How Important Is Oligopoly?

We have seen that, across industries, oligopoly is far more common than either perfect competition or monopoly. When we try to analyze oligopoly, the economist’s usual way of thinking—

Given the prevalence of oligopoly, then, is the analysis we developed in earlier chapters, which was based on perfect competition, still useful?

The conclusion of the great majority of economists is yes. For one thing, important parts of the economy are fairly well described by perfect competition. And even though many industries are oligopolistic, in many cases the limits to collusion keep prices relatively close to marginal costs—

It is also true that predictions from supply and demand analysis are often valid for oligopolies. For example, in Chapter 5 we saw that price controls will produce shortages. Strictly speaking, this conclusion is certain only for perfectly competitive industries. But in the 1970s, when the U.S. government imposed price controls on the definitely oligopolistic oil industry, the result was indeed to produce shortages and lines at the gas pumps.

So how important is it to take account of oligopoly? Most economists adopt a pragmatic approach. As we have seen in this chapter, the analysis of oligopoly is far more difficult and messy than that of perfect competition; so in situations where they do not expect the complications associated with oligopoly to be crucial, economists prefer to adopt the working assumption of perfectly competitive markets. They always keep in mind the possibility that oligopoly might be important; they recognize that there are important issues, from antitrust policies to price wars, where trying to understand oligopolistic behavior is crucial.

We will follow the same approach in the chapters that follow.

ECONOMICS in Action: The Price Wars of Christmas

The Price Wars of Christmas

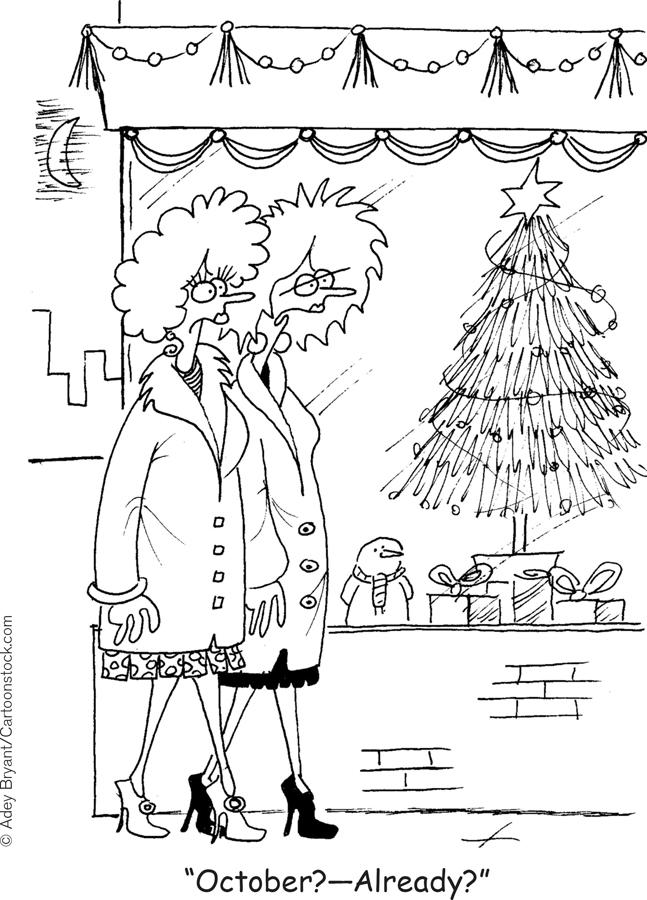

Over the last decade, the toy aisles of American retailers have been the scene of cutthroat competition. The 2011 Christmas shopping season saw Elmo at the center of a price-

What is happening? The turmoil can be traced back to trouble in the toy industry itself as well as to changes in toy retailing. Every year for several years now, overall toy sales have fallen a few percentage points as children increasingly turn to video games and the internet.

The result is much like a story of tacit collusion sustained by repeated interaction run in reverse: because the overall industry has been in a state of decline and there are new entrants, the future payoff from collusion is shrinking. The predictable outcome is a price war.

