1.3 Module 26: Graphing Perfect Competition

WHAT YOU WILL LEARN

How to evaluate a perfectly competitive firm’s situation using a graph

How to evaluate a perfectly competitive firm’s situation using a graph

How to determine a perfect competitor’s profit or loss

How to determine a perfect competitor’s profit or loss

How a firm decides whether to produce or shut down in the short run

How a firm decides whether to produce or shut down in the short run

In the previous module we learned how to compare market price and average total cost to determine whether or not a competitive firm is profitable. Now we can evaluate the profitability of perfectly competitive firms in a variety of situations.

Interpreting Perfect Competition Graphs

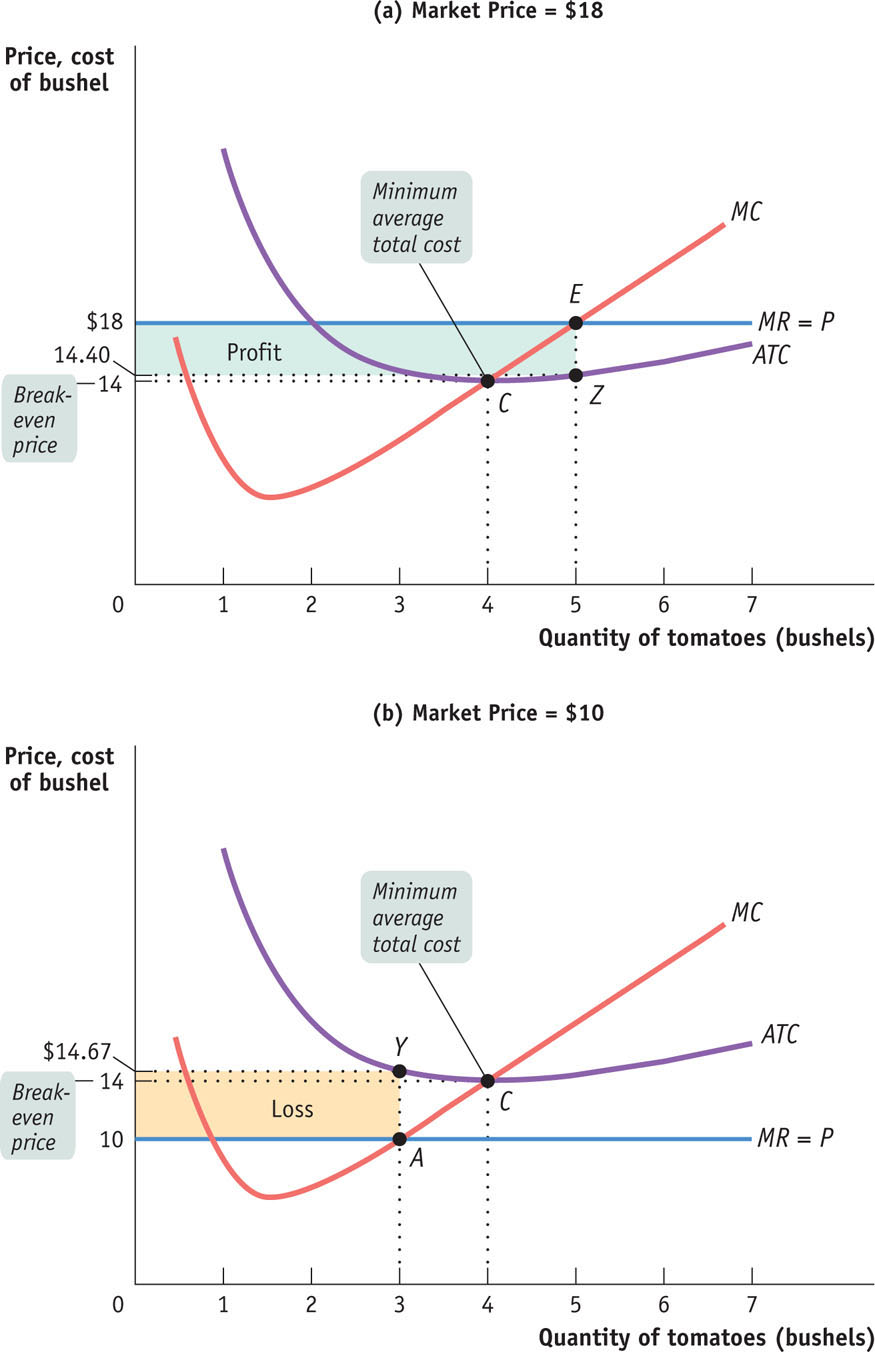

Figure 26-1 illustrates how the market price determines whether a firm is profitable. It also shows how profits are depicted graphically. Each panel shows the marginal cost curve, MC, and the short-

