.

The flooding in Pakistan is an example of an event that shifted the supply curve for a good without having much effect on the demand curve. There are many such events. There are also events that shift the demand curve without shifting the supply curve. For example, a medical report that chocolate is good for you increases the demand for chocolate but does not affect the supply. Events often shift either the supply curve or the demand curve, but not both; it is therefore useful to ask what happens in each case.

We have seen that when a curve shifts, the equilibrium price and quantity change. We will now concentrate on exactly how the shift of a curve alters the equilibrium price and quantity.

What Happens When the Demand Curve Shifts

Cotton and polyester are substitutes: if the price of polyester rises, the demand for cotton will increase, and if the price of polyester falls, the demand for cotton will decrease. But how does the price of polyester affect the market equilibrium for cotton?

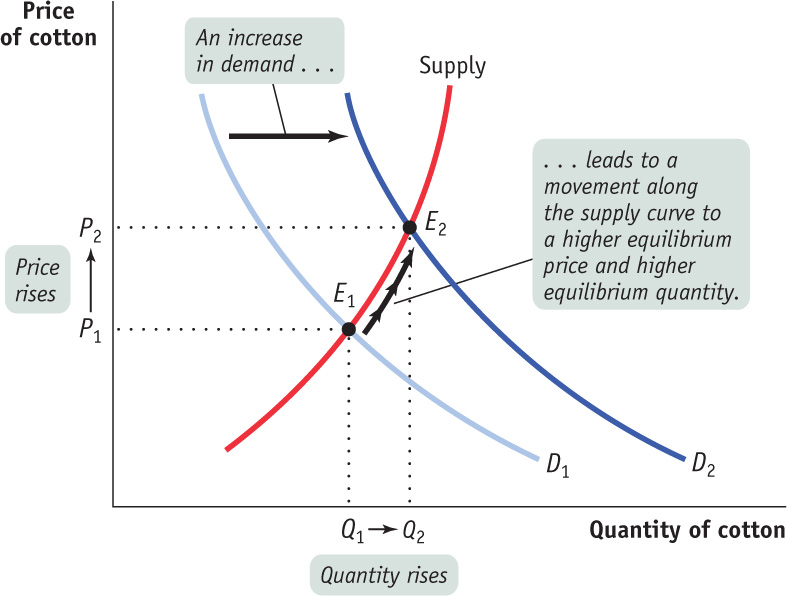

Figure 7-1 shows the effect of a rise in the price of polyester on the market for cotton. The rise in the price of polyester increases the demand for cotton. Point E1 shows the equilibrium corresponding to the original demand curve, with P1 the equilibrium price and Q1 the equilibrium quantity bought and sold.

An increase in demand is indicated by a rightward shift of the demand curve from D1 to D2. At the original market price P1, this market is no longer in equilibrium: a shortage occurs because the quantity demanded exceeds the quantity supplied. So the price of cotton rises and generates an increase in the quantity supplied, an upward movement along the supply curve. A new equilibrium is established at point E2, with a higher equilibrium price, P2, and higher equilibrium quantity, Q2. This sequence of events reflects a general principle: When demand for a good or service increases, the equilibrium price and the equilibrium quantity of the good or service both rise.

What would happen in the reverse case, a fall in the price of polyester? A fall in the price of polyester reduces the demand for cotton, shifting the demand curve to the left. At the original price, a surplus occurs as quantity supplied exceeds quantity demanded. The price falls and leads to a decrease in the quantity supplied, resulting in a lower equilibrium price and a lower equilibrium quantity. This illustrates another general principle: When demand for a good or service decreases, the equilibrium price and the equilibrium quantity of the good or service both fall.

To summarize how a market responds to a change in demand: An increase in demand leads to a rise in both the equilibrium price and the equilibrium quantity. A decrease in demand leads to a fall in both the equilibrium price and the equilibrium quantity.

What Happens When the Supply Curve Shifts

In the real world, it is a bit easier to predict changes in supply than changes in demand. Physical factors that affect supply, like the availability of inputs, are easier to get a handle on than the fickle tastes that affect demand. Still, with supply as with demand, what we can best predict are the effects of shifts of the supply curve.

