1.3 Module 10: Other Elasticities

(right) © Lauri Pattersoni/iStockphoto

WHAT YOU WILL LEARN

How the cross-

How the cross-price elasticity of demand measures the responsiveness of demand for one good to changes in the price of another good  The meaning and importance of the income elasticity of demand, a measure of the responsiveness of demand to changes in income

The meaning and importance of the income elasticity of demand, a measure of the responsiveness of demand to changes in income

The significance of the price elasticity of supply, which measures the responsiveness of the quantity supplied to changes in price

The significance of the price elasticity of supply, which measures the responsiveness of the quantity supplied to changes in price

The factors that influence the size of these various elasticities

The factors that influence the size of these various elasticities

Using Other Elasticities

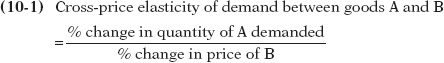

We stated earlier that economists use the concept of elasticity to measure the responsiveness of one variable to changes in another. However, up to this point we have focused on the price elasticity of demand. Now that we have used elasticity to measure the responsiveness of quantity demanded to changes in price, we can go on to look at how elasticity is used to understand the relationship between other important variables in economics.

The quantity of a good demanded depends not only on the price of that good but also on other variables. In particular, demand curves shift because of changes in the prices of related goods and changes in consumers’ incomes. It is often important to have a measure of these other effects, and the best measures are—

Finally, we can also use elasticity to measure supply responses. The price elasticity of supply measures the responsiveness of the quantity supplied to changes in price.

The Cross-Price Elasticity of Demand

The cross-

The demand for a good is often affected by the prices of other, related goods—

When two goods are substitutes, like hot dogs and hamburgers, the cross-

When two goods are complements, like hot dogs and hot dog buns, the cross-

Note that in the case of the cross-

Our discussion of the cross-

To see the potential problem, suppose someone told you that “if the price of hot dog buns rises by $0.30, Americans will buy 10 million fewer hot dogs this year.” If you’ve ever bought hot dog buns, you’ll immediately wonder: is that a $0.30 increase in the price per bun, or is it a $0.30 increase in the price per package of buns? It makes a big difference what units we are talking about! However, if someone says that the cross-

The Income Elasticity of Demand

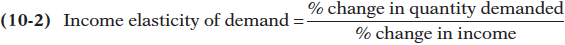

The income elasticity of demand measures how changes in income affect the demand for a good. It indicates whether a good is normal or inferior and specifies how responsive demand for the good is to changes in income. Having learned the price and cross-

The income elasticity of demand is the percent change in the quantity of a good demanded when a consumer’s income changes divided by the percent change in the consumer’s income.

Just as the cross-

- When the income elasticity of demand is positive, the good is a normal good—

that is, the quantity demanded at any given price increases as income increases. - When the income elasticity of demand is negative, the good is an inferior good—

that is, the quantity demanded at any given price decreases as income increases.

Economists often use estimates of the income elasticity of demand to predict which industries will grow most rapidly as the incomes of consumers grow over time. In doing this, they often find it useful to make a further distinction among normal goods, identifying which are income-

The demand for a good is income-

The demand for a good is income-

The demand for a good is income-

!world_eia!WILL CHINA SAVE THE U.S. FARMING SECTOR?

In the days of the Founding Fathers, the great majority of Americans lived on farms. As recently as the 1940s, one American in six—

First, the income elasticity of demand for food is much less than 1—

Second, the demand for food is price-

The combination of these effects explains the long-

That is, up until now. Starting in the mid-

The Price Elasticity of Supply

In the wake of the flu vaccine shortfall of 2004, attempts by vaccine distributors to drive up the price of vaccines would have been much less effective if a higher price had induced a large increase in the output of flu vaccines by flu vaccine manufacturers other than Chiron. In fact, if the rise in price had precipitated a significant increase in flu vaccine production, the price would have been pushed back down. But that didn’t happen because, as we mentioned earlier, it would have been far too costly and technically difficult to produce more vaccine for the 2004–

This was another critical element in the ability of some flu vaccine distributors, like Med-

Measuring the Price Elasticity of Supply

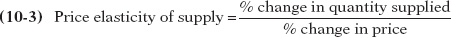

The price elasticity of supply is defined the same way as the price elasticity of demand (although there is no minus sign to be eliminated here):

The price elasticity of supply is a measure of the responsiveness of the quantity of a good supplied to the price of that good. It is the ratio of the percent change in the quantity supplied to the percent change in the price as we move along the supply curve.

