Problems

1.For each of the following, is the industry perfectly competitive? Referring to market share, standardization of the product, and/or free entry and exit, explain your answers.

- a. aspirin

- b. Alicia Keys concerts

- c. SUVs

2.Kate’s Katering provides catered meals, and the catered meals industry is perfectly competitive. Kate’s machinery costs $100 per day and is the only fixed input. Her variable cost consists of the wages paid to the cooks and the food ingredients. The variable cost per day associated with each level of output is given in the accompanying table.

| Quantity of meals | VC |

|---|---|

| 0 | $0 |

| 10 | 200 |

| 20 | 300 |

| 30 | 480 |

| 40 | 700 |

| 50 | 1,000 |

- a. Calculate the total cost, the average variable cost, the average total cost, and the marginal cost for each quantity of output.

- b. What is the break-

even price? What is the shut- down price? - c. Suppose that the price at which Kate can sell catered meals is $21 per meal. In the short run, will Kate earn a profit? In the short run, should she produce or shut down?

- d. Suppose that the price at which Kate can sell catered meals is $17 per meal. In the short run, will Kate earn a profit? In the short run, should she produce or shut down?

- e. Suppose that the price at which Kate can sell catered meals is $13 per meal. In the short run, will Kate earn a profit? In the short run, should she produce or shut down?

3.Bob produces DVD movies for sale, which requires a building and a machine that copies the original movie onto a DVD. Bob rents a building for $30,000 per month and rents a machine for $20,000 a month. Those are his fixed costs. His variable costs per month are given in the accompanying table.

| Quantity of DVDs | VC |

|---|---|

| 0 | $0 |

| 1,000 | 5,000 |

| 2,000 | 8,000 |

| 3,000 | 9,000 |

| 4,000 | 14,000 |

| 5,000 | 20,000 |

| 6,000 | 33,000 |

| 7,000 | 49,000 |

| 8,000 | 72,000 |

| 9,000 | 99,000 |

| 10,000 | 150,000 |

- a. Calculate Bob’s average variable cost, average total cost, and marginal cost for each quantity of output.

- b. There is free entry into the industry, and anyone who enters will face the same costs as Bob. Suppose that currently the price of a DVD is $25. What will Bob’s profit be? Is this a long-

run equilibrium? If not, what will the price of DVD movies be in the long run?

4.Consider Bob’s DVD company described in Problem 3. Assume that DVD production is a perfectly competitive industry. For each of the following questions, explain your answers.

- a. What is Bob’s break-

even price? What is his shut- down price? - b. Suppose the price of a DVD is $2. What should Bob do in the short run?

- c. Suppose the price of a DVD is $7. What is the profit-

maximizing quantity of DVDs that Bob should produce? What will his total profit be? Will he produce or shut down in the short run? Will he stay in the industry or exit in the long run? - d. Suppose instead that the price of DVDs is $20. Now what is the profit-

maximizing quantity of DVDs that Bob should produce? What will his total profit be now? Will he produce or shut down in the short run? Will he stay in the industry or exit in the long run?

5.Consider again Bob’s DVD company described in Problem 3.

- a. Draw Bob’s marginal cost curve.

- b. Over what range of prices will Bob produce no DVDs in the short run?

- c. Draw Bob’s individual supply curve.

6.

- a. A profit-

maximizing business incurs an economic loss of $10,000 per year. Its fixed cost is $15,000 per year. Should it produce or shut down in the short run? Should it stay in the industry or exit in the long run? - b. Suppose instead that this business has a fixed cost of $6,000 per year. Should it produce or shut down in the short run? Should it stay in the industry or exit in the long run?

7.The first sushi restaurant opens in town. Initially, people are very cautious about eating tiny portions of raw fish, as this is a town where large portions of grilled meat have always been popular. Soon, however, an influential health report warns consumers against grilled meat and suggests that they increase their consumption of fish, especially raw fish. The sushi restaurant becomes very popular and its profit increases.

