When Is Production Profitable?

Recall from Chapter 9 that a firm’s decision whether or not to stay in a given business depends on its economic profit—the measure of profit based on the opportunity cost of resources used in the business. To put it a slightly different way: in the calculation of economic profit, a firm’s total cost incorporates the implicit cost—

In contrast, accounting profit is profit calculated using only the explicit costs incurred by the firm. This means that economic profit incorporates the opportunity cost of resources owned by the firm and used in the production of output, while accounting profit does not.

A firm may make positive accounting profit while making zero or even negative economic profit. It’s important to understand clearly that a firm’s decision to produce or not, to stay in business or to close down permanently, should be based on economic profit, not accounting profit.

So we will assume, as we always do, that the cost numbers given in Tables 12-1 and 12-2 include all costs, implicit as well as explicit, and that the profit numbers in Table 12-1 are therefore economic profit. So what determines whether Noelle’s farm earns a profit or generates a loss? The answer is that, given the farm’s cost curves, whether or not it is profitable depends on the market price of trees—

|

Quantity of trees Q |

Variable cost VC |

Total cost TC |

Short- |

Short- |

|---|---|---|---|---|

|

10 |

$160.00 |

$300.00 |

$16.00 |

$30.00 |

|

20 |

220.00 |

360.00 |

11.00 |

18.00 |

|

30 |

300.00 |

440.00 |

10.00 |

14.67 |

|

40 |

420.00 |

560.00 |

10.50 |

14.00 |

|

50 |

580.00 |

720.00 |

11.60 |

14.40 |

|

60 |

780.00 |

920.00 |

13.00 |

15.33 |

|

70 |

1,020.00 |

1,160.00 |

14.57 |

16.57 |

TABLE 12-

In Table 12-3 we calculate short-

To see how these curves can be used to decide whether production is profitable or unprofitable, recall that profit is equal to total revenue minus total cost, TR − TC. This means:

If the firm produces a quantity at which TR > TC, the firm is profitable.

If the firm produces a quantity at which TR = TC, the firm breaks even.

If the firm produces a quantity at which TR < TC, the firm incurs a loss.

We can also express this idea in terms of revenue and cost per unit of output. If we divide profit by the number of units of output, Q, we obtain the following expression for profit per unit of output:

TR/Q is average revenue, which is the market price. TC/Q is average total cost. So a firm is profitable if the market price for its product is more than the average total cost of the quantity the firm produces; a firm loses money if the market price is less than average total cost of the quantity the firm produces. This means:

If the firm produces a quantity at which P > ATC, the firm is profitable.

If the firm produces a quantity at which P = ATC, the firm breaks even.

If the firm produces a quantity at which P < ATC, the firm incurs a loss.

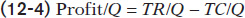

Figure 12-3 illustrates this result, showing how the market price determines whether a firm is profitable. It also shows how profits are depicted graphically. Each panel shows the marginal cost curve, MC, and the short-

In panel (a), we see that at a price of $18 per tree the profit-

Noelle’s total profit when the market price is $18 is represented by the area of the shaded rectangle in panel (a). To see why, notice that total profit can be expressed in terms of profit per unit:

or, equivalently,

Profit = (P − ATC) × Q

since P is equal to TR/Q and ATC is equal to TC/Q. The height of the shaded rectangle in panel (a) corresponds to the vertical distance between points E and Z. It is equal to P − ATC = $18.00 − $14.40 = $3.60 per tree. The shaded rectangle has a width equal to the output: Q = 50 trees. So the area of that rectangle is equal to Noelle’s profit: 50 trees × $3.60 profit per tree = $180—

What about the situation illustrated in panel (b)? Here the market price of trees is $10 per tree. Setting price equal to marginal cost leads to a profit-

How much does she lose by producing when the market price is $10? On each tree she loses ATC − P = $14.67 − $10.00 = $4.67, an amount corresponding to the vertical distance between points A and Y. And she would produce 30 trees, which corresponds to the width of the shaded rectangle. So the total value of the losses is $4.67 × 30 = $140.00 (adjusted for rounding error), an amount that corresponds to the area of the shaded rectangle in panel (b).