The only difference is that now we consider movements along the supply curve rather than movements along the demand curve.

Suppose that the price of tomatoes rises by 10%. If the quantity of tomatoes supplied also increases by 10% in response, the price elasticity of supply of tomatoes is 1 (10%/10%) and supply is unit-

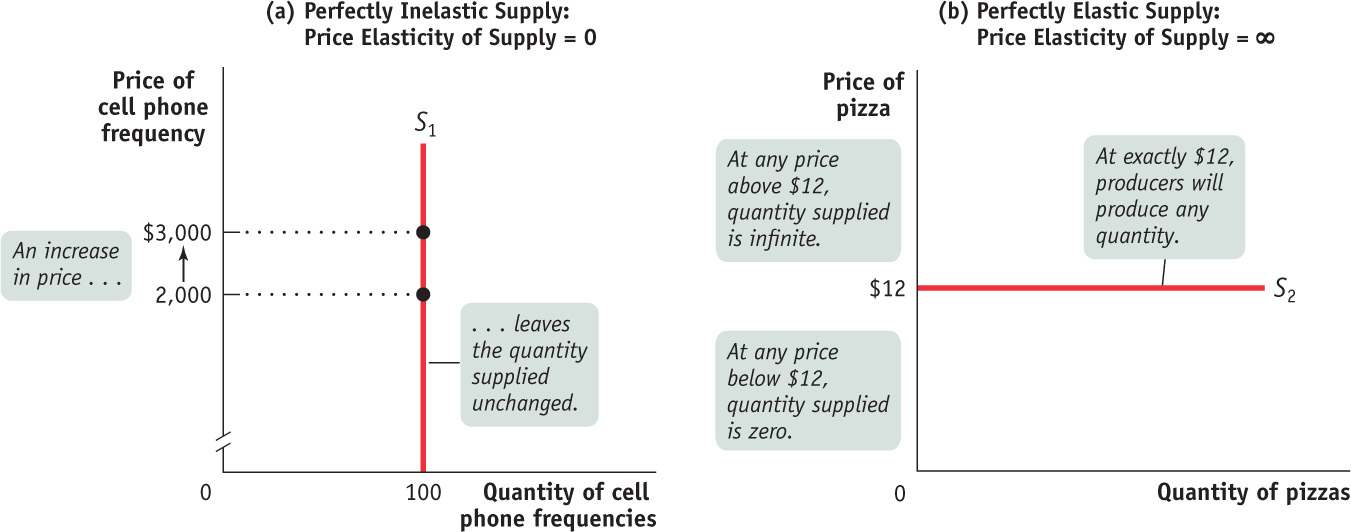

As with the demand side, the extreme values of the price elasticity of supply have a simple graphical representation. Panel (a) of Figure 10-1 shows the supply of cell phone frequencies, the portion of the radio spectrum that is suitable for sending and receiving cell phone signals. Governments own the right to sell the use of this part of the radio spectrum to cell phone operators inside their borders. But governments can’t increase or decrease the number of cell phone frequencies they have to offer—

There is perfectly inelastic supply when the price elasticity of supply is zero, so that changes in the price of the good have no effect on the quantity supplied. A perfectly inelastic supply curve is a vertical line.

So the supply curve for cell phone frequencies is a vertical line, which we have assumed is set at the quantity of 100 frequencies. As you move up and down that curve, the change in the quantity supplied by the government is zero, whatever the change in price. So panel (a) illustrates a case of perfectly inelastic supply, meaning that the price elasticity of supply is zero.