In panel (a), we see that at a price of $18 per bushel the profit-

Jennifer and Jason’s total profit when the market price is $18 is represented by the area of the shaded rectangle in panel (a). To see why, notice that total profit can be expressed in terms of profit per unit:

or, equivalently, because P is equal to TR/Q and ATC is equal to TC/Q,

Profit = (P − ATC) × Q

The height of the shaded rectangle in panel (a) corresponds to the vertical distance between points E and Z. It is equal to P − ATC = $18.00 − $14.40 = $3.60 per bushel. The shaded rectangle has a width equal to the output: Q = 5 bushels. So the area of that rectangle is equal to Jennifer and Jason’s profit: 5 bushels × $3.60 profit per bushel = $18.

What about the situation illustrated in panel (b)? Here the market price of tomatoes is $10 per bushel. Producing until price equals marginal cost leads to a profit-

How much do they lose by producing when the market price is $10? On each bushel they lose ATC − P = $14.67 − $10.00 = $4.67, an amount corresponding to the vertical distance between points A and Y. And they produce 3 bushels, which corresponds to the width of the shaded rectangle. So the total value of the losses is $4.67 × 3 = $14.00 (adjusted for rounding error), an amount that corresponds to the area of the shaded rectangle in panel (b).

But how does a producer know, in general, whether or not its business will be profitable? It turns out that the crucial test lies in a comparison of the market price to the firm’s minimum average total cost. On Jennifer and Jason’s farm, average total cost reaches its minimum, $14, at an output of 4 bushels, indicated by point C. Whenever the market price exceeds the minimum average total cost, there are output levels for which the average total cost is less than the market price. In other words, the producer can find a level of output at which the firm makes a profit. So Jennifer and Jason’s farm will be profitable whenever the market price exceeds $14. And they will achieve the highest possible profit by producing the quantity at which marginal cost equals price.

Conversely, if the market price is less than the minimum average total cost, there is no output level at which price exceeds average total cost. As a result, the firm will be unprofitable at any quantity of output. As we saw, at a price of $10—

The break-

The minimum average total cost of a price-

So the rule for determining whether a firm is profitable depends on a comparison of the market price of the good to the firm’s break-

- Whenever the market price exceeds the minimum average total cost, the producer is profitable.

- Whenever the market price equals the minimum average total cost, the producer breaks even.

- Whenever the market price is less than the minimum average total cost, the producer is unprofitable.

The Short-Run Production Decision

You might be tempted to say that if a firm is unprofitable because the market price is below its minimum average total cost, it shouldn’t produce any output. In the short run, however, this conclusion isn’t right. In the short run, sometimes the firm should produce even if price falls below minimum average total cost. The reason is that total cost includes fixed cost—cost that does not depend on the amount of output produced and can be altered only in the long run. In the short run, fixed cost must still be paid, regardless of whether or not a firm produces. For example, if Jennifer and Jason have rented a tractor for the year, they have to pay the rent on the tractor regardless of whether they produce any tomatoes. Since it cannot be changed in the short run, their fixed cost is irrelevant to their decision about whether to produce or shut down in the short run.

Although fixed cost should play no role in the decision about whether to produce in the short run, another type of cost—