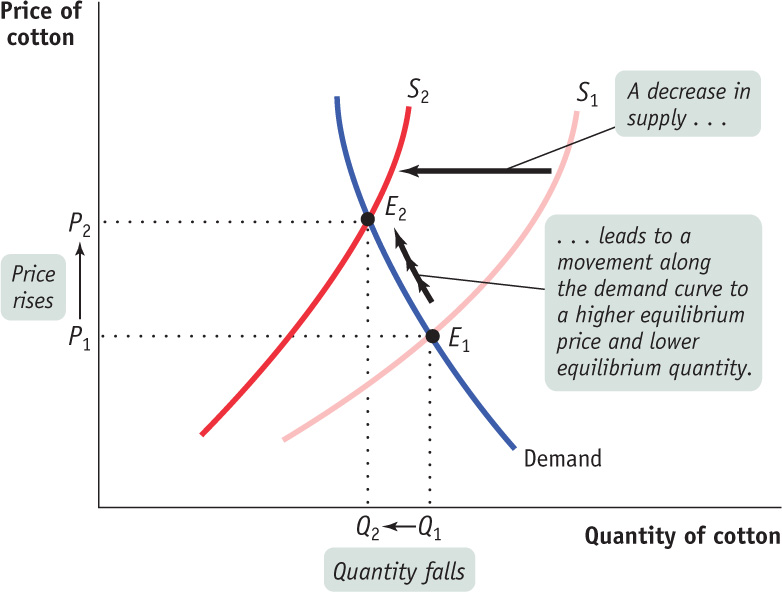

As we mentioned in this chapter’s opening story, devastating floods in Pakistan sharply reduced the supply of cotton in 2010. Figure 7-2 shows how this shift affected the market equilibrium. The original equilibrium is at E1, the point of intersection of the original supply curve, S1, and the demand curve, with an equilibrium price P1 and equilibrium quantity Q1. As a result of the bad weather, supply falls and S1 shifts leftward to S2. At the original price P1, a shortage of cotton now exists and the market is no longer in equilibrium. The shortage causes a rise in price and a fall in quantity demanded, an upward movement along the demand curve. The new equilibrium is at E2, with an equilibrium price P2 and an equilibrium quantity Q2. In the new equilibrium, E2, the price is higher and the equilibrium quantity lower than before. This can be stated as a general principle: When supply of a good or service decreases, the equilibrium price of the good or service rises and the equilibrium quantity of the good or service falls.

What happens to the market when supply increases? An increase in supply leads to a rightward shift of the supply curve. At the original price, a surplus now exists; as a result, the equilibrium price falls and the quantity demanded rises. This describes what happened to the market for cotton as new technology in creased cotton yields. We can formulate a general principle: When supply of a good or service increases, the equilibrium price of the good or service falls and the equilibrium quantity of the good or service rises.

To summarize how a market responds to a change in supply: An increase in supply leads to a fall in the equilibrium price and a rise in the equilibrium quantity. A decrease in supply leads to a rise in the equilibrium price and a fall in the equilibrium quantity.