There is perfectly elastic supply if the quantity supplied is zero below some price and infinite above that price. A perfectly elastic supply curve is a horizontal line.

Panel (b) shows the supply curve for pizza. We suppose that it costs $12 to produce a pizza, including all opportunity costs. At any price below $12, it would be unprofitable to produce pizza and all the pizza parlors would go out of business. At a price of $12 or more, there are many producers who could operate pizza parlors. The ingredients—

Since even a tiny increase in the price would lead to an enormous increase in the quantity supplied, the price elasticity of supply would be virtually infinite. A horizontal supply curve such as this represents a case of perfectly elastic supply.

As our cell phone frequencies and pizza examples suggest, real-

What Factors Determine the Price Elasticity of Supply?

Our examples tell us the main determinant of the price elasticity of supply: the availability of inputs. In addition, as with the price elasticity of demand, time may also play a role in the price elasticity of supply. Here we briefly summarize the two factors.

The Availability of InputsThe price elasticity of supply tends to be large when inputs are readily available and can be shifted into and out of production at a relatively low cost. It tends to be small when inputs are available only in a more-

TimeThe price elasticity of supply tends to grow larger as producers have more time to respond to a price change. This means that the long-

The price elasticity of the supply of pizza is very high because the inputs needed to make more pizza are readily available. The price elasticity of cell phone frequencies is zero because an essential input—

Many industries are like pizza and have large price elasticities of supply: they can be readily expanded because they don’t require any special or unique resources. On the other hand, the price elasticity of supply is usually substantially less than perfectly elastic for goods that involve limited natural resources: minerals like gold or copper, agricultural products like coffee that flourish only on certain types of land, and renewable resources like ocean fish that can be exploited only up to a point without destroying the resource.

But given enough time, producers are often able to significantly change the amount they produce in response to a price change, even when production involves a limited natural resource. For example, consider again the effects of a surge in flu vaccine prices, but this time focus on the supply response. If the price were to rise to $90 per vaccination and stay there for a number of years, there would almost certainly be a substantial increase in flu vaccine production. Producers such as Chiron would eventually respond by increasing the size of their manufacturing plants, hiring more lab technicians, and so on. But significantly enlarging the capacity of a biotech manufacturing lab takes several years, not weeks or months or even a single year.