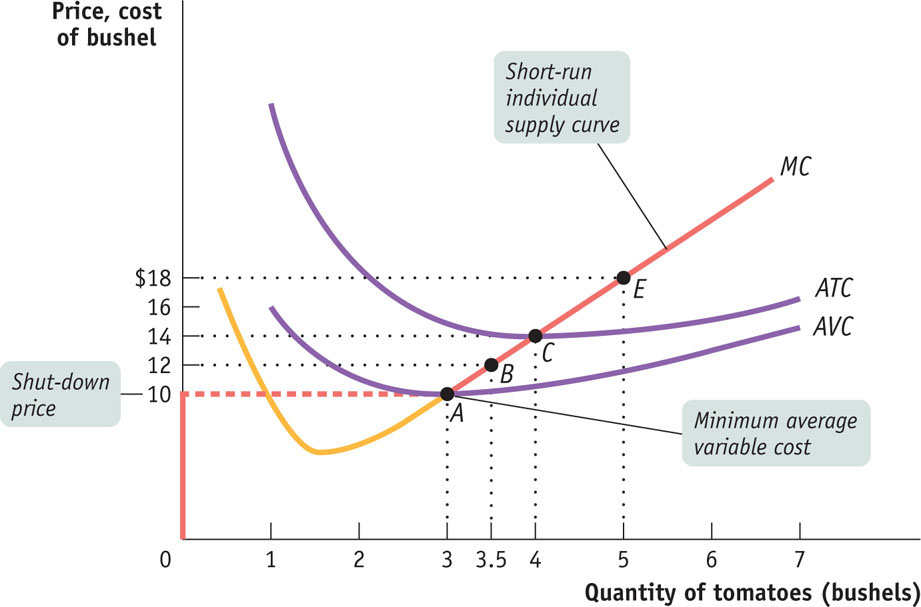

Let’s turn to Figure 26-2: it shows both the short-

The Shut-Down Price

We are now prepared to analyze the optimal production decision in the short run. We have two cases to consider:

- When the market price is below the minimum average variable cost

- When the market price is greater than or equal to the minimum average variable cost

A firm will cease production in the short run if the market price falls below the shut-

When the market price is below the minimum average variable cost, the price the firm receives per unit is not covering its variable cost per unit. A firm in this situation should cease production immediately. Why? Because there is no level of output at which the firm’s total revenue covers its variable cost—

When price is greater than minimum average variable cost, however, the firm should produce in the short run. In this case, the firm maximizes profit—

But what if the market price lies between the shut-

This means that whenever price falls between minimum average total cost and minimum average variable cost, the firm is better off producing some output in the short run. The reason is that by producing, it can cover its variable cost and at least some of its fixed cost, even though it is incurring a loss. In this case, the firm maximizes profit—

It’s worth noting that the decision to produce when the firm is covering its variable cost but not all of its fixed cost is similar to the decision to ignore a sunk cost, a concept we studied previously. You may recall that a sunk cost is a cost that has already been incurred and cannot be recouped; and because it cannot be changed, it should have no effect on any current decision. In the short-

And what happens if the market price is exactly equal to the shut-

Putting everything together, we can now draw the short-

As long as the market price is equal to or above the shut-

Do firms sometimes shut down temporarily without going out of business? Yes. In fact, in some industries temporary shut-

Changing Fixed Cost

Although fixed cost cannot be altered in the short run, in the long run firms can acquire or get rid of machines, buildings, and so on. In the long run the level of fixed cost is a matter of choice, and a firm will choose the level of fixed cost that minimizes the average total cost for its desired output level. Now we will focus on an even bigger question facing a firm when choosing its fixed cost: whether to incur any fixed cost at all by continuing to operate.

In the long run, a firm can always eliminate fixed cost by selling off its plant and equipment. If it does so, of course, it can’t produce any output—

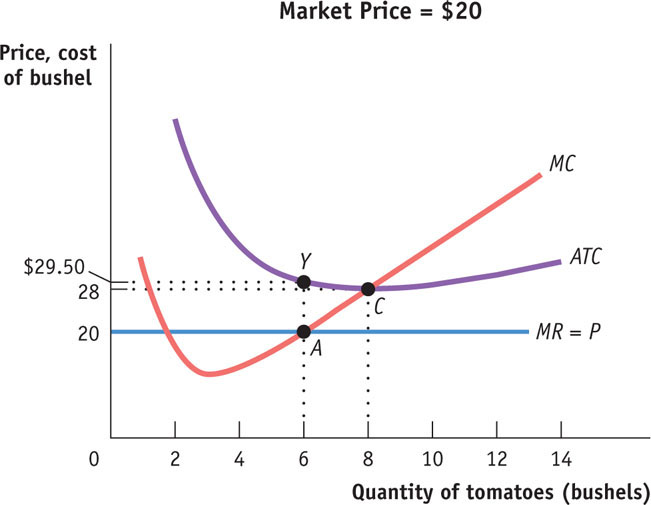

Consider Jennifer and Jason’s farm once again. In order to simplify our analysis, we will sidestep the issue of choosing among several possible levels of fixed cost. Instead, we will assume that if they operate at all, Jennifer and Jason have only one possible choice of fixed cost: $14. Alternatively, they can choose a fixed cost of zero if they exit the industry. It is changes in fixed cost that cause short-

