Problems

1.Determine the amount of consumer surplus generated in each of the following situations.

- a. Leon goes to the clothing store to buy a new T-

shirt, for which he is willing to pay up to $10. He picks out one he likes with a price tag of exactly $10. When he is paying for it, he learns that the T- shirt has been discounted by 50%. - b. Alberto goes online to the iTunes store hoping to find Mumford & Son’s new album, and is willing to pay up to $12. He sees that iTunes is selling the album for $11.99, so he purchases it.

- c. After soccer practice, Stacey is willing to pay $2 for a bottle of mineral water. The 7-

Eleven sells mineral water for $2.25 per bottle, so she declines to purchase it.

2.Determine the amount of producer surplus generated in each of the following situations.

- a. Gordon lists his old Lionel electric trains on eBay. He sets a minimum acceptable price, known as his reserve price, of $75. After five days of bidding, the final high bid is exactly $75. He accepts the bid.

- b. So-

Hee advertises her car for sale in the used- car section of the student newspaper for $2,000, but she is willing to sell the car for any price higher than $1,500. The best offer she gets is $1,200, which she declines. - c. Sanjay likes his job so much that he would be willing to do it for free. However, his annual salary is $80,000.

3.There are six potential consumers of computer games, each willing to buy only one game. Consumer 1 is willing to pay $40 for a computer game, consumer 2 is willing to pay $35, consumer 3 is willing to pay $30, consumer 4 is willing to pay $25, consumer 5 is willing to pay $20, and consumer 6 is willing to pay $15.

- a. Suppose the market price is $29. What is the total consumer surplus?

- b. The market price decreases to $19. What is the total consumer surplus now?

- c. When the price fell from $29 to $19, how much did each consumer’s individual consumer surplus change? How does total consumer surplus change?

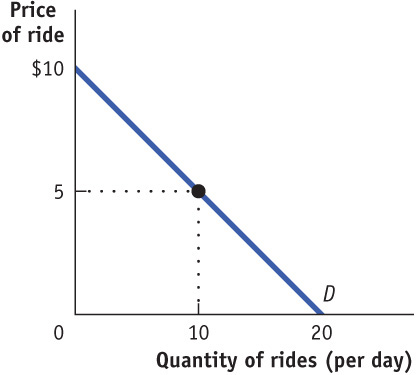

4.You are the manager of Fun World, a small amusement park. The accompanying diagram shows the demand curve of a typical customer at Fun World.

- a. Suppose that the price of each ride is $5. At that price, how much consumer surplus does an individual consumer get? (Note that the area of a right triangle is ½ × the height of the triangle × the base of the triangle.)

- b. Suppose that Fun World considers charging an admission fee, even though it maintains the price of each ride at $5. What is the maximum admission fee it could charge? (Assume that all potential customers have enough money to pay the fee.)

- c. Suppose that Fun World lowered the price of each ride to zero. How much consumer surplus does an individual consumer get? What is the maximum admission fee Fun World could charge?

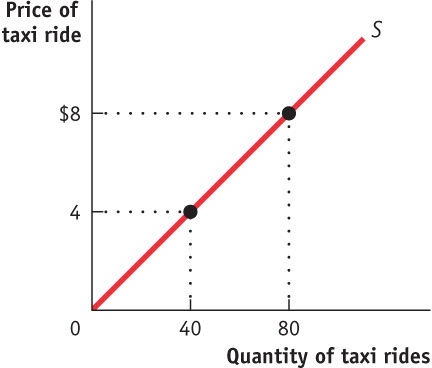

5.The accompanying diagram illustrates a taxi driver’s individual supply curve (assume that each taxi ride is the same distance).

- a. Suppose the city sets the price of taxi rides at $4 per ride, and at $4 the taxi driver is able to sell as many taxi rides as he desires. What is this taxi driver’s producer surplus? (Note that the area of a right triangle is ½ × the height of the triangle × the base of the triangle.)

- b. Suppose that the city keeps the price of a taxi ride set at $4, but it decides to charge taxi drivers a special fee. What is the maximum special fee the city could extract from this taxi driver?

- c. Suppose that the city allowed the price of taxi rides to increase to $8 per ride. Again assume that, at this price, the taxi driver sells as many rides as he is willing to offer. How much producer surplus does an individual taxi driver now get? What is the maximum special fee the city could charge this taxi driver?

6.The accompanying table shows the supply and demand schedules for used copies of the second edition of this textbook. The supply schedule is derived from offers at Amazon.com. The demand schedule is hypothetical.

| Price of book | Quantity of books demanded | Quantity of books supplied |

|---|---|---|

| $55 | 50 | 0 |

| 60 | 35 | 1 |

| 65 | 25 | 3 |

| 70 | 17 | 3 |

| 75 | 14 | 6 |

| 80 | 12 | 9 |

| 85 | 10 | 10 |

| 90 | 8 | 18 |

| 95 | 6 | 22 |

| 100 | 4 | 31 |

| 105 | 2 | 37 |

| 110 | 0 | 42 |

- a. Calculate consumer and producer surplus at the equilibrium in this market.

- b. Now the third edition of this textbook becomes available. As a result, the willingness to pay of each potential buyer for a second-

hand copy of the second edition falls by $20. In a table, show the new demand schedule and again calculate consumer and producer surplus at the new equilibrium.

7.Suppose that Hollywood screenwriters negotiate a new agreement with movie producers stipulating that they will receive 10% of the revenue from every video rental of a movie they authored. They have no such agreement for movies shown on on-

- a. When the new writers’ agreement comes into effect, what will happen in the market for video rentals—

that is, will supply or demand shift, and how? As a result, how will consumer surplus in the market for video rentals change? Illustrate with a diagram. Do you think the writers’ agreement will be popular with consumers who rent videos? - b. Consumers consider video rentals and on-

demand movies substitutable to some extent. When the new writers’ agreement comes into effect, what will happen in the market for on- demand movies— that is, will supply or demand shift, and how? As a result, how will producer surplus in the market for on- demand movies change? Illustrate with a diagram. Do you think the writers’ agreement will be popular with cable television companies that show on- demand movies?

8.A few years ago a New York district judge ruled in a copyright infringement lawsuit against the popular file-

- a. If everyone obtained music and video content for free from websites such as LimeWire, instead of paying the record companies, what would happen to the record companies’ producer surplus from music sales? What are the implications for record companies’ incentive to produce music content in the future?

- b. If the record companies had lost the lawsuit and music could be freely downloaded from the Internet, what do you think would happen to mutually beneficial transactions (the producing and buying of music) in the future?

9.EAuction and EMarketplace are two competing Internet auction sites, where buyers and sellers transact goods. Each auction site earns money by charging sellers for listing their goods. Over time, because EAuction provides much better technical service than its rival, EMarketplace, buyers and sellers come to prefer EAuction. Eventually, EMarketplace closes down, leaving EAuction as the sole provider of this service (it becomes a monopolist). EAuction also owns a site that handles payments over the Internet, called PayForIt. It is competing with another Internet payment site, called PayBuddy. EAuction has now stipulated that any transaction on its auction site must use PayForIt, rather than PayBuddy, for the payment. What is the impact on market efficiency, producer surplus, and consumer surplus from EAuction’s position in the market as the only provider of the service?