For this reason, economists often make a distinction between the short-

An Elasticity Menagerie

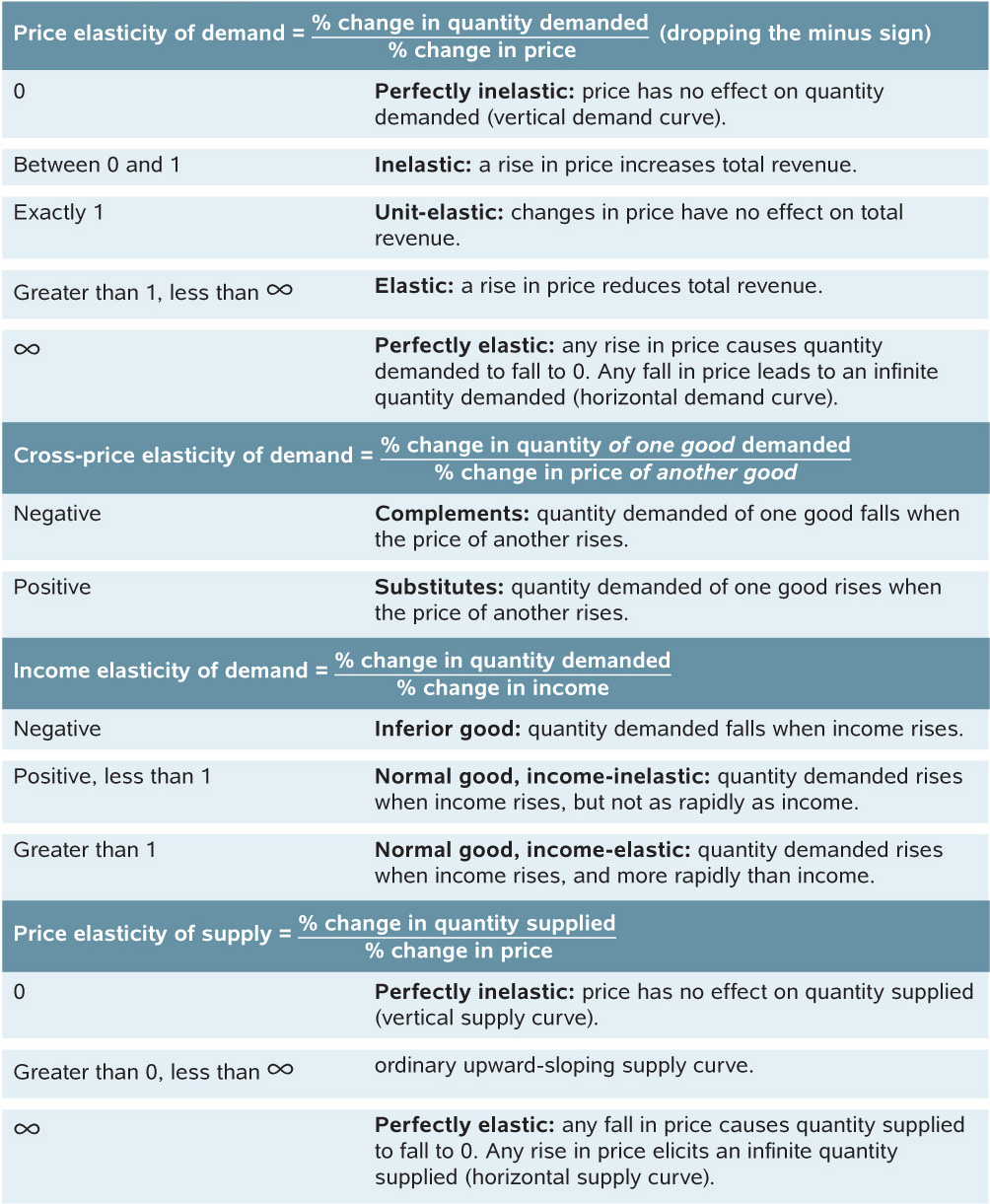

We’ve just run through quite a few different types of elasticity. Keeping them all straight can be a challenge. So in Table 10-1 we provide a summary of all the types of elasticity we have discussed and their implications.

Module 10 Review

Solutions appear at the back of the book.

Check Your Understanding

1. After Chelsea’s income increased from $12,000 to $18,000 a year, her purchases of DVDs increased from 10 to 40 DVDs a year. Calculate Chelsea’s income elasticity of demand for DVDs using the midpoint method.

2. As the price of margarine rises by 20%, a manufacturer of baked goods increases its quantity of butter demanded by 5%. Calculate the cross-

3. Using the midpoint method, calculate the price elasticity of supply for web-

Multiple-

Question

oT6o/e+w5mNKeU6PInxF4A+mgTEDqytEj+3j9FikhVdpZ9Ka5W+ZsCRW3ZbGXnLchSZFn7LRpuP0+llESJ8dqd4T0WO8yUyT/zvEuSVBgYkkW+/ma6AU/RPqCFHM9Y8bj+E5CqE6SsiTTnXPe7XrHXqssAZDh20qWFPnSHZhRHRsJgBMNveh/yobRfc+QzWzREJNfvXMdxNFYWZMreWXOtxdHgsSbiI1g3xrDxCv4TaElgcE1vIS+QL6O7hdqLaAdVJ4toc/1OQg6154d04l1CwUMapSChZG7QKVhRRAuT7pTHnwmfD6XVOcZBCU9J8tO7U3rLvZxiNbFN+eNvObCcxoKpJaQ/msbiCbfucaWVI3sJJJIcPjGEJEP90=Question