Since retailers depend on holiday sales for nearly half of their annual sales, the holidays are a time of particularly intense price-

And with each passing year, the holiday price-

With toy retailers forced to cut prices to keep pace with their rivals or lose sales, we have a phenomenon known as “creeping Christmas”: the price wars of Christmas arrive earlier each year.

Quick Review

Oligopolies operate under legal restrictions in the form of antitrust policy. But many succeed in achieving tacit collusion.

Tacit collusion is limited by a number of factors, including large numbers of firms, complex products and pricing, differences in interests among firms, and bargaining power of buyers. When collusion breaks down, there is a price war.

To limit competition, oligopolists often engage in product differentiation. When products are differentiated, it is sometimes possible for an industry to achieve tacit collusion through price leadership.

Oligopolists often avoid competing directly on price, engaging in nonprice competition through advertising and other means instead.

14-4

Question 14.6

Which of the following factors are likely to support the conclusion that there is tacit collusion in this industry? Which are not? Explain.

For many years the price in the industry has changed infrequently, and all the firms in the industry charge the same price. The largest firm publishes a catalog containing a “suggested” retail price. Changes in price coincide with changes in the catalog.

There has been considerable variation in the market shares of the firms in the industry over time.

Firms in the industry build into their products unnecessary features that make it hard for consumers to switch from one company’s products to another company’s products.

Firms meet yearly to discuss their annual sales forecasts.

Firms tend to adjust their prices upward at the same times.

Solutions appear at back of book.

!worldview!Virgin Atlantic Blows the Whistle... or Blows It?

The United Kingdom is home to two long-

The rivalry between the two has ranged from relatively peaceable to openly hostile over the years. In the 1990s, British Airways lost a court case alleging it had engaged in “dirty tricks” to drive Virgin out of business. In April 2010, however, British Airways may well have wondered if the tables had been turned.

It all began in mid-

Eventually, three Virgin executives decided to blow the whistle in exchange for immunity from prosecution. British Airways immediately suspended its executives under suspicion and paid fines of nearly $500 million to U.S. and U.K. authorities. And in 2010 four British Airways executives were prosecuted by British authorities for their alleged role in the conspiracy.

The lawyers for the executives argued that although the two airlines had swapped information, this was not proof of a criminal conspiracy. In fact, they argued, Virgin was so fearful of American regulators that it had admitted to criminal behavior before confirming that it had indeed committed an offense. One of the defense lawyers, Clare Montgomery, argued that because U.S. laws against anti-

In late 2011 the case came to a shocking end for Virgin Atlantic and U.K. authorities. Citing e-

QUESTIONS FOR THOUGHT

Question 14.7

Jgcvqvm4YUl+qPoy0/ztqVe/22SiohDZPBhDqiEagnazs9xBG6szsTnbc7dZ3+LBRPrC2quV03yr55unJSTjsiOON9oKaqE+jzhbER5k4eJPx9sFa02LGyaYpsHbeh3LvPOKWyDihq3e0HlST2tdx3KeZnkc+kXv4ARIzEeHEoAEMwigw9TO+u4Lz1zvKItf7Dj5F4RU34w=Explain why Virgin Atlantic and British Airlines might collude in response to increased oil prices. Was the market conducive to collusion or not?Question 14.8

/nLQBLDKOsl8E3YUg/NCk+E8BfpO35L5uyrj61GsJEHvl2PQ5pZKHsNgVT0qX+LFfWIfN9GRrXjWs79HW6c8+1ab3sNjwgquasbUO8QOK6vylwF8+6dVmg+RykrsAPbIqGJ8QAI1NECrPPTSVdcwSlvSJ1UMbBBUXjWRQ9BgspQlhPJwHow would you determine whether illegal behavior actually occurred? What might explain these events other than illegal behavior?Question 14.9

9/kEzeRD2OVcMJRCJepIunWTzQ2EWhOw1D6HnNVPFbscTtvcaBSLYUN5k1zaIYFtz5csLWQGKA77YRWsL9CANn9jnG2bduxjJAgjsYiNdh+JbXDdpf7Jqw==Explain the dilemma facing the two airlines as well as their individual executives.