Simultaneous Shifts of Supply and Demand Curves

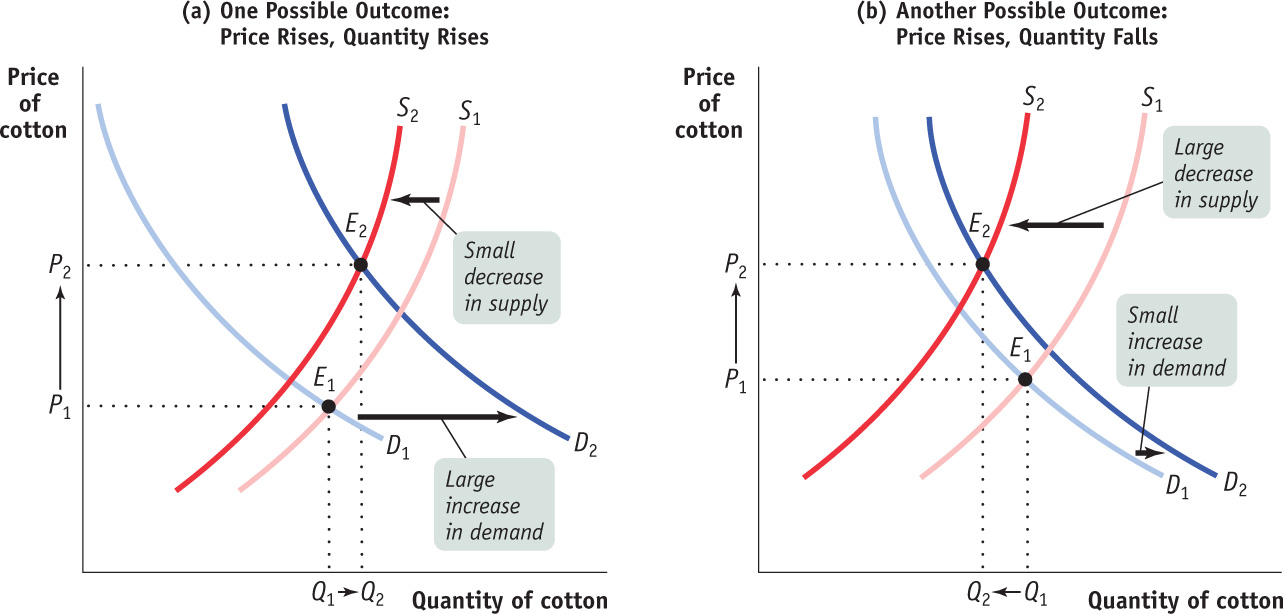

Finally, it sometimes happens that events shift both the demand and supply curves at the same time. This is not unusual; in real life, supply curves and demand curves for many goods and services shift quite often because the economic environment continually changes. Figure 7-3 illustrates two examples of simultaneous shifts. In both panels there is an increase in demand—

In both cases, the equilibrium price rises from P1 to P2, as the equilibrium moves from E1 to E2. But what happens to the equilibrium quantity, the quantity of cotton bought and sold? In panel (a) the increase in demand is large relative to the decrease in supply, and the equilibrium quantity rises as a result. In panel (b), the decrease in supply is large relative to the increase in demand, and the equilibrium quantity falls as a result. That is, when demand increases and supply decreases, the actual quantity bought and sold can go either way, depending on how much the demand and supply curves have shifted.

In general, when supply and demand shift in opposite directions, we can’t predict what the ultimate effect will be on the quantity bought and sold. What we can say is that a curve that shifts a disproportionately greater distance than the other curve will have a disproportionately greater effect on the quantity bought and sold. That said, we can make the following prediction about the outcome when the supply and demand curves shift in opposite directions:

- When demand increases and supply decreases, the equilibrium price rises but the change in the equilibrium quantity is ambiguous.

- When demand decreases and supply increases, the equilibrium price falls but the change in the equilibrium quantity is ambiguous.

But suppose that the demand and supply curves shift in the same direction. Before 2010, this was the case in the global market for cotton, where both supply and demand had increased over the past decade. Can we safely make any predictions about the changes in price and quantity? In this situation, the change in quantity bought and sold can be predicted, but the change in price is ambiguous. The two possible outcomes when the supply and demand curves shift in the same direction (which you should check for yourself) are as follows:

- When both demand and supply increase, the equilibrium quantity rises but the change in equilibrium price is ambiguous.

- When both demand and supply decrease, the equilibrium quantity falls but the change in equilibrium price is ambiguous.

!world_eia!THE RICE RUN OF 2008

In April 2008, the price of rice exported from Thailand—

In much of Asia, governments are major buyers of rice. They buy rice from their rice farmers, who are paid a government-

Now, even farmers in rural areas of Asia have access to the Internet and can see the price quotes on global rice exchanges. And as rice prices rose in response to changes in demand and supply, farmers grew dissatisfied with the government price and instead hoarded their rice in the belief that they would eventually get higher prices. This was a self-

At the same time, India, one of the largest growers of rice, banned Indian exports of rice in order to protect its domestic consumers, causing yet another leftward shift of the supply curve and pushing the price of rice even higher.

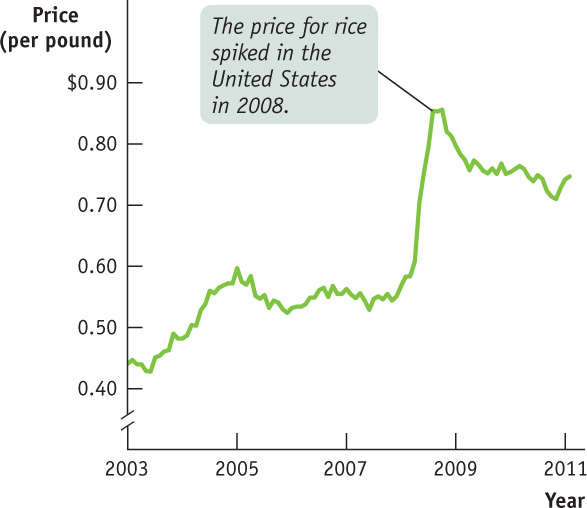

As shown in Figure 7-4, the effects even spilled over to the United States, which had not suffered any fall in its rice production. American rice consumers grew alarmed when large retailers limited some bulk rice purchases in response to the turmoil in the global rice market.