fVLEhf6NutKhq8hKpsucMqwRatz/2Lj+s3Zxtl00sTUeliOljDB1EUP7dn2KcGll8ZDUq4gtO+ld3yZmwhTvyZXSGX5OuCknwWzRyW9LouUP8fTcG7gVM8p/Go/q7duizInx7v6DN6x5K1yAC7afrm3E49y+Sd6nbwPPiXVTp8inm/O12wuUF6ViGS02ZKPKt2rMIMPqD3mAfuRs5zA65/aRR0W+4vybzGJ6fr8Y2AC0cydZkW3bD6usb+qpvDQ4R8yKjez6PAmqJxkhCrJbjd4ryZ+3sbeVekOk15yW1uWu+9T7WnOExcw7AWrf+1/kds74/6hFEQlFbx3UiXX16fxSzxuyWpN0NUevCMmflrVWRwoRhcwpdVbERgWjr7WRuwoxwRdibYqEq5a59JHIOA==Question

3zmlEdRMOOA/e7mMEvPJq2wnLClwaf3MGvNGWo0y+70loy3QrvB+/XcPjDkG8zcnIh2YmJrJtpcEg3AFzIlxu5wgTW6UynHVQQNZKUJNMwgE+iLQYL5//IW/HDmsyt5OIYiNZZiKd+9cy4I6cb4nI5WMjfey+hPmZiN2HsLVuRxB/ucHF4DRMtRPj9hVKd46OnfukNVK/yn3JdFLXwUqAhOhD1DwY4BvvO8sJTs6QZbPyvtlQuestion

QxHPsUv00qFiKE1ZFwO+eDrAbGapHvJlCjS1I2zZXzeHVGSu2+9feOfDDo3mVS/dB1a5K+p3a2FtJD9ANuDPDgwo500g2WpdTk54/bDJtfB0tc5aaA1s85cMpLpltOYpVzLOUwINs+WCdqObNZngd7eqiK7tOgWF+ZAtKLkOBMRSgYjwkIbt6vPFVDbv2D+EGlabvVNw2MaQ4ZSVNlNDnZ8HlwVnuQlGzdcyP2uDRvORpv7ANEvDAs2RfU9BsxyU0VjyH5HZf5fJAu2rWMCP2rzXP6whdS2sYzFx+o7qussKw+4ya89PqG8gyBuRGdDgw1TSkg==Question

yGUdRxP/sOp91CAXNyIt5K95HfRjcK4vPHrUi2/I+Os5w8KStCsCBiAEypzApz2tWc/iO8YrrcAYO1TJpd1tGt6fcZR2tO0WE2Ju1fc93fILyazdPopLyn9+Za32KndZMDyypPYNSI9Vdpj7WiuycsUgb3xCVCEViUSVx2e5I3ZpQBcRf7xaKVVvz2Nx1jJMh8BeFsUpAcsFS7LV3zY/dx3DmU39ZTSw5ZWHQb7X/c/qvJgbRx57BIek0C1xMLoQ58MvMvp335dHWlYXVxm4dktoPpjgGUFPtinGIHRnjeGCx+2lUSP1/chKBcMsi9yMCyEkop13mSoqT1k8x6dfofibE84HryDFnFBL6gysRsmohmWREpe921m+dpbm75mNXBlIzMRytkzRoTnTDI29n7fEEvc0X9YxF31TDPU71AyBM0kGzdR4GWbEugpQUCZZ3wMGcYG1lBRucy0VScgV3zUogt4HGjRExLq/2dZ6iWyA0/2pltNXyekJPwYAbR1xp5AnoQBBAhxS9cPd3ghGokuMXPSTfAA/srP7nqzbMZnSd5lnsFovkbICSq6DRGGxeBHpbjFG6rU=Critical-

Assume the price of corn rises by 20% and this causes suppliers to increase the quantity of corn supplied by 40%.

1. Calculate the price elasticity of supply.

2. In this case, is supply elastic or inelastic?

3. Draw a correctly labeled graph of a supply curve illustrating the most extreme case of the category of elasticity you found in part b (either perfectly elastic or perfectly inelastic supply).

4. What would likely be true of the availability of inputs for a firm with the supply curve you drew in part c? Explain.