- a. What will happen to the short-

run profit of the sushi restaurant? What will happen to the number of sushi restaurants in town in the long run? Will the first sushi restaurant be able to sustain its short- run profit over the long run? Explain your answers. - b. Local steakhouses suffer from the popularity of sushi and start incurring losses. What will happen to the number of steakhouses in town in the long run? Explain your answer.

8.A perfectly competitive firm has the following short-

| Quantity | TC |

|---|---|

| 0 | $5 |

| 1 | 10 |

| 2 | 13 |

| 3 | 18 |

| 4 | 25 |

| 5 | 34 |

| 6 | 45 |

Market demand for the firm’s product is given by the following market demand schedule:

| Price | Quantity demanded |

|---|---|

| $12 | 300 |

| 10 | 500 |

| 8 | 800 |

| 6 | 1,200 |

| 4 | 1,800 |

- a. Calculate this firm’s marginal cost and, for all output levels except zero, the firm’s average variable cost and average total cost.

- b. There are 100 firms in this industry that all have costs identical to those of this firm. Draw the short-

run industry supply curve. In the same diagram, draw the market demand curve. - c. What is the market price, and how much profit will each firm make?

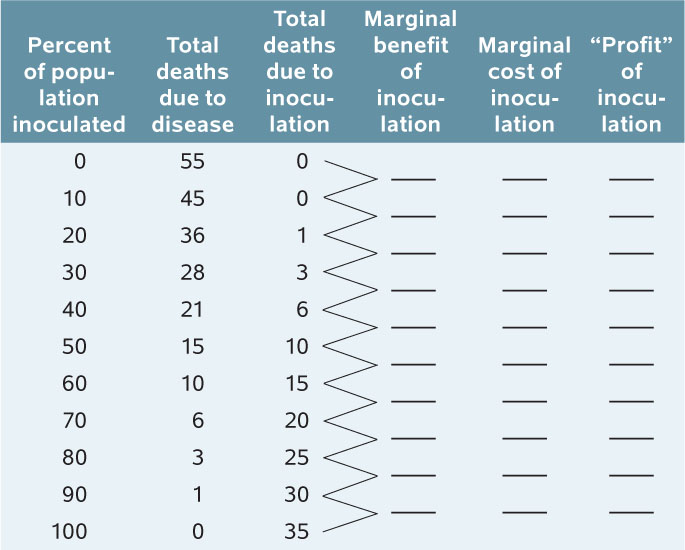

9.A new vaccine against a deadly disease has just been discovered. Presently, 55 people die from the disease each year. The new vaccine will save lives, but it is not completely safe. Some recipients of the shots will die from adverse reactions. The projected effects of the inoculation are given in the accompanying table:

- a. What are the interpretations of “marginal benefit” and “marginal cost” here? Calculate marginal benefit and marginal cost per each 10% increase in the rate of inoculation. Write your answers in the table.

- b. What proportion of the population should optimally be inoculated?

- c. What is the interpretation of “profit” here? Calculate the profit for all levels of inoculation.

10.The production of agricultural products like wheat is one of the few examples of a perfectly competitive industry. In this question, we analyze results from a hypothetical study about wheat production in the United States in 2001 and make some comparisons to wheat production in 2013.

- a. The average variable cost per acre planted with wheat was $107 per acre. Assuming a yield of 50 bushels per acre, calculate the average variable cost per bushel of wheat.

- b. The average price of wheat received by a farmer in 1998 was $2.65 per bushel. Do you think the average farm would have shut down in the short run? Explain.

- c. With a yield of 50 bushels of wheat per acre, the average total cost per farm was $3.80 per bushel. The harvested acreage for rye (a type of wheat) in the United States fell from 418,000 acres in 1998 to 250,000 in 2010. Using the information on prices and costs here and in parts a and b, explain why this might have happened.

- d. Using the above information, do you think the price of wheat was higher or lower than $2.65 per bushel prior to 1998? Why?

www.worthpublishers.com/

www.worthpublishers.com/