Suppose that the market price of organic tomatoes is consistently less than the break-

Conversely, suppose that the price of organic tomatoes is consistently above the break-

But things won’t stop there. The organic tomato industry meets the criterion of free entry: there are many potential organic tomato producers because the necessary inputs are easy to obtain. And the cost curves of those potential producers are likely to be similar to those of Jennifer and Jason, since the technology used by other producers is likely to be very similar to that used by Jennifer and Jason. If the price is high enough to generate profits for existing producers, it will also attract some of these potential producers into the industry. So in the long run a price in excess of $14 should lead to entry: new producers will come into the organic tomato industry.

As we will see shortly, exit and entry lead to an important distinction between the short-

PRICES ARE UP … BUT SO ARE COSTS

Because of the Energy Policy Act of 2005, 7.5 billion gallons of alternative fuel, mostly corn-

This sharp rise in the price of corn caught the eye of American farmers like Ronnie Gerik of Aquilla, Texas, who, in response to surging corn prices, reduced the size of his cotton crop and increased his corn acreage by 40%. He was not alone; overall, the U.S. corn acreage planted in 2011 was 9% more than the average planted over the previous decade. And 4% more was planted in 2012.

Although this sounds like a sure way to make a profit, Gerik was actually taking a big gamble: even though the price of corn increased, so did the cost of the raw materials needed to grow it—

Moreover, corn is much more sensitive to the amount of rainfall than a crop like cotton. So farmers who plant corn in drought-

Despite all of this, what Gerik did made complete economic sense. By planting more corn, he was moving up his individual short-

So the moral of this story is that farmers will increase their corn acreage until the marginal cost of producing corn is approximately equal to the market price of corn—

Summing Up: The Perfectly Competitive Firm’s Profitability and Production Conditions

In this module we’ve studied what’s behind the supply curve for a perfectly competitive, price-

| Profitability condition (minimum ATC = break- |

Result |

|---|---|

| P > minimum ATC | Firm profitable. Entry into industry in the long run. |

| P = minimum ATC | Firm breaks even. No entry into or exit from industry in the long run. |

| P < minimum ATC | Firm unprofitable. Exit from industry in the long run. |

| Production condition (minimum AVC = shut- |

Result |

| P > minimum AVC | Firm produces in the short run. If P < minimum ATC, firm covers variable cost and some but not all of fixed cost. If P > minimum ATC, firm covers all variable cost and fixed cost. |

| P = minimum AVC | Firm indifferent between producing in the short run or not. Just covers variable cost. |

| P < minimum AVC | Firm shuts down in the short run. It cannot cover variable cost. |

Module 26 Review

Solutions appear at the back of the book.

Check Your Understanding

1. Draw a short-

-

a. The firm shuts down immediately.

-

b. The firm operates in the short run despite sustaining a loss.

-

c. The firm operates while making a profit.

2. The state of Maine has a very active lobster industry, which harvests lobsters during the summer months. During the rest of the year, lobsters can be obtained by restaurants from producers in other parts of the world, but at a much higher price. Maine is also full of “lobster shacks,” roadside restaurants serving lobster dishes that are open only during the summer. Supposing that the market demand for lobster dishes remains the same throughout the year, explain why it is optimal for lobster shacks to operate only during the summer.

Multiple-

To answer questions 1–

Question

ahB7p+4s+GzFOS7X1u22xy7Lg/3vSh4ZMaoy1QWsTTau0UMfCWCidVPxU/jonAg8mZMw3eRN+Hisb9qOBLFB0KpQloXGZbCeMhT4t/qzc7d0DqduPkB5WUTzuQc8CeBPlbpRPEHdkDQ+gn1KBw+knyQtM9x4WezjmsPEdoFQURNyUAjZ/hxmLiBBtZ+IqCrTY4nPcos18SIgN/X46KCxxw==Question

US4zMCPckxm16qvWwTkFmMcFzkokhYRa990d2Z7AlkuXMZhEFnaLi77gXAZ6x3pjcdl0eEU6686MplqRrjdOyM9BIDbckvVtUV5ckM/fsPfcSNoaEAoOvsfdHh1LY968d9IlBHYXqBin3B6zeXTX1/91tccCamQv9sxw/3kxwlwN9UGpNfx4okrjt1ZuOL0SNXXKhJlfUsPrPVqdQuestion