Fearful of paying even higher prices in the future, panic buying set in. As one woman who was in the process of buying 30 pounds of rice said, “We don’t even eat that much rice. But I read about it in the newspaper and decided to buy some.” In San Francisco, some Asian markets reported runs on rice. And, predictably, this led to even higher prices as panic buying shifted the demand curve rightward, further feeding the buying frenzy. As one market owner said, “People are afraid. We tell them, ‘There’s no shortage yet’ but it was crazy in here.”

Module 7 Review

Solutions appear at the back of the book.

Check Your Understanding

1. For each of the following examples, explain how the indicated change affects supply or demand for the good in question and how the shift you describe affects equilibrium price and quantity.

-

a. As the price of gasoline fell in the United States during the 1990s, more people bought large cars.

-

b. As technological innovation has lowered the cost of recycling used paper, fresh paper made from recycled stock is used more frequently.

-

c. When a local cable company offers cheaper pay-

per- view films, local movie theaters have more unfilled seats.

2. Periodically, a computer chip maker like Intel introduces a new chip that is faster than the previous one. In response, demand for computers using the earlier chip decreases as customers put off purchases in anticipation of machines containing the new chip. Simultaneously, computer makers increase their production of computers containing the earlier chip in order to clear out their stocks of those chips.

Draw two diagrams of the market for computers containing the earlier chip: (a) one in which the equilibrium quantity falls in response to these events and (b) one in which the equilibrium quantity rises. What happens to the equilibrium price in each diagram?

Multiple-

Question

Zl4h4haSNQANopoZtYO5jfVhof5JarAv5T0dG6L1s5OpFTjFmLuvRxeT/AssklCrYvXteIyv/hRYOXg0/c0ji0KRcN5TdG2MK6upowYtRqdF+wTneLnA+IozA84cV3TZrz94yifaMYFXuK4RbbAQwtHc+mi0nX9sMBJe/VW8KZdpyONL8MKqJVVCTsr2qJZgxAyXtMkMqTvSCocOL1EBlESrX1HssdPbFQ9eFgADcwWDFlqz8dzCOxuOBFZ8spxnCzDanTM1RSygAP138KfKKiRsJiAABUmLtNT4gigWOZ2Tc8is8uclBNLsrGILp/jfzPceKj3LDU2W8g5EwkC1ZbO+Y5nfOy7HddcqpOpPM0F7Ez8VozhyzwjYzlALZQhlKUrpwzGVjnXd1T8bZZG1yZ0oRggzVGCwCSPOgTtiWhr9e8OgzC6uuUO9NmvB11Pblc1IH8ifcg9tmbUh74+gnDfZzG+vWvTIbVelOdfv6e9rITHHhCH9Wyx23U/7OPXtfaIh4C9WkyAT+CmXJEz2syibaQkPadnrWhpFE+HRR/o/oWcrZqxeOTFNQ8FXM8jfJNJZh5bYNgakOfMGlYImjQ==Question

WfdvmCiDwM94jNrHnh3oEL8LY1Zhmf12jBdMMdPN/K+gscYCQJElqJw+S+xFF2VKIjSO4lxEvvuV8ajgLpXwO3p6eg+t3boNUDSTbxy82I0pnR/TjA9wXsWQNZMQguarxwdEbxSMOuSuKbwIOqaVQnLmW6hd3j6xsiPJHZL9gOFr/e+Wa9ag5gspholBAyg9K909GS8e1V9869SGieCQENTND9POY2m86waJQn8zJJyh0bRXnIMzcNDrK26W34Ji3qp3xu2Z7NNr8Drco7GViPAta5K+y4spVLuKj0yh60rxjxv/rpTNKIcXEqS2cJvNKcvYNMAWekOi4mVpTb0AKjQlEdYmdGvaO/mmt5ea7Y9vgpbaP0ikSqRnEhHGBOfd0nEo4uz75VY8bP6D/u4ZW78eIpRWn7P3znd1cANpybIs3rSpH++PdXuMEp+6xtBPq8CSOr2oq6L6wckG3EMIW0ttBHd8SKJE1JMcHlEedLc67J0chtFfjDRH9USXlIFdOEmlJPP6/10lh9mMtpC5Yes08MeKc4gQsbAJcEFxQ6zWMhLuW2CPOdshLqU/htEsU3y3FTbnlI5gL8AGYhJpUJGsaJAENaM0lid8iW4FkB+1nQxMl3pKhYsMAupaz4RVakSuwWWjJfvg9CABdpU81v8goZHcp0owJSAJWNd9Q/N5RnwtkIT9EA==Question