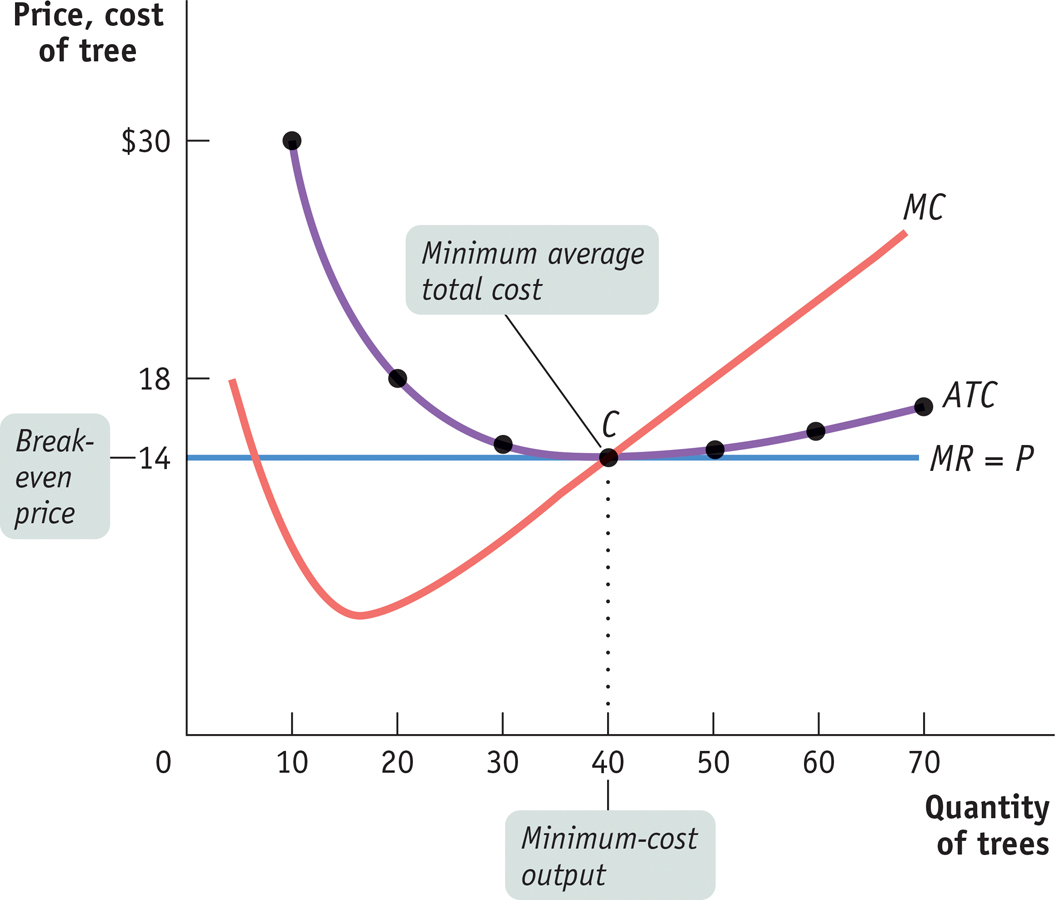

But how does a producer know, in general, whether or not its business will be profitable? It turns out that the crucial test lies in a comparison of the market price to the producer’s minimum average total cost. On Noelle’s farm, minimum average total cost, which is equal to $14, occurs at an output quantity of 40 trees, indicated by point C.

Whenever the market price exceeds minimum average total cost, the producer can find some output level for which the average total cost is less than the market price. In other words, the producer can find a level of output at which the firm makes a profit. So Noelle’s farm will be profitable whenever the market price exceeds $14. And she will achieve the highest possible profit by producing the quantity at which marginal cost equals the market price.

Conversely, if the market price is less than minimum average total cost, there is no output level at which price exceeds average total cost. As a result, the firm will be unprofitable at any quantity of output. As we saw, at a price of $10—

The break-

The minimum average total cost of a price-

So the rule for determining whether a producer of a good is profitable depends on a comparison of the market price of the good to the producer’s breakeven price—

Whenever the market price exceeds minimum average total cost, the producer is profitable.

Whenever the market price equals minimum average total cost, the producer breaks even.

Whenever the market price is less than minimum average total cost, the producer is unprofitable.