BW5hVp/EjiJI11nlWn/2hC8gN1gE2lnnSfFyH59FHEyq3gcPBWMtQUYykofpquxIXM/4FzHaI7alvm+rv5QvNdi/TCqmVpLqIyLFuPa7Id+OIsa26V/HrkGocaHMw1KpU1w61nVsVVG0J+BSRg14IfRtG9axasVJoQp3PzOJRKns+9Az3l6jwnw9EPPvZeYKXmPKCcWdeVztK3uRdFlHh7AO+1A0NpRnsOq0FbXtFZj21e48FUlEIP4WjTTfprIVSSFggMlpmeV2DU/E4nI0MXfMXRc=Question

bzxVP1ZSS66PbTN1lK9UCpnUk70T44cQs6LLBDl+WMZ0rr27kwILP0mp8UtVCAzyMC8cZIq17WjP2X0VQq7TujmmXvREiBrUVO8VjnC3gub02UB+xDamRyxtZDg1EFWPC77J5mwtvDz9SMWcCyJbnjynBGM3h3ItdIpbKGkw2WzDpa59GEMzyexUNayqU8wwo7leDSHGPGakF5+Brs9s70mYtR7lHldZvqidU220yNYSm0k1TmDQd9hDo0SlAV3eYgLS8XDicGsPmWXnYGa5T0wdFYodiXyd94KWFw70RxmC/n+jtbJ3cCKm4NAQbCi6BUBPCm9zk8nmMlMWNTnpPd3SU8Onw5deQuestion

LVl9JfgzvCEvmFYv9iixPzXy7q2/J3/QgvMLUiFGsOPb53c88lo5Fo2OkGZr1ULncywQJgwAo90KqfqLXmdCVFNc85CNeK1D0FoiSOKVngtKWL615QPJaX2P85njM1b6biucWLa+6hA5DoE9rczdOJeyNWsaOHHzBnvhU+i4kLWHzcY5nW6h6AVUAyRNtQRO84Y4Gg6UDhSHboI11MfI5usAL9lgIfy3RFD+aLBvzZSnS3bgKKjB1CYFSwjBgW4FFJWijKR0lK7nZpnxtxp/bMX84mdYgYz9hOsdkGyNinucOB5IxfTpzR9T8Mdawfj3NkMOnBdIoVKdk2tex1mkMOou055wN5G2ctu3jZhpQ/fiETcKV0IC2fHefr1iY331kNI3AXhrQFbNu0qxB2qQ62/4blgCGmt83Itj2eNKCMxECztJiJTCDJtMXzoSPxyFzo8vDSWQbXHQtTI8TlEgPrUTGir2XEjKDf7Gr7rYq1obzTBb0wwa+y3zqq4=Critical-

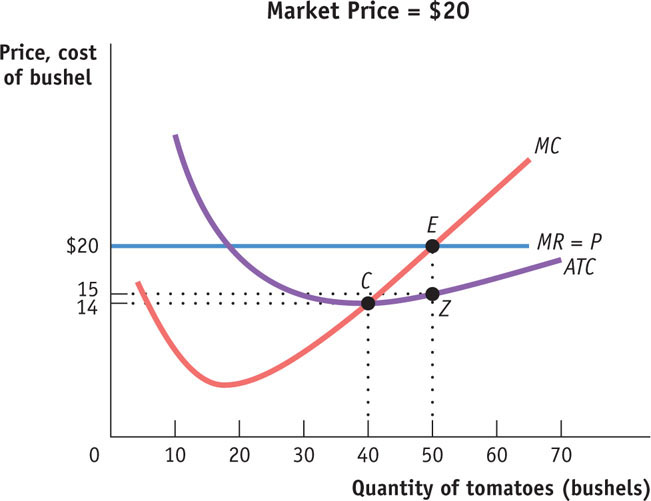

Refer to the graph provided to answer the questions that follow.

1. Assuming it is appropriate for the firm to produce in the short run, what is the firm’s profit-

2. Calculate the firm’s total revenue.

3. Calculate the firm’s total cost.

4. Calculate the firm’s profit or loss.

5. If AVC were $22 at the profit-