mk+LumVoQTbOdYeJ398cqoWAbXZcwTd0MsbMcbZhkRi2Tn+VN5cYjRpufmwu+GnIPJ/bwa049ycjLyUdoauwhW27DGvz62qwpABYPKW8Nu5oMHMHURbz4wkBVG8jk/acixClvZP2BrYJlLgjA9SaYAq/ro8umKTu2enDCEYGLHH/vEdab3InIEFZTP4fP19gU1vmdIIp2e0SznQDw5D0cI+bLu/eBIurVnoq+yliPJuXYLsq76/ucLgzjVppn04NIdSkc3DEIOBN5imTg6pH8AEt2hqidXmz24yPl0UCDxb6ghui8gOO8Kdz/0olluuBBSgN2HR1Ah4lVB2Mg0ICvGeESRHhd0GY+A2lfcfoKou18p38gRFTGuxC27F8bEwCGFGjIJEkvEyppyewAUWA4XT1w+RCfK++N3E46eIRy36BxXNy+smebapSXmwnIm0jtmcm+YfYkZZs/M4YFjSIdWR1l2dlNQy8FeZzS5ghWWOFne2gLm5MbI1QSoaQVOUL2xqO8uR68lI=Question

W4OWITRgXsg29WfGnIZaMuyMaIA9Og4jwJOsLpplVAYB0UkS0Zqq+p/3RyQAEHSqF+DYOsZm98bxi8XJG6dLt1LbzKIqiPow5/awS5gDmLD/x82Y2le1p57169QPqsOnRp/bFN/XFX8H313HhtCHpg3ZEJYTRsSjOh+6VU2KM+ADyDV9lKU6Q3T+Ss/L/eVom9rE+Yg9j1im4JX5Hs8D0CkfPZ7yBGNH6hOkPcVb6pNsaZ1APOTM3K3sZGP10JteGtpyeJxdwJrJPVxpsvw5Nd69iqlbEf8faag3t3O+meUErr3ifC8v9bMX3/IlsdustEqXRBYIUpTqIophb/ivigs25kw5B1oDJmO/aThxTmdwBtWMuBgnyeVxUkvQaem0/6KxAwQTdv/nHy43dackqIik3CKLNfIxdvGF3NSq38FXreNN0p+jlV4EEeQ6c4EKNVxW0DK/taHFeVyhXXbgyzjgApsUscP9pilMXY8ZRRGEQUpReYcRUxHf/sOJouFsQuestion

1qcKblMJArrGof7BG6kHq6ypTVrYMvINuUNm5KaYPSYYHC4EjpagXm42xGIR44Oe143xaMTUuN/cL42qwMdVz7QwDB5YhGLnfnsPh815RDXH78mRrtNhy7SuXV7sRGh3BWUzVvkIkaZ78Hjpe4HgGlyh5rOi0Y/f4qvrWRVyhk9DSmBtkz1tZVlo0fKZudGI1sZ9r7CeWUG/o9NX4HYRVgyH9qxR2woXuJZvN2DUEp27e37dZTsqvVm4MZBrIrxLT6dZ5CyU4O2TwbTSluCbrANLUt9bf4GsMxy+5YPbTowFizYoB6nbBNqqDUg+lKe1hznGcDHO1vUekWxGkSZ0yj1biCi1zrd26Z95OfLQhh8S+9qOz8dzFC+kfFlH966lIw/yvQEUae3+oAyWjkdbwalPTVwDhRiV06+e6FDDN8R6LVteIiJsJ4HENwVhO4WiSbxxNaHzdRGt2vuwSJ5avH956T+epFeiaF0lDa14djaRkqEXPqJ0em+D+d5rb9piZflcyhpGUETUqJ9Ehn/ARA==Critical-

Draw a correctly labeled graph showing the market for cotton in equilibrium. On your graph, show the effect of an increase in the supply of cotton on equilibrium price and equilibrium quantity in the